Amidst the high and volatile gold market, small and medium-sized miners may have a good opportunity to catch up

17:29 August 30, 2025 EDT

Key Points:

Against the backdrop of high gold prices, mid-sized miners have demonstrated profitability and sustainability far exceeding that of their large counterparts;

The true average costs of mid-sized miners remain competitive. Meanwhile, some miners, such as Equinox Gold and OceanaGold, have shown strong performance in production expansion, driving significant share price increases. This suggests that mid-sized miners are better able to maximize gold price resilience during industry cycles.

With the average gold price rising further to $3,347 per ounce in the third quarter, implied unit profits are expected to reach a record high of $1,935 per ounce. Against the backdrop of a historically strong earnings cycle and low valuations, mean reversion and a catch-up rally for small and mid-sized gold stocks are almost inevitable.

Small and mid-sized gold mining companies have just delivered impressive quarterly results. At a critical juncture in the gold industry's upward cycle, their fundamental performance has not only reached record highs, but they have also significantly outperformed their larger peers in terms of profitability and operations. This strong financial and operational performance contrasts sharply with their currently undervalued stock prices, suggesting the potential for a significant valuation recovery ahead.

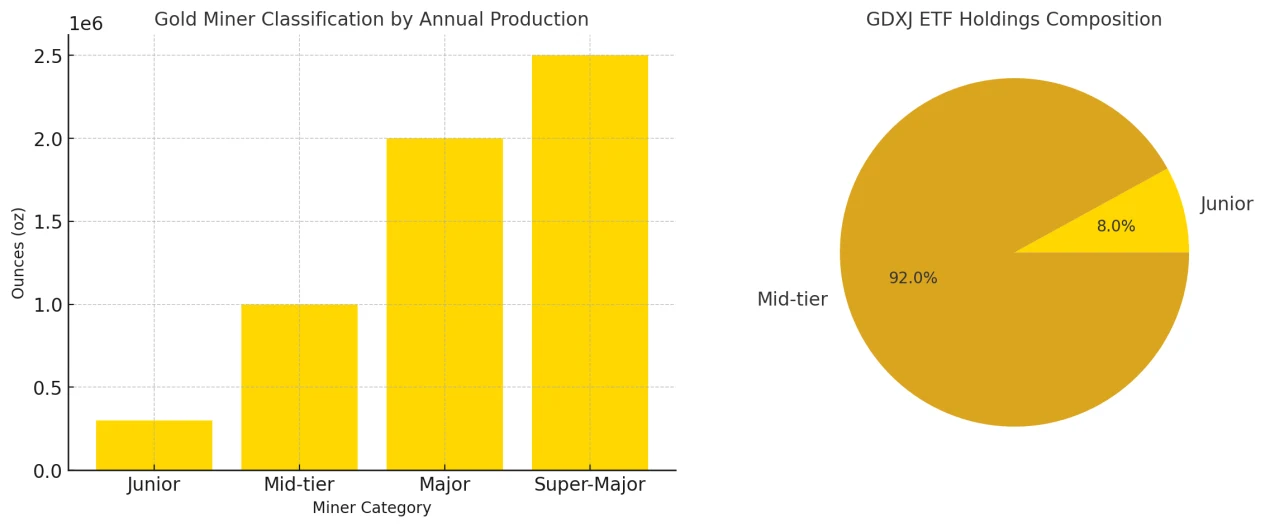

At the ETF level, the VanEck Junior Gold Miners ETF (VanEck Junior Gold Miners ETF) is a leading investment vehicle for mid-cap gold stocks. As of mid-week, its net assets reached $6 billion, second only to its larger counterpart, the VanEck Gold Miners ETF. Despite the "Junior" in its name, GDXJ's holdings are heavily weighted toward mid-cap miners, with a minimal weighting toward true juniors. Currently, only two of its top 25 holdings are typical junior gold miners.

The industry typically categorizes gold mines by annual production: junior mines produce less than 300,000 ounces, mid-sized mines produce between 300,000 and 1 million ounces, large mines produce over 1 million ounces, and super-large mines produce over 2 million ounces. Converted to quarterly production, the corresponding thresholds are less than 75,000 ounces, 75,000 to 250,000 ounces, over 250,000 ounces, and over 500,000 ounces. Based on the latest disclosed data, GDXJ's holdings are primarily concentrated in mid-sized miners, which exhibit both scale and growth.

Junior miners often rely on smaller, single mines, resulting in limited production and higher risk. There are also streaming and royalty companies that purchase future production on an upfront basis, and silver miners that generate gold revenue as a by-product. However, compared to these models, mid-sized gold mines offer greater investment appeal: they are both more stable than junior miners and more resilient to gold price increases than large miners.

The mid-sized miners currently dominating GDXJ possess a rare combination of characteristics: a diversified production base, clear growth potential, and a relatively small market capitalization. These factors lend themselves to both aggressiveness and safety during gold's upcycles. These advantages offer investors a superior risk-reward profile compared to junior miners while also allowing for more resilient returns than larger miners during price increases.

The increase is far lower than the historical leverage level, and mid-sized gold mining stocks may usher in a rebound.

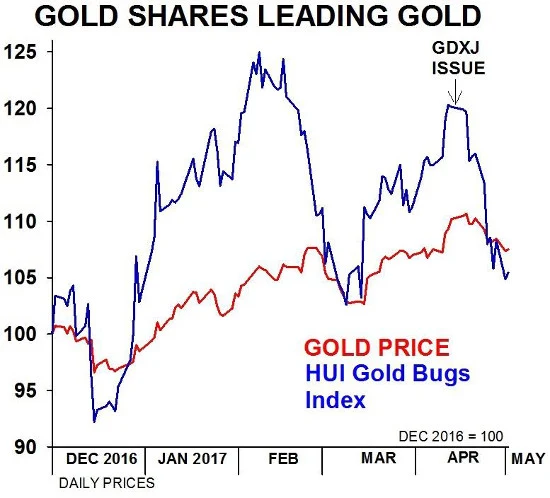

The strong performance of GDXJ is increasingly reflecting the impressive fundamentals of mid-cap gold mining stocks . As of midweek, the ETF had surged 71.4% year-to-date, extending a larger bull market (+139.6%) that began in October 2023. So far in 2025, GDXJ has reached new long-term highs 15 times, closing at $73.88 last Friday, a record high in 12.7 years. This bull market has created numerous profitable opportunities for investors.

However, the gains for mid-tier gold miners remain modest by historical standards. These companies typically leverage their exposure to gold price increases by 3 to 4 times. From early October 2023 to mid-June 2025, gold prices rose 88.6%, with no corrections exceeding 10%. Using historical leverage, GDXJ would have seen gains of 266% to 354%, far exceeding its current performance of 140%.

History also bears this out. In August 2020, gold prices saw a robust 40% surge, while GDXJ surged 188.9% during the same period, leveraging its holdings to a whopping 4.7x. Given the record-breaking fundamentals demonstrated by small and mid-sized gold miners in the latest quarter, their share prices are poised to match or even surpass gold's gains going forward, and the current surge may just be the beginning.

To better assess this trend, we can systematically analyze the operating and financial performance of the top 25 GDXJ components for 37 consecutive quarters. These stocks, primarily mid-cap miners, currently account for 69.4% of the ETF's total weighting. While analyzing quarterly data is laborious, it effectively demystifies industry history and helps investors understand the true fundamentals.

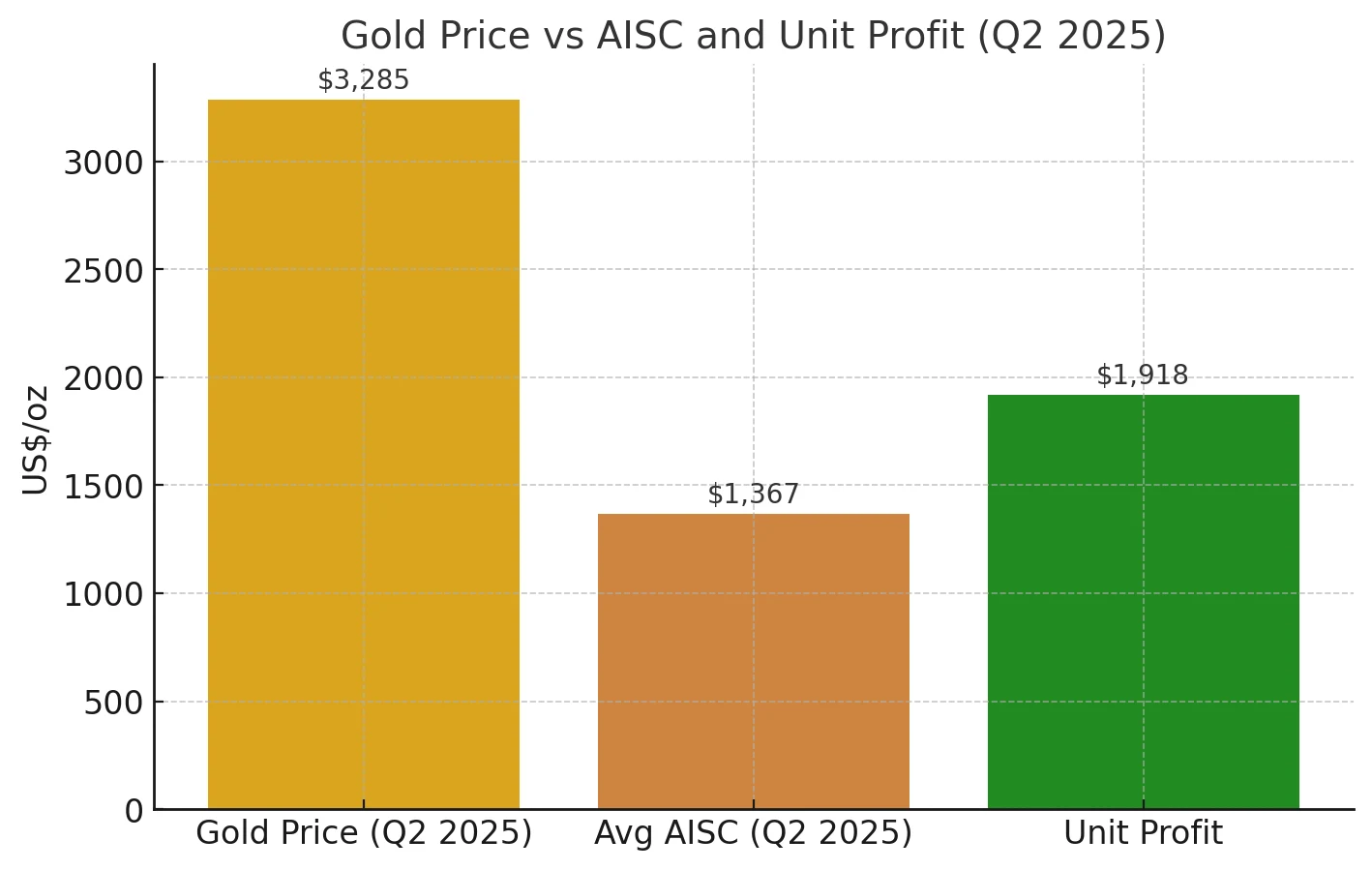

The latest data for the second quarter of 2025 is undoubtedly a milestone. The report shows that the constituents generally achieved production growth, solid performance in cash costs and all-in sustaining costs, and continued profitability improvement. The financial statements also performed well: revenue, profit, and operating cash flow all reached record highs, and cash reserves improved significantly. Benefiting from the average year-on-year increase of 40.6% in the gold price to a record $3,285 per ounce, the GDXJ constituents collectively delivered their best quarterly performance to date. Investors need to understand that this is not a one-time cyclical high. Mid-tier gold miners have reported significant profit growth for eight consecutive quarters, demonstrating rare consistency and resilience in the industry.

Therefore, the conclusion is clear: GDXJ mid-cap miners are currently delivering on their strong performance potential, and their stock prices still have considerable room to rise relative to fundamentals.

GDXJ components show strength among mid-sized miners

Aside from the major gold giants, GDXJ's composition closely mirrors GDX. Unlike GDX, which primarily features super-large and large-cap miners, GDXJ has eliminated most large companies with weak fundamentals and significantly increased the weighting of small and mid-sized miners. Twenty-one of its top 25 components are also GDX stocks, but GDXJ holds a higher weighting. Overall, by reducing the weighting of the top tier of GDX to approximately one-fifth and more than doubling the weighting of the bottom tier, GDXJ becomes a more resilient gold stock ETF. While GDX is more susceptible to mediocre performance from large miners, GDXJ offers significant advantages.

GDXJ components have shown strong performance in the latest earnings season. On the surface, the top 25 miners produced a combined 2.678 million ounces in the second quarter, a year-on-year decrease of 19.3%. However, this data is significantly distorted by two factors. First, South Africa's Harmony Gold only reported half-year results, leaving no comparable data for the second quarter of 2025. Second, Kinross Gold was mistakenly included in GDXJ for a long time, even though it should have been part of GDX and was removed in the third quarter of 2024. If HMY and KGC are removed and added back after adjustment, the top 25 components' production in the second quarter of 2025 actually increased by 5.8% year-on-year, far exceeding the 0.5% increase in GDX after adjustment.

Mid-sized gold mining companies have smaller production capacity, typically operating only one to four mines. Therefore, any expansion or new project significantly boosts production. This helps offset resource depletion and provides room for future growth. Investors particularly favor production expansion because it generates higher cash flow, which in turn supports capital expenditures and new mine development, driving up stock prices. In the second quarter, Equinox Gold's production increased by 23.4% year-over-year, primarily driven by mergers and acquisitions; OceanaGold's production increased by 21.7% year-over-year, driven by improved ore grades. These gains drove share prices up 15.2% and 10.3%, respectively, following their earnings reports. Similar examples abounded this quarter, explaining why GDXJ (Gold Shares) rose 11.6% despite a 0.4% drop in gold prices in the second quarter. Fund flows indicate that professional investors are actively allocating to gold stocks.

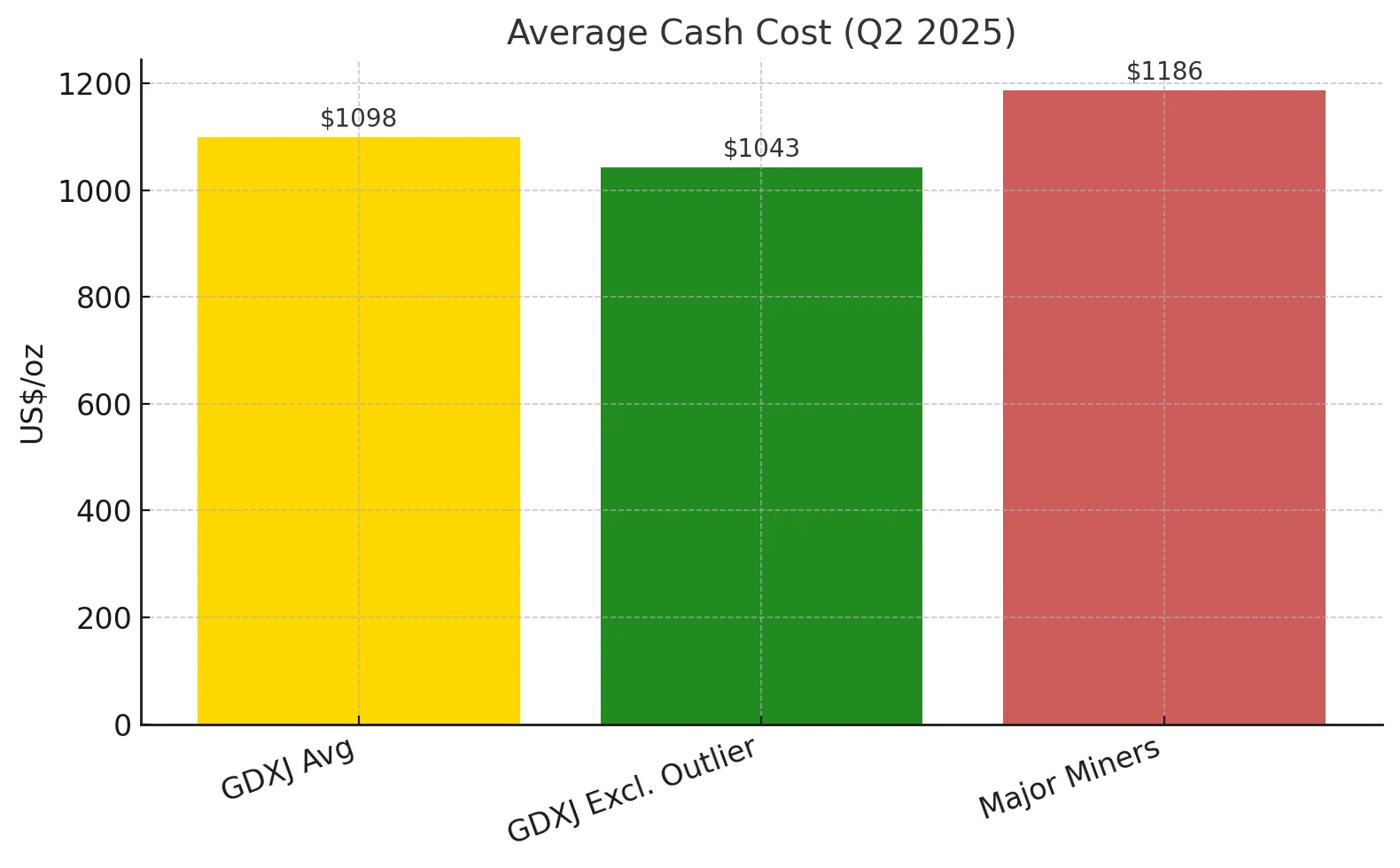

Cost control is one of the sources of competitiveness for mid-sized miners. Fixed costs in gold mining are highly dependent on ore grade. High-grade ore spreads more fixed expenses, thereby reducing unit costs. Cash costs are a classic metric for measuring operational efficiency. While not including mine construction and exploration expenses, they can reflect a miner's short-term viability. In the second quarter, the average cash cost of the top 25 GDXJ components rose only 3.3% to $1,098 per ounce, while the average cash cost of large miners increased by 14.5% to $1,186 per ounce. Excluding the outlier Buenaventura, which saw a cost of $2,136, the average for the remaining miners was only $1,043 per ounce.

All-in sustaining costs (AISC) are also a comprehensive measure. The long-term expenses required to maintain current production and replenish reserves can reveal a miner's true profitability. Data shows that mid-sized miners maintain their advantage in production expansion and significantly outperform their large counterparts in cost control, providing strong support for future stock price performance.

Therefore, by excluding large miners and focusing on mid-sized companies, GDXJ amplifies the resilience of gold prices. During periods of high and volatile gold prices, mid-sized miners are gaining favor among professional investors due to their production growth and cost advantages.

With the explosion of profits of medium-sized gold mines, is valuation repair inevitable?

Last quarter, the average all-in sustaining costs (AISC) for the top 25 GDXJ companies rose 8.2% year-over-year to $1,367 per ounce, the second-highest on record, second only to $1,378 in the first quarter of 2025. This still significantly outperforms the $1,424 AISC for the top 25 GDX companies. Back in late June, I predicted that large-cap miners would achieve AISCs around $1,375, but mid-cap miners have shown stronger performance, continuing to lead in operational efficiency. The full-year midpoint AISC guidance for GDXJ companies is $1,412, significantly lower than the GDX index's $1,537, suggesting that mid-cap miners enjoy higher profit margins in the current bull market.

It's important to note that the second-quarter AISC data was impacted by an extreme outlier from Peruvian polymetallic miner Buenaventura. Because the company uses copper as a by-product to offset costs, its gold AISC was calculated to be -$6,618. Excluding this outlier, the true average AISC for the top 25 GDXJ components was $1,487, still significantly below the gold price.

Image source: BCEWeb

As the gold price surged 40.6% year-over-year to a record high of $3,285 per ounce, profitability for mid-tier miners surged. Implied unit profits (gold price minus AISC) reached $1,918 per ounce in the second quarter, a 78.6% year-over-year surge and a significant record high. By comparison, the implied profits of large GDX miners were $1,861 per ounce, still far behind. In fact, for the past eight consecutive quarters, mid-tier miners have maintained year-over-year implied unit earnings growth between 60% and 130%, demonstrating remarkable consistency and explosive growth.

Looking at the second quarter of 2025, the top 25 GDXJ components saw revenue increase 41.3% year-over-year to $10.92 billion, net profit soared 212.4% year-over-year to a record $2.599 billion, and operating cash flow increased 73% year-over-year to $4.58 billion, pushing cash reserves to a new high of $12.38 billion. Compared to large miners, mid-sized companies have significantly faster profit growth, more abundant cash flow, and greater room for investment in production expansion and new mines.

This demonstrates that despite record earnings, these companies remain undervalued, with price-to-earnings ratios generally in the single or low double digits over the past 12 months, far from reflecting their fundamentals. With the average gold price rising to $3,347 per ounce in the third quarter, a year-on-year increase of approximately 35%, the implied unit profit of GDXJ components is expected to break another record, reaching $1,935 per ounce, indicating continued profit expansion for mid-tier miners.

Mid- and small-cap gold mining companies are experiencing a historically strong profit cycle, with mining costs remaining stable or even declining, while gold prices are consolidating at high levels. Against this backdrop, their profitability far exceeds that of large miners, yet their stock prices remain significantly undervalued. A mean-reversion rally is not only possible, but almost inevitable. As the gap between fundamentals and valuations continues to widen, small- and mid-cap gold stocks are poised for further exponential growth.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates