Cook Files Lawsuit Against Trump: A Legal and Institutional Test of the Fed's Independence

03:06 August 29, 2025 EDT

On August 28, 2025, Federal Reserve Governor Lisa D. Cook filed a lawsuit in the U.S. District Court for the District of Columbia against former President Donald J. Trump, Federal Reserve Chair Jerome H. Powell, and the Board of Governors of the Federal Reserve System itself. The legal action seeks to block President Trump's attempt to remove her from office, arguing that it violates the "for cause" removal provision stipulated in the Federal Reserve Act.

President Trump announced Governor Cook's removal on August 25, 2025, citing alleged fraud related to her 2021 mortgage applications, in which properties in both Michigan and Georgia were designated as primary residences. Cook's legal team contends these allegations do not meet the statutory threshold for "cause" and characterize the move as an attempt to undermine the central bank's independence.

A hearing on Governor Cook's request for a temporary restraining order is scheduled for 10:00 a.m. Eastern Time on August 29, 2025, before Judge Jia M. Cobb, who was appointed by President Biden in 2021. The outcome of the hearing is not yet publicly known.

Historical Context of the Fed's Independence

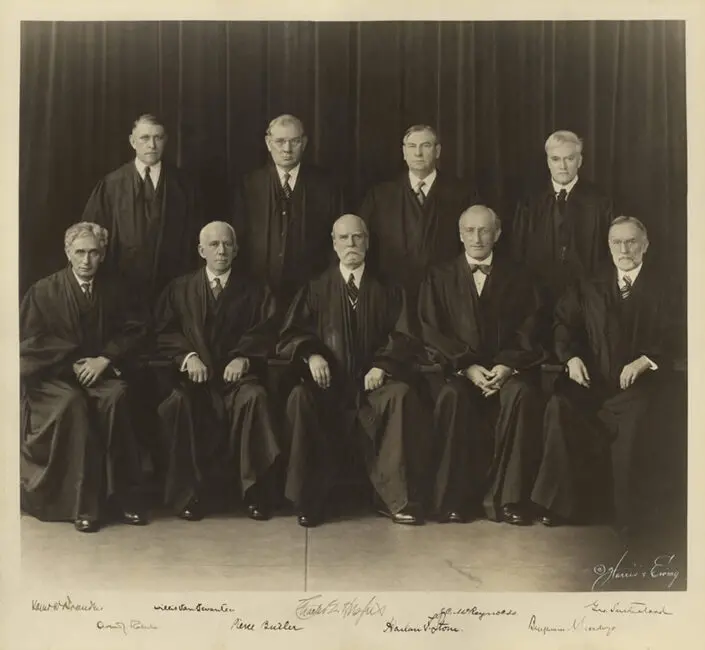

The Federal Reserve System was established by Congress through the Federal Reserve Act of 1913 in response to the Panic of 1907, with the objective of creating a stable banking framework. This legislation emerged from a series of banking crises in the late 19th and early 20th centuries, including the Panic of 1893, which led to the failure of thousands of banks.

Initially, the Federal Reserve possessed limited independence. During World War I, it primarily facilitated government debt financing by purchasing Treasury securities to maintain low interest rates in support of war funding. Its true operational independence originated from the 1951 Treasury-Fed Accord, which released the Fed from the obligation to monetize Treasury debt at fixed rates, allowing it to prioritize inflation control and economic stability. This agreement arose from political interference in monetary policy during World War II and the Korean War, when President Harry S. Truman sought to influence the Fed to maintain low interest rates for war financing. Ultimately, the Accord established the Fed’s policy autonomy.

Historically, the independence of the Federal Reserve has faced multiple threats. A notable example occurred during the Great Depression of the 1930s, when President Franklin D. Roosevelt reformed the Federal Reserve through the Banking Act of 1933, strengthening its central authority but also increasing presidential influence over the appointment of governors. Another key incident took place in 1951, when President Truman pressured Federal Reserve Chair Thomas McCabe to resign due to his refusal to maintain low interest rates in support of financing the Korean War. While not a formal removal, this episode illustrated the potential impact of executive pressure on Federal Reserve leadership.

In the 1970s, President Richard Nixon exerted pressure on Fed Chair Arthur Burns to maintain low interest rates to support his reelection, contributing to a period of stagflation—a combination of high inflation and economic stagnation. Inflation peaked at over 13% annually, while the unemployment rate rose to 9%.

In contrast, the tenure of Paul Volcker from 1979 to 1987 demonstrated the benefits of independence. In 1981, he raised the federal funds rate to over 20%, reducing inflation from 13.5% in 1980 to 3.2% by 1983. Although the unemployment rate initially climbed to 10.8%, this policy ultimately ended the era of stagflation.

In recent years, during his first term (2017–2021), Donald Trump repeatedly criticized Federal Reserve Chair Jerome Powell publicly, calling for interest rate cuts and even threatening his removal. In 2019, four former Fed Chairs—Paul Volcker, Alan Greenspan, Ben Bernanke, and Janet Yellen—issued a joint statement warning that threats to remove Fed leadership would undermine its independence.

Trump’s tweets criticizing Fed policies contributed to market volatility. One study indicated that his 2019 tweets led to a short-term increase in bond yields, reflecting investor concerns over central bank independence. Additionally, President Andrew Jackson’s opposition to the Second Bank of the United States in the 1830s, which resulted in the non-renewal of its charter, serves as a historical precursor to executive influence over central banking, even though it predated the Federal Reserve.

These historical episodes have reinforced the consensus that an independent central bank supports long-term economic stability by insulating policy from short-term political objectives. The design of the Federal Reserve’s independence stems from Congressional intent to prevent monetary policy from being dominated by electoral cycles or fiscal demands.

The Legal Basis for the Removal of a Federal Reserve Governor

The Federal Reserve Act stipulates that Governors serve 14-year terms and may be removed by the President only "for cause." While the term is not explicitly defined in the Act, it has been interpreted based on precedents from other independent agencies to generally encompass inefficiency, neglect of duty, or malfeasance.

Cook’s lawsuit argues that the mortgage allegations—which stem from applications filed prior to her 2022 appointment—do not meet this standard, as there is no evidence of intentional misconduct, demonstrable harm, or connection to her official responsibilities. Her legal team characterizes the accusations as potentially clerical in nature, lacking material significance, and contends that pre-appointment conduct cannot serve as grounds for removal unless it involves grave misconduct.

Legal precedent in this area stems largely from the Supreme Court’s 1935 ruling in Humphrey’s Executor v. United States, which involved Federal Trade Commissioner William Humphrey. The Court held that the President could not remove officials of independent agencies based solely on policy disagreements—a principle applied to the Federal Reserve—emphasizing that Congress may protect agencies from arbitrary executive interference through "for cause" provisions. This protection was reinforced in the 1953 case Wiener v. United States, concerning a member of the War Claims Commission, wherein the Court reaffirmed that removal requires statutorily justified grounds rather than political motives.

However, recent Supreme Court decisions indicate an evolution in the limitations on presidential removal authority. In the 2020 case Seila Law v. Consumer Financial Protection Bureau, the Court ruled that restrictions on removing the CFPB Director were unconstitutional, granting the President broader removal power. A similar conclusion was reached in the 2021 case Collins v. Yellen, which involved the Director of the Federal Housing Finance Agency. On April 9, 2024, Chief Justice John Roberts signed an order permitting the Trump administration to temporarily remove two board members of the National Labor Relations Board and the Merit Systems Protection Board. On May 22, 2025, the Supreme Court further ruled that President Trump could dismiss members of certain independent federal agencies, including the National Labor Relations Board.

Notably, the Supreme Court has never directly adjudicated a case involving the removal of a Federal Reserve Governor. An unsigned order in May 2025 referenced the Fed’s “unique quasi-private structure,” suggesting that its protections may be more robust compared to other agencies. Historically, no President has attempted to remove a sitting Federal Reserve Governor, making Cook’s case the first of its kind. A potential appeal to the Supreme Court would test the application of these precedents.

The structure of the Federal Reserve further reinforces its independence: the Board of Governors exercises budgetary autonomy, and its policy decisions do not require approval from the President or Congress. The Act designs staggered terms specifically to prevent any single president from dominating the Board.

Analysis of the Allegations and Cook's Defense

The allegations against Cook originated from Bill Pult, Director of the Federal Housing Finance Agency (appointed by President Trump), who referred the matter to the Department of Justice on August 20, 2025. Pult alleged that Cook falsely designated multiple properties as primary residences on mortgage applications filed in 2021. President Trump cited this as grounds to demand her resignation.

Cook has not faced civil or criminal charges related to these claims. Her legal team maintains that the issues are unsubstantiated and unrelated to her role at the Federal Reserve. They argue that even if errors occurred, there is no evidence of intentional misrepresentation or personal gain, and thus the threshold for “for cause” removal has not been met. In court filings, attorney Abbe Lowell emphasized that the conduct in question occurred prior to her appointment and has no bearing on the performance of her official duties.

Legal experts widely agree that the Trump administration faces significant legal hurdles. First, it must demonstrate a connection between Cook’s personal conduct and her official responsibilities—a challenge given that current evidence pertains solely to private financial matters. Second, the administration would need to overcome the precedent established in *Humphrey’s Executor v. United States*, which explicitly prohibits the removal of independent agency officials based on policy disagreements. Finally, an unsigned Supreme Court order in May 2025 suggested that the Federal Reserve’s “unique quasi-private structure” may afford its employees stronger protections than those at other federal agencies.

Notably, in February 2025, the Trump administration argued that the Supreme Court should overturn the *Humphrey’s Executor* precedent, asserting that it infringes on the President’s authority over the executive branch. Previous dismissals of officials at the National Labor Relations Board and the Merit Systems Protection Board by the Trump administration also led to legal challenges, with Chief Justice John Roberts temporarily blocking the reinstatement of affected members. These developments contribute to heightened uncertainty regarding the judicial outcome of the current case.

Potential Outcomes

Following the announcement of President Trump's decision to remove Governor Cook, financial markets exhibited an immediate reaction. The yield on the 2-year U.S. Treasury note fell sharply, the U.S. dollar index declined temporarily, and gold prices rose, reflecting investor concerns regarding the independence of the Federal Reserve. Market analysts interpreted the event as amplifying fears that monetary policy could be subject to political interference, prompting a shift toward safe-haven assets. Anxiety over increased policy uncertainty has been growing; a August 2025 survey by the National Association for Business Economics indicated that 96% of economists expressed concern over threats to the Fed’s independence.

From an institutional perspective, the incident could influence the composition of the Federal Reserve Board. The Board is currently composed of seven members. Having already appointed two Governors during his first term, if President Trump succeeds in removing Cook and appointing a successor—along with his previously nominated candidate, Stephen Milan—he could establish a four-member majority on the Board. Although monetary policy is ultimately determined by the Federal Open Market Committee (FOMC), which consists of the seven Board members and five regional Federal Reserve Bank presidents, a majority on the Board could still enhance Trump’s influence over policy direction.

The independence of the Federal Reserve is critical to the credibility of monetary policy. As of July 2025, the unemployment rate stood at 4.2%, nonfarm payroll growth remained subdued, and the federal funds rate was maintained within the range of 4.25%–4.50%. The Federal Open Market Committee’s meeting on September 16–17, 2025, is expected to include discussions regarding potential interest rate cuts. Any erosion of the Fed’s independence raises the risk of politically driven decisions that could lead to easier monetary policy, increasing inflationary pressures. European Central Bank official Ollie Rehn has warned that weakened Fed independence could elevate inflation in the United States.

Judicially, the U.S. District Court for the District of Columbia held a hearing on August 29 to determine whether to issue a temporary restraining order that would suspend President Trump’s removal decision pending litigation. The case is being heard by Judge Jia M. Cobb, who was appointed by President Biden in 2021.

Legal observers widely anticipate that, regardless of the outcome at the district court level, the case will likely be appealed to the Supreme Court. A ruling from the Supreme Court would ultimately redefine the balance of power between the President and the Federal Reserve.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates