A Key Comparison of Investment Options for 2025 : Homebuilders or Semiconductors ?

09:57 August 30, 2025 EDT

Key Points:

XHB (homebuilders) benefit more directly from falling interest rates and an easing credit environment, while SMH (semiconductors) are sensitive to the global demand and capital expenditure cycles. Their performance varies significantly under different macroeconomic scenarios.

The current market focus is on whether positive news can exceed expectations. When valuations are concentrated and passive funds are driving the market higher, even a slight disappointment in expectations can trigger a market sell-off.

In the current scenario of moderate growth, investors are more inclined to increase their allocation to XHB and relatively reduce their weighting in SMH, while retaining SMH. Investors need to dynamically monitor interest rate levels and volatility, the breadth of earnings revisions, market breadth, and the credit environment, and maintain portfolio flexibility through position control and hedging.

An intriguing question has been circulating in the stock market lately: Would you rather own homebuilders (XHB) or semiconductors (SMH)?

Last Friday, as stocks and bonds rallied and interest rates retreated, Federal Reserve Chairman Powell noted that inflation could rebound while the labor market was in "a strange equilibrium," implying a large number of "known unknowns" in the outlook. He further suggested that this "unusual" situation could prompt the Fed to support economic growth through rate cuts.

It is worth noting that the market’s reaction to the Fed’s last rate cut (December 18, 2024) was not optimistic: stocks plummeted that day and long-term interest rates rose, a negative trend that continued until mid-January 2025.

Friday's market reaction to Powell's speech was surprising, but likely only a preliminary one. Such moves tend to be short-lived, so it's crucial to observe the market's true reaction after digesting the information over the weekend. This week's Market Outlook, featuring "Key Takeaways," "Actionable Trading Insights," Keith's video analysis, and indicator interpretations, offers a wealth of information to help investors avoid being misled by the market's counterintuitive reaction to Fed policy.

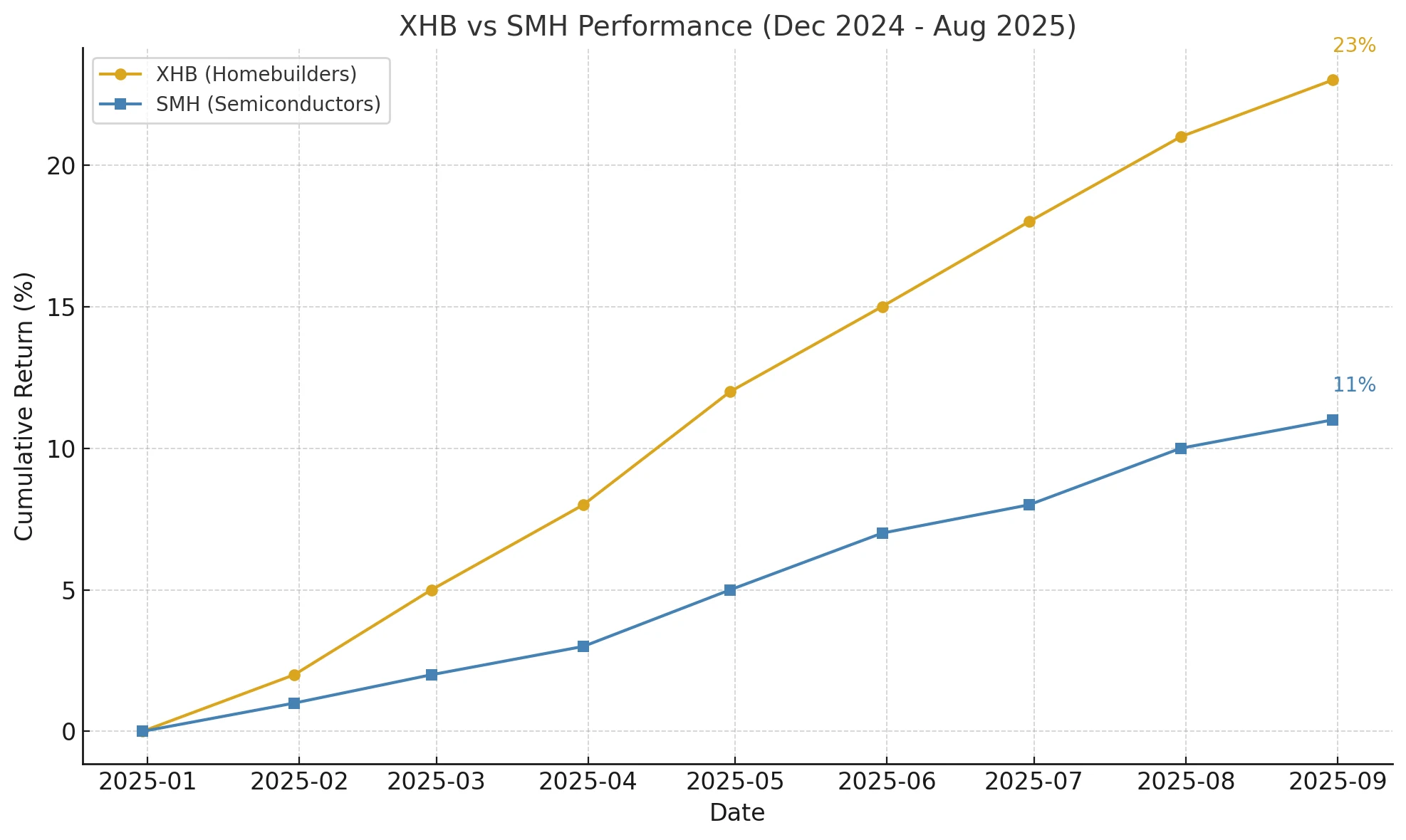

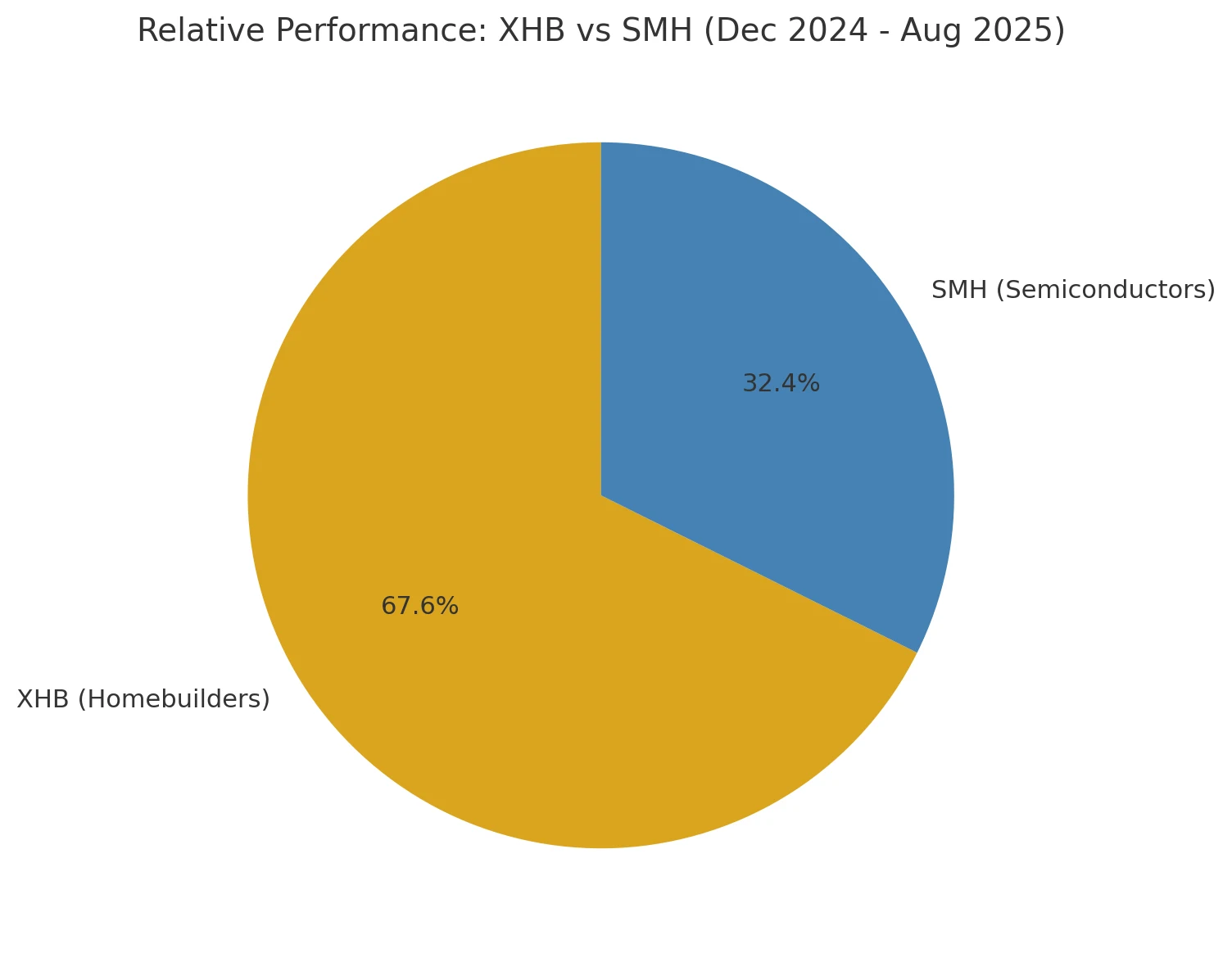

As can be seen in the chart below, semiconductors (SMH) remain the leading force driving the bull market. However, beneath this surface, a sector rotation within the market is quietly unfolding, worthy of investors' close attention.

Friday's price action is more of a "first reaction," with true pricing typically occurring one to three days after weekend digestion. For the next few weeks, I prefer to consider semiconductors (SMH) and homebuilders (XHB) as indicators of macroeconomic trends : one is most sensitive to the global demand and capital expenditure cycle, the other to interest rate levels and fluctuations. The winner isn't determined by whether the Fed will cut rates, but rather by what factors influence market sentiment: an insurance cut, a reactive firefighting strategy, or reflation.

In the case of "insurance easing" (growth remains stable, inflation is rising but declining): with falling interest rates, lower interest rate volatility, a decline in mortgage rates from high levels, and no tightening of financing channels, XHB's resilience is often better than expected. SMH can also benefit from falling discount rates, but it requires fundamental catalysts (order fulfillment of AI servers and storage, and inventory replenishment) to maintain its relative strength. In this combination, XHB has a higher chance of winning because its earnings are more directly resilient to the "falling interest rates + non-tightening credit" scenario, which is reflected more quickly in orders and deliveries.

If the scenario involves a reactive firefighting strategy (unexpected weakening of growth, rapid cooling of the labor market), nominal interest rates will decline, while credit spreads and interest rate volatility will rise. Historically, this scenario has not been favorable for high-beta growth stocks. SMH is prone to experiencing a "favorable interest rate situation but negative earnings impact," while XHB needs to monitor physical demand and mortgage ratios, as negative interest rate factors may not be immediately reversible. In this portfolio, both should be downgraded.

If a reflationary rebound occurs (demand recovery and inflation stickiness increases), real interest rates and term premium risks will rise, and valuations will be pressured. XHB will face the risk of rising mortgage costs and further demand deferrals. SMH will rely on economic growth and rising earnings to hedge valuation risks, leading to stock market volatility. In this case, investors will be better off choosing profit-taking stocks within SMH rather than beta stocks at the ETF level.

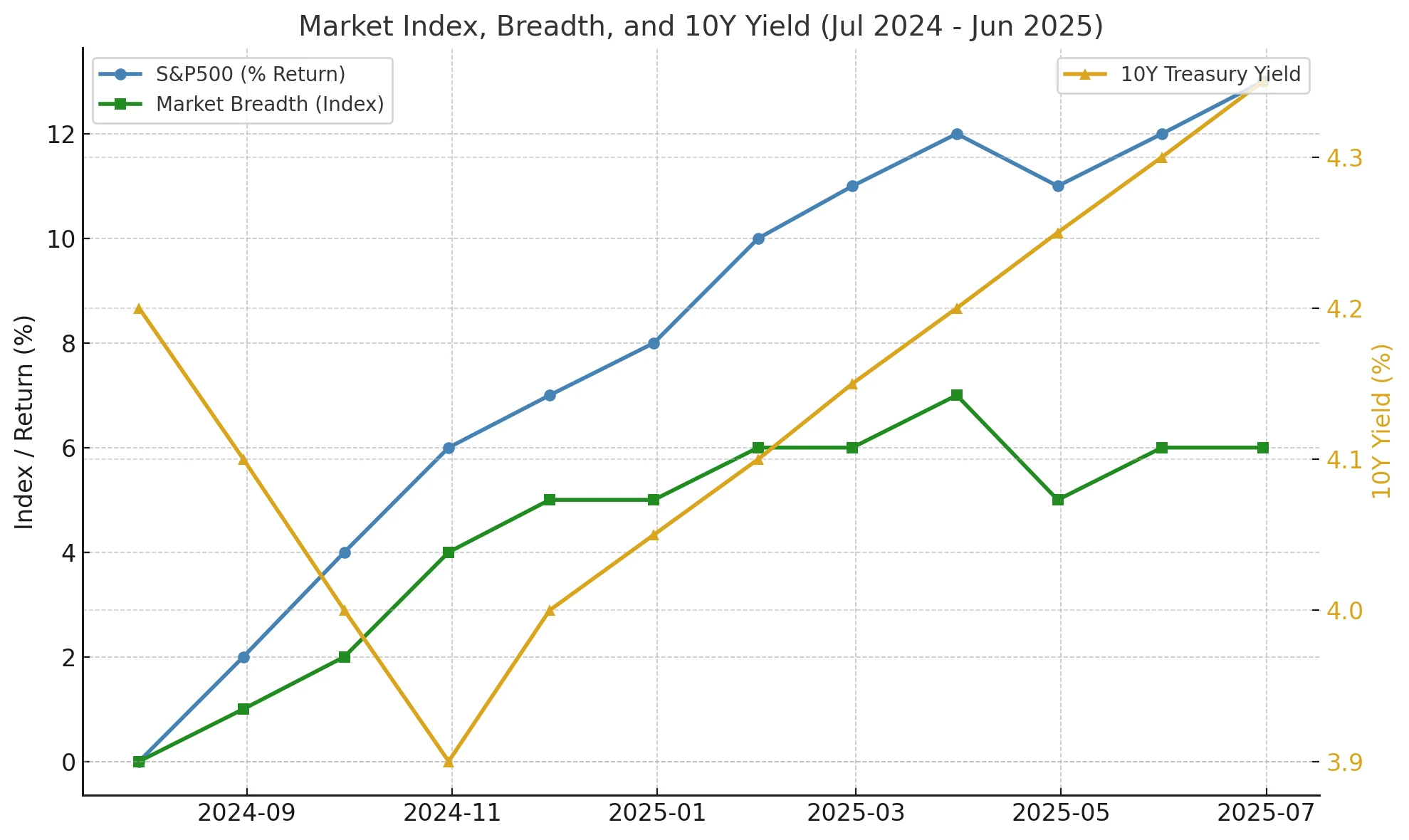

To avoid being misled by my first reaction, I monitor four key factors to determine whether to continue investing in semiconductors, shift my weighting toward homebuilders, or make a relative value pairing: The "level and volatility" of interest rates are factors. While the direction of nominal and real interest rates is more important, interest rate volatility (such as implied volatility in interest rate options) determines the tolerance for asset pricing. When interest rates and volatility fall, XHB's winning rate significantly increases. When interest rates fall but volatility rises, investors should be wary of the potential for reactive firefighting.

Second, the breadth of earnings revisions. This compares the number of upward revisions minus the number of downward revisions in the two sectors. If the breadth of revisions for builders continues to turn positive while semiconductors peak and fall, it suggests that the "rate cut pass-through to demand" trade is gaining momentum, with XHB holding a relatively dominant position. Otherwise, SMH continues to dominate the style.

Third, breadth and concentration. If the index's new highs are primarily driven by a small number of heavyweight stocks, while the equal-weighted index and the number of stocks that rise and fall do not follow suit, the group's fragility is increasing. If a "semiconductor retreat, followed by financials, industrials, and energy" phenomenon occurs, and market health improves, it will benefit assets more sensitive to domestic demand, such as XHB.

Fourth, the credit and real estate outlook. Investors should monitor credit spreads and leading housing indicators (such as the economic sentiment index, permits and starts, and existing/new home sales). A stable credit spread and a positive housing outlook are essential for XHB to continue to strengthen; otherwise, short-term resilience will be difficult to transform into a trend.

On an operational level, I offer a clear view: the baseline scenario is more likely to be "moderate growth and insurance easing," meaning lower interest rates and steadily declining volatility. The corresponding relative allocation is to increase XHB holdings on pullbacks and relatively reduce SMH beta, while retaining SMH's higher-performing exposure (focused on AI hardware nodes and oligopoly performance). Therefore, this can be expressed in two ways: the first is directional: core positions are biased toward XHB, while SMH prioritizes "lighter positions and event resilience." If the three conditions of "falling interest rates, declining interest rate volatility, and positive earnings for construction companies" are met, XHB can be added to the upper limit of the strategy; if any of these conditions are violated, the position should be immediately reduced to neutral.

The second leg is relative value: Invest in a ratio trade: long XHB and short SMH . Increase your position when the "low interest rate and low volatility" combination holds. If you experience a "reactive firefighting" situation (widening credit spreads, negative earnings revisions), reduce your position or reverse course by going long SMH premium components and short XHB, waiting for the next window of interest rate volatility to fall.

When it comes to risk management, investors can't choose a single investment strategy. They need to manage three levers: position limits, drawdown thresholds, and time-based stop-losses. Use a ratio line to regulate relative spreads. Halve the price if it falls below the recent month's key moving average, and halve again if it breaks below that level. For directional positions, use options to partially replace spot positions to manage gap risk. If funds permit, allocate a layer of put options or inverse ETFs to specifically hedge against reactive firefighting scenarios.

Let interest rate levels and volatility, earnings revision breadth, and market breadth determine your style preferences. Under the current baseline, betting on interest rate-friendly flexibility in XHB and leaving "high-growth structural alpha" to leading stocks within SMH or during specific event periods allows you to maintain your focus on the bull market while also avoiding placing all your bets on a single direction.

Risks the market is facing

Corporate earnings remain solid, the Federal Reserve is likely to cut interest rates in September, and the real estate sector appears to be recovering. So, what could weigh on the stock market? The problem isn't a lack of bearish evidence; the potential for disappointing bullish expectations is the primary factor. When the market overly relies on the logic of positive news, any news that falls short of expectations can trigger a sell-off, potentially turning price action bearish even on the surface.

Funding also presents vulnerabilities. Over the past year, massive inflows into passive index funds have led to a high degree of concentration in investment sectors. A small number of heavyweight stocks drive the broader market, and valuations are already at historically high levels. This means that even a slight disappointment in expectations could trigger a chain reaction through the balance of passive funds, amplifying market corrections.

Inflationary stickiness could hinder the pace of interest rate cuts, geopolitical tensions could re-inflate energy prices, and potential default risks in the credit market could be underestimated. These factors don't move the market on a daily basis, but they constitute a "low-probability, high-impact" external trigger. If combined with overly high market expectations, they could easily trigger a sharp correction.

Therefore, maintaining a certain level of cash flexibility, focusing on industries with reasonable valuations, and using hedging tools to manage tail risks may be safer than relying solely on favorable investments.

Price is the key information

We've consistently emphasized that observing price action is more important than interpreting news. Since July, we've cautioned against closely monitoring the "July calendar range." Currently, most indices have broken through their July highs, with only a few sectors remaining stagnant within this range. If more sectors fall back into their six-month ranges or turn red on the indicator, the risk of a market reversal is accumulating.

As long as the index and most sectors remain firmly above their July highs, it indicates continued capital inflows and the bull market's foundation remains intact. However, if more and more sectors fall back into their ranges, it suggests that the breadth of capital flows is shrinking, and the market's upward momentum is increasingly reliant on a few leading stocks, often signaling emerging fragility. Investors should focus not on one or two-day fluctuations but on whether capital flows can maintain their momentum across a wider range of sectors. If the market loses breadth, caution is warranted even if the index remains elevated.

The same applies to the 10-year US Treasury yield. If the yield represented by the IEF breaks through a technical level, interest-rate-sensitive ETFs will react positively. When XHB leads the market amid rate cuts, even if tech stocks aren't at the forefront, the overall market still has a bullish foundation. It's important to note that September is historically a challenging month for US stocks—there have been three significant declines in the past four years, and September has been the worst performing month overall over the past decade.

Conclusion

Looking ahead to the end of 2025, the core market question, previously focused on "whether there will be positive news," has shifted to "whether the positive news will exceed expectations." Currently, semiconductors and homebuilders are the industries with the most significant impact on global demand and interest rates. Their performance will reveal the true flow of funds during the Federal Reserve's easing cycle.

Therefore, under the baseline scenario, the probability of moderate growth and insurance-style easing is higher, which means that XHB's elasticity is faster and more direct , while SMH's overall alpha is still worth retaining, because at present, whether it is sector selection or position layout, investors' investment environment must be based on continuous monitoring of interest rate levels and fluctuations, earnings breadth, market breadth and credit environment.

At present, any market that is favorable but fails to meet earnings expectations may become the fuse that triggers a pullback, especially in the traditional weak window period of September, when defense and flexibility are even more important.

Therefore, in addition to judging whether the current macroeconomic policies are factors that induce investor sentiment, investors also need to dynamically observe the continuous changes in individual stock prices and sector funds, and use hedging and position management to maintain flexibility, so as to build a solid investment portfolio in this bull market.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates