How Investors Can Protect Their Finances Under Trump’s 2025 Tariff Policies

05:58 August 22, 2025 EDT

In 2025, the Trump administration has continued to advance its tariff policies, aiming to reduce the trade deficit, support domestic manufacturing, and enhance U.S. economic competitiveness. Since the beginning of the year, these tariff measures have gradually expanded, covering multiple countries and product categories, with far-reaching effects on global trade and the U.S. economy.

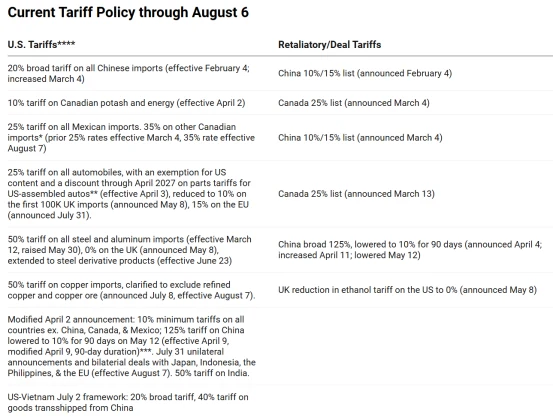

Notably, the “reciprocal tariffs” executive order, which took effect on April 2, imposed tariffs of 10%-25% on nearly all trade partners, bringing the effective U.S. tariff level to a century-high. As of August, the U.S. has set tariffs of 50% on steel and aluminum, 25% on copper, automobiles, and auto parts, while threatened import duties on pharmaceuticals could reach rates as high as 200%.

Source: The Budget Lab at Yale

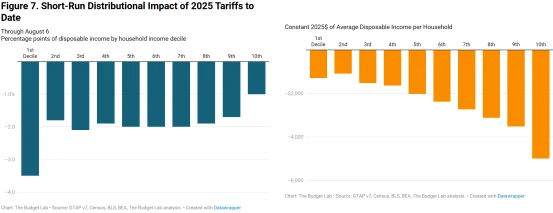

These policies not only raise corporate costs but also directly impact consumer spending and investor asset allocation. According to the Center for American Progress, the Trump tariff measures require a typical U.S. household to spend an additional $4,600 annually. Analysis by the Yale Program on Budgetary Studies indicates that the new tariff plan carries an annualized cost of approximately $4,700. Facing this pressure, individual investors must adopt effective strategies to minimize the impact of tariffs on their finances and investment portfolios.

Source: The Budget Lab at Yale

The Impact of Tariffs

The Trump administration’s tariff policies continue to exacerbate global economic uncertainty. In its July 2025 update of the World Economic Outlook, the International Monetary Fund (IMF) highlighted that U.S. trade policies expose major global economies to heightened risks, with tariffs distorting international trade and economic activity.

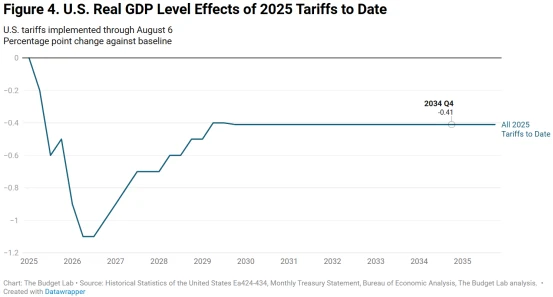

The Yale Program on Budgetary Studies projects that, under the tariff measures, U.S. real GDP growth could decline by 0.5 percentage points in both 2025 and 2026. The Bank of England similarly warned that U.S. tariffs are intensifying global trade conflicts, increasing economic uncertainty worldwide. The United Nations Conference on Trade and Development (UNCTAD) noted that tariff uncertainty is hindering trade and investment decisions, with particularly severe effects on less-developed countries, potentially triggering cascading economic consequences.

Source: The Budget Lab at Yale

On inflation, the Personal Consumption Expenditures (PCE) price index has risen from near 2% in April to nearly 3%. The Producer Price Index (PPI) in July increased 3.3% year-over-year, marking the highest level since February and indicating upward pressure on consumer prices. The Federal Reserve’s July meeting minutes noted that tariff effects are increasingly visible in goods price inflation. Some committee members observed that core inflation excluding tariffs is close to the target, but overall inflationary pressures limit room for rate cuts.

Source: BEA

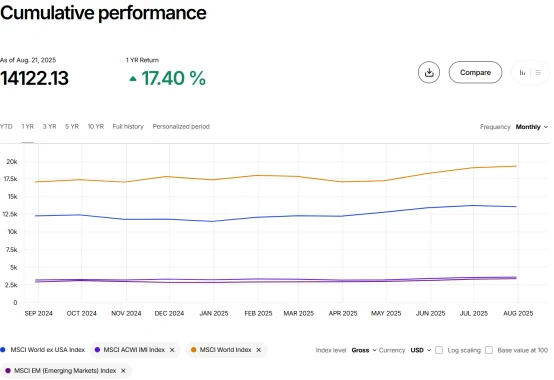

Financial markets have reflected this uncertainty, with significant volatility across U.S. equities, commodities, and bonds. Year-to-date 2025, the MSCI Global Index (excluding the U.S.) has risen nearly 18%, substantially outperforming the S&P 500’s 8.3% gain.

Source: MSCI

Commodity prices have also experienced sharp fluctuations. On April 7, global markets saw a “Black Monday” selloff due to reciprocal tariffs, with WTI crude oil dropping below $60 per barrel. Gold prices surged above $3,500 per ounce amid heightened safe-haven demand.

Source: TradingView

The impact of tariffs varies across sectors. The steel and aluminum industries benefit from higher import costs, expanding domestic market share. Consumer goods sectors, such as apparel and electronics, face price pressures as costs are passed to consumers, with Yale estimating a 17% increase in clothing prices. The automotive sector is notably affected, with S&P Global projecting an average increase of $3,000 per new vehicle. Supply chains are disrupted: port activity has decreased, and ocean freight bookings have fallen by roughly 50%, potentially creating shortages. Companies have also stockpiled high-value goods, including pharmaceuticals and precious metals, with Q1 2025 imports exceeding historical trends by 26%.

Investor Response Strategies

Facing the market uncertainty and cost pressures brought by Trump’s tariff policies, investors can optimize financial management and investment allocation through the following approaches:

Diversify Investment Geographies

Trump’s tariffs primarily target imports from specific countries and regions. Concentrating investments in areas heavily affected by tariffs carries significant risk. Investors should diversify capital across different countries and regions, such as Southeast Asia and Europe. Southeast Asia has experienced rapid economic growth in recent years, with strong activity in manufacturing and services. Investing in related ETFs or local stocks allows investors to capture growth opportunities while reducing reliance on the U.S. market.

Some European companies hold leading technology and market positions globally. Allocating to related stocks or bonds can optimize the geographic distribution of portfolios and reduce exposure to single-region policy shocks.

Focus on Beneficiary Industries and Companies

Not all industries are negatively impacted by tariffs; some may even benefit. For example, U.S. domestic steel companies gain a competitive edge as tariffs raise import costs, potentially boosting profitability. Investors can focus on high-quality companies in these beneficiary industries to capture potential returns in advance.

Additionally, companies primarily serving domestic markets and with high supply-chain self-sufficiency, such as local food processing and utilities, are relatively resilient and can retain a portion in the investment portfolio.

Use Futures and Options to Hedge Risk

In 2025, options trading volume increased 20% due to tariff-related uncertainty, indicating rising market hedging demand. Experienced individual investors can use derivatives to manage market volatility risks caused by tariff policies. For instance, soybean prices may fluctuate sharply due to tariffs. Investors holding related company stocks can establish long or short positions in the futures market, or purchase put options to hedge potential losses.

Derivatives provide flexibility and can effectively protect asset value amid market volatility, but require accurate market judgment. For example, S&P 500 put options (SPY puts). Options strategies require precise market assessment and are suitable for investors with high risk tolerance.

Optimize Fixed-Income Investments

In an environment of rising market uncertainty, the stability of fixed-income assets is particularly important. U.S. Treasuries serve as safe-haven assets, offering protection during periods of market turbulence. Investors may increase the allocation of Treasuries in their portfolios from 20% to 30%-40%.

High-credit-rating corporate bonds generally continue to pay interest and principal on schedule despite shocks, providing stable returns and relative safety. Proper allocation of fixed-income assets helps mitigate the impact of tariff-driven market volatility on portfolios.

Allocate to Safe-Haven Assets

Market volatility induced by tariffs increases the attractiveness of safe-haven assets.

Gold, as a traditional safe-haven asset, performed strongly in 2025, driven by tariff uncertainty and a weaker dollar. Year-to-date, spot gold prices have risen 26.7%. The World Gold Council noted that gold has formed a “triangle” continuation pattern; if it breaks through $3,351/oz, it may rise further toward $4,000/oz.

Given tariff-driven inflation expectations, the allocation to gold as a safe-haven asset can increase from 5% to 10%-15%. When Trump threatened additional tariffs on the EU in May 2025, spot gold rose nearly 2% in a single day, demonstrating its hedging effectiveness.

Stay Informed and Seek Professional Advice

Trump’s tariff policies are frequently adjusted, with new provisions and details constantly issued. Investors need to stay updated through professional financial media, government documents, and industry reports. Financial advisors can provide personalized strategies based on individual financial situations, investment goals, and risk tolerance, helping investors interpret policy changes and adjust portfolios in advance.

Before Trump announced the “reciprocal tariffs” in April 2025, some investors had already adjusted portfolios to reduce market volatility losses. Since August, investors subscribed to financial news have increased portfolio adjustments by 15%, highlighting the importance of timely information.

Optimize Portfolio Structure

Investors should reassess portfolios and reduce exposure to tariff-sensitive sectors. The technology sector, especially semiconductors, faces risks due to high revenue exposure to the Chinese market (e.g., Nvidia 20%-25%). It is recommended to reduce technology stock allocation from 30% to 15%. Increasing allocation to low-volatility assets, such as low-volatility ETFs (SPLV), which returned about 6% in 2025, outperforming the S&P 500. Regular portfolio rebalancing (quarterly recommended) helps adapt to market changes.

Investors should also monitor policy exemptions, as some industries may receive tariff waivers due to “national security” or economic significance, such as renewable energy and semiconductors. Investors can follow these companies and adjust strategies promptly.

Optimize Daily Financial Management

In addition to investment strategies, daily financial planning can help mitigate tariff pressures:

Prioritize savings: Establish or increase emergency reserves to cope with rising prices or unexpected expenses.

Reduce unnecessary spending: Optimize budgets to lower discretionary expenditures.

Adjust debt strategy: Consider consolidating low- or zero-interest debt to improve cash flow.

Shop strategically: Purchase essential goods before price increases and use cashback tools to reduce expenses.

In summary, investors should adopt a systematic approach across global investment diversification, industry selection, derivative usage, fixed-income allocation, and daily financial management to reduce the impact of Trump’s tariffs on personal finances.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates