Will the Fed hold higher rates for longer or turn dovish early?

03:15 August 22, 2025 EDT

Key Points:

The long-term trend in US real GDP growth has clearly weakened, while the federal fiscal deficit and debt ratio continue to climb, creating a dilemma of "high debt and low growth." Revenue from tariffs will hardly change this upward debt ratio dilemma.

When nominal interest rates exceed nominal growth rates, the fiscal adjustment required to stabilize debt rises sharply. If fiscal spending is biased toward transfer payments and interest payments, the investment multiplier becomes low or even negative, further crowding out private investment and weakening productivity.

To achieve debt sustainability, we must simultaneously advance: 1) increasing potential growth (infrastructure, human capital, and regulatory reform); 2) managing financing costs (stabilizing the issuance curve and reducing risk premiums); and 3) optimizing the deficit structure (expanding the tax base, restructuring spending, and strengthening automatic stabilizers).

The market is betting on a September Fed rate cut signal, but this week is more of a test of expectations. With high-frequency data clearly cooling, the agenda shifts to central bank communications: the FOMC minutes will be released first, followed by a flurry of speeches at the Jackson Hole symposium. Traders are anticipating less new facts than a framework for rewriting pricing.

The minutes are important but delayed. Reflecting discussions from the previous regular meeting, they lag behind recent revisions to labor and price data, serving as a mirror for the Committee's risk management decisions within its narrative of "cooling inflation but remaining above target, and marginal weakening in employment." Jackson Hole is where the final path can truly be rewritten: past experience shows that the Chair discusses principles more than positions here—reassessing the neutral interest rate, the relationship between productivity and potential growth, why the term premium remains resistant to reduction, and the impact of declining data quality on real-time decision-making are all possible themes. If the speech gives equal weight to "further inflation progress" and "downward labor risks," and emphasizes the "reversibility" and "data-driven" nature of policy, it would signal a mildly dovish stance. Conversely, if it emphasizes the stickiness of services inflation, the lag in housing measurement, and the durability of the upward trend in the term premium, it would suggest that the "longer, higher" tone remains dominant.

The market's fork in the road lies in the granularity of forward guidance. If the chairman explicitly "leaves the door open to a September rate cut, but makes no promises," the most immediate reaction would likely be a slight reduction in front-end interest rates, with the long end not necessarily following suit. In an environment of high supply and rising term premiums, the curve could experience a mild bearish steepening, with a stronger dollar and pressure on growth stock valuations. Only if the wording convinces investors of a higher probability of "continuous easing this year," accompanied by a reaffirmation of the inflation anchor, will a smooth bullish steepening in the long end become more likely, with a decline in the dollar, interest rate duration, and gold all benefiting simultaneously. Regardless of which path is taken, caution is warranted regarding the "information misalignment" between the minutes and the annual meeting: the historical perspective of the minutes can easily be quickly overshadowed by the forward-looking narrative of the annual meeting, exacerbating short-term volatility and making a repeat of the "rumor-and-implementation" pricing pattern more likely.

Two other details are worth listening for in advance. The first is the hint at the "neutral interest rate": If the speech acknowledges that r* may be higher than before the pandemic, the market will interpret this as an upward revision to the nominal central rate, thereby limiting the potential for downward movement in the long term. The second is the discussion of quantitative tightening and reserve adequacy: Any hint of slowing balance sheet reduction, stabilizing repo use, or "smoothing the supply curve" will affect 10-30 year interest rates through the term premium channel. Interpreting these clues alongside key words like "further progress," "two-sided risks," and "risk-management considerations" is often more effective than dwelling on the 25 basis point difference between individual points.

Source : trading view.com

From another perspective, this week is more about pricing in narrative than data. The data window gives the central bank the final say, and marginal changes in communication become the primary driver of prices. If the final communication falls within the "cautious, imperfect" range, the market may need to roll back some of its bets on a September rate cut. While the disappointment won't be dramatic, it will be reflected in the stickiness at the top of the yield curve and a further tightening of financial conditions. If the communication opens the door more clearly, the probability of a rapid test of the lower range increases, but further inflation and employment confirmation will still be needed to consolidate the trend. For investors, the real focus isn't on whether there will be a rate cut, but whether the central bank has provided a self-consistent and sustainable narrative for its path forward—only such a narrative can transform a weekly fluctuation into a quarterly direction.

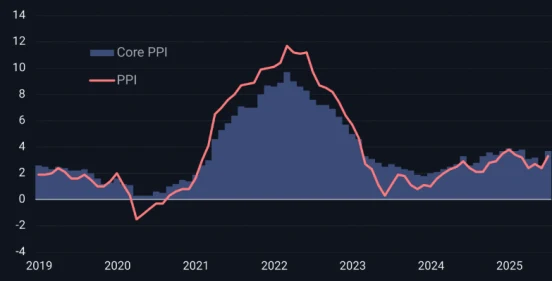

The unexpected rise in PPI disrupted bets on rate cuts: the September meeting went from being a "certainty" to being "data-dependent."

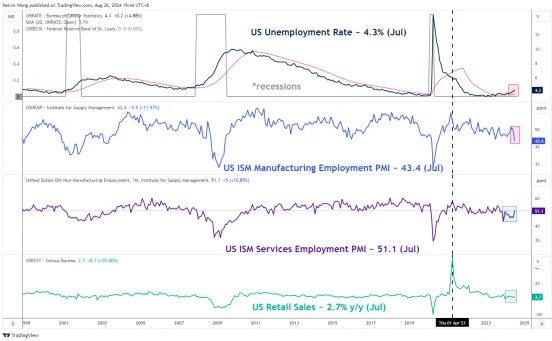

Before last week, traders had practically accepted a September rate cut as a foregone conclusion, with the market even debating whether it would be 25 basis points or 50 basis points. However, a higher-than-expected PPI reading suddenly threw this path into doubt: the implied probability in futures fell from nearly 100% to around 85%, and this probability still has room to adjust downwards before new inflation and employment data are released. The 0.9% month-over-month and 3.3% year-over-year increase in the PPI went beyond simply exceeding expectations; it shifted the inflation narrative from a "steady decline" to a "return of stickiness," forcing the Federal Reserve to rebalance its priorities between stabilizing growth and stabilizing prices.

From a mechanistic perspective, the impact of producer price inflation won't be directly passed on to CPI/PCE. However, as upstream costs rise across a wider range of product categories and corporate inventory and profit margin buffers narrow, the momentum for passing on inflation to the end user will grow. This is especially true in the service sector, where items related to wages, rents, and insurance are inherently sticky. In other words, this round of PPI increases won't necessarily push consumer inflation back to its previous high, but it will be enough for the committee to demand more evidence of convergence toward 2% before cutting rates in September. Combined with the frequent downward revisions to labor market data and the widening confidence intervals, the Fed is more likely to adopt a "data-dependent and risk-managed" approach to avoid premature easing when inflation resurfaces.

Source: investing.com

At the market pricing level, this signals a temporary return to the "longer, higher" narrative: bets on the number of rate cuts are cooling on the front end, while the long end, supported by supply and term premiums, is limited in its downward trend, making the curve susceptible to a mild bearish steepening. The US dollar is strengthening, the beta of long-dated assets is retreating, and the valuation elasticity of growth-focused assets is suppressed. To push the probability of a September rate cut back into the "certain zone," a series of data points will need to coincide: continued decline in core PCE, a cooling but not disorderly employment situation, and a PPI decline that isn't a single-month noise. Conversely, if any link in the inflation chain experiences setbacks, the Fed would have ample reason to delay the first rate cut or offer only a symbolic 25 basis points, while using communication to guide financial conditions toward a "gentle, not drastic, tightening."

We must also recognize the limits of this PPI "shock": energy and certain midstream sectors often experience monthly fluctuations, and base effects and seasonally adjusted figures can amplify short-term discrepancies. Consumer inflation is primarily weighted towards services, and PPI measurement of these services is asymmetrical. Therefore, a more plausible interpretation is not that "interest rate cuts are out of the question," but rather that "the door remains open, but the threshold has been raised." In this environment, asset prices have become more sensitive to central bank rhetoric, and trading has shifted from "betting on the pace" to "betting on the path certainty." Any signal that reduces uncertainty—such as clearer guidance on the neutral interest rate, term premiums, and the pace of balance sheet reduction—will have greater pricing power than a single point.

Hidden concerns over overbought

I remain optimistic in the medium to long term, but from a technical perspective and trading structure, the current market is indeed more like a period of range-bound trading that requires a consolidation. The S&P 500 (SPX) is in a significant overbought zone, with prices reaching new highs while the daily and weekly RSI are showing negative divergence. This divergence between momentum and price is often a classic sign of an upward trend entering a "stretch phase." Since the April low, the index has been almost unbroken, with the exception of a shallow retracement of approximately 3% in late July. The moving average divergence, upward angle, and pace of gains all suggest accumulating short-term digestion demand. A 5%-10% retracement in the coming weeks would not be surprising.

This technical cooling isn't a "trend end," but more like a cooling after an overheat. Market insiders are also suggesting similar trends: large-cap leading stocks are leading the gains, while equal-weighted indices and small-cap stocks are relatively weak. Breadth indicators (percentage of stocks rising and number of stocks hitting new highs) haven't simultaneously confirmed new highs, suggesting this surge is more reliant on momentum from a small number of heavyweight stocks rather than a widespread surge. At the options level, the initial high density of call premiums and positive gamma suppressed volatility. However, once prices escaped the sellers' protective band, gamma gradually turned negative, and volatility risk actually increased. The "trend acceleration" during the pullback may be faster than in previous periods. Combined with seasonal factors and noise from the earnings window, the buyback quiet window, and the peak of macroeconomic events, the distribution of short-term volatility is significantly right-skewed.

Over a longer timeframe, the fundamental and valuation framework remains intact. Earnings expectations are still being revised upwards. Balance sheets with ample cash flow, relatively healthy inventories, and the spillover effects of supply-side efficiency improvements and AI capital expenditures support medium-term earnings. As long as long-term interest rates remain within their trading range and inflation continues to slowly decline toward target, the risk premium, while not cheap, can be absorbed by earnings expansion. In other words, the medium-term "earnings-driven, valuation-driven" bullish structure remains in place, but short-term prices are significantly ahead of fundamentals, requiring time and space for the two to realign.

Source: articles.stockcharts.com

Operationally, a more sensible approach is to "hold long cautiously and adopt a more restrained pace." When odds and win rates are misaligned, reducing the portfolio's instantaneous beta, shifting positions from pure momentum to sectors with better cash flow and valuation margins, and using protective tools (such as option hedging) after volatility increases to manage the downside tail of extreme scenarios are often more critical than predicting the precise magnitude of the drawdown. Technically, focus on the 50- and 100-day moving averages, previous areas of high trading volume, and the strength of gap-filling reactions. Fundamentally, monitor whether long-term interest rates break out of their range, whether credit spreads widen unwarranted, and whether there are "directional surprises" consistent with employment/inflation data. A pullback accompanied only by a reduction in volume and a recovery in breadth is healthy; if accompanied by a rapid widening of spreads and a steepening of the volatility curve, more conservative risk management is warranted.

In short, the short-term "fast and expensive" issue needs to be addressed, either through sideways fluctuations or a meaningful downward move. However, the medium-term "quality vs. quantity" conflict remains minimal. As long as there's no significant misalignment between interest rates and growth in the macroeconomic environment, there's still a path to higher targets this year (such as the 7,000-point anchor you mentioned). Viewing short-term declines as a necessary price to pay for medium-term market sustainability is healthier and more sustainable than continuing to accelerate from a high level.

Conclusion

This week's focus isn't on whether there will be a rate cut, but on the next step. The minutes merely recap what was said at the previous meeting; Jackson Hole sets the tone: How will the Fed balance elevated inflation with weakening employment? Last week's jump in the PPI makes an imminent rate cut less certain; yet, the frequent downward revisions to employment data give the Fed reason to shift toward a dovish stance. For us, the more pressing question is whether the Fed will lay out a clear and sustainable path forward, rather than dwelling on whether or not to cut rates by 25 basis points in September.

At the market level, don't put all your bets on a single meeting. The next phase will likely be "volatility first, direction later." If the statement is "the door is open, but we'll see the data first," market sentiment will cool slightly; if the statement is more concrete, there's a greater chance of easing before the end of the year, and long-term interest rates may fall slightly. Operationally, don't chase highs or stay flat. Reduce your positions gradually, select stocks with stable cash flows and affordable valuations, and use cheaper hedging instruments as a backup. Wait for two or three more sets of "confirmed" signs of inflation and employment moving in the same direction. In short, spend less on second guessing and more on focusing on this path—listen carefully to the Fed's direction, safeguard the quality of your assets, and give the market time to transform "rumors" into "trends."

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates