Take Note of This Stock Buffett Is Heavily Invested In

05:45 August 21, 2025 EDT

Warren Buffett has long adhered to a value investing philosophy, emphasizing caution during market overheating while seeking opportunities in undervalued, high-quality companies.

Recently, with the S&P 500 index price-to-earnings ratio climbing to approximately 30 times, Berkshire Hathaway has adopted a cautious approach: reducing holdings in some top-tier stocks, increasing its cash reserves, and suspending stock buybacks in 2024. Nevertheless, even amid elevated market valuations, Buffett continues to increase stakes in companies with steady growth potential, with the insurance giant Chubb standing out as a key focus for investors.

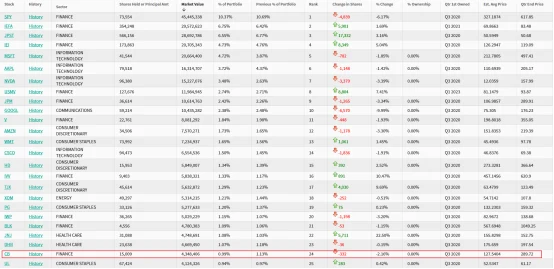

As of the first quarter of 2024, Berkshire held approximately 25.92 million shares of Chubb, valued at over $6.7 billion, accounting for 2.5% of its equity portfolio and ranking as the ninth-largest holding. Berkshire began building this position incrementally in the third quarter of 2023 and continued to add shares through the first quarter of 2025.

Source: WhaleWisdom

Core Competitive Advantage

Chubb Limited is headquartered in Zurich, Switzerland, with a global workforce of approximately 43,000 employees operating across 54 countries and regions. The company's core businesses include property insurance, accident insurance, liability insurance, and health insurance, with a particularly strong and longstanding competitive edge in the property and casualty (P&C) sector. In 2015, ACE Group (formerly ACE Limited) acquired the Chubb insurance group, and following the merger's completion in 2016, the company adopted the Chubb brand, establishing its current global business network.

Currently, Chubb's total assets exceed $500 billion, with annual net revenues surpassing $135 billion. Forty-seven percent of its business originates outside the United States, enhancing its stability and resilience against economic cycles. The company's financial strength is recognized by top ratings: A++ from A.M. Best, AA+ from Standard & Poor's, and Aaa from Moody's.

Source: Chubb

Industry Trends and Policy Tailwinds

The global insurance market is projected to reach $7.5 trillion in 2025, with an annual growth rate of approximately 4.5%, of which property and casualty (P&C) insurance accounts for about 40%. The U.S. market is estimated at $2.1 trillion, with P&C premium income expected to grow by 5.2%, driven by inflation, rising interest rates, and frequent natural disasters. Industry characteristics, including high entry barriers, stable cash flows, and relative immunity to macroeconomic cycles, attract long-term investors.

The macroeconomic environment provides support for the insurance sector. The U.S. inflation rate remains at 2.7%, with the federal funds rate ranging from 4.25% to 4.5%, and higher interest rates boost investment income. Chubb anticipates adjusted net investment income of $17.2 billion to $17.4 billion for the third quarter of 2025, reflecting improved returns from its bond portfolio. Despite rising trade costs, demand for core insurance policies remains stable, contributing to a 6.3% increase in Chubb's net premium income.

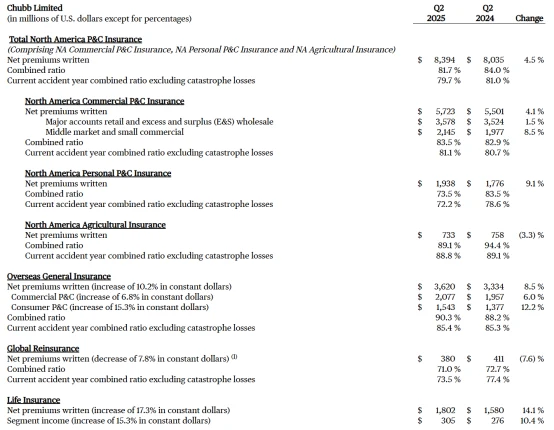

The increasing frequency of natural disasters also drives growth in underwriting demand. Global natural disaster losses are forecasted to reach $320 billion in 2025, a 15% increase from the previous year, with North American commercial premium rates rising by an average of 4.5%. Chubb reported $630 million in catastrophe losses during the second quarter, representing 5.1% of its P&C net premiums written ($12.39 billion), which is below the industry average of 6.2%, demonstrating the company's disciplined underwriting and risk management capabilities.

Source: Chubb

Technological applications and efficiency improvements further enhance profitability. Chubb leverages artificial intelligence to optimize claims processing, reducing its combined ratio to 85.6% in 2024, significantly below the industry average of 96.6%. McKinsey projects that global insurance industry technology investments between 2025 and 2030 could boost efficiency by 10-15%, generating approximately $500 billion in additional profits.

Internationalization and diversification are also key advantages. Chubb derives 47% of its revenue from markets outside the United States, with international business growing by 7.1% in 2025. The Asia-Pacific region saw premium growth of 8.3%, exceeding North America's 5.2%, effectively mitigating market and geopolitical risks.

Financial Health and Profitability

Chubb Limited demonstrates robust performance in underwriting capability and profit quality. In 2024, its property and casualty (P&C) combined ratio stood at 86.6%, significantly below the U.S. property insurance industry average of 96.6%, reflecting a prudent approach to risk management and underwriting strategies. A combined ratio below 100% indicates that the company's premium income sufficiently covers claims and operating expenses, generating stable value for shareholders.

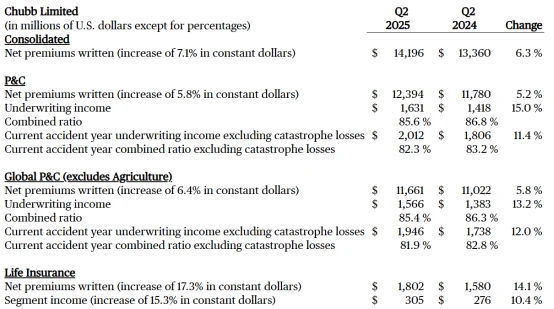

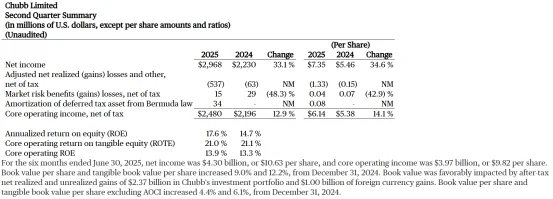

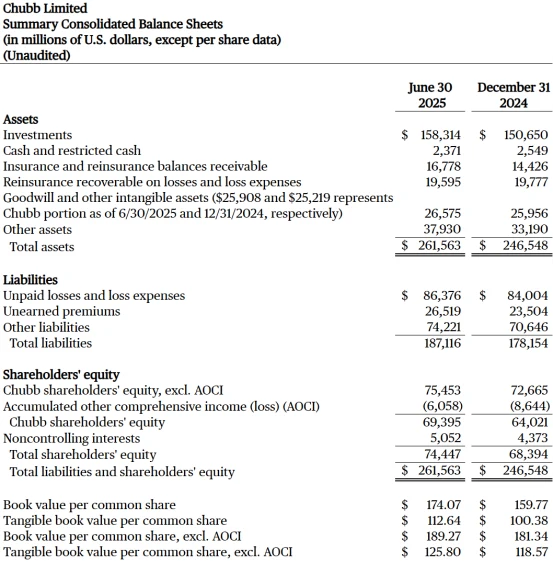

The second quarter 2025 earnings report highlights Chubb's strong financial results, with core operating earnings per share (EPS) reaching a record $6.14, a 14% increase year-over-year, and core operating income rising to $2.5 billion, up 13%. The underwriting business performed notably well, with net premiums written totaling $12.39 billion, a 5.2% increase, and underwriting profit at $1.63 billion, up 15%. Net income climbed to $2.97 billion, reflecting a 33.1% year-over-year gain. Additionally, book value per share reached $174, marking a 6% increase.

Source: Chubb

The company maintains a steady dividend policy, announcing a 6.6% increase in its annual dividend to $3.88 per share in 2025, marking the 32nd consecutive year of dividend growth. This underscores the consistency of the company's cash flows while providing reliable dividend income for long-term investors.

Source: Chubb

Investment Appraisal

Chubb Limited's stock valuation appears reasonable. The current price-to-earnings (P/E) ratio stands at approximately 12 times, while analysts project a compound annual growth rate (CAGR) for earnings per share (EPS) of about 8% from 2024 to 2027. Although short-term price volatility may be limited, the stock exhibits significant long-term growth potential.

Based on its solid financial performance and ongoing business expansion, if EPS grows at an approximate 8% CAGR over the next 10 years and achieves a forward P/E ratio of 15 at the end of that period, the stock price could more than double to over $800. This calculation, starting from the current EPS of $22.65 and projecting to approximately $48.81 in 10 years with a $732.15 valuation (potentially exceeding $800 with additional growth factors), highlights substantial long-term return potential.

From an institutional perspective, several Wall Street firms have assigned high ratings to Chubb. Keefe, Bruyette & Woods maintains an "Outperform" rating with a target price of $324, while Raymond James upholds a "Strong Buy" rating with a target price of $340. These institutions cite the company's robust potential for both organic and inorganic premium growth, as well as sustained expansion in core underwriting profit margins.

Overall, Chubb Limited is a globally influential property and casualty insurer with strong financials, diversified operations, and a stable dividend policy, alongside significant long-term growth prospects. As a key holding in Berkshire Hathaway's portfolio, its continued attention from Buffett and his team underscores the recognition of its long-term value by professional investors.

Currently, the stock trades at approximately $279.68, with a year-to-date gain of about 2%, suggesting that the market has not yet fully priced in its long-term growth potential.

Source: TradingView

For investors seeking steady returns and a focus on long-term value investing, Chubb Limited warrants consideration.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates