Inflation Signals Under Trump’s Tariff Pressures

03:49 August 21, 2025 EDT

Key points:

Although the Trump administration’s “reciprocal tariffs” directly pushed up import prices, inflationary pressure has not erupted all at once in the short term but has emerged more gradually.

Lower-than-expected effective tariff rates, optimized product structures, and inventory buffers have eased tariff pressure, preventing an immediate surge in inflation.

From an investment perspective, the gradual onset of tariff-driven inflation suggests that short-term market volatility may be limited, while opportunities are slowly taking shape.

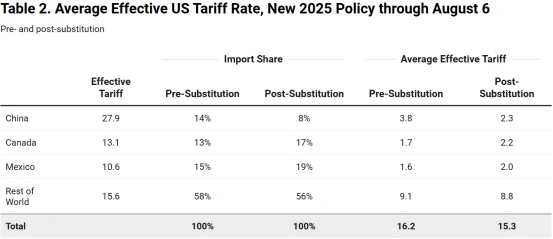

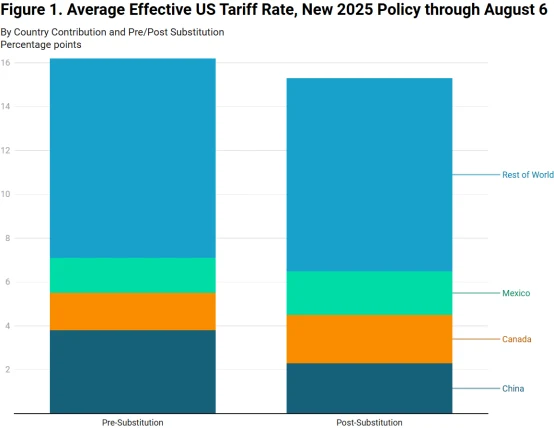

In 2025, a series of import tariffs imposed by the Trump administration raised U.S. import costs, with the average effective tariff rate climbing to about 15.3% by midyear. These measures targeted major trading partners including China, Japan, and the European Union, aiming to protect domestic industries and reduce the trade deficit. However, signs of inflation have appeared only gradually, influenced by corporate strategies, supply chain adjustments, and the dynamics of policy implementation.

Although nominal tariff rates generally ranged between 20% and 40%, wholesale and retail price increases have been far below market expectations. This indicates that tariff costs have been absorbed and dispersed throughout the supply chain. According to Capital Economics, as of June 2025, the effective tariff rate on U.S. imports was around 9%, below analysts’ earlier forecasts of 15%. Companies have eased tariff burdens by adjusting sourcing and product structures—imports of high-tariff goods from China have declined, while imports from lower-tariff sources such as Vietnam and India have increased, keeping the average tariff level below expectations.

In addition, companies have optimized product portfolios to buffer the impact of tariffs on end prices. Imports of high-tariff goods such as steel and aluminum have declined as a share of total imports, while imports of duty-free or low-tariff electronics have increased. These adjustments have kept inflationary pressure from erupting suddenly and instead allowed it to emerge gradually, providing investors and policymakers with a clearer view of how economic costs are being transmitted through the system.

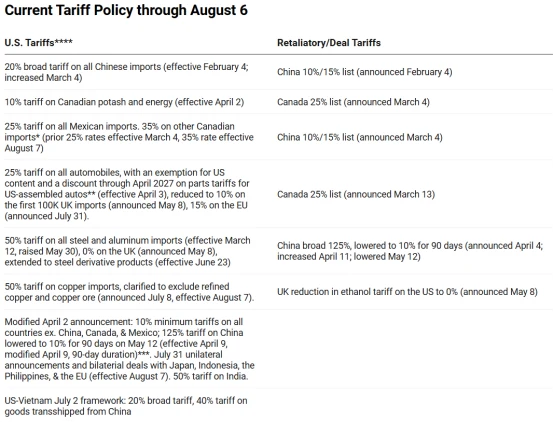

Present Stage of Tariff Policy Rollout

Tariffs implemented in 2025 have increased the average cost of affected import categories by nearly 20%. According to data from the Budget Lab at Yale, the average tariff rate rose from 2.5% prior to implementation to a peak of 28% in April and May before easing to around 15%.

Source: The Budget Lab at Yale

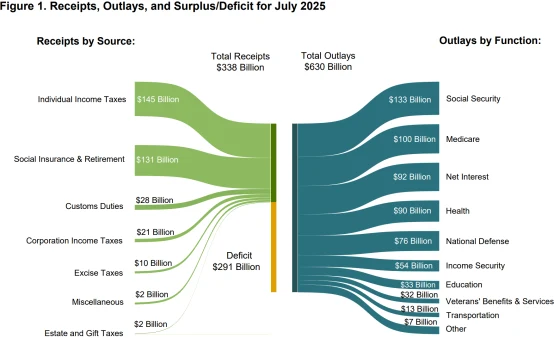

This shift has generated significant fiscal revenue. Monthly tariff collections surged from roughly $8 billion before implementation to $30 billion in June 2025, with annual additional revenue projected at $172.1 billion—equivalent to 0.57% of GDP.

Source: U.S. Treasury Department

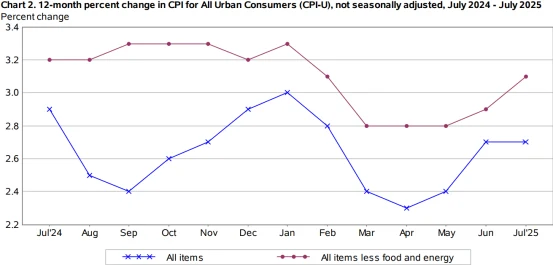

Even so, inflationary pressures have yet to fully materialize. In July 2025, the Consumer Price Index (CPI) rose 2.7% year-over-year, while core CPI climbed 3.1%—both exceeding forecasts but showing no sharp spike. The Producer Price Index (PPI), however, posted its largest gain in three years, signaling emerging upstream cost pressures.

Source: BEA

These trends resemble the experience during the 2018 tariffs on Chinese goods, when import costs rose 15–20%, but retail price adjustments were slow to follow.

While tariffs directly increase import prices, the pass-through to consumers typically follows a staged path—“cost shock → short-term absorption → profit compression → downstream price adjustment”—rather than an immediate surge.

In the short run, importers have absorbed 60–70% of tariff costs by squeezing margins or optimizing operations, delaying full transmission to end consumers. As profit buffers erode, prices gradually move downstream. Between 2018 and 2019, the CPI for furniture rose from 1.2% to 2.3%, and for apparel from 0.8% to 1.9%, illustrating this gradual pass-through.

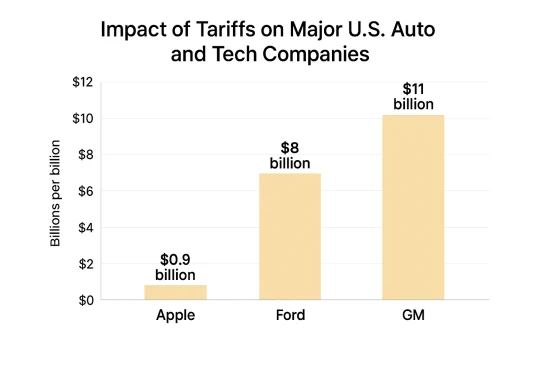

Similar signals are now evident in 2025. Wholesale prices jumped sharply in July, and companies such as Apple, Ford, and General Motors reported in their Q2 earnings that tariff-related costs have eroded profit margins.

Citi analysts project that businesses will increasingly shift costs to foreign suppliers and U.S. customers, potentially pushing core CPI higher by an additional 0.8 to 1.2 percentage points over the course of 2025. However, inventory buffers and contractual obligations mean this process will take several months to fully unfold.

Delayed Emergence of Inflation Signals

Inflation Signals Emerge Gradually Under Tariff Pressures Due to Multiple Factors

First, actual tariff rates are lower than anticipated, averaging 9% in June instead of an estimated 15%. Importers have shifted sourcing to countries with lower tariffs: imports from China declined due to 40% tariffs, while imports from Vietnam, India, and Taiwan increased, facing rates of 20% or below.

Source: The Budget Lab at Yale

Second, changes in product composition have alleviated pressure. High-tariff items such as steel and aluminum (subject to 25% tariffs) account for a smaller share of imports, while duty-free electronics imports have gained a larger share. Third, pre-tariff stockpiling created a buffer; imports surged by 11% in Q1 2025. As inventories are depleted, upward price pressures will gradually emerge. Meanwhile, multinational tech companies like Apple and Microsoft have successfully lobbied for exemptions on electronics tariffs, effectively mitigating the direct cost impact of the policies. Overall, businesses have absorbed the majority of tariff costs in the short term. According to Citi Research, U.S. firms are currently bearing approximately 60%–70% of tariff expenses.

However, as tariffs persist and supply chain adjustments are finalized, pressure for firms to pass on costs will gradually intensify. Core consumer goods such as furniture and electronics saw their prices rise in July 2025 at the fastest pace in three years, indicating that tariff-induced inflation is gradually taking hold.

Policy volatility also plays a role. Tariffs have been implemented in phases, delayed, or negotiated lower—for instance, reduced from 25% to 15% for Japan and from 46% to 20% for Vietnam—creating uncertainty and prompting cautious pricing. These factors extend the lag in effects, consistent with the 2018 experience, when the full impact took 1–2 years to materialize.

Source: The Budget Lab at Yale

Additionally, U.S. companies are responding to tariff pressures through diversification and efficiency measures. Supply chain shifts to Mexico and Vietnam have reduced exposure, though new supply arrangements add 3–5% in costs due to lower efficiency. Automation and supplier negotiations have further absorbed some pressure. However, these strategies have limits. As inventories decline, restocking at higher costs will accelerate cost pass-through.

Importantly, legal and political factors add complexity. In May 2025, a court ruling cast doubt on the authority to impose tariffs under the International Emergency Economic Powers Act (IEEPA), suspending partial implementation and prolonging delays. International countermeasures, such as the EU’s 25% tariff on U.S. goods, increase costs but have not immediately triggered a sharp rise in inflation. Still, the prolonged implementation of reciprocal tariffs will inevitably lead to a restructuring of global trade patterns, further amplifying the pass-through effect of rising import costs.

Macroeconomic Impact and Monetary Policy Dilemma

Major authoritative institutions have issued highly consistent warnings regarding the long-term impact of tariff policies. The International Monetary Fund (IMF) estimates that U.S. tariffs could add 0.8–1.2 percentage points to core CPI, while global growth may slow. The World Bank warns that global trade growth could decelerate to 1.8%, and supply chain regionalization will raise costs and reduce global economic efficiency. The Organisation for Economic Co-operation and Development (OECD) notes that U.S. households will directly bear tariff costs, with low-income groups being disproportionately affected. The Congressional Budget Office (CBO) emphasizes that the fiscal gains from tariffs will be offset by long-term economic losses.

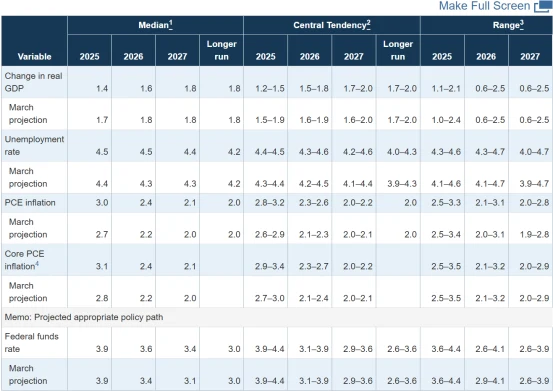

The Federal Reserve faces a serious dilemma in navigating this environment. Rising inflationary pressures coincide with slowing economic growth, limiting policy flexibility. July 2025 meeting minutes revealed that some officials support rate cuts to address deteriorating employment conditions, but must simultaneously guard against further inflation.

Source: Federal Reserve

Uncertainty around tariff policy makes it difficult for monetary policy to balance growth and price stability, creating one of the most complex policy challenges in half a century.

Future Trajectory of Inflation

Sector performance further confirms the delayed and uneven impact of tariff-induced inflation. The effects of Trump-era tariffs have varied significantly across industries. In the automotive sector, for instance, rising raw material costs have pressured corporate profits, with Q2 2025 profits down more than 35% year-on-year. Japanese automakers saw a particularly notable decline in exports, reflecting the dual impact of high tariffs on both production costs and international competitiveness.

In contrast, the technology sector has benefited from some tariff exemptions, though the cost of semiconductor manufacturing equipment has still risen by approximately 15%, potentially constraining R&D investment and innovation. The agricultural sector is also under pressure, with EU retaliatory tariffs leading to an 18% decline in soybean exports. While fiscal subsidies have partially offset these losses, they are unlikely to fully compensate for the impact of the export contraction.

Over the long term, as inventories are drawn down and tariff measures are fully implemented, the costs of highly taxed goods will be increasingly passed through to end prices, keeping core CPI under persistent pressure. Meanwhile, supply chain regionalization is likely to persist, raising the risk of a restructuring of global trade patterns. Policy objectives such as reshoring manufacturing and reducing the trade deficit remain challenging, and the long-term costs of high tariffs could far exceed short-term gains. Corporate cost management and supply chain adjustments will be critical in response, while consumer spending and overall economic growth may also be affected.

From an investment perspective, the gradual emergence of tariff inflation suggests near-term market volatility may be limited, but opportunities are slowly materializing. Companies with diversified supply chains and strong cost-control capabilities are likely to demonstrate earnings resilience amid tariff pressures, while those heavily reliant on single import sources face rising cost risks. Additionally, policy uncertainty remains a latent risk factor, requiring investors to closely monitor policy developments and reactions from trade partners.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates