Markets Are Betting on a September Rate Cut — What’s Making the Fed Hesitate?

23:18 August 20, 2025 EDT

Key Points:

The July meeting minutes showed that the upside risk to inflation outweighs the downside risk to employment, due to inflation remaining above the 2% target and the potential for tariffs to push prices higher.

The minutes reiterated that premature easing could stimulate demand and hinder disinflation, while delayed action could worsen employment weakness. The Fed faces a dilemma between “fighting inflation” and “supporting jobs.”

In the coming months, should employment deteriorate further while inflation gradually declines, rate cuts could accelerate; however, if core inflation rises again, holding steady in September is also possible.

The Federal Reserve’s July Federal Open Market Committee (FOMC) minutes revealed an unusually high degree of internal disagreement over rate policy. While the federal funds rate remained at 4.25%–4.5%, two members already favored an immediate 25-basis-point cut—an open dissent rarely seen in the past 30 years.

Most officials emphasized that inflation risks still outweigh employment risks. They noted that the U.S. economy continues to grow moderately, but with the unemployment rate rising to 4.2% and job creation slowing significantly, the labor market is cooling. Some members warned that keeping rates too high for too long could rapidly increase recession risks. The Fed is caught in a tug-of-war between inflation priorities and employment objectives.

Tariff Shock and Sticky Inflation

New external factors have further intensified this dilemma. The inflationary effects of recent tariff hikes have not fully materialized, but the minutes show that most officials agree that short-term price increases are inevitable.

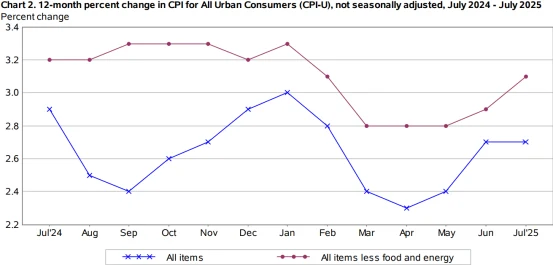

Although headline CPI in July rose 2.7% year-on-year, below expectations, core CPI (excluding food and energy) has kept the Fed on alert—core CPI rose 3.1% year-on-year and 0.3% month-on-month, the highest monthly reading since January 2025. Goods CPI increased 0.4% month-on-month (led by tariff-affected categories such as furniture and electronics), while services CPI rose 0.2% month-on-month, with stickiness remaining in housing and healthcare.

Source: BEA

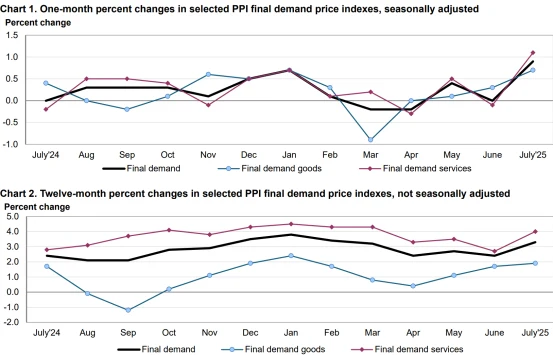

More importantly, the July Producer Price Index (PPI) rose 3.8% year-on-year, marking a three-year peak since June 2022, indicating that cost pressures are still being transmitted to consumer prices.

Source: BEA

The minutes show significant disagreement within the Fed over the impact of tariffs, which adds to policy hesitation. Some members believe tariffs will only trigger a “one-time price increase,” with inflationary pressure gradually easing as firms adjust supply chains. Others worry that if current tariff policies persist or escalate, efficiency losses from supply chain restructuring and rising input costs could keep core inflation above 2.5% through the second half of 2025 into early 2026, creating “sticky inflation.”

In addition, some participants explicitly noted that if inflation remains above the 2% target for an extended period, market confidence in Fed policy could decline, potentially unanchoring long-term inflation expectations. This risk discourages the Fed from signaling easing through rate cuts.

Economist surveys show that nearly two-thirds of respondents believe the substantive inflationary impact of tariffs has not yet appeared. July 2025 retail sales grew 0.5% month-on-month, below the expected 0.6%, reflecting pressure on consumer spending. These uncertainties all contribute to the Fed’s cautious stance on the timing of rate cuts.

Soft Labor Market vs. the Soft Landing Objective

Despite weak employment data in July, the Fed’s assessment of the labor market is not entirely pessimistic, which is a key reason for its hesitation.

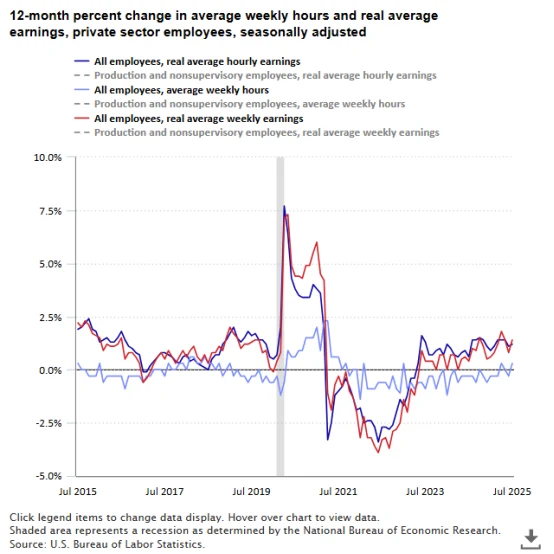

Looking at the details, average hourly earnings in July rose 4.4% year-on-year, above the expected 4.2%, and 0.3% month-on-month, indicating that wage growth remains elevated. The labor force participation rate held steady at 62.5%, showing no significant contraction in labor supply. Fed staff noted during the meeting that “the current cooling in the labor market is more of a ‘moderate adjustment’ rather than a ‘recession signal,’” and revisions to May-June data may reflect seasonal factors, requiring August data for further confirmation.

Source: BEA

Importantly, the Fed’s policy objective is an “economic soft landing”—to prevent a sharp deterioration in the labor market while avoiding a rebound in inflation. Cutting rates prematurely could signal a shift to easing, leading to overly loose financial conditions, which might stimulate demand and exacerbate inflationary pressures. Conversely, refraining from cuts while employment remains weak could further slow economic growth.

The current data trend is similar to July 2024. At that time, inflation had eased somewhat but remained elevated, the unemployment rate rose to 4.1%, and job growth slowed. The 2025 meeting minutes reiterated that premature easing could stimulate demand and hinder disinflation, while delayed action could worsen employment weakness. This dilemma between “fighting inflation” and “supporting jobs” lies at the core of the Fed’s hesitation.

Financial Stability and Stablecoin-Related Risks

The July meeting minutes linked “financial stability risks” directly to interest rate policy for the first time, representing a key factor in the Fed’s hesitation to cut rates. Two types of risks were highlighted:

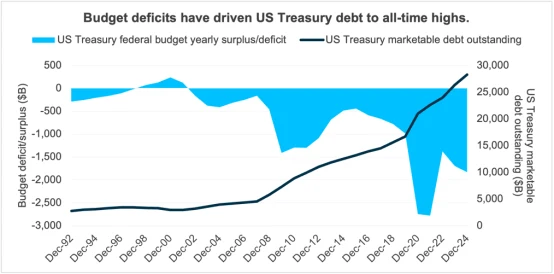

First, vulnerabilities in the U.S. Treasury market. Some members noted that the intermediation capacity of current Treasury market dealers has declined significantly. For primary dealers, their Treasury inventories as a share of total market volume are at the lowest level since 2008. Although the New York Fed reports that holdings have reached nearly $400 billion—a record high—the balance sheet expansion of these dealers lags far behind overall market growth, resulting in insufficient market depth.

At the same time, hedge fund positions increase instability. According to IMF estimates, by summer 2024, hedge fund Treasury holdings accounted for 11% of total U.S. Treasuries. OFR data show that by the end of 2024, total hedge fund Treasury holdings reached nearly $3.4 trillion, double the level at the start of 2023. A September rate cut triggering large interest rate swings could prompt leveraged hedge fund trades to unwind rapidly. For reference, in March 2020, hedge fund short positions in Treasury futures fell by $62 billion in just two weeks—a similar scenario could amplify market volatility.

In addition, U.S. Treasury issuance in 2025, including refinancing, is projected to reach $31 trillion (109% of GDP), a historical high. Since April 2025, the Fed has reduced the monthly cap on Treasury holdings sales from $25 billion to $5 billion. A rate cut that disrupts Treasury demand expectations could further raise borrowing costs—$6.5 trillion of low-yield Treasuries will mature in June 2025, and refinancing would add roughly $260 billion in interest payments, conflicting with the goal of fiscal stability.

Source: Silicon Valley Bank

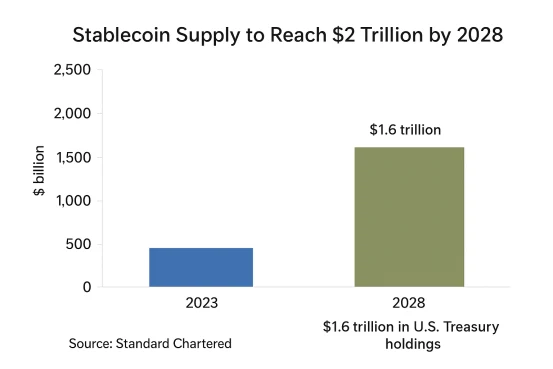

Second, potential shocks from stablecoins. Following the implementation of the GENIUS Act, the market expects a significant expansion in stablecoin supply. Standard Chartered predicts total supply could rise from the current $230 billion to $2 trillion by the end of 2028. Under the Act’s requirement that reserves consist primarily of short-term Treasuries, stablecoin holdings of Treasuries could reach $1.6 trillion by 2028, creating substantial incremental demand.

However, the Fed is concerned that if stablecoins expand rapidly following a rate cut amid higher risk appetite, large-scale redemptions could trigger concentrated Treasury sales, impacting market liquidity. Additionally, widespread stablecoin payment adoption could alter the traditional money multiplier effect, reducing the Fed’s ability to control base money. The uncertainty introduced by this “new financial variable” makes the Fed more cautious when adjusting interest rates.

Political Influence vs. Policy Autonomy

Discussions over the next Federal Reserve chair have added further uncertainty to monetary policy. Criticism of current Chair Powell by former President Trump has intensified, and his team has shifted attention to potential successors. Treasury Secretary Scott Baesent indicated that 10–11 candidates are being considered.

According to a CNBC survey, economists predict that Kevin Hassett, Trump’s former chief economic advisor, is favored due to loyalty and is among the top candidates. Other potential candidates include Fed Governor Christopher Waller and former Fed Governor Kevin Warsh. However, in rankings based on suitability, Warsh tops the list, while Hassett ranks fourth. Notably, Hassett has publicly supported “rate cuts to complement fiscal stimulus,” raising market concerns over potential threats to central bank independence.

These concerns were indirectly reflected in the Fed’s July meeting minutes. While some participants did not explicitly mention political factors, they emphasized that “monetary policy must remain independent of short-term political pressures and aim for long-term price stability and full employment,” signaling caution against politically influenced policy. Market expectations show that only 41% of respondents believe the next chair will uphold Fed independence, 37% expect coordination with the president, and 22% are uncertain.

The controversy over candidates and independence concerns together further constrain the Fed’s policy space. Cutting rates now in line with market expectations could be interpreted as “yielding to political pressure,” undermining credibility. Conversely, maintaining a wait-and-see approach requires facing both market expectations and economic data, while independence concerns themselves may affect market judgments on policy continuity, reinforcing the Fed’s cautious stance.

Rate Cut Outlook

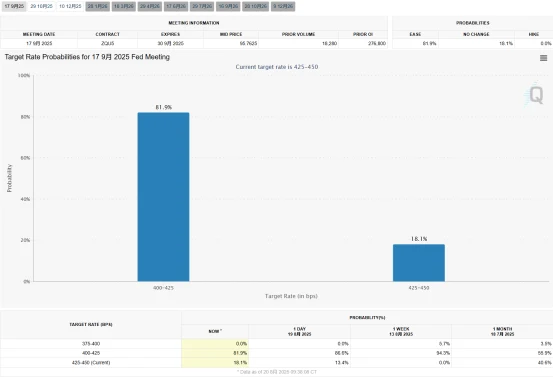

Market signals on a September rate cut are sending a sharply different message. According to CME FedWatch, the probability of a 25-basis-point cut in September is currently priced at 81.9%, up 18.8 percentage points from 63.1% at the close of the July FOMC meeting.

Source: CME

Goldman Sachs expects three rate cuts in 2025, while Citigroup even anticipates the Fed may cut rates consecutively to bring the range down to 3%–3.25%. However, Morgan Stanley warns that Powell could adopt a hawkish tone at the Jackson Hole symposium in August to temper overly accommodative market expectations. This underscores a growing disconnect between internal Fed caution and market optimism.

Subtly, the Fed is considering adjusting its policy framework from a “flexible average inflation targeting” regime to a “flexible inflation targeting” approach. This could allow inflation to run slightly above 2% in the short term, providing greater operational leeway, but may also prompt the market to reassess long-term interest rate expectations.

Fed Chair Powell is scheduled to speak at the Jackson Hole symposium on August 22, 2025. As a key policy window ahead of the September FOMC meeting, any mention of “inflation risks remaining elevated” could temper market expectations for a rate cut, whereas acknowledgment of “rising downside employment risks” could signal a clearer easing bias. In a similar setting in 2024, Powell emphasized data-driven decisions; current analysis expects his tone to remain neutral to moderate aggressive market expectations.

Final Thoughts

The Federal Reserve now faces a complex situation: the tension between inflation and employment remains unresolved, external shocks are increasing uncertainty, and vulnerabilities within the financial system constrain policy flexibility.

In the coming months, if employment deteriorates further while inflation gradually eases, rate cuts could accelerate; however, if core inflation rises again, holding steady in September remains a possibility. Powell’s upcoming remarks at Jackson Hole will be a key signal.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates