Investment Picks in a High-Valuation Market

05:04 August 20, 2025 EDT

Recently, global financial markets have been broadly overvalued, leaving investors struggling to find significant safety margins in traditional assets. As of August 2025, the S&P 500's Shiller CAPE ratio has reached 38.6 times, surpassing the pre-financial crisis peak of 2007 and ranking among the highest levels in history. Additionally, the Buffett Indicator (total U.S. stock market capitalization to GDP) has risen to approximately 212%, placing it in the top 1% of historical data, a rarely seen high.

Shiller CAPE Ratio Source: Multpl

This elevated valuation trend is also evident in the bond market. The yield on the 10-year U.S. Treasury note has dropped 15 basis points from its April high to 4.306%. Meanwhile, the credit spread on investment-grade corporate bonds has narrowed from 1.49% to 0.75%, the lowest level since 2010. This indicates that investors are currently earning minimal additional yield for taking on risk, reflecting strong market optimism and suggesting an expansionary valuation trend across the broader financial landscape.

Year Treasury Yield Source: Multpl

Current Market Conditions

Since the beginning of 2025, the U.S. stock market has experienced sustained gains, but concerns over high valuations have notably intensified. Specifically, as of now, the S&P 500 index has risen 9% year-to-date, while the Nasdaq has climbed over 10%. However, the price-to-earnings ratios of both indices have reached 29.88 times, significantly exceeding their historical averages, indicating that the buffer for future market volatility has been substantially reduced.

Source: TradingView

In the realm of alternative assets, London spot gold has surged from $2,624 per ounce to $3,500 per ounce since 2025, marking a cumulative increase of 33%, while Bitcoin has also posted gains exceeding 20% over the same period. Nevertheless, these rises are largely driven by trade uncertainties and a year-over-year inflation rate of 2.7%, rather than a robust enhancement of their intrinsic value logic, thus heightening the risk of subsequent declines.

Source: TradingView

Additionally, caution is warranted regarding potential pressures on economic fundamentals and corporate earnings. According to the Federal Reserve's Summary of Economic Projections, U.S. GDP growth is forecasted at 1.7% for 2025 and 1.8% for 2026, showing no decline but remaining in a moderate growth range. Meanwhile, the Deloitte Economic Outlook explicitly notes that current tariff policies could further elevate corporate input costs, potentially compressing profit margins by 1-2%.

The current high-valuation environment across asset classes has significantly increased market sensitivity to unexpected events. For investors, prioritizing assets with reasonable valuations to mitigate volatility impacts is essential, alongside emphasizing diversified allocations to avoid over-reliance on previously leading large-cap stocks. Shifting focus to areas offering higher safety margins is critical to navigating potential economic shocks and market corrections. In this high-valuation context, the following options may emerge as key areas of interest for investors.

Emerging Markets and Mid-Cap Stocks

Emerging market equities offer significant valuation appeal and should be prioritized in portfolio allocations. As of August 2025, the MSCI Emerging Markets Index trades at a price-to-earnings ratio of approximately 15.2x, representing a 15% discount relative to its fair value, while the S&P 500 trades at 29.1x over the same period, highlighting the clear valuation advantage of emerging markets.

From a fundamentals perspective, core emerging market economies are showing strong growth momentum: India’s GDP is expected to grow 6.3% in 2025, and Brazil’s is projected at 3.2%. Annual earnings growth in the technology and energy sectors in both countries remains around 8%, reflecting a healthy alignment between corporate profitability and economic expansion.

The latest International Monetary Fund (IMF) outlook indicates that overall GDP growth for emerging markets will reach 4.1% in 2025, significantly higher than the 2.1% growth expected for developed markets. This growth differential provides a structural support for long-term returns in emerging market equities. In particular, in countries where local currencies are stabilizing and corporate earnings quality continues to improve, emerging market equities offer meaningful portfolio diversification benefits.

Source: IMF

Within the U.S. market, mid-cap stocks demonstrate notable allocation potential and can serve as a core component of domestic portfolios, helping to avoid the volatility risks associated with overvalued large-cap stocks. As of August 2025, the Russell Midcap Index trades at a P/E of 22.1x, below that of the S&P 500. Earnings performance is also stronger: the index’s constituents collectively posted 6.5% earnings growth, outperforming the 4.8% growth of large-cap stocks.

By sector, U.S. mid-caps in industrials (benefiting from diversified supply chains and domestic infrastructure demand) and healthcare (supported by aging demographics and new drug demand) are expected to see 10%-12% gains over the next 12 months. Historically, FTSE Russell data shows that U.S. mid-caps have delivered a 9.5% annualized return since 1990 and tend to outperform large-caps during economic recoveries, offering both growth potential and relative stability.

High-Yield Municipal Bonds and Emerging Market Debt

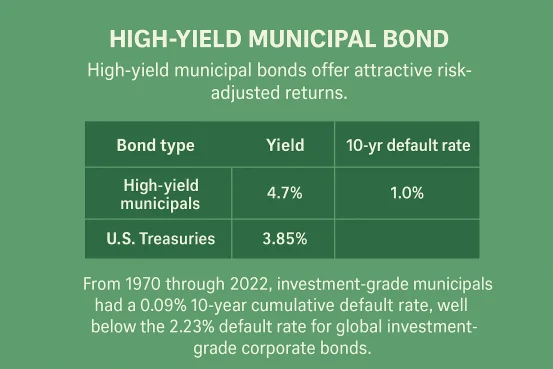

High-yield municipal bonds currently offer yields of 4.7%, exceeding U.S. Treasuries at 3.85%. Historical data show that from 1970 to 2022, investment-grade municipal bonds had a cumulative 10-year default rate of just 0.09%, far below the 2.23% default rate of global investment-grade corporate bonds, indicating relatively low credit risk. Considering municipal bonds across all credit ratings, the overall default rate remains significantly lower than high-yield corporate bonds, generally around 1%, compared with 32.53% for high-yield corporates. In favorable market conditions, total return potential for high-yield municipal bonds is expected to reach 5%-7%.

This advantage is particularly pronounced in a narrowing spread environment, and investors may consider increasing allocations to these bonds to enhance income stability. Moody’s data indicate that among investment-grade municipal bonds, those rated A and above account for a high proportion—typically 60%-70%—highlighting the generally solid credit quality of the municipal bond market.

Short-term emerging market debt yields can reach 5.8%, with an average maturity of approximately 4.74 years. Issuance volumes fluctuate with market conditions and may increase during periods of lower default risk. Due to their relatively short duration, these bonds can mitigate interest rate risk to some extent.

JPMorgan Asset Management notes that portions of this high-yield debt have credit support, with some rated as high as BB, making them a strong complement to fixed-income portfolios. Particularly in the context of potential Federal Reserve rate adjustments, under assumptions of stable economic conditions and favorable emerging market trends, returns for 2026 are expected to reach 6%-8%.

Energy and Consumer Staples

The energy sector currently trades at a price-to-earnings ratio of 16.14, below the five-year adjusted average of 13.5, reflecting a market re-pricing of the sector’s long-term value. WTI crude oil prices are expected to range between $60–70 per barrel, while U.S. daily production reaches 13.2 million barrels, laying a solid foundation for earnings growth.

Source: TradingView

Analysts forecast that energy sector earnings could grow by 15% in 2026, supported by continued infrastructure investment, which effectively mitigates the negative impact of trade disputes on supply chains. As such, the energy sector should be prioritized in portfolios to hedge against inflationary pressures. Additionally, Goldman Sachs notes that in a low oil price environment, energy equities—driven by improved production efficiency—could achieve annualized returns of up to 12%, demonstrating strong cyclical resilience.

Meanwhile, the consumer staples sector attracts attention for its defensive qualities. With a P/E of 21.7, slightly above the market average, and a dividend yield of approximately 2.9%, it provides stable cash flow support. Domestic supply chain costs have risen only 3%, well below the 8%-10% seen in other sectors, highlighting its risk-resistant profile. According to the MarketGrader Index, the sector’s average operating margin reaches 15%, reflecting robust profitability. These characteristics make consumer staples particularly appealing in an environment of rising uncertainty.

Fidelity projects that returns in the consumer staples sector could reach 8% in 2025, above the overall market average, making it suitable as a core defensive allocation to balance portfolio risk exposure.

Final Thoughts

Although global markets are generally trading at elevated valuations, investors can still identify potential opportunities across equities, international markets, and high-yield bonds through prudent asset allocation and in-depth fundamental analysis. The key lies in balancing return potential with risk management to maintain portfolio resilience in a high-valuation environment.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates