Walmart’s FY2026 Q2 Results: What Investors Should Focus On

03:15 August 20, 2025 EDT

Key Points:

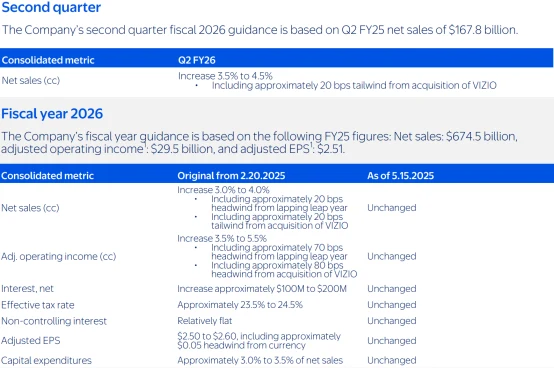

Walmart expects Q2 net sales to grow 3.5%–4.5% at constant currency, with total revenue projected at around $176 billion, up roughly 4% year over year.

While operating income is expected to rise by about 10%, both gross margin and net profit remain under pressure. Over the past two quarters, gross margin has declined by a cumulative 120 basis points, primarily due to import tariffs and rising supply chain costs.

As competitors accelerate their offline expansion, Walmart’s strategic discipline and execution efficiency will determine whether it can maintain its lead in this marathon among retail giants.

Retail powerhouse Walmart is set to release its fiscal 2026 Q2 earnings report before the market opens on Thursday, August 21, 2025. Amid mounting macroeconomic headwinds — particularly cost volatility driven by trade policy — this earnings report will shed light on how Walmart is managing import costs while sustaining top-line growth in an intensely competitive retail landscape.

For investors and industry watchers, the core value of this earnings report goes beyond simply confirming whether Walmart meets expectations. The numbers are expected to answer three critical questions:

Has tariff pressure on gross margin exceeded expectations?

How effective have Walmart’s cost-control measures been so far?

Can high-margin businesses such as advertising and membership offset tariff-driven profit erosion?

The answers to these questions will directly influence assessments of Walmart’s short-term valuation and its long-term resilience.

Source: Walmart

Earnings Outlook

Walmart expects Q2 net sales to grow 3.5%–4.5% at constant currency, with total revenue projected at approximately $176 billion, up about 4% year over year. While operating income is expected to rise around 10%, both gross margin and net profit remain under pressure. Over the past two quarters, gross margin has declined by a cumulative 120 basis points, driven primarily by import tariffs and rising supply chain costs.

Source: Walmart

Analysts note that Walmart’s low-margin merchandise model leaves limited flexibility to absorb rising costs. However, its stable same-store sales and strong grocery mix continue to provide some cushion.

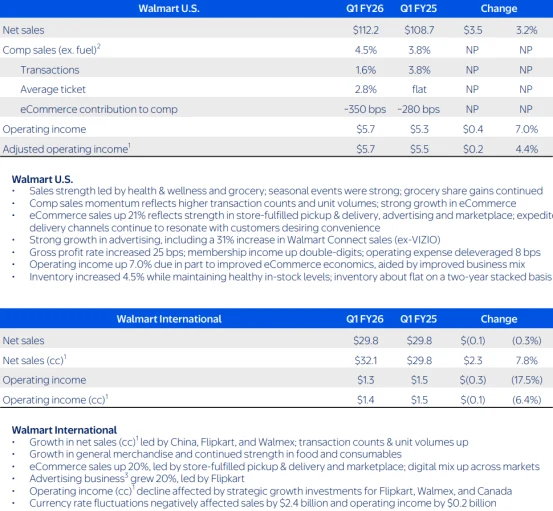

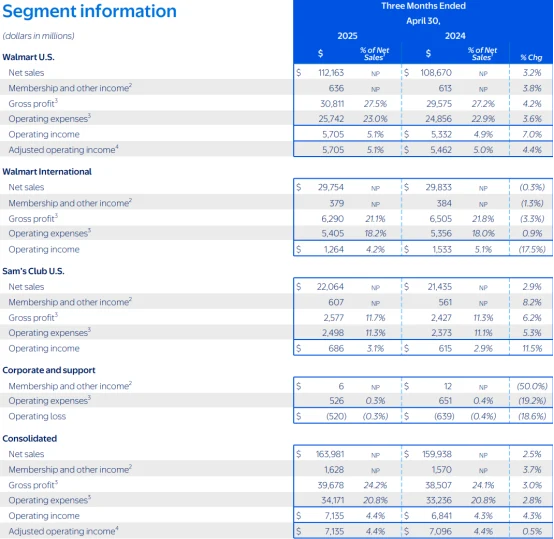

In recent years, Walmart has made key operational adjustments, including the launch of Walmart Connect — an omnichannel marketing platform — and the expansion of its advertising business. In fiscal Q1 2026, Walmart’s global advertising revenue grew 50% year over year, including contributions from newly acquired VIZIO, showing robust momentum. U.S. advertising revenue (Walmart Connect) rose 31% excluding VIZIO, far outpacing traditional retail sales growth and highlighting the profitability potential of this revenue stream relative to core retail operations.

As advertising and membership revenues continue to grow, these “flywheel” income streams are becoming a critical driver of operating margin improvement. In fiscal Q1 2026, total membership fee income rose nearly 15% year over year.

Source: Walmart

In the U.S. market, Sam’s Club has seen steady gains in membership counts, higher renewal rates, and deeper penetration of Plus-tier memberships, driving a 9.6% increase in membership revenue. Walmart+ membership income also posted double-digit growth. Internationally, Sam’s Club China recorded more than 40% growth in membership revenue, with continued expansion in its member base. Together, advertising and membership form a dual engine that is helping Walmart carve out a new path to improving profitability amid an increasingly complex retail landscape.

Source: Walmart

Still, the growth of these high-margin businesses has not been sufficient to fully offset tariff pressures. Cost control remains the central determinant of margin trends. Walmart has now automated roughly 50% of its supply chain in a push to reduce operating costs. Historically, Walmart’s operating margin averaged 4.31% in fiscal 2025, down from 5%–6% in the early 2010s but holding steady around 4% since 2016. In the past two quarters, operating margins have edged up to 4.69%–4.70%, signaling gradual improvements driven by automation and efficiency gains.

Source: Walmart

Tariff Pressure

However, the ongoing impact of the Trump-era tariff policies and Walmart’s responses have become central to market expectations for this quarter’s performance and the assessment of the company’s operational resilience.

The effects of these tariffs on Walmart have now entered a deeper transmission stage. According to the latest research from Goldman Sachs, as of June 2025, U.S. companies were still absorbing 64% of tariff costs, but this share is expected to drop sharply to below 10% by October 2025, while the portion passed on to consumers will rise to 67%. This shift directly threatens Walmart’s profit margins — approximately 30% of its merchandise is imported, with electronics and toys relying on Chinese supply chains at over 70%.

For example, the price of Chinese-made “FurMonkey” toys surged 42% in a single week in May 2025, while Costa Rican banana imports rose 10%, with these cost increases already reflected in Walmart’s reported results.

At the financial level, tariff pressures have weighed on Walmart’s gross margin for two consecutive quarters: Q4 fiscal 2025 gross margin declined 34 basis points year over year, followed by an additional 86 basis-point drop in Q1 fiscal 2026, totaling a cumulative 120 basis-point decline. Although management has mitigated some pressure through supplier material substitutions and inventory strategy adjustments, the price elasticity risk in discretionary categories remains significant. Industry estimates suggest that if current tariff levels persist, Q2 gross margins in discretionary goods could fall an additional 150–200 basis points, exceeding prior company guidance.

Source: Walmart

Furthermore, the Trump administration’s recent tariff increases on steel, aluminum, and semiconductors are generating ripple effects across related supply chains. Construction costs have risen 3.7%, and chip prices are up 2.4%. If tariffs extend further into the consumer electronics sector, prices for products from major tech companies such as Apple could increase 15%–20%, further squeezing middle-class purchasing power and potentially dampening sales of Walmart’s consumer electronics category.

Competitive Pressure

Beyond policy-driven cost pressures, Walmart faces intensified competition within the retail industry.

Amazon recently announced an expansion of its Prime same-day grocery delivery service, directly challenging Walmart’s core strength. As a strategic category accounting for nearly 60% of Walmart’s U.S. total sales, the gross margin stability of grocery operations is critical. While Walmart maintains prices roughly 25% below traditional supermarkets through its “Everyday Low Price” strategy, its overall gross margin for fiscal 2025 stood at 25.09%, with grocery margins likely near this level, still below Target’s Q2 2024 grocery margin of 28.9%.

Source: Amazon

This margin gap is even more pronounced in e-commerce: Walmart’s online business carries gross margins 300–400 basis points lower than in-store operations, whereas Amazon offsets this with the high-margin AWS business, achieving a 12-month gross margin of 48.9%.

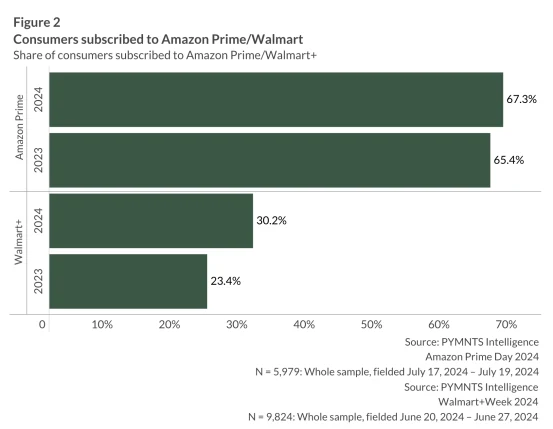

In terms of membership competition, Amazon Prime has a penetration rate of 67%, compared with just 30% for Walmart+. However, Walmart has pursued differentiation through initiatives such as offering dining incentives in partnership with Burger King. During the 2024 Walmart+ Week, membership engagement grew by 71%, with an average transaction value of $473, exceeding Amazon Prime Day’s $326. Whether this strategy can sustainably convert into repeat purchases will be a key focus for Q2 results.

Source: PYMNTS

It is also worth noting that Walmart’s China operations remain strong. Sam’s Club contributes 70% of revenue in the region, with omnichannel sales exceeding 100.5 billion RMB, e-commerce penetration surpassing 50%, and annual per-store sales reaching $320 million.

Valuation Considerations

As of the close on August 19 Eastern Time, Walmart’s stock was trading at $101.29, implying a forward P/E of approximately 36.8x for fiscal 2026. This is notably higher than the S&P 500 Consumer Discretionary sector (including retail) average of 26.7x. Part of this premium reflects market recognition of Walmart’s defensive qualities—even during the 2008 financial crisis, the company maintained positive same-store sales growth.

Source: TradingView

However, Walmart’s free cash flow has been deteriorating, with a five-year compound annual growth rate of -9.75%, declining from $25.81 billion in 2020 to $12.66 billion in 2024. At the same time, the dividend yield has fallen to a historical low of 0.91%, raising questions about the stock’s valuation.

Using a discounted cash flow model and assuming a 10-year free cash flow CAGR of 5.7%, Walmart’s intrinsic value is estimated at around $36.76, well below the current stock price. Even when factoring in the moat of its grocery business and the growth potential of its advertising segment—global advertising revenue in Q4 fiscal 2025 rose 29% year-over-year—the internal valuation only reaches $89–$90, still implying a 12–15% premium relative to the current market price. This valuation discrepancy highlights how the market is weighing short-term tariff pressures against Walmart’s long-term strategic value.

Bottom Line

Walmart’s Q2 earnings will serve as a microcosm for assessing the economic impact of tariff policies. While short-term profit margins face significant pressure, the company’s scale advantages in the grocery segment, supply chain resilience, and growth potential in its advertising business continue to provide long-term value support. Investors should pay close attention to management’s quantitative guidance on passing through tariff costs, the path to improving e-commerce margins, and potential gains in ARPU (average revenue per user) within the membership ecosystem.

If Q2 revenue growth remains within the 3.5%–4.5% range and advertising revenue exceeds 6% of total sales, it could act as a catalyst for valuation recovery. Conversely, if margins decline more than expected and same-store traffic falls below 2%, the defensive premium logic of the stock may need to be reassessed.

Against the backdrop of Amazon accelerating its offline penetration, Walmart’s strategic discipline and execution efficiency will ultimately determine whether it can maintain a leading position in this marathon among retail giants.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates