Tech Stocks Plunge: Is the AI Bubble About to Burst?

23:09 August 19, 2025 EDT

On Tuesday, August 19, U.S. tech stocks faced their sharpest correction in months, with the Nasdaq Composite Index falling 1.46%, marking the largest single-day drop since August 1. AI-focused names such as Nvidia and Palantir led the decline. This pullback disrupted the recent upward momentum in the tech sector, contrasting sharply with the consecutive gains seen in prior days, and the single-day decline stands out in the market’s performance since the beginning of August.

Source: TradingView

On the surface, this market volatility appears to be a mild, broad-based adjustment, but it actually reflects a clear withdrawal of capital from high-valuation, high-momentum growth segments. Moreover, the pullback exposes deeper market doubts over the commercialization pace of generative AI. Coupled with valuation pressures in the tech sector, these factors collectively triggered a rotation of funds from high-momentum stocks into defensive assets.

The Reality Gap in AI Investment Returns

On August 18, the MIT research project NANDA released its report, The Generative AI Divide: The State of Commercial AI in 2025, which has become a market inflection point.

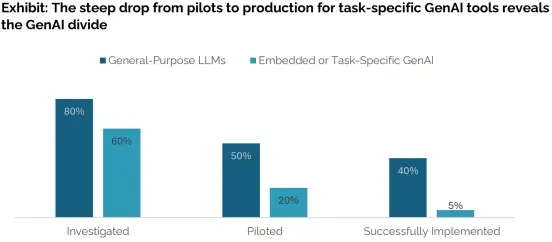

The study is based on interviews with 150 corporate leaders, surveys of 350 employees, and analysis of 300 public case studies. Its conclusions are stark: 95% of companies have yet to realize measurable financial returns from generative AI investments, with only about 5% of pilot projects generating significant revenue contributions. The report emphasizes that the issue is not model performance, but rather implementation and organizational structure:

Returns are highly polarized. Most budgets are allocated to sales and marketing tools, yet the highest gains come from back-office process automation and cost reduction.

Success rates for externally purchased AI tools approach 67%, while in-house development succeeds less than one-third of the time.

Large-scale projects led by central labs often become disconnected from business needs, whereas small-scale pilots driven by frontline managers are more likely to deliver tangible value.

Source: MIT Media Labs

These findings sharply contrast with market expectations, challenging the long-held assumption that AI can quickly drive profitability. Investors are now forced to reassess whether the lofty valuations of AI-focused stocks are justified.

Despite tech giants investing hundreds of billions into AI—for example, Nvidia’s data center business generated $115.2 billion in fiscal 2025—actual conversion efficiency at the enterprise level falls well short of expectations. Similarly, Palantir’s AI platform performs strongly in defense applications, yet its forward P/E stands at 245x, compared with Nvidia’s 35x. Analysts estimate that Palantir would need $60 billion in annual revenue to match industry-average valuations, while the market broadly projects just $4 billion in revenue for 2025.

Source: Nvidia

As DA Davidson analyst Gil Luria notes: “To sustain its current stock price, Palantir would need to maintain 50% revenue growth for five consecutive years. That leaves virtually no room for error.” This fragility makes highly valued stocks the first to be hit when market sentiment shifts.

Bubble Worries Add to High Valuation Pressure

Almost simultaneously with the report’s release, OpenAI CEO Sam Altman issued a clear warning: signs of irrational exuberance are emerging in the AI sector, and some investors could face significant losses. Altman did not dispute AI’s long-term prospects but emphasized the large gap between short-term hype and actual returns.

As a central driver of the AI wave, Altman’s caution quickly triggered a chain reaction: “disaster” put option trading in the Invesco QQQ Trust Series 1 ETF surged, reflecting market concerns over short-term volatility in tech stocks.

From a valuation perspective, tech stock prices have long exceeded historical averages. Current high valuations set the stage for a pullback. Bloomberg data shows that the Nasdaq-100’s forward P/E has risen to 27x, more than one-third above its ten-year average. Excluding the “Big Seven” tech giants, the sector’s P/E climbs to 24.4x—a record high. This valuation expansion rests on optimistic expectations of rapid AI monetization, but the MIT report directly challenges that underlying logic.

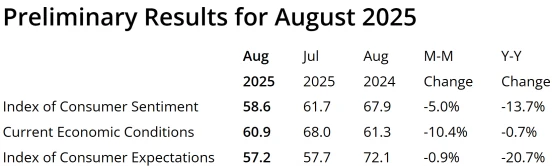

Macroeconomic factors also play a role. On August 18, 2025, the U.S. Department of Commerce announced that 407 product categories would be subject to a 50% tariff on steel- and aluminum-derived goods, covering items such as wind turbines, cranes, and railway vehicles. The policy sparked concerns over potential supply chain disruptions and economic growth prospects. The preliminary August 2025 University of Michigan Consumer Sentiment Index fell to 58.6, below July’s 61.7 and the expected 62, while short- and long-term inflation expectations rose, reflecting ongoing worries over tariff impacts.

Source: University of Michigan

Market Structure Adjustment

During this round of market pullback, capital rotated from high-risk tech sectors into defensive areas, with consumer staples, utilities, and real estate sectors posting gains against the broader trend. About 70% of S&P 500 constituents closed higher. The bond market mirrored this shift: U.S. Treasury yields fell, with the 10-year note dropping 2.73 basis points to 4.30% from the previous trading day.

Within the tech sector, clear divergence emerged. High-momentum names that performed strongly earlier this year led the selloff: Nvidia fell 3.5%, marking its largest drop in four months; Palantir plunged 9.4%, wiping out $23 billion in market value from its May peak; AMD, Oracle, and other AI industry chain companies fell more than 5%. This concentrated selling reflects a market re-pricing of the AI narrative—from “concept-driven hype” to “profitability validation.”

Source: TradingView

Final Thoughts

The “AI divide” revealed by the MIT report essentially reflects a mismatch between technology deployment and commercial demand. The report notes that successful AI applications tend to focus on specific scenarios, such as back-office process automation, rather than generalized marketing tools. This contrasts with a 2024 Google survey, which showed that 74% of companies realized AI investment returns within a year—but the sample was concentrated among early adopters and emphasized efficiency gains rather than revenue growth.

Upcoming key events are set to further test market sentiment: Federal Reserve Chair Jerome Powell’s policy remarks at the Jackson Hole symposium, and Nvidia’s earnings report, which will provide forward guidance on AI chip demand.

Current interest rate futures indicate a 68% probability of two rate cuts in 2025, but uncertainty over timing and magnitude has led investors to take a cautious stance toward high-valuation tech stocks. A Reuters survey shows the S&P 500 year-end target at 6,300 points, slightly below current levels.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates