Oil Market Direction: What’s Next After the Trump–Putin Meeting?

04:32 August 18, 2025 EDT

Key Points:

Following the meeting between U.S. President Donald Trump and Russian President Vladimir Putin in Alaska, oil prices plunged as markets viewed the risk of Russian oil supply disruptions as temporarily easing.

On August 18, European leaders will meet Trump in the U.S. together with Ukrainian President Volodymyr Zelensky to discuss a potential ceasefire plan. If talks progress smoothly, it could pave the way for a U.S.-Russia-Ukraine summit, easing geopolitical tensions and benefiting global risk assets.

Wall Street analysts believe that without a significant breakthrough in the Russia-Ukraine conflict, crude oil prices are likely to trade within a relatively narrow range.

On August 15, U.S. President Donald Trump met with Russian President Vladimir Putin in Alaska (the so-called “Trump-Putin Summit”) to discuss the Russia-Ukraine conflict and related energy issues. Even before the meeting was announced, markets had anticipated a potential diplomatic resolution to the conflict, sending oil prices lower. On August 7, Brent crude futures fell 0.69% to $66.43 per barrel, while U.S. crude futures declined 0.73% to $63.88 per barrel.

Following the summit, markets interpreted the risk of Russian oil supply disruptions as temporarily easing, triggering a sharp drop in oil prices. WTI crude intraday losses approached 2%, settling at $63.14 per barrel. However, prices quickly rebounded, recouping most of the losses. At the time of writing, both Brent and WTI have returned to roughly pre-summit levels.

Source: TradingView

Oil Prices Under Short-Term Pressure

After the “Trump-Putin Summit,” President Trump said at a joint press conference with President Putin that both sides had made significant progress, reached agreement on many issues, and left only a few matters unresolved — though one of them is particularly important, and no agreement has yet been reached. Even so, the perception that the risk of Russian oil supply disruptions had eased put short-term pressure on oil prices.

Wall Street analysts generally believe that the easing of short-term supply risks is the main driver behind the recent oil price decline, though the downside appears limited. Ajay Parmar, an analyst at ICIS, noted that Russian oil supply remains stable and has only a modest impact on prices in the near term, expecting crude to see only mild fluctuations. Phil Flynn, senior analyst at Price Futures Group, said that without a substantive breakthrough in the Russia-Ukraine conflict, crude prices are likely to stay in a relatively narrow trading band.

Historical data show that geopolitical shocks tend to hit oil prices with a “fast reaction—quick reversal” pattern. For example, on June 13, Israel launched military strikes against Iran, escalating tensions in the Middle East and causing a sharp, short-term spike in global oil prices. On that day, July-delivery light crude futures on the New York Mercantile Exchange jumped 7.26%, while August Brent futures rose 7.02%, marking the biggest intraday gains since the start of the Ukraine crisis. Market fears over a potential blockade of the Strait of Hormuz — which handles about one-third of global seaborne oil trade — drove prices higher. By June 23, WTI and ICE Brent futures briefly approached $80 per barrel, the highest levels since January.

Source: TradingView

However, on June 24, after President Trump announced a comprehensive ceasefire agreement between Israel and Iran, market sentiment reversed sharply. ICE Brent dropped as much as 8%, and WTI crude plunged as much as 9%, erasing nearly two weeks of gains. Since then, oil prices have consolidated around $67 per barrel, showing that while geopolitical shocks can be severe in the short term, markets tend to retreat just as quickly once tensions ease.

Geopolitical Risks Ahead

On August 18, President Trump is scheduled to meet with Ukrainian President Zelensky and European leaders to discuss a Russia-Ukraine ceasefire plan. Prior to this, Zelensky and European leaders held a video conference and reached five key agreements, including Ukraine’s direct participation in peace negotiations, preparation for a U.S.-Russia-Ukraine trilateral meeting, ceasefire and security guarantees, and the imposition of stronger sanctions on Russia if it refuses to comply. If the meeting goes smoothly, it could pave the way for the trilateral talks and ease geopolitical risks; if not, it may trigger a rise in risk-aversion sentiment.

Trump has emphasized that achieving a ceasefire is the core objective and warned that failure could lead to withdrawing from the process and imposing stricter sanctions, though he recently indicated that punitive measures will not be pursued immediately. This adds a layer of uncertainty. If the risk of Russian supply disruption is further controlled, oil prices could face downward pressure; conversely, a breakdown in negotiations could tighten supply and push prices higher.

For example, during the early stages of the 2022 Russia-Ukraine war, Brent crude surged from around $90 per barrel to $130 per barrel, an increase of over 40%, before gradually retreating under the impact of sanctions and supply adjustments, illustrating the significant influence of geopolitical risks on oil prices.

Source: TradingView

Long-Term Outlook

Long-term oil price trends are likely to depend on the developments in the Russia-Ukraine conflict and global supply-demand dynamics.

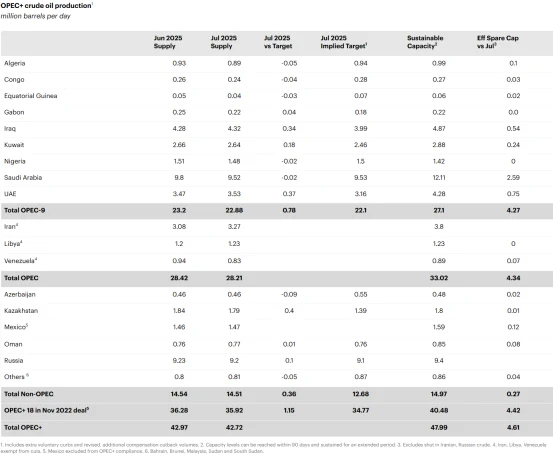

According to the International Energy Agency (IEA) August report, global oil demand is expected to increase by 680,000 barrels per day in 2025 and 700,000 barrels per day in 2026, reaching 104.4 million barrels per day. On the supply side, OPEC+ is projected to complete its planned supply restoration of 2.2 million barrels per day one year ahead of schedule, while non-OPEC countries such as the U.S., Guyana, Canada, and Brazil are expected to increase output by 1 million barrels per day in 2026, bringing total global supply growth to 1.9 million barrels per day. If the market remains unchanged, global inventories in 2026 would grow at a rate of 2.96 million barrels per day, creating a record surplus.

Source: IEA

If the U.S. and Russia reach an agreement easing sanctions, the resulting increase in Russian supply could push the oil price baseline lower, although short-term gains would be limited by OPEC+ quotas and insufficient investment. Conversely, if negotiations break down and sanctions intensify, tighter supply would keep prices elevated. If no clear outcome emerges, the market would remain largely governed by OPEC+ production and global demand. With slowing global economic growth and accelerated electrification limiting demand expansion, the surge in non-OPEC supply is likely to create a looser market, putting downward pressure on the oil price baseline.

The IEA emphasizes that while geopolitical tensions support upward pressure on oil prices, persistent concerns about demand growth continue to weigh on the market. The forecast for 2025 demand growth is 730,000 barrels per day. Prospects of easing the Russia-Ukraine conflict have provided short-term market support, but uncertainty continues to keep prices volatile.

Technical Analysis

Brent crude has recently been trading in a range of $65–$67 per barrel, with support near $65 and resistance around $67.5. The daily chart shows limited recent volatility, a slightly narrowing Bollinger Band, and the RSI hovering between 42 and 45, indicating short-term equilibrium between buyers and sellers. Historically, this range has repeatedly acted as both support and resistance; from early 2023 through mid-2024, Brent frequently oscillated within this range before rebounding, highlighting the range's reliability.

Source: TradingView

WTI crude has been fluctuating in a $61.5–$63.5 per barrel range, with short-term moving averages trending sideways and the MACD lines nearly parallel, signaling limited short-term volatility. However, prices remain sensitive to geopolitical events. Combining technical and fundamental factors, oil prices are likely to maintain narrow-range oscillations in the short term, with trading opportunities primarily driven by event-specific catalysts.

Source: TradingView

Bottom Line

Oil market volatility is expected to remain limited in the short term, with prices experiencing modest declines, primarily driven by the Israel-Iran ceasefire and easing of Russian supply risks. However, the long-term trajectory will continue to hinge on developments in both the Russia-Ukraine conflict and Middle East tensions: if situations ease and supplies increase, oil prices may face downward pressure; conversely, escalating conflicts could support prices at higher levels. Meanwhile, the risk of supply-demand imbalance is rising, and projected future surpluses resemble patterns observed during previous oil price downturns, suggesting that the market’s price base may gradually shift lower.

From a technical perspective, the market shows a bearish bias, and investors should monitor whether key support levels hold. Attention should also be paid to the August 18 multilateral meeting and potential OPEC+ production adjustments to gauge short-term risks and opportunities. Historical experience indicates that geopolitical events generally exert only brief shocks on oil prices, while the global supply landscape remains the dominant factor shaping long-term trends.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates