Market Update: Meeting Between U.S., European, and Ukrainian Leaders — Federal Reserve’s Jackson Hole Symposium — U.S. Retailers’ Earnings Week

22:11 August 17, 2025 EDT

FoolBull Brings You This Week’s Market Highlights:

Market Focus

Meeting Between U.S., European, and Ukrainian Leaders

On August 18, European leaders and Ukrainian President Volodymyr Zelensky will meet with U.S. President Donald Trump to discuss a potential ceasefire plan for the Russia-Ukraine conflict. If talks go smoothly, they could pave the way for a U.S.-Russia-Ukraine summit, easing geopolitical tensions and benefiting global risk assets. Conversely, failure could drive risk-off sentiment higher.

Back on February 28, U.S. and Ukrainian leaders clashed sharply at the White House. Following U.S.-Russia talks, European nations feared being sidelined, prompting several EU leaders to accompany Zelensky to Washington to jointly address Ukraine’s future.

On August 13, Zelensky and European leaders held a video conference with Trump, reaching five principles for negotiations with Moscow: Ukraine must directly participate in any peace settlement; all Ukraine-related matters must be discussed with Kyiv; preparations should begin for a trilateral U.S.-Ukraine-Russia summit; an immediate ceasefire with concrete security guarantees must be secured; and if Russia refuses, sanctions must be strengthened.

On August 18, Trump and Zelensky will first hold separate meetings with their respective delegations at the White House before joining a broader multilateral session. Key topics include Russia’s territorial demands, Ukraine’s security arrangements, and the role Washington will play in any agreement.

Federal Reserve Jackson Hole Symposium

The Federal Reserve will hold its annual Jackson Hole symposium from August 21 to 23. Fed Chair Jerome Powell is set to deliver a speech under this year’s theme, “A Labor Market in Transition: Demographics, Productivity, and Macroeconomic Policy.” His remarks are expected to provide critical guidance on the Fed’s policy path.

Markets widely expect Powell to hint at a September rate cut. However, even if the Fed moves in September, divisions within the FOMC could widen, adding uncertainty to future policy and volatility to markets.

In addition, on August 21 the Fed will release minutes from its July policy meeting. With the Fed signaling a dovish shift in recent weeks, investors expect the first rate cut to come as soon as September. The minutes may reveal the extent of debate inside the FOMC.

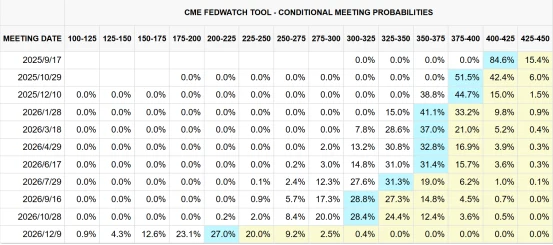

Currently, markets are almost certain the Fed will lower the federal funds rate by 25 basis points in September, from 4.25%–4.50% to 4.00%–4.25%. However, the rate path beyond September is less clear: CME FedWatch data shows a 51.5% probability of another cut in October.

Source: CME

Tariff Policy Takes Effect

On August 15, the Trump administration announced an expansion of 50% tariffs on steel and aluminum imports, adding hundreds of derivative products to the tariff list. The measure took effect on August 18.

According to a U.S. Department of Commerce notice in the Federal Register, the Bureau of Industry and Security has added 407 product codes to the U.S. Harmonized Tariff Schedule. These products, containing steel or aluminum components, will now be subject to additional tariffs. Non-steel and non-aluminum portions of the products will remain subject to tariffs imposed on goods from specific countries under existing trade measures.

The new tariff scope primarily covers two categories: (1) intermediate and semi-finished goods containing steel or aluminum, such as billets and slabs; and (2) finished metal structures, containers, fasteners, and other items made from steel or aluminum.

Retail Earnings to Be Released

The week of August 18 will see a wave of earnings reports from major U.S. retailers. As an industry directly hit by tariffs and closely tied to U.S. consumers, their commentary on trade impacts will be closely watched.

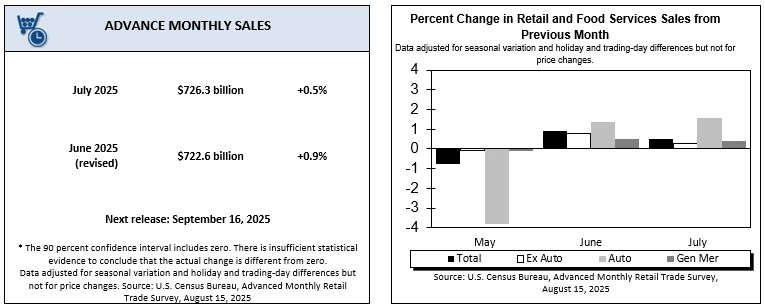

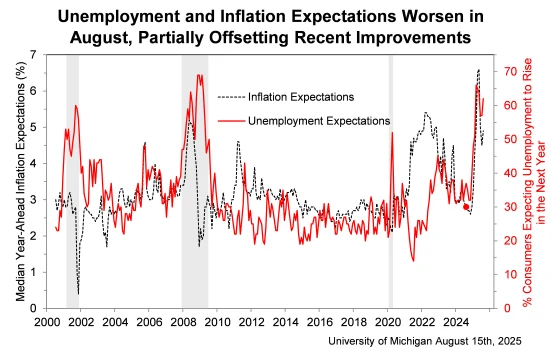

U.S. retail sales rose 0.5% in July from the prior month, or 0.3% excluding autos—roughly in line with expectations. However, the University of Michigan Consumer Sentiment Index unexpectedly fell to 58.6, its first decline since April, while one-year inflation expectations rose to 4.9% and long-term expectations to 3.9%. The data suggests tariffs are raising business costs and weighing on consumer confidence.

Source: U.S. Census Bureau

Google Product Launch Event

Google will host its Made by Google product launch event on August 20 in New York, livestreamed on the company’s official YouTube channel.

The event is expected to showcase the Pixel 10 lineup—including the Pixel 10, Pixel 10 Pro, Pixel 10 Pro XL, and the foldable Pixel Pro Fold—alongside the Pixel Watch 4, Pixel Buds 2a, and new magnetic chargers. The launch will focus on multimodal interaction and on-device AI features, demonstrating deep integration of Google’s Gemini AI into mobile experiences.

Market Recap

U.S. stocks posted moderate gains last week. The S&P 500 rose 0.94% to close at 6,449.37, setting an intraday record high. The Nasdaq Composite gained 0.81% for the week but slipped 0.40% on Friday under pressure from chip stocks, finishing at 21,622.98. The Dow Jones Industrial Average climbed 1.74% to 44,946.12, approaching the key 45,000 level.

Source: TradingView

Last week, U.S. President Donald Trump and Russian President Vladimir Putin held a more than two-and-a-half-hour closed-door meeting in Anchorage, Alaska. With markets hypersensitive to potential disruptions, uncertainty surrounding the talks weighed on sentiment.

In addition, economic data sent mixed signals. U.S. retail sales rose 0.5% in July, slightly below expectations, but June data was revised up to 0.9%, showing consumer spending remains resilient. The latest University of Michigan survey showed preliminary August consumer sentiment dropped to 58.6, missing the forecast of 62, while year-end inflation expectations climbed to 4.9%, reflecting growing concern over rising prices. Federal Reserve data showed overall industrial production fell 0.1% in July, indicating slight weakness in manufacturing. These divergent data points have created differing views on the economic outlook, influencing market performance.

Source: University of Michigan

Market expectations for a Fed rate cut shifted. Earlier weak nonfarm payrolls and soft CPI data had reinforced bets on a September rate cut, but stronger-than-expected PPI data and hawkish remarks from the St. Louis Fed President and other officials revealed divisions within the Fed over the pace of easing. This has complicated market expectations and affected U.S. stock performance.

UnitedHealth Group surged 11.98% in one session, its largest one-day gain since October 2008, after Berkshire Hathaway disclosed a $1.6 billion position (5.04 million shares) in Q2.

Source: TradingView

On August 15, U.S. President Donald Trump said tariffs on imported chips and semiconductors could reach 200% to 300% within two weeks, with lower initial rates to encourage manufacturers to shift production to the U.S., followed by a sharp increase after the transition period. He added the tariffs would not apply to companies building plants in the U.S. Earlier, on August 6, Trump announced plans for a 100% tariff on imported semiconductors.

The news triggered a sell-off in semiconductor stocks on August 15: Micron fell 3.5%, AMD dropped 1.9%, and the Philadelphia Semiconductor Index declined 2.26%.

Source: TradingView

Sunrun rose 32.82% for the week as new U.S. clean energy tax credit rules boosted residential solar demand, lifting the company’s stock sharply.

Source: TradingView

CoreWeave shares plunged more than 15% after a $1 billion block trade arranged by Morgan Stanley and other investment banks. The sale marked the first insider share disposal since the company’s IPO and likely triggered selling pressure in the market.

Source: TradingView

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates