Stabilizers in Market Fluctuations: Defensive Stock Investment Analysis

00:48 August 16, 2025 EDT

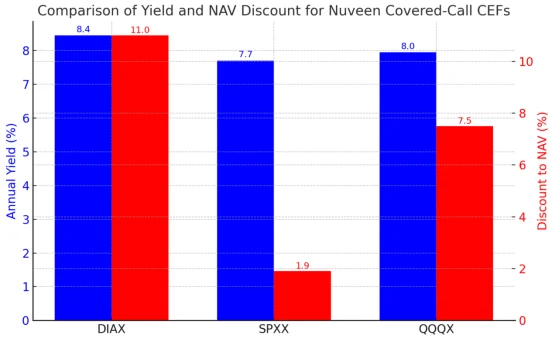

As market dynamics continue to evolve in August 2025, the latest data from three Nuveen covered call CEFs further demonstrates their resilience in a volatile environment. At the latest market price, the Nuveen Dow 30 Dynamic Overwrite Fund (DIAX) is trading at approximately $14.73, maintaining an annualized dividend yield of approximately 8.53%. Its discount to net asset value (NAV) has widened to 13.60%, offering contrarian investors greater potential for valuation recovery. This discount has deepened compared to the beginning of the year, primarily due to pressure on Dow Jones components during short-term volatility. However, this also amplifies option premium income during the current period of elevated volatility, ensuring dividend stability.

Similarly, the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX), with a stable share price around $17.99 and an annualized dividend yield of approximately 7.50%, maintains a 1.96% discount, offering significant advantages as an S&P 500 tracking fund. Despite this low discount, SPXX has seen strong inflows, attracting significant defensive capital over the past month. This is primarily due to its broad index coverage, which helps the fund maintain low volatility amid market uncertainty. However, compared to DIAX, its yield is slightly lower, making it suitable for more balanced investors.

The Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX) trades at $26.97, offering an annualized dividend yield of 8.31% and trading at a discount of approximately 7.98%. As a technology-focused fund, QQQX benefits from the growth potential of the Nasdaq 100. Driven by AI and the digital economy, its options strategy generates significant additional income during periods of heightened volatility. Recent data shows that its dividend growth has exceeded expectations over the past three months, demonstrating the unique cash flow advantages of the tech sector, even during an economic slowdown.

Volatility Indicators and Labor Market Analysis: Opportunities Outweigh Risks

Current market volatility indicators further reinforce the investment appeal of these CEFs. The CBOE Volatility Index (VIX) rebounded from its lows to a range of 15.15-16.57 in August 2025, up approximately 8.57% from the previous month, but still well below panic thresholds (such as the 2022 peak). This suggests that volatility has returned but remains within its control, aligning with the "volatility-driven yield" principle of covered call strategies. A higher VIX often indicates higher option premiums, thereby enhancing the fund's cash generation capacity.

Meanwhile, while the July employment data released by the U.S. Bureau of Labor Statistics showed only 73,000 new jobs, a rise in the unemployment rate to 4.2%, and a significant downward revision of 258,000 jobs for the previous two months, overall job growth is still well above the pandemic trough. This "weak but not yet collapsed" signal has caused short-term sentiment fluctuations, but has created bargain-hunting opportunities for contrarian investors. Historical data shows that during periods of labor market slowdowns like those in 2022, high-dividend CEFs tend to outperform the broader market, with average annualized returns exceeding the market average by 5-7%, thanks to their defensive cash flows. For example, during a brief spike in the VIX in the first half of 2025, the average discount for such funds narrowed by 3-5%, generating additional capital appreciation for holders.

In an environment of continued volatility in 2025, investors are advised to prioritize DIAX, offering a compelling combination of high discounts and high returns. Diversification into SPXX and QQQX can also diversify away from technology and blue-chip stocks. These funds offer a smart strategy for staying calm during sentiment cycles, and we anticipate valuation recovery this year will further enhance total returns.

The three "volatility-loving" dividend stocks we're discussing—all with annualized dividend yields exceeding 7%—are perfectly suited to the current market environment. They are all closed-end funds (CEFs) and share a common characteristic: their cash flows are enhanced during market volatility. The secret lies in their regular use of covered call options within their portfolios.

This strategy is both smart and relatively robust, generating additional income for the fund and returning it to investors in the form of dividends exceeding 7%. The principle is simple: the fund sells the right to sell its shares to other investors at a fixed price and at a fixed time in the future, collecting a "premium." Regardless of whether the option is ultimately exercised, this premium is guaranteed to be pocketed, forming part of the dividend stream and directly benefiting our cash flow.

Annualized Rate of Return

Market volatility has quietly returned recently, and in this environment, high-dividend assets have once again become a focus of investors. Three Nuveen covered call closed-end funds (CEFs)—Nuveen Dow 30 Dynamic Overwrite Fund (NYSE: DIAX), Nuveen S&P 500 Dynamic Overwrite Fund (NYSE: SPXX), and Nuveen NASDAQ 100 Dynamic Overwrite Fund (NASDAQ: QQQX)—are representative examples of this sector. Their annualized dividend yields, all exceeding 7%, are quite impressive among high-dividend US equity products.

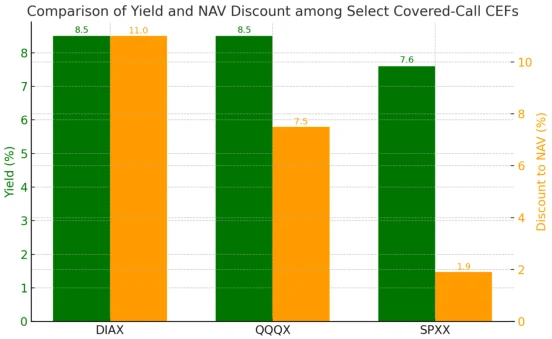

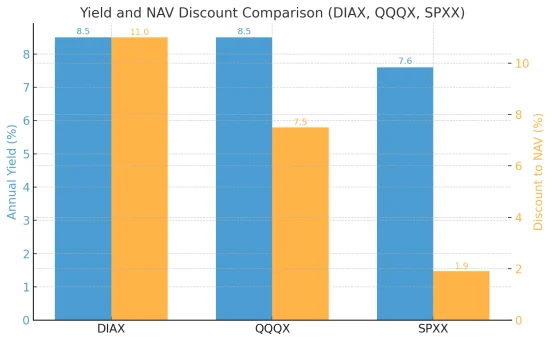

DIAX's current share price is approximately $14.29, with an annualized dividend yield between 8.4% and 8.5%. Over the past year, the fund's dividend growth has maintained a range of 1.2% to 3.7%, demonstrating strong dividend resilience. Its portfolio consists of Dow Jones 30 stocks, and it regularly sells covered call options to increase cash flow, making its returns more robust during market volatility. DIAX currently trades at a discount of nearly 11% to its net asset value, providing investors with additional room for valuation recovery.

The SPXX, based on the S&P 500, boasts an annualized return of approximately 7.6% to 7.8%. While trading at a mere 1.9% discount to DIAX and QQQX, the S&P 500's popularity and broad coverage have attracted significant inflows. This explains its relatively strong valuation, though its returns lag slightly behind those of DIAX and QQQX.

QQQX tracks the Nasdaq-100 Index, with a portfolio primarily comprised of large-cap growth technology stocks. Its annualized dividend yield ranges from 7.6% to 8.3%. Over the past year, its dividend has grown by 8.3%, the strongest of the three. This performance is primarily due to the tech sector's consistent profitability and the impact of option premium income, which has enabled it to maintain a stable dividend even during periods of heightened market volatility.

Taken together, these three funds not only offer dividend returns significantly above the market average, but also utilize covered call strategies to convert market volatility directly into cash income. With volatility elevated but not yet reaching extreme levels of panic, these funds offer both stable cash flow during these volatile times and the potential for additional capital returns through discount recovery. For investors seeking a balance between return and risk in these markets, these high-dividend CEFs are undoubtedly excellent tools worth considering.

Investor sentiment is shifting from greed to uncertainty. So, what happens next?

I mention these funds now because, despite all the hype in the media, the current market trajectory is still following an age-old path.

The process often goes like this: a stock market rally is interrupted by a major piece of news, sparking investor concerns and questioning whether the rally can continue. Panic quickly builds, leading to selling until "smart money" takes advantage of the opportunity to buy at a low price. Then, more investors recognize the opportunity, and the market begins to rebound.

This cycle typically happens quickly—perhaps just a few weeks or even a month or two. A prime example is President Trump’s announcement of high tariffs in April, which triggered a sharp drop in the stock market, only to rebound quickly.

Of course, there are exceptions. When negative sentiment persists, the correction period can be prolonged. This was the case in 2022: after strong economic growth in 2021, many feared an impending economic crisis. However, these fears proved misplaced, with no signs of a recession in 2022, 2023, or even 2024.

The result was that although the market eventually recovered, the process took much longer than expected - because experts continued to insist on the "recession theory", but reality repeatedly denied their judgment.

We review this history because we are likely at the beginning of the next correction, with volatility resurfacing. The latest trigger was the weak employment data released by the U.S. Bureau of Labor Statistics last Friday—not only did it miss expectations for the current month, but it also significantly revised down the figures for the previous two months.

However, it's worth noting that overall job growth is still underway. Looking at the data from the past five years, we're still a long way from the trough during the pandemic. In other words, we're in the "panic phase" of the market sentiment cycle, and the intense media coverage is amplifying concerns about a so-called "labor market downturn."

Over the past few months, market sentiment has fallen from "extreme greed" to neutral, a trend similar to that seen in March and late April. In those instances, after a sharp decline in early April, sentiment initially cooled and then rebounded. Notably, the market ultimately posted gains in both those instances.

Historically, neutral sentiment has often led to positive stock market returns. If sentiment continues to cool, the market could experience a short-term sell-off, followed by a stronger rebound. This scenario currently appears most likely.

While volatility has risen slightly, it's still far from the highs seen during the massive sell-off. This suggests a short-term correction isn't certain; the risk of a sell-off would only increase significantly if the VIX climbs further. The VIX has recently risen from unusually low levels, suggesting the market is emerging from its previous complacency. However, in this environment, liquidating positions is unrealistic, as even a successful short-term risk-off would risk missing out on stable dividend income.

However, for the current investment risk profile, the magnitude and duration of any short-term decline are difficult to predict. The current sentiment environment is significantly different from the deep correction in 2022—investor panic is far less than at the beginning of the epidemic. Therefore, the most likely outcome is a short-term minor correction, followed by sideways trading.

In such a market, converting volatility into cash income is an effective strategy. This is why three covered call closed-end funds (CEFs) are worth noting. These funds use call options to convert the premium income generated by volatility into high dividends, and the current valuation gap between them provides investors with arbitrage opportunities.

For example, as of this writing, the Nuveen Dow 30 Dynamic Overwrite Fund (NYSE: DIAX) is trading at a nearly 11% discount to its net asset value, yielding 8.5%. This compares favorably to the Nuveen NASDAQ 100 Dynamic Overwrite Fund (NASDAQ: QQQX), which trades at a 7.5% discount. The Nuveen S&P 500 Dynamic Overwrite Fund (NYSE: SPXX), with a 7.6% yield, trades at a mere 1.9% discount.

This phenomenon has its logic—because the SP500 is the most well-known index, investors often blindly flock to the SPXX, driving up its price. However, from an investment value perspective, the DIAX portfolio is more attractive: it includes high-quality blue-chip stocks such as 3M (NYSE: MMM), American Express (NYSE: AXP), Boeing (NYSE: BA), Coca-Cola (NYSE: KO), and Procter & Gamble (NYSE: PG). Since its portfolio consists of only 30 Dow Jones stocks, it may experience greater short-term volatility. However, this actually helps its options strategy unlock profit potential in a volatile environment and creates conditions for the discount to narrow.

Therefore, DIAX is not only a high-yield option, but also an ideal tool to cope with short-term volatility in the current market.

Looking ahead, if volatility continues to rise and market sentiment gradually stabilizes, these high-dividend, low-valuation covered call CEFs are poised to benefit from both valuation recovery and dividend stability. For investors seeking both cash flow and risk hedging, allocating a portion of their holdings to instruments like DIAX, SPXX, and QQQX not only allows them to lock in higher dividends during volatile markets but also potentially capitalize on the potential for capital appreciation from a reversal of market discounts. More importantly, this strategy isn't short-term speculation; rather, it leverages market fluctuations to transform uncertainty into a source of certainty, thereby acting as a stabilizer in long-term portfolios. In other words, in an environment characterized by high valuations and volatile sentiment, these assets are the perfect way for contrarian investors to leverage volatility to generate returns.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates