Here are five consumer staples leaders that investors should care about

14:35 August 16, 2025 EDT

Sometimes, Wall Street can be overly pessimistic about high-quality companies that are temporarily in trouble, and this can create opportunities for dividend investors.

Although some industry sectors have long been home to leading companies with stable operations, market sentiment always fluctuates cyclically, so even companies with solid fundamentals will inevitably experience lows.

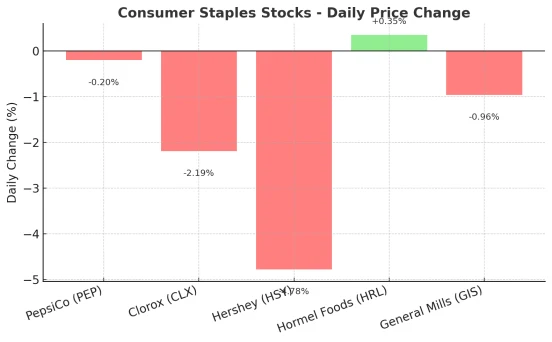

Currently, investors' confidence in the consumer staples sector is clearly insufficient, and industry representatives such as PepsiCo (PEP -0.20%), Clorox (CLX -2.19%), Hershey's (HSY -4.78%), Hormel Foods (HRL 0.35%) and General Mills (GIS -0.96%) are all facing certain challenges.

However, historically, long-term holding (at least five years) of consumer staples companies that maintain strong operational quality despite challenging times has often yielded satisfactory returns. Market sentiment will eventually improve, and patient dividend investors will reap the rewards and confidence.

From a macro perspective, the fundamentals of the consumer staples sector remain solid. These companies can consistently sell relatively low-priced, frequently used goods, even during economic cycles. For long-term investors, this sector remains a worthwhile focus, particularly given the current bearish outlook on Wall Street, which may present opportunities.

Over the past year, the consumer staples sector has generally performed flat, while the S&P 500 has risen over 15%. This trend is largely due to the new administration in Washington, D.C., actively promoting health-related policies, coupled with evolving consumer tastes and preferences, which have led to a misalignment between some consumer staples companies and the needs of their end customers.

However, such situations are not uncommon. Successful consumer staples manufacturers often proactively adapt by launching new products, acquiring trend-aligned brands, or divesting businesses that no longer fit into their existing portfolios. While this process takes time, it often yields positive results.

If you're willing to invest and hold for at least five years, PepsiCo, Clorox, Hershey's, Hormel Foods, and General Mills are all worth considering, for the following reasons.

PepsiCo (NASDAQ: PEP)

PepsiCo is a true dividend king, boasting a portfolio of industry-leading brands spanning beverages (Pepsi), salty snacks (Frito-Lay), and packaged foods (Quaker Oats). Its current dividend yield is nearly 4%, a historically high. While its stock price has underperformed its peers recently, its business competitiveness rivals that of its largest competitor. The company has been optimizing its portfolio, including acquisitions of a probiotic beverage maker and a Mexican-American food company. Patient investors can expect to see the company regain its growth trajectory, supported by its high dividend.

Furthermore, PepsiCo's extensive global presence and balanced revenue streams provide a natural buffer against fluctuations in a single market. The company has not only established itself in North America and Europe for many years but also continues to expand in emerging markets. Through localized product strategies and channel expansion, PepsiCo is able to continuously increase its market penetration. While facing short-term challenges such as rising raw material prices, shifting consumer preferences, and a shift toward healthier lifestyles, PepsiCo, with its strong brand appeal, innovative capabilities, and scaled operations, is well-positioned to adapt and transform.

Management has consistently adhered to a prudent capital return policy. In addition to continuously increasing the dividend, it has also maintained moderate share repurchases to further enhance shareholder returns. Amidst increasing global economic uncertainty, PepsiCo, with its stable cash flow and strong brand moat, is expected to continue to provide long-term investors with solid returns and potential capital appreciation.

Clorox (NYSE:CLX)

Clorox, with a 48-year streak of dividend increases, operates across cleaning products and food products like Hidden Valley. While profit margins have been squeezed by surging demand, inflation, and data breaches during the pandemic, the company has increased its gross margin by approximately 10 percentage points over three years, with further room for improvement. Market pessimism about the stock price has boosted the dividend yield to approximately 4%, making it attractive for long-term investors.

Furthermore, Clorox maintains a strong brand presence in the consumer staples sector, particularly in the household cleaning and disinfecting market, where its core brands enjoy high recognition and trust among consumers. This brand strength provides the company with a strong foundation for securing shelf space and maintaining price stability in a highly competitive retail environment.

To address shifting consumer preferences and cost pressures, Clorox is accelerating product innovation and portfolio optimization. For example, the company is introducing more environmentally friendly formulas in its cleaning products and launching new health-focused and convenience-oriented categories in its food business to capture growth opportunities. Furthermore, supply chain efficiency improvements and investments in automation are helping to further improve profitability.

Clorox's stable cash flow and continued dividend commitment provide a solid underlying return for long-term holders. If management can deliver on its goal of restoring gross margins to historical averages and maintain steady revenue growth, the stock price is expected to recover, driving higher total returns.

Hershey (NYSE:HSY)

Hershey's dividend yield of 3.1%, while lower than other companies on this list, is historically high. As a leading candy maker, Hershey has increased its dividend for 15 consecutive years. Recent challenges primarily stem from the sharp rise in cocoa prices, and this reversion to the mean may be a long process. However, in the long term, as raw material costs decline, the stock price may recover.

Meanwhile, Hershey's brand moat remains solid, with its core products commanding an overwhelming market share in North America. The company continues to strengthen consumer loyalty through holiday marketing and limited-edition new products. The company is also actively expanding into high-growth categories such as sugar-free chocolate, plant-based snacks, and acquiring premium chocolate brands to diversify its dependence on cocoa raw materials.

In terms of international markets, Hershey is increasing its presence in emerging markets, primarily in Asia and Latin America. Through partnerships with local distributors and customized product strategies, the company is gradually increasing the proportion of overseas revenue. This helps diversify risks in a single market and opens up new opportunities for long-term growth.

Although short-term fluctuations in raw material prices will compress profit margins, Hershey's stable cash flow, continuous product innovation and shareholder return policy mean that after enduring cyclical pressure, investors are expected to share the dual benefits of the company's restored profitability and valuation repair.

Hormel Foods (NYSE:HRL)

Hormel, another dividend king, is deeply embedded in the protein food sector, with brands holding strong positions in their respective market segments. Recent challenges include price transmission difficulties, a slow recovery in the Chinese market, and the avian influenza outbreak and the Planters acquisition falling short of expectations. However, these issues can be gradually resolved. With a historically high dividend yield exceeding 4%, long-term holding remains attractive.

Hormel's core competitiveness lies in its stable brand portfolio and strong distribution network. This diverse product line, ranging from refrigerated meats to ready-to-eat meals, caters to diverse consumer scenarios and price points. The company boasts a strong retail channel presence in North America, while its presence in the foodservice sector provides a stable source of wholesale revenue.

To address the slowdown in growth, Hormel is actively promoting product innovation, such as launching healthier low-sodium and low-fat product lines, and increasing R&D investment in emerging categories such as plant-based protein to capture demand driven by healthy eating trends. Furthermore, the company continues to optimize its supply chain, improving automation and production efficiency to alleviate cost pressures and increase profit margins.

Regarding internationalization, Hormel's continued expansion into the Chinese, Japanese, and Southeast Asian markets remains a long-term strategic priority. As the impact of avian influenza subsides and overseas economic activity rebounds, its overseas business is expected to gradually resume growth. Combined with its robust cash flow and over half a century of uninterrupted dividend growth, Hormel remains a high-quality long-term investment in defensive portfolios.

General Mills (NYSE:GIS)

General Mills currently offers a dividend yield of nearly 5%, a historically high level, and has increased its dividend for six consecutive years. While the company is currently experiencing a sales decline, its strategy of brand reshaping and product portfolio optimization has proven successful in the past. For investors willing to wait a few years, this period of adjustment could also present opportunities.

General Mills' core strength lies in its broad and diversified brand portfolio, encompassing multiple segments including cereal, snacks, baked goods, dairy, and pet food. This portfolio includes globally recognized brands such as Cheerios, Nature Valley, Häagen-Dazs, and Blue Buffalo. This portfolio not only secures a stable position on retail shelves but also provides strong pricing power and channel penetration, providing a solid foundation for the company to withstand short-term sales fluctuations.

In response to changing consumer trends, General Mills is accelerating product innovation, launching healthier products such as high-protein, low-sugar, and gluten-free options. It is also expanding its investment in pet food and ready-to-eat snacks to meet consumer demand for both convenience and health. At the same time, the company continues to advance digital marketing and expand its e-commerce channels to enhance brand engagement with younger consumers.

Operationally, General Mills is improving its profit structure through supply chain optimization and cost control, laying the foundation for future growth. Despite short-term sales pressure, the company is poised to return to growth after the cyclical downturn thanks to its robust cash flow, solid market position, and commitment to shareholder returns, providing long-term investors with attractive dividend returns and capital appreciation.

Wall Street sentiment

When short-term headwinds weigh on stock prices, companies with strong fundamentals, strong brand moats, and stable cash flows often provide a margin of safety for patient investors. Historical experience has repeatedly shown that high-quality consumer staples companies, after experiencing periodic downturns, can ultimately resume growth and drive valuation recovery, leveraging their robust distribution channels, brand influence, and product adaptability.

For PepsiCo, Clorox, Hershey's, Hormel Foods, and General Mills, current dividend yields are generally at historically high levels, meaning investors can still earn substantial cash returns while awaiting a recovery. This not only increases the certainty of holding, but also lays the foundation for future compounding growth. As the macro environment improves, cost pressures ease, and product mix optimizations are implemented, these companies are expected to see a rebound in earnings, with their stock prices recovering in tandem with fundamentals.

In a market rife with uncertainty, the value of contrarian investing lies in seeing through sentiment and capturing undervalued long-term assets. For the consumer staples sector, time is often the best catalyst.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates