Cathie Wood went against the trend and invested heavily in this stock. Should investors follow suit?

06:08 August 14, 2025 EDT

Key Points:

After The Trade Desk released its second-quarter 2025 financial report, its stock price plummeted 38.6%, extending its year-to-date decline to 54%.

When the market was in panic selling, Cathie Wood significantly increased her holdings, buying about 730,000 shares with a total value of approximately US$113.54 million.

For investors who are willing to bear certain volatility risks and are optimistic about the structural growth of the digital advertising industry, Trade Desk is still worthy of attention and research.

Recently, after releasing second-quarter 2025 financial results that slightly exceeded market expectations, advertising technology giant The Trade Desk (TTD) saw its stock price plummet nearly 40%. However, amid the market's panic selling, ARK Invest founder Cathie Wood significantly increased her position during the decline, quickly purchasing 738,367 shares, totaling approximately $113.54 million.

Image source: TradingView

Among them, ARKK bought 535,292 shares and ARKW bought 203,075 shares, reflecting Cathie Wood's long-term confidence in the stock. As of August 11, Trade Desk ranked 27th in ARKK's holdings, holding 1.57 million shares worth $85.14 million; and ranked 29th in ARKW, holding 523,000 shares worth $28.39 million.

Against the backdrop of generally cautious market conditions, Wood's purchase has become a focus of attention. Should investors follow her lead and buy the stock on dips?

Financial Performance

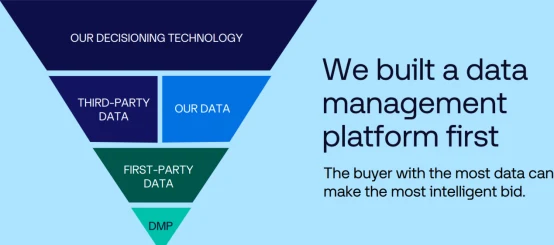

First, it's important to understand that Trade Desk is the world's largest independent DSP, offering an omnichannel platform across display, mobile, video, audio, and digital out-of-home advertising. It charges based on ad spend and uses machine learning to optimize audience targeting. The company partners with retailers like Walmart and Kroger to gain access to unique data and improve advertising ROI.

Currently, Trade Desk is focusing on the fast-growing connected TV (CTV) and retail media sectors. CEO Jeff Green predicts that CTV will be the fastest-growing channel in the future, with the global advertising market size reaching $1 trillion.

Image source: Trade Desk

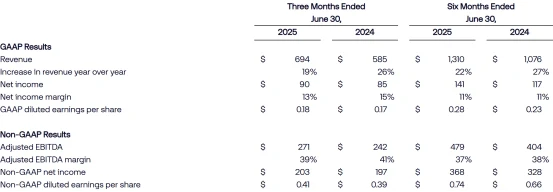

According to its latest financial report, Trade Desk's revenue for the second quarter of 2025 was $694 million, a 19% year-over-year increase, exceeding the FactSet consensus of $685 million. Earnings per share were $0.41, in line with market expectations. Net income was $90 million, representing a 13% profit margin. The company's customer retention rate has remained above 95% for 11 consecutive years, and it repurchased $261 million of its Class A common stock, with $375 million remaining authorized for future repurchases.

Image source: Trade Desk

However, third-quarter revenue guidance of at least $717 million, a 14% year-over-year increase, fell short of some investor expectations. Furthermore, the impending departure of Chief Financial Officer Alex Kayyal heightened market concerns about management stability. Furthermore , the complex global trade environment, particularly tariff uncertainty, has put pressure on client advertising budgets, directly impacting Trade Desk's growth expectations and valuation , leading to a deterioration in market sentiment and a significant drop in its stock price.

In contrast, Amazon's advertising revenue in the second quarter increased by 22% year-on-year to US$15.69 billion, highlighting the relative disadvantage of Trade Desk in growth rate.

Cathie Wood 's Buying Logic

Cathie Wood 's increase continues her strategy of building a position in Trade Desk's stock price at its lows, with her most recent purchase occurring on February 13, 2025, the day after the stock fell 33% following its earnings report on February 12. Since November 2024, ARKK has increased its holdings in the stock seven times and ARKW has increased its holdings in the stock six times.

Wood's investment philosophy focuses on disruptive innovators in areas such as artificial intelligence and digital transformation, emphasizing long-term growth potential over short-term volatility. As advertising spend shifts from traditional linear TV to streaming and the open internet, demand-side platforms (DSPs) are becoming a critical bridge between advertisers and consumers. The Trade Desk, leveraging its advanced Kokai AI platform and OpenPath supply chain tools, is accelerating this transformation, expanding its market reach and competitive advantage.

Image source: Trade Desk

currently boasts industry-leading AI-powered ad placement decision-making capabilities and , through partnerships with major retailers like Walmart and Kroger, accesses unique first-party data. This not only enhances its precision targeting capabilities but also improves customer retention and solidifies its revenue foundation.

Cathie Wood has always insisted on buying high-growth technology stocks on dips when the market is sluggish. She believes that the current stock price adjustment caused by macroeconomic pressure and policy uncertainty is an ideal time to invest in high-quality technology targets.

The Trade Desk has maintained profitability in recent years, with its customer retention rate remaining above 95%, fully demonstrating the strong resilience of its business model.

The ARK fund's returns also support this investment strategy: since inception, ARKW has returned 807.4%, while ARKK has returned 286.5%. Although Tesla remains the largest holding for both funds, accounting for 10.56% and 7.94% of their holdings, respectively, the performance of other high-growth technology stocks such as Trade Desk continues to provide stable growth potential for the portfolios.

Opportunities and risks

Despite Wood's steadfast stance, Wall Street is divided on Trade Desk. Jefferies and BofA Securities both downgraded their ratings, citing concerns over the company's conservative third-quarter growth guidance and uncertainties in the macroeconomic and trade environment.

Morgan Stanley analysts maintained a buy rating, emphasizing the customer spending driven by Kokai's platform and its continued expansion into retail media and CTV. This view suggests that despite short-term volatility, long-term growth potential remains promising.

Investors need to be wary that global trade frictions, customer budget adjustments and intensified industry competition may put pressure on performance; management changes also need to be closely monitored for their impact on strategic execution.

From a pricing and valuation perspective, Trade Desk's stock price plummeted 38.61% following the release of its earnings report. As of Tuesday's US market close, the stock closed at $53.27, down over 50% year-to-date and nearly halving its 52-week average price of $93.18. This plunge wiped out over $12 billion in market capitalization and marked the second significant correction following the 33% drop following its February earnings report. Compared to the stock's peak of $141.53 at the end of 2024, the current valuation premium has significantly diminished.

Image source: TradingView

Despite this, the average 12-month price target of $76.88 from 30 Wall Street analysts compiled by TipRanks suggests approximately 44% upside potential. This valuation reflects a trade-off between investors' expectations for Trade Desk's future growth and the current realities of the market. Future stock price movements will be highly dependent on the company's ability to deliver on its growth projections and achieve the results of its strategic transformation.

Conclusion

Cathie Wood's increased investment in Trade Desk, a move that defies market trends, is an investment in the digital advertising industry's growth prospects . With its leading technology platform, solid customer base, and the potential unlocked through transformation, Trade Desk is well-positioned for the open internet advertising era.

However, facing macroeconomic policy risks and fierce market competition, investors should remain rational and focus on the company's core technology development, customer trends, and changes in the macro environment. Only when these factors become clearer can Trade Desk truly unleash its valuation potential.

For investors who are willing to bear certain volatility risks and are optimistic about the structural growth of the digital advertising industry, Trade Desk is still worthy of attention and research.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates