Is a September Rate Cut a Done Deal?

22:29 August 12, 2025 EDT

Key Points:

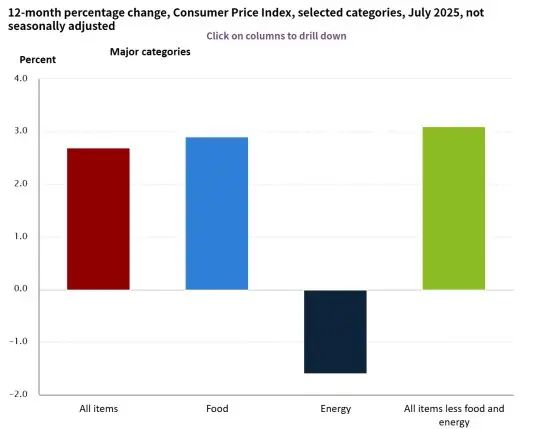

July CPI rose 0.2% month-over-month and 2.7% year-over-year; core CPI increased 0.3% month-over-month and accelerated to 3.1% year-over-year.

Although core CPI reached its highest year-to-date level, overall inflation remained below market expectations, indicating that the Trump administration’s tariff policies have yet to significantly drive up prices.

If inflation continues to cool, the Fed may support economic growth through rate cuts, but pressure from core CPI calls for caution to prevent a rebound in inflation.

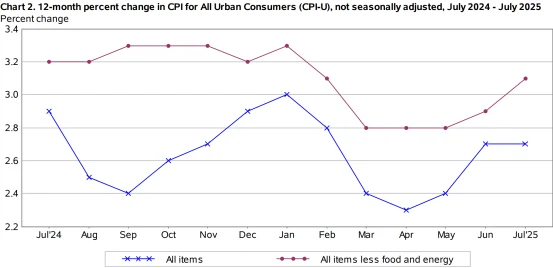

On August 12, the U.S. Bureau of Labor Statistics released data showing that the annual inflation rate in July held steady at 2.7%, unchanged from the previous month and below the market expectation of 2.8%, failing to sustain the earlier rebound. Core CPI rose to 3.1% year-over-year, marking the highest level this year, but overall price pressures remained moderate. A slowdown in the labor market further strengthened market bets on a Federal Reserve rate cut in September.

Despite the ongoing implementation of the Trump administration’s tariff policies, inflation data indicate that their price-driving effect remains limited at present. Against the backdrop of diverging views within the Fed, the market has largely priced in a rate cut as a fait accompli.

Tariffs Have Limited Effect

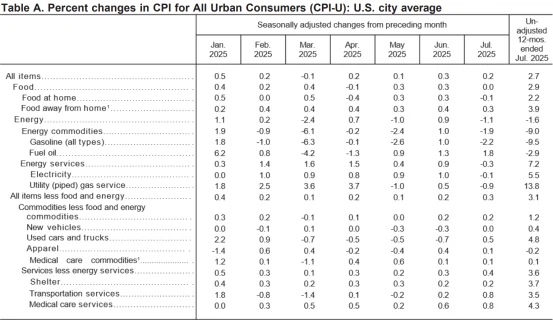

July’s Consumer Price Index (CPI) rose 0.2% month-over-month and 2.7% year-over-year, below the market expectation of 2.8%, ending a two-month rebound. Core CPI, which excludes food and energy, increased 0.3% month-over-month and accelerated to 3.1% year-over-year, exceeding the 3.0% forecast and reaching its highest level since February. This reflects sustained pressure on service prices, with the overall rate remaining above the Fed’s long-term 2% target.

Source: U.S. Bureau of Labor Statistics

The Bureau of Labor Statistics report shows that housing costs rose 0.2% month-over-month, serving as the primary driver of the overall CPI increase. Food prices were unchanged from the previous month, while energy prices declined 1.1%. Despite tariff impacts, new car prices remained flat, but used car and truck prices increased 0.5%. Transportation and medical care service prices each rose 0.8%. The urban consumer CPI increased 2.5% year-over-year.

Source: U.S. Bureau of Labor Statistics

Overall, the tariff pass-through effect on goods prices remains limited, and service price increases are moderate, with no signs of runaway inflation. July’s CPI did not continue the anticipated rise, indicating a weakening of the prior rebound momentum and extending the cooling trend seen since 2022.

Source: U.S. Bureau of Labor Statistics

Analysts note that core goods prices remain the primary driver of the index’s increase, while declines in energy and housing costs partially offset this pressure. Neil Dutta of Renaissance Macro suggests that the inflation data effectively secures a Fed rate cut in September.

Rate Cut Outlook Is Nearly Set

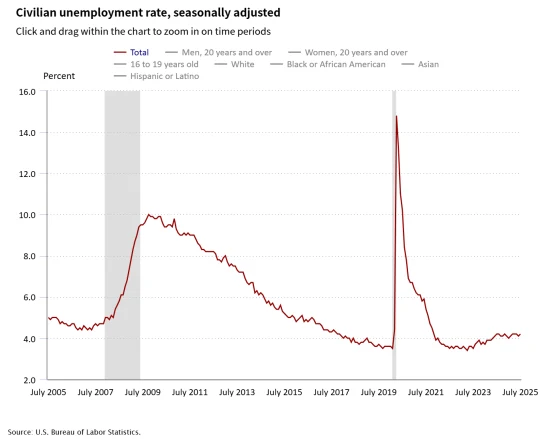

Beyond inflation, a weakening labor market has further fueled expectations for a rate cut.

Recent data show that U.S. nonfarm payroll additions have fallen to their lowest level in nearly two years, with a slight uptick in the unemployment rate. Slower wage growth has also reduced the risk of upward inflationary pressures. U.S. Treasury Secretary Janet Yellen stated that if more accurate employment data had been available, the Federal Reserve should have cut rates earlier in June or July and called for openness to a 50 basis point rate cut in September.

Source: U.S. Bureau of Labor Statistics

According to CME’s “FedWatch” tool, following the July CPI release, the market’s probability of a 25 basis point rate cut in September has risen above 94%, reflecting near consensus. Traders generally expect the Fed to cut rates at least once over the next three FOMC meetings, with some investors betting the September cut could reach 50 basis points.

Source: CME

Art Hogan, Chief Market Strategist at B. Riley Wealth, noted that rising core goods prices were the main driver behind the July CPI increase. However, declines in energy and housing costs indicate that overall price pressures remain manageable, which supports the market’s expectation for multiple rate cuts by the Fed within the year.

Federal Reserve Internal Divisions

Despite the market’s consensus on a September rate cut, Federal Reserve officials remain divided in their views.

Richmond Fed President Thomas Barkin noted that sustained consumer spending may temporarily offset the inflationary impact of tariffs, but warned that if corporate profits come under pressure leading to reduced hiring, employment could deteriorate.

Kansas City Fed President Esther George stated that the limited impact of tariffs on inflation indicates that policy is appropriately calibrated and argued against premature rate cuts, advocating for maintaining a moderately restrictive stance.

Former St. Louis Fed President James Bullard expressed that if economic slowdown becomes more pronounced, the Fed should adjust its policy stance promptly to avoid a reactive approach.

This divergence highlights that although a September rate cut appears highly likely, the magnitude and subsequent policy trajectory will depend on forthcoming data.

Rising Uncertainty

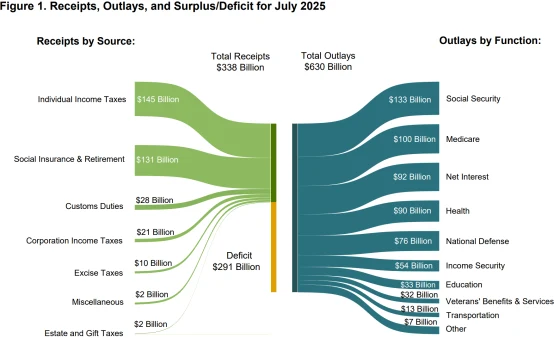

In addition, the Federal Reserve faces increased uncertainty from rising fiscal deficits and potential political interference. U.S. Treasury Department data show that tariff revenues reached $28 billion in July, a year-over-year surge of 273%, setting a historic record. However, due to rapid growth in government spending, the federal budget deficit expanded to $291 billion in the same month, up nearly 20% year-over-year.

Source: U.S. Department of the Treasury

President Trump has repeatedly emphasized that the cost of tariffs is borne by businesses and foreign governments, with limited impact on inflation, while publicly pressuring the Fed to cut rates. He also criticized certain Wall Street institutions for “wrong” and overly pessimistic forecasts on the effects of tariffs.

Meanwhile, beyond monetary policy discussions, the White House is advancing Federal Reserve personnel changes. Treasury Secretary Janet Yellen disclosed that the administration hopes the Senate will confirm Christopher Waller as a Fed governor before the September meeting and has begun searching for a successor to Chair Jerome Powell. Trump has even suggested considering former Fed Chair Janet Yellen for the role. These developments indicate an increased risk of political influence over monetary policy.

Conclusion

Moderate inflation and a cooling labor market in July have nearly locked in expectations for a September rate cut, though rising core CPI constrains the scope for aggressive easing. The market broadly anticipates a 25 basis point cut, yet the Treasury Secretary’s calls for larger reductions contrast with the more cautious stance of some Fed officials.

Key variables going forward include whether core inflation will recede, whether the labor market will continue to weaken, and the Fed’s internal assessment of policy space. Should subsequent data confirm further economic slowdown, the Fed may be compelled to accelerate the pace of cuts; conversely, if core prices remain elevated, the scope for easing could be limited.

Upcoming releases, including the August Producer Price Index (due August 14) and the Jackson Hole Symposium, are expected to provide clearer guidance on policy direction.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates