A Key Pitfall to Avoid Before You Buy Amazon Stock

04:17 August 12, 2025 EDT

Amazon just went through a quarter that shook investor sentiment. While the Q2 earnings report had some bright spots, the guidance for Q3 came in noticeably below market expectations — revenue growth is projected between 10% and 13%, and the operating income range even includes a double-digit decline. In the two days following the earnings release, the stock price dropped nearly 10% cumulatively. Although there was some rebound afterward, the year-to-date gains still lag behind the broader market.

Source: TradingView

This price action is not just a short-term reaction; it reflects a fundamental market concern about Amazon’s growth model: whether the company’s long-standing “reinvestment-driven” strategy can continue to meet investor expectations amid the current macro environment and competitive landscape.

AWS Growth Slows

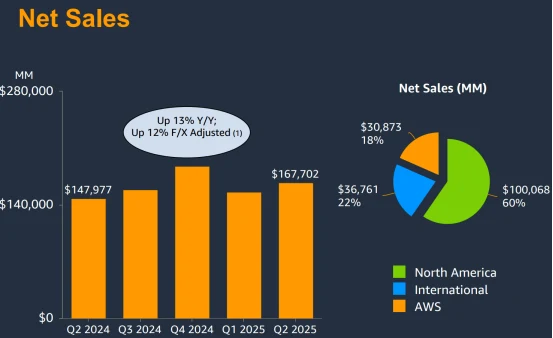

Amazon’s Q2 results beat expectations. The company reported total revenue of $167.7 billion, up 13% year-over-year, with net income reaching $18.2 billion and earnings per share (EPS) of $1.68 — all above market consensus. However, despite the strong report, the stock dropped 8.27% following the earnings release.

Source: Amazon

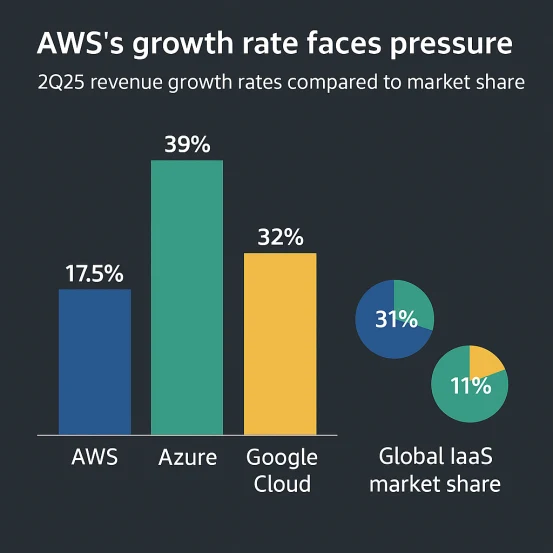

The direct cause of the negative market reaction was the slowdown in AWS cloud service growth.

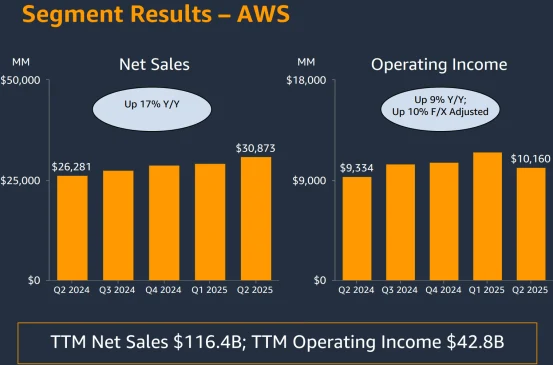

Compared with competitors, AWS’s growth rate is under pressure. In Q2 2025, Microsoft Azure posted revenue growth of about 39%, Google Cloud grew 32%, both outpacing AWS’s 17.5%. In the global Infrastructure-as-a-Service (IaaS) market, AWS holds a 31% share, followed by Azure at 20% and Google Cloud at 11%. Although AWS remains the leader, faster growth by rivals signals that Amazon must continue investing to maintain its edge. Analysts warn that if these investments don’t generate timely returns, Amazon’s profitability could be pressured in the near term.

Additionally, the Q3 guidance raised concerns. The company expects sales between $174 billion and $179.5 billion, representing about 10% to 13% year-over-year growth. Operating income is projected between $14 billion and $15 billion, implying a possible 11% decline or 18% increase year-over-year. This outlook reflects ongoing elevated capital expenditures to support AI and cloud infrastructure expansion.

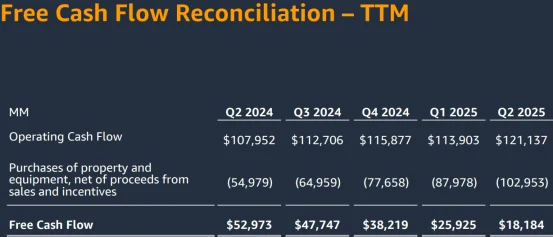

Capital spending is central to Amazon’s operating model. In Q2 2025, capital expenditures reached $31.4 billion, a 90% increase year-over-year. Full-year capex is expected to hit $100 billion, primarily for AWS data center buildout and generative AI tool development. This level surpasses 2024’s $83 billion and exceeds analyst expectations.

Management stated these investments aim to expand AWS capacity and enhance AI capabilities to sustain market leadership. As of Q2 2025, AWS revenue totaled $30.9 billion, but free cash flow fell from $53 billion the prior year to $18.2 billion, partly due to these reinvestments.

Source: Amazon

These expenditures are essentially a bet on the future, but the reality of near-term cash flow pressure and challenged capital efficiency means investors need to carefully weigh the short-term cash flow impact against the potential payoff timeline.

Shareholder Return Model

Investors often overlook Amazon’s strategy of prioritizing reinvestment over short-term shareholder returns when buying its stock. This approach results in greater volatility in earnings per share (EPS) and cash flow.

Over the past decade, Amazon’s stock has experienced at least three declines of 25% or more from its historical highs, including a peak-to-trough drawdown of 51% in 2022. Currently, the share price has dropped about 8.5% from its February 4, 2025 peak of $242.52. Historical volatility data shows a 90-day historical volatility of 31.29% and a 20-day rolling volatility of 2.26%. These figures indicate that Amazon’s stock exhibits higher volatility than the industry average.

Source: TradingView

Moreover, a key difference between Amazon and other tech giants is that it does not return capital to shareholders through large-scale buybacks or dividends, instead reinvesting the vast majority of its profits back into the business. Over the past 12 months, stock-based compensation expenses exceeded $20 billion, yet the company has not offset this dilution through buybacks, resulting in a steadily rising share count.

In contrast, Apple, Microsoft, Alphabet, and Meta, while also incurring significant stock compensation costs, use share repurchases to offset or even reduce their total share count, directly boosting EPS. This difference means that Amazon shareholders must accept passive dilution of their ownership and extend their investment horizon to the point where reinvestment returns become visible.

The Pitfall You Must Avoid

From a valuation perspective, Amazon’s current forward price-to-earnings (P/E) ratio stands at 33.9x, close to Microsoft’s 33.6x. However, the two differ fundamentally in cash return policies and earnings stability. Over the past decade, Amazon’s stock has experienced three pullbacks exceeding 25% from peak levels, reflecting the tension between its reinvestment cycles and market patience.

AWS’s high gross margins remain the key pillar supporting Amazon’s valuation. Yet, if competition intensifies and margins come under pressure while capital expenditures remain difficult to cut, valuation stability could be at risk—especially if capex returns fall short of expectations. Essentially, the market’s premium on Amazon is a bet that these investments will convert into new growth drivers.

Source: Amazon

For Amazon, the greatest trap is not competitors catching up, but investors misjudging the timing of returns. In the short term, the company could appease market sentiment by cutting spending and improving cash flow, but that runs counter to its long-term strategic direction. Investors expecting quick payoffs may find themselves forced out during the trough of the capital expenditure cycle.

Therefore, before buying Amazon stock, one must be clear: this is a classic long-term investment case, where returns depend on years of accumulated investment成果, not a few quarters of earnings improvement.

If you believe in Amazon’s integrated strengths in cloud computing, e-commerce, and advertising—and have sufficient patience to wait for capex to translate into profit growth—the current valuation holds some appeal. But if your investment goals prioritize stable cash returns and shareholder distributions, names like Microsoft and Alphabet may be better fits.

After all the analysis, this “trap” is simple—mistakenly treating Amazon as a short-term earnings machine, while ignoring that it is fundamentally a company that converts cash flow into durable long-term competitive moats.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates