90-Day Extension of US-China Tariff Truce: Short-Term Easing, Long-Term Risks Remain

23:18 August 11, 2025 EDT

On August 11, 2025, U.S. President Donald Trump signed an executive order extending the tariff pause on China for 90 days, which was originally set to expire that day. This decision means the tariff easing maintained since the May Geneva Joint Statement between the U.S. and China will temporarily continue, and the risk of reinstating tariffs with triple-digit rates has been postponed once again. Hours before signing the executive order, Trump remained ambiguous about whether to extend the truce but emphasized that his relationship with the Chinese leadership is “very good.”

The decision came just hours before the original truce was set to expire and immediately triggered market reactions: Asian stocks opened higher, while the Dow Jones Industrial Average closed down 200 points, though overall volatility stabilized.

Source: TradingView

However, this short-term positive development has not fundamentally altered the underlying tensions between the U.S. and China in trade and technological competition. Alongside tariffs, this round of friction has introduced an unprecedented export licensing revenue-sharing mechanism. The 2025 trade negotiations may have already broken through the framework established in 2018 in both methods and objectives.

From 2018 to 2025

History has shown that Sino-US trade frictions tend to follow a cyclical pattern of “pressure—negotiation—repetition.” The 2018 trade war serves as an important reference point.

At that time, the Trump administration imposed tariffs based on the Section 301 investigation on approximately $60 billion worth of Chinese goods, gradually expanding over the following year to around $370 billion in goods, with rates reaching as high as 25%. This process lasted 18 months, reducing the US trade deficit with China from about $419 billion in 2018 to $295 billion in 2024. However, the overall US trade deficit widened as imports shifted to other countries. According to data from the Peterson Institute for International Economics, tariffs during this period were fully passed on to consumers, increasing monthly costs by $1.4 billion and causing a 0.2% to 0.4% decline in US GDP.

Entering 2025, tariff policies during Trump’s second term became more aggressive and rapid.

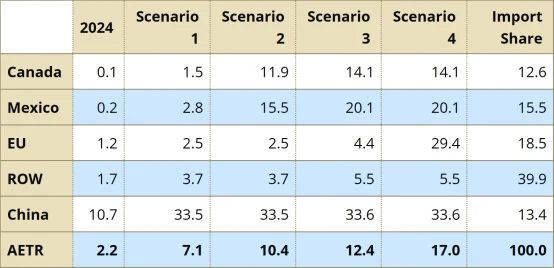

Compared to 2018-2019, the peak tariff rates in 2025 are higher, coverage broader, and expanded to include the European Union and Mexico.

However, the overall effect on reducing the trade deficit remains limited, as trade diversion has increased the total US trade deficit. A Richmond Fed report notes that tariffs in 2025 increased the cost of Chinese imports by 22 cents per dollar—significantly higher than the average level in 2018-2019.

Source: Federal Reserve Bank of Richmond

Notably, 2025 trade policies have extended their influence beyond tariffs through new measures. According to an August report by the Financial Times, US chipmakers Nvidia and AMD agreed to pay 15% of their sales revenue from certain chips destined for the Chinese market to the White House in exchange for export licenses. This practice is unprecedented in the history of US export controls.

The immediate effect of this arrangement is increased compliance costs for companies, potentially weakening their competitiveness in the Chinese market over the medium to long term. At the same time, it provides the US government with an additional source of revenue, partially offsetting the loss of tariff income due to the suspension.

Implications

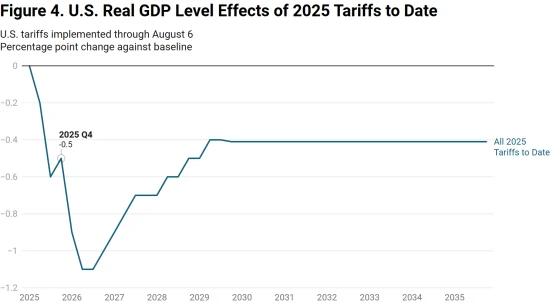

While tariffs increase fiscal revenue in the short term, they suppress growth in the long run. The Yale Budget Lab estimates that tariffs and retaliatory measures will reduce GDP growth by 0.5 percentage points in 2025 and raise the unemployment rate by 0.3 percentage points. The International Monetary Fund warns that global growth in 2025 will be just 2.8%, with tariffs exacerbating this slowdown.

Source: The Budget Lab

Market reactions further highlight the prevailing uncertainty. In the short term, the extension of the tariff pause has reduced market uncertainty, particularly benefiting U.S. tech companies closely tied to Chinese supply chains. However, medium-term risks remain. Uncertainty around tariff policies, export licensing restrictions, and industry-specific taxes may force multinational corporations to accelerate supply chain diversification, further weakening the potential for bilateral investment and trade growth between the U.S. and China.

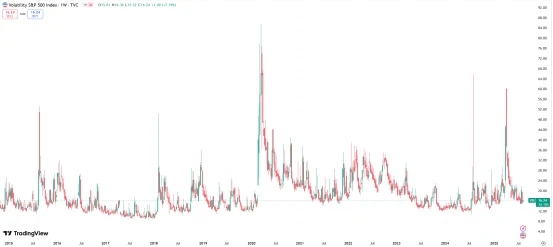

Moreover, if no longer-term agreement is reached after the 90-day extension, global markets could face renewed tariff shocks, putting pressure on both U.S. equities and the Chinese yuan. History has proven this: during the 2018-2019 tariff escalation, the volatility index rose above 30, the S&P 500 declined roughly 5% between June and July, and the Chinese market fell by 20%.

Source: TradingView

Trade frictions have also accelerated the restructuring of global supply chains. Between 2018 and 2019, U.S. imports shifted toward “winning” countries such as Vietnam, while the Eurozone increased imports from China by 2-3%. This trend is expected to intensify in 2025: Rodem Group reports that tariff differentials between China and other countries are driving change, with U.S. retailers forecasting import declines of 20-30%. Analysis from the European Central Bank suggests the trade war may repeat history, causing more Chinese exports to be redirected to Europe.

Future Outlook

The extension of the tariff pause provides a time window for further negotiations but does not alter the core disagreements between the two sides over supply chains and technology control. If no new trade agreement is reached after 90 days, the U.S. may reinstate or even escalate tariff measures, while China could respond with targeted countermeasures.

Against this backdrop, market participants need to pay close attention not only to tariff rates themselves but also to the underlying policy signals—the 2025 trade friction may have shifted from a mere trade deficit issue to a contest for strategic industries and technological dominance.

This means that even if there are signs of short-term easing, medium- to long-term uncertainties will remain significant risks for the global economy and capital markets.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates