401(k) Private Investment: How Trump’s Executive Order Will Impact Your Retirement Savings

04:00 August 11, 2025 EDT

On August 6, 2025, U.S. President Donald J. Trump signed an executive order directing the Department of Labor, the Securities and Exchange Commission (SEC), and the Treasury Department to develop a framework allowing private equity funds, cryptocurrencies, and other alternative assets to be included in 401(k) and other defined-contribution retirement plans.

This policy shift marks a significant turning point in the U.S. retirement investment landscape, potentially opening new channels for everyday investors to access high-growth but higher-risk assets. However, with the potential for elevated returns comes complex risks, making it essential for investors to take a clear-eyed view of both the opportunities and challenges this policy presents and to craft practical, well-structured investment strategies.

Background

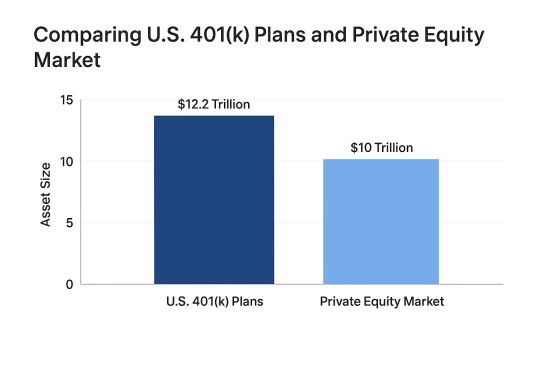

As of the end of 2024, the asset size of U.S. 401(k) and similar defined contribution plans is approximately $12.5 trillion, historically allocated primarily to public equities, bonds, and mutual funds. The private equity market, on the other hand, manages about $10 trillion in assets and has achieved a compound annual growth rate exceeding 15% over the past decade—significantly outperforming public markets. This gap highlights the potential room for improvement in defined contribution plan allocations.

In 2020, the U.S. Department of Labor issued an opinion letter permitting private assets to enter retirement plans indirectly through vehicles like target-date funds. The recent executive order builds upon this foundation and accelerates the process of regulatory enhancement.

Investment Advantages

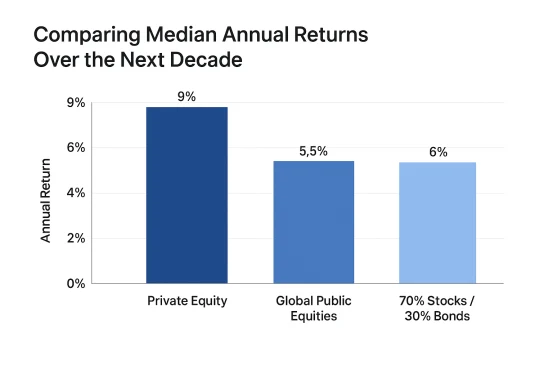

According to data from Vanguard Group, the median annual return for private equity portfolios over the next decade is projected to approach 9%, outperforming global public equity portfolios by 3.5 percentage points and exceeding a 70% equity / 30% bond balanced portfolio by nearly 3 percentage points.

Additionally, the private markets have expanded significantly: over the past five years, global private credit has grown by 60%, while the number of IPOs declined by 22% during the same period. This reflects that private companies are staying private longer, making their growth dividends less accessible to ordinary investors through traditional public markets, thereby reducing growth opportunities in the public market.

On the positive side, this shift aligns well with the long-term investment nature of retirement accounts. 401(k) plans typically penalize early withdrawals, which is consistent with private equity’s buy-and-hold strategy, where holding periods often range from 5 to 7 years. Analysis shows that increasing exposure to private assets could generate approximately 15% additional retirement wealth for participants over a 40-year horizon. Pension funds have demonstrated this benefit: the 20 global pension plans with the highest private equity allocations invested over $700 billion last year.

Risk Factors

However, the risks are equally significant.

Private equity typically suffers from lower liquidity, higher fees, limited transparency, and valuation challenges. While public markets provide daily pricing, private assets lack active trading, which can make it difficult for investors to accurately assess value—especially when they need to secure loans or report assets.

Historical cases like Theranos, a private company backed by private equity, demonstrate the limited reporting obligations of private firms and the challenges in conducting thorough due diligence. The FTX scandal in the cryptocurrency space further highlights regulatory risks associated with highly volatile alternative asset categories. Additionally, fee structures are complex, with double-digit fee rates common; although these are expected to decline over time, current fees remain higher than those of public assets. Volatility is also greater—private equity experiences periods of high returns but tends to underperform public markets during downturns.

Expert opinions are divided. Proponents argue that this move broadens investment opportunities, allowing ordinary investors access to high-growth startups and private markets. Critics point out that many retail investors have limited understanding of private assets, making it difficult to accurately assess risks and even distinguish between basic asset classes.

Research from Stanford University indicates that while increasing allocations to alternative assets can help public pension funds achieve excess returns, it also significantly raises fiduciary responsibilities and regulatory scrutiny.

Implementation Challenges

It is important to note that although the executive order accelerates the process, the related policies will not take effect immediately. It is expected that from the formulation of specific rules to full implementation, at least six months to several years will be required. This timeline includes amendments to regulations such as the Employee Retirement Income Security Act (ERISA) to reduce litigation risks faced by plan sponsors. Meanwhile, plan sponsors will also need to address numerous operational challenges, such as managing cash flow and maintaining adequate liquidity buffers.

Currently, the main driving force behind this policy change comes from asset management firms targeting the $12.5 trillion defined contribution retirement market, with declining institutional financing rates further fueling this trend.

The executive order has prompted regulators to actively develop guidance for incorporating private assets into retirement plans, with a focus on protecting investor rights and clarifying plan sponsors’ fiduciary duties and risk disclosure obligations. The U.S. Securities and Exchange Commission (SEC) encourages the development of standardized vehicles that package private assets into mutual funds or exchange-traded funds (ETFs) to enhance liquidity, transparency, and lower investment barriers.

At the same time, asset managers and recordkeepers are leveraging big data and behavioral modeling to simulate participant cash flow behavior, thereby scientifically setting liquidity buffer measures. For example, if a plan expects a high redemption rate among participants, private funds will increase allocations to highly liquid assets such as ETFs to ensure sufficient cash is available to meet redemption demands in a timely manner.

Investor Response Strategies

Investors should carefully assess their individual circumstances. The first step is to review risk tolerance and investment horizon. Private equity is suitable for long-term holding but should generally not exceed 10% to 15% of a portfolio to maintain liquidity. Consulting a certified financial planner is recommended to understand fees, tax implications, and potential returns.

Within plans, prioritize alternative assets bundled into mutual funds or target-date funds to reduce direct exposure risks. Monitor regulatory updates closely: avoid making hasty decisions before the Department of Labor issues formal guidance. Diversification remains key—combine public equities, bonds, and a modest allocation to alternatives, with regular portfolio rebalancing. For highly volatile assets like cryptocurrencies, limit allocations to below 5% and consider self-directed IRAs as a supplemental option.

Overall, the executive order presents new growth opportunities for retirement investing, but investors must carefully weigh potential rewards against associated risks. Although private markets offer significant growth potential, they are not suitable for everyone. Relying on data-driven analysis and professional advice will help investors better optimize and manage their retirement asset allocations.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates