Two Stocks Investors Need to Pay Attention to This Week

01:42 August 11, 2025 EDT

Key Points:

If Nvidia’s upcoming earnings report meets or exceeds expectations, the stock is likely to attract further buying interest.

Although Starbucks maintains revenue growth, its profit pressures and regional performance divergence highlight ongoing challenges.

Over the past week, major U.S. stock indices closed higher overall, with the technology sector continuing to lead gains. The Nasdaq rose 3.9%, marking its 18th record closing high this year, with a year-to-date gain of approximately 11%. The S&P 500 increased 2.4% last week, closing near all-time highs, while the Dow Jones Industrial Average climbed 1.4%, maintaining a steady upward trend. Market sentiment benefited from expectations of a potential rate cut and optimism around earnings reports from large tech companies.

Source: TradingView

Sector-wise, the information technology and communication services sectors led gains, primarily driven by strong earnings expectations for AI-related companies. The energy sector lagged due to oil price volatility. Overall, investors balanced economic data and policy expectations, with short-term market volatility remaining moderate.

As investors continue to digest changes in tariff policies, inflation trends, and retail sales data, U.S. equities may experience sustained volatility this week. Trade measures from the Trump administration continue to impact corporate earnings forecasts, while upcoming economic releases could serve as key drivers for near-term market direction.

The U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) are scheduled to be released this week, with the market widely expecting July CPI to show a year-over-year increase of around 2.8%. Additionally, retail sales figures and several manufacturing reports will provide investors with further insight into economic resilience and consumer trends.

Against this backdrop, investment opportunities and risks are likely to be relatively concentrated this week. Based on earnings catalysts, sector trends, and fundamental developments, Nvidia stands out as a key buy candidate, whereas Starbucks may face short-term earnings and valuation pressures, making it a potential sell or avoid.

Key Buy Opportunity: NVIDIA

Nvidia’s leading position in AI computing and high-performance chips underpins its sustained profitability growth. With global data centers accelerating deployment of generative AI training and inference platforms, demand for GPUs and related software ecosystems remains elevated.

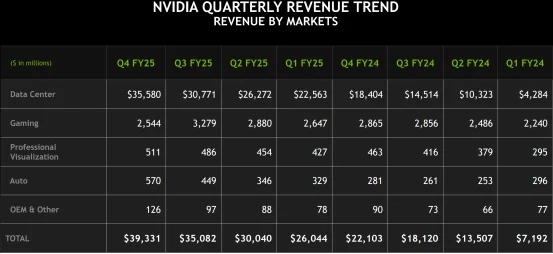

The company is scheduled to release its latest quarterly earnings on August 27, with analysts broadly expecting continued strong revenue growth, driven primarily by its data center business. According to Bloomberg and other sources, market consensus projects total revenue in the range of $28 billion to $30 billion, reflecting a year-over-year growth rate potentially between 80% and 100%. Data center revenue is expected to account for over 80% of the total, benefiting from the ongoing expansion of global AI compute demand.

Source: Nvidia

Institutional forecast revisions have shown a clear upward bias, with most major investment banks raising target prices and earnings estimates over the past three months. Nvidia’s first-mover advantages in supply chain management, advanced process capacity locking, and software platform development provide resilience against short-term market volatility.

Notably, beyond positive fundamentals and industry trends, recent policy developments have also supported Nvidia’s market performance. The U.S. Department of Commerce has reportedly begun issuing export licenses to Nvidia, permitting the shipment of key H20 graphics processor chips to China. This move removes a significant barrier for Nvidia’s access to one of the world’s most critical AI markets and offers regulatory assurance for continued expansion.

According to the Financial Times, Nvidia and AMD have reached agreements to remit 15% of their chip sales revenue from the Chinese market to the U.S. government as a condition of obtaining semiconductor export licenses. While this revenue-sharing arrangement increases costs, it secures continued market access in China, preserving their competitiveness within the global supply chain.

On the technical side, Nvidia’s stock price broke through the important resistance level of $180 last week, accompanied by significantly increased trading volume, indicating strong buying momentum. Coupled with the rapid growth in the AI sector and Nvidia’s market leadership, the stock shows substantial upside potential. If the upcoming earnings meet or exceed expectations, the stock price is likely to receive additional buying support.

Source: TradingView

Sell Risk Alert: Starbucks

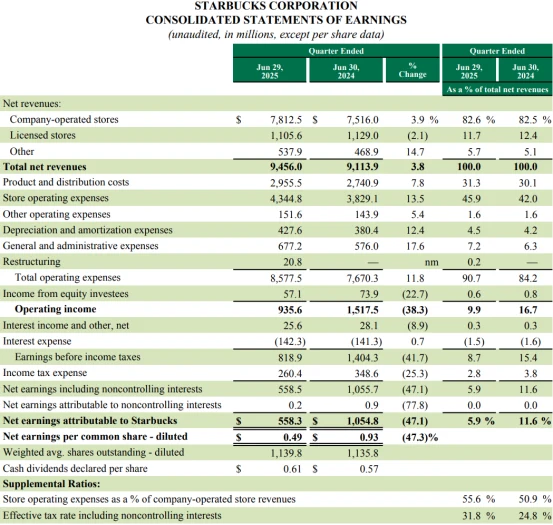

As a leading global coffee chain, Starbucks is currently facing pressures from rising raw material costs, increased labor expenses, and weakened demand in certain markets. Starbucks’ fiscal 2025 third-quarter earnings showed a 3.8% year-over-year revenue increase to $9.456 billion, exceeding market expectations. However, net profit and profit margins came under significant pressure. Net income attributable to shareholders was only $558 million, down 47.1% year-over-year, while operating income declined 38.3%, highlighting notable challenges to the company’s profitability.

Source: Starbucks

The decline in margins was mainly driven by sharply higher operating expenses. Management costs increased by $101 million, including $81 million spent on the “2025 Leadership Experience” initiative. Additional labor costs rose approximately 160 basis points, and marketing expenses grew about 90 basis points. Furthermore, inflationary pressure from rising coffee raw material prices added to cost burdens, causing the overall profit margin to fall 680 basis points year-over-year to 9.9%.

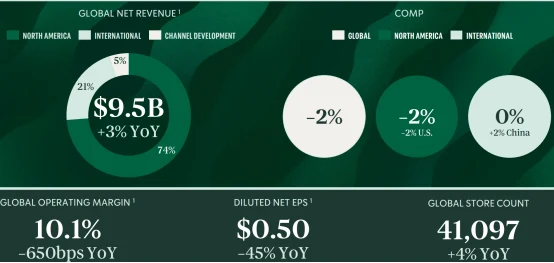

Regionally, the Americas market remains weak. North America’s same-store sales declined 2% in the quarter, with U.S. transaction volume down 4%, partially offset by a 2% increase in average ticket price. Operating income plummeted 36% to $918.7 million, with operating margin falling sharply from 21% to 13.3%, marking a multi-year low and reflecting clear softness in consumer demand.

In contrast, the China market demonstrated resilience, with net revenue growing 8% year-over-year to $790 million and same-store sales increasing 2%, reversing prior declines. However, uncertainty over supply chain costs and intensified industry competition may limit Starbucks’ ability to improve profitability in the near term.

Source: Starbucks

From a technical perspective, the stock has shown signs of recent correction, with the RSI falling back after reaching overbought levels. Given the multiple challenges currently faced by the company, investors should approach the stock cautiously and consider gradually reducing exposure to mitigate potential downside risks.

Source: TradingView

Final Thoughts

Currently, major U.S. stock indices have nearly reached their highest cumulative gains for the year over the same period in history. Against the backdrop of trade policy uncertainties and fluctuating inflation levels, investors should place greater emphasis on company fundamentals and the sustainability of earnings.

For short-term traders, the focus this week should be on capitalizing on volatility driven by earnings reports and macroeconomic data releases, selecting stocks that benefit from structural growth trends while avoiding those with pressured fundamentals and lacking near-term catalysts.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates