Market Update: U.S. Aims to Conclude Trade Talks by Late October; July CPI Due — Will September Mark the Fed’s First Rate Cut?

22:34 August 10, 2025 EDT

FoolBull Brings You This Week’s Market Highlights:

Market Focus

U.S. Expected to Wrap Up Trade Talks by Late October

U.S. Treasury Secretary Besent told Nikkei in an interview that President Trump’s tariff policy is aimed at bringing manufacturing back to the United States. He likened Trump’s economic agenda to a “three-legged stool” — taxes, trade, and deregulation.

On taxes, the administration pushed through the “Big and Beautiful Act” at record speed, which was signed into law on July 4.

On trade, Besent said the work could be “substantially completed” by late October. He added, “As for deregulation, that’s an ongoing process. The President has made it clear: for every new regulation introduced, ten old ones must be scrapped. The main reason trade policy has shifted toward tariffs is to rebalance the current account deficit. Over time, tariffs should be like a melting ice cube — if production returns to the U.S., our imports will decline.”

White House Clarifies No Gold Tariffs

A 39% tariff imposed on Switzerland — home to the world’s largest gold refining hub — initially applied to key gold bar exports, sending gold futures briefly more than 2% higher. The White House later moved to issue an executive order clarifying that officials had “misread” the policy, confirming that gold would not be subject to tariffs. In addition, Trump said he plans to announce tariffs on semiconductors and pharmaceuticals “around this week.”

July CPI Data Coming Up

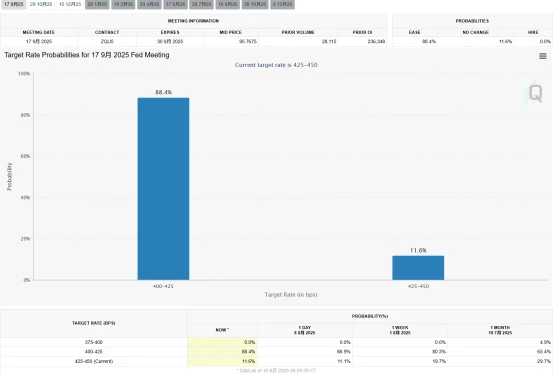

The U.S. July CPI report will be released on August 12, with the market expecting a 2.8% year-over-year increase. A reading above expectations could dampen the probability of a September rate cut. According to the CME FedWatch Tool, the market currently prices in an 88.4% chance of a September cut.

Source: CME

Notably, on August 9, Fed Vice Chair for Supervision Michelle Bowman published prepared remarks on the Fed’s website, voicing support for three rate cuts this year and calling for the first one to begin at the September meeting.

Bowman said that recent weakness in the U.S. labor market has reinforced her stance, noting that a September cut “would help avoid further unnecessary deterioration in labor market conditions and reduce the likelihood that the Committee would need to make larger corrective moves if conditions worsen further.” She reiterated that tariff-driven price increases are unlikely to keep pushing inflation higher, and that as confidence grows that tariffs won’t have lasting inflationary effects, the upside risks to price stability have diminished.

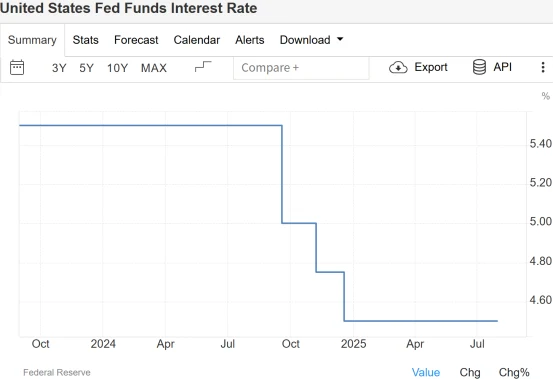

At the July FOMC meeting, the Fed held the federal funds rate target range at 4.25%–4.50% for the fifth straight meeting. Bowman and fellow Governor Christopher Waller dissented, voting instead for a 25-basis-point cut.

Source: TradingEconomics

U.S.-Russia Summit

On August 8, President Trump announced he will meet Russian President Vladimir Putin in Alaska on August 15 to focus on a long-term resolution to the Ukraine crisis. The Kremlin confirmed the meeting and said the next round would take place in Russia.

Circle to Report Earnings on Tuesday

Stablecoin issuer Circle will release fiscal Q2 2025 earnings before the bell on Tuesday, August 12. Bloomberg analysts forecast Q2 revenue of $646.2 million and adjusted EPS of -$0.22.

As the first publicly traded stablecoin company, Circle’s shares have surged 412% since its June 5 IPO as of August 8, 2025.

Source: TradingView

Market Recap

Last week, the U.S. stock market delivered a strong overall performance, with all three major indexes posting sizable gains, led by the technology sector. Specifically, the Dow Jones Industrial Average rose 1.35% to close at 44,175.61 points; the S&P 500 gained 2.43% to close at 6,389.45 points; and the Nasdaq Composite climbed 3.87% to close at 21,450.02 points, marking its best weekly performance since July 2020.

Source: TradingView

Among them, technology giants such as Apple, Google, and Tesla stood out, playing a major role in driving the indexes higher. Apple’s share price surged more than 13% over the week, adding $138.3 billion in market capitalization — its best weekly gain since July 2020 — and the company announced an additional $100 billion investment in U.S. manufacturing.

Source: TradingView

In addition, Tesla obtained a ride-hailing license in Texas, paving the way for its Robotaxi operations. Intel, on the other hand, saw its financing plan and a major AI company acquisition stall due to strategic differences.

It is worth noting that although the Trump administration launched a new round of tariffs (including on India and Switzerland), the market’s reaction has been relatively “numb,” with investor sentiment shifting more toward expectations of interest rate cuts. At the same time, affected by weak U.S. employment data and other factors, short-term risk-off sentiment increased significantly, prompting notable inflows into bonds and money markets. This week, gold prices once climbed above $3,400 per ounce.

Source: TradingView

In summary, after prior pullbacks, the U.S. stock market posted a notable rebound last week, with technology and certain consumer/healthcare companies leading the gains. At the same time, macroeconomic uncertainty and policy factors continue to influence investor sentiment. Investors should pay close attention to the upcoming CPI data and the Federal Reserve’s policy moves.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates