Is Wall Street's optimism a real trend or a false prosperity?

04:12 August 10, 2025 EDT

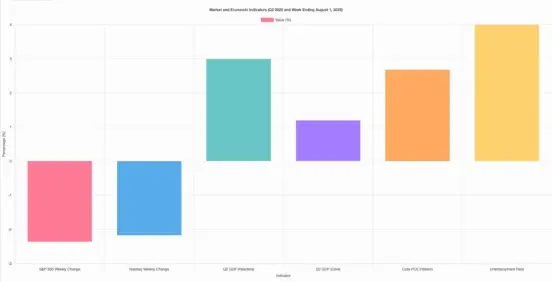

Last week, the market saw significant volatility, driven by a combination of macroeconomic headwinds and earnings reports from high-risk companies. The S&P 500 fell 2.36% and the Nasdaq dropped 2.17%. While technology stocks performed strongly this week, overall volatility was significant. Most of the decline occurred on Friday, dragged down by weak employment data. Frequent tariff-related news also exacerbated market anxiety. Below is a summary of key data.

The Federal Reserve held interest rates steady, as expected, but internal opinion showed a rare split, creating a more complex tone than usual. For the first time since 1993, two governors dissented, arguing for a 25 basis point rate hike to address persistent inflationary pressures. These two governors, Christopher Waller and Michelle Baumann, argued that rather than holding steady, a small rate hike would reduce the risk of runaway inflation, particularly given that tariffs are likely to have only a short-term impact on prices. They favored early action.

Meanwhile, Chairman Powell acknowledged in his statement that inflation is gradually receding, but emphasized that the Fed will continue to make data-driven decisions and is not yet ready to declare victory in the fight against inflation. While the market generally interpreted Powell's remarks as dovish, persistently high core PCE inflation has shaken investors' confidence in a September rate cut, causing market expectations for a rate cut to plummet from around 65% to around 39%.

The second-quarter GDP data looked impressive on paper, but the underlying strength was lackluster. The 3% annualized growth rate, seemingly a strong economic rebound, was primarily driven by a sharp decline in imports, a "technical" boost. This growth was significantly exaggerated against the backdrop of weak domestic demand. Core GDP, which excludes volatile items like trade and inventories, grew by a mere 1.2%, the lowest level since 2022.

Business investment suffered a particularly severe setback, declining nearly 16% month-over-month, the worst decline since the COVID-19 outbreak. Consumer spending, on the other hand, was mediocre, growing only slightly by 1.4%. Meanwhile, inflation showed signs of a rebound. The trimmed mean PCE price index, the Federal Reserve's preferred core inflation indicator, rose from 2.57% to 2.68%, but this increase was insufficient to prompt the Fed to adjust its current path of interest rate cuts.

Overall, the GDP data for the first and second quarters were significantly affected by the "preemptive tariff" policy, which distorted economic indicators. The truly noteworthy data is the upcoming third-quarter data, which may provide a more realistic and clear picture of economic performance.

Technical aspects

After a long period of complacency, market volatility finally showed up on Friday, with the major indices falling by more than 1%. As we noted before the opening bell:

While this period of low volatility has lasted longer, historical experience shows that low volatility often precedes high volatility, and such dramatic fluctuations are not uncommon. Typically, such "buying sprees" last for an average of approximately 15 trading days, but this one has lasted for 25 trading days, clearly exceeding the norm and suggesting that this period of volatility may be further prolonged.

Over the past week, the market's technical outlook has weakened significantly, with the S&P 500 index retreating sharply from its all-time high and breaking below the short-term rising channel established by its 20-day moving average. While longer-term moving averages, such as the 50-day and 200-day moving averages, remain upward, recent price action has clearly shown signs of fatigue, and the technical structure continues to deteriorate. The index has fallen below key support at 6,300 points, increasing the likelihood of a further decline to around 6,150 points, the support level of its 50-day moving average.

Image source: TradingView

Momentum indicators are signaling caution. The Relative Strength Index (RSI) has retreated from previously overbought territory and is now approaching neutral territory (around 50), suggesting waning bullish momentum. Meanwhile, the MACD indicator has formed a death cross, confirming a fading upward trend momentum.

Market breadth has also contracted. Only about 58% of the S&P 500's components are still trading above their 50-day moving averages, down from over 70% two weeks ago, suggesting weakening internal support.

Image source: TradingView

Fund flows also deteriorated significantly, with buying pressure significantly weakening. Small-cap stocks suffered a massive sell-off, and the volatility index (VIX) quickly rose to over 17, highlighting the potential for increased risk aversion in the market.

Despite this, the S&P 500's long-term uptrend remains intact. The index remains significantly above its 200-day moving average (currently around 5,900 points), suggesting no major reversal of trend. Large-cap technology stocks continue to provide support, while strong earnings from AI-related companies have mitigated some of the overall market weakness. As long as the S&P 500 remains below its 50-day moving average, the current correction can be considered a technical consolidation within the uptrend.

Looking ahead, market sentiment is neutral to mildly bearish. In the short term, if upcoming key economic data, such as the ISM services index and productivity report, fall short of expectations, further downward pressure could be triggered. However, unless the market sell-off accelerates and effectively breaks below the critical support level of the 50-day moving average, the current correction will likely be viewed as a technical correction from the previously overbought conditions.

Against this backdrop, investors should maintain a cautious approach, appropriately tighten stop-loss strategies, and avoid blindly increasing positions before clear signs of stabilization emerge. At this stage, more attention should be paid to market structural changes and risk management rather than blindly chasing rebounds.

Will it grow further?

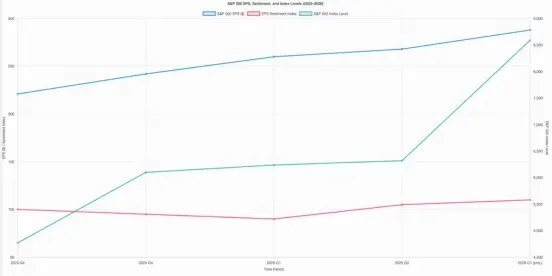

Since April, Wall Street's confidence in corporate earnings has significantly increased. Analysts have been raising their earnings per share forecasts for the second half of 2025 and even for the full year 2026. At first glance, this optimism appears justified—economic data continues to show resilience, the labor market remains solid, and the boom in artificial intelligence continues to fuel expectations of higher profit margins and improved productivity.

However, behind this seemingly logical expectation, we should also think calmly: Are analysts too optimistic or even a little too hasty?

The current market narrative is indeed attractive: although economic growth has slowed, it has not fallen into recession; the unemployment rate remains at a historical low; although inflation is stubborn, it has not reaccelerated to the extent that it would cause the Federal Reserve to be vigilant, and for now, the new tariffs have not brought any substantial impact.

This has created a macroeconomic environment that supports optimistic expectations and has prompted analysts to intensively raise their earnings forecasts. Optimism is particularly high among large technology and artificial intelligence-related companies, as well as some non-essential consumer goods sectors that have outperformed expectations.

There's a growing belief that artificial intelligence will unleash a wave of productivity gains in the coming years, potentially significantly reducing costs and boosting profit margins. Coupled with market expectations of interest rate cuts later this year or early next year, this seems to be the perfect formula for a continued upward trend in valuations. Meanwhile, a weakening US dollar is creating a favorable environment for multinational corporations, further boosting valuation sentiment for global companies.

Against this backdrop, optimism seems justified, prompting Wall Street analysts to quickly adjust their stances and raise their year-end targets for the S&P 500. One investment bank even raised its forecast to 7,100 points, reflecting strong confidence in future market performance.

Of course, the late 1990s remains a hot topic in the market, and memories of that bubble have led some pessimists to predict the possibility of the next crash. However, it is noteworthy that analyst sentiment regarding corporate earnings has shifted dramatically in a short period of time, from caution to optimism. As the chart shows, S&P 500 earnings sentiment has not only returned to its December level but has even reached a new high.

In contrast, earnings sentiment in other parts of the world is significantly weaker, prompting a reassessment and questioning of the view that "American exceptionalism will continue." Whether the unique performance of the US market can be maintained in the long term remains to be seen.

We're all familiar with this dynamic. When the macro economy weakens, analysts are often reluctant to lower their earnings forecasts; however, once market sentiment turns optimistic, they quickly raise their projections. This pattern is evident in the current market: EPS growth expectations for S&P 500 companies through 2025 have reached double digits, while revenue growth expectations remain in the low single digits.

Such strong earnings growth would require a significant expansion in profit margins. However, with input costs remaining high and productivity growth slowing, there is significant uncertainty about whether profit margins can continue to expand.

Upward earnings revisions are currently concentrated in a handful of large tech companies, leaving overall earnings breadth weak. Excluding the "Big Seven," the market's earnings picture appears much more muted. This structural imbalance is a classic late-cycle characteristic: optimism at the index level has priced perfection into asset prices, but the market has overlooked the fragile underlying foundations.

Against this backdrop, investors should be wary of the volatility risks associated with excessive sentiment. Despite the short-term bullish sentiment in the market, potential risks to earnings growth cannot be ignored:

First, economic growth is beginning to show signs of fatigue. The main factors that once supported consumer spending—excess savings and easy credit—are drying up. Credit card defaults continue to rise, student loan repayments have resumed, and wage growth momentum is weakening. When consumer spending slows, corporate revenues naturally come under pressure.

Second, cost pressures remain. While overall inflation has moderated, labor costs remain high, and geopolitical disruptions (whether related to energy supplies, critical raw materials, or global conflict) could exacerbate cost pressures and further erode profit margins.

Finally, if inflation resumes and heats up, it will force the Federal Reserve to postpone interest rate cuts or even raise interest rates again, thereby weakening the basis for corporate valuation expansion.

In other words, in the current environment where multiples are already high and optimism is strong, investors should remain sober and hedge against potential downside risks rather than blindly chasing short-term sentiment-driven gains.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates