Microsoft Soars to New Highs: Is It Currently Overvalued?

07:16 August 10, 2025 EDT

The tech giant ended its fiscal year with a "speculators' quarter."

Microsoft, the only one of the "Big Seven" stocks to underperform the S&P 500 last year, staged a strong rebound in 2025. Now, it's closing out the fiscal year with a strong earnings report, sending its stock price even higher. As of this writing, Microsoft's stock is up over 25% year-to-date.

Next, we'll delve into Microsoft's fourth-quarter financial performance and future outlook to explore whether this strong momentum can continue or whether it has reached a point where investors should consider taking profits.

A strong end to the year

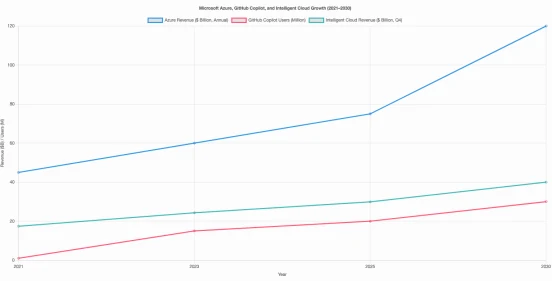

Microsoft delivered a strong fiscal year, particularly driven by the strong performance of its core growth engine, Azure. By the end of the fiscal year, Azure revenue had surged 39% year-over-year, far exceeding consensus expectations for a 34% to 35% increase and maintaining growth exceeding 30% for the eighth consecutive quarter. The company attributed this performance to the continued expansion of its core infrastructure business, primarily driven by rapid usage growth among large customers.

Despite strong demand, Microsoft acknowledges that production capacity remains limited and expects this constraint to persist through the first half of the new fiscal year. However, the company still forecasts 37% growth in Azure revenue for the next fiscal quarter, based on constant exchange rates. In addition to AI, Microsoft also sees quantum computing as its next growth engine and has partnered with Atom Computing to launch the world's first operational level 2 quantum computer.

The "Intelligent Cloud" segment saw overall revenue increase by 26% year-over-year to $29.9 billion, maintaining strong performance. GitHub also performed well, with its Copilot user base increasing by 75% year-over-year to over 20 million.

Other business segments also showed strong momentum:

Revenue from the Productivity and Business Processes segment increased 16% year-over-year to $33.1 billion. Microsoft 365 Consumer Edition revenue increased 21% due to price increases and user growth, while Business Edition saw a 16% increase. LinkedIn revenue grew 9%, and Dynamics products as a whole grew 18%, with Dynamics 365 leading the way with a 23% increase.

Revenue from the "More Personal Computing" segment (including Windows and Xbox) increased 9% year-over-year to $13.5 billion. Search and News Advertising saw the fastest growth, increasing 21% year-over-year, driven by search volume, revenue per search, and strong partner ecosystem. Windows OEM and Devices revenue grew 3%.

Overall, Microsoft's total revenue for this fiscal year increased by 18% year-on-year to US$76.4 billion; earnings per share were US$3.65, up 24%, far exceeding analysts' expectations of US$73.8 billion in revenue and US$3.37 in EPS.

The company expects first-quarter revenue to be between $74.7 billion and $75.8 billion, higher than the consensus estimate of $74.1 billion. It also plans to invest $30 billion in capital expenditures, with full-year CapEx projected to exceed fiscal 2025 levels, albeit at a slower pace. At the same time, the company will increase its focus on shorter-cycle assets like GPUs to achieve faster revenue conversion.

financial reports

Microsoft demonstrated rare, all-around strength in its fiscal fourth quarter, with nearly all of its growth engines firing on all cylinders, propelling the company to one of its strongest quarterly results in recent years. While Microsoft has always been known for its stability, this quarter's performance pushed its growth momentum to a new high.

Azure remains at the forefront of growth, and its market opportunities remain vast. However, Microsoft's growth is not limited to cloud computing. The rapid rise of its AI assistant business has become another source of growth for multiple product lines, demonstrating synergistic effects.

From a valuation perspective, Microsoft currently trades at approximately 35 times earnings, based on analysts' estimates for fiscal year 2026. While this valuation isn't cheap, given its accelerating revenue growth and significant stake in OpenAI, its PEG (price-to-earnings-growth ratio) is below 1.2, making it a reasonable price-to-earnings ratio. Generally speaking, a PEG below 1 is considered undervalued, especially for growth companies, which often trade at a premium.

Overall, Microsoft still offers long-term value, with exciting growth prospects. However, considering the current valuation is already quite high, I personally prefer to invest in it when the stock price experiences a correction.

uncertainty

The most intuitive reason why Microsoft has performed strongly in the era of artificial intelligence and maintained its historical highs is that in addition to its strong strength in cloud infrastructure, it has also made good progress in application software.

This is no easy task. Microsoft faces competition from multiple fronts in the cloud computing market: on the one hand, industry leader Amazon and third-place Alphabet are continuously increasing their cloud investments; on the other hand, smaller companies like Oracle and IBM are also expanding their cloud product offerings. In such a competitive market, Microsoft has not only maintained its position but also continued to expand its market share, which is truly remarkable.

Initially, investors were brimming with anticipation about the potential of combining enterprise software with artificial intelligence, believing that AI tools and intelligent agents would significantly improve productivity and save users time. However, as market sentiment cooled, many software stocks experienced a sharp correction. For example, Salesforce has fallen 21% this year since hitting a record high in December of last year; Adobe has fallen over 16% year-to-date, even down 46% from its peak.

In an era of accelerating development of agent-based artificial intelligence (Agentic AI), it remains uncertain which companies will truly benefit. Agent-based AI refers to intelligent tools that can automatically complete complex tasks without constant human prompting. For traditional SaaS companies that rely on selling subscriptions and user licenses, AI agents could pose a significant threat to their core business models. If a single intelligent agent can integrate the functionality of multiple SaaS services and replace human labor to complete tasks, software giants like Salesforce and Adobe, which previously enjoyed competitive advantages, could face the risk of eroding profitability.

While Microsoft also faces the challenge of AI agents, it has demonstrated greater resilience on multiple levels. The Microsoft 365 product portfolio is deeply integrated into users' daily lives, offering low barriers to entry and strong functional integration. AI tools like Copilot seamlessly integrate into Windows and the full suite of Office applications. Azure AI is also deeply integrated into the Azure cloud ecosystem. On GitHub, Microsoft has launched "agent-based DevOps," enabling efficient collaboration between developers and AI agents to accelerate software development.

Microsoft shareholders shouldn't be complacent just because the stock price has soared. While the current market capitalization is impressive, the real test will be whether users are willing to continue paying for its AI tools and whether Microsoft can maintain its high profit margins and steady growth.

Microsoft's stock price has recently outpaced its earnings growth. This suggests that investors are paying a premium based on future expectations, betting on higher growth. This has also caused its valuation to deviate from its historical average. Currently, Microsoft's forward price-to-earnings ratio is near its median high over the past decade, indicating that the market is willing to pay a "one-year-ahead" valuation premium for its stock, assuming the company's future performance matches this high valuation.

Furthermore, Microsoft's market capitalization/free cash flow ratio continues to climb. While Microsoft is fundamentally a cash-rich company, its R&D investments in artificial intelligence and other cutting-edge technologies have significantly increased capital expenditures and compressed free cash flow. If these investments ultimately significantly accelerate earnings growth, the current high-investment strategy will be worthwhile. However, this strategy currently faces uncertainty.

Overall, Microsoft's fundamentals remain solid, and its growth potential is promising, but its current valuation is indeed high. Investors considering increasing or building positions should exercise caution and monitor whether its AI business's monetization capabilities and profit expansion can live up to the market's high valuation expectations. Ultimately, Microsoft isn't resting on its laurels with its existing business model, but rather continuously evolving its products and services. It's this high adaptability and comprehensive ecosystem integration capabilities that have enabled Microsoft to demonstrate steady and strong growth momentum despite widespread pressure on many enterprise software companies.

fair value

In the stock market, short-term fluctuations are often unpredictable, so it's not inconceivable that Microsoft's stock price could be driven to $600 per share by market enthusiasm. However, to maintain this level and continue to climb, Microsoft must effectively convert its massive capital expenditures into profit growth.

Specifically, the company needs to continue expanding its leading position in cloud infrastructure, launching more practical AI tools, and maintaining its industry leadership in the development of agent-based AI. Otherwise, the market may begin to question whether its high-intensity capital investment is worthwhile, or even worry about whether it is a waste of resources.

It's worth noting that Microsoft isn't betting everything on AI at this point. It maintains strong financial discipline—not only continuing its stock buybacks and dividends, but also maintaining a healthy balance sheet structure where cash and short-term assets significantly outweigh long-term liabilities. In other words, while Microsoft is investing heavily in AI, it's also implementing a more aggressive capital allocation strategy than ever before, without compromising its financial soundness.

Microsoft remains a core growth company worthy of long-term trust. While its valuation is high, this doesn't mean you should rush out. Many investors choose to sell shares of high-quality companies when faced with high valuations, often missing out on opportunities to accumulate long-term value.

A wiser strategy is to let high-quality assets continue to shine and let the winners run. As long as the company can consistently deliver on its growth expectations, its valuation will ultimately be supported and justified by fundamentals. While Microsoft's stock price appears expensive, its clear strategic direction, strong execution, and continued growth momentum mean it may be worth its price in the future. For investors with a long-term perspective, now is still a good time to hold or even increase your holdings.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates