401(k) Alternative Investment Limits Removed: What Investors Need to Know About Opportunities and Risks

23:46 August 7, 2025 EDT

Key points:

U.S. President Donald Trump signed an executive order allowing alternative assets such as private equity, real estate, and cryptocurrencies to be included in 401(k) retirement savings plans.

Relevant agencies will clarify fiduciary responsibility rules in the coming months and remove regulatory barriers that currently hinder alternative assets from entering retirement accounts.

The implementation of the executive order will open new asset allocation opportunities for investors, enabling portfolio customization based on individual risk tolerance and financial goals.

On August 7, 2025, the 401(k) retirement savings plan reached a historic milestone. On that day, U.S. President Donald Trump signed an executive order directing the Department of Labor (DOL), the Securities and Exchange Commission (SEC), and other federal regulators to ease restrictions on including alternative assets in 401(k) and other employer-sponsored retirement plans. The scope covers investment categories that have rarely appeared in mainstream retirement plans, such as private equity, real estate, and cryptocurrencies.

This move could reshape the asset allocation landscape of U.S. retirement investing for the first time in nearly half a century. According to the order, relevant agencies will clarify fiduciary responsibility rules in the coming months and remove regulatory obstacles that currently prevent alternative assets from entering retirement accounts.

This means the nearly fifty-year-old “safe asset” boundary of 401(k) plans, which has primarily focused on publicly traded stocks and bond mutual funds, will gradually be lifted, opening the door to approximately $12.5 trillion in retirement account funds for industries like cryptocurrency.

Behind the Regulation

Since its establishment in 1978, the 401(k) plan has become the primary employer-sponsored pension account in the United States, with total assets of approximately $12.5 trillion and coverage of 60 million employees. For a long time, due to concerns over liquidity, transparency, and valuation risks, investment options have been almost exclusively concentrated in publicly traded stocks, bonds, and mutual funds.

This structure is closely tied to the fiduciary duties under the Employee Retirement Income Security Act of 1974 (ERISA). Employers and plan administrators are required to ensure that investment costs are reasonable, performance meets market benchmarks, and additional risks borne by participants are minimized. As a result, although alternative assets are not legally prohibited, they have been largely excluded from retirement accounts in practice.

However, the low-interest-rate environment has compressed returns on traditional assets such as bonds. The average yield on the 10-year U.S. Treasury note was approximately 3.5% in 2024. Meanwhile, certain high-volatility assets have delivered strong performance in recent cycles. For example, data from CoinDesk shows that Bitcoin outperformed the Nasdaq Index in five out of the past six years.

Source: TradingView

Private equity has also performed well. The Cambridge Associates U.S. Private Equity Index reports an annualized return of approximately 13% from 2014 to 2023, surpassing the S&P 500’s roughly 10% return.

Policymakers likely aim to enhance the long-term return potential of retirement funds by broadening the investment scope, while simultaneously supporting emerging sectors such as private markets and digital assets to maintain the United States’ competitiveness in global capital markets.

Market Reaction

Given the massive scale of 401(k) plans, even a 1% allocation shift toward alternative investments would generate over $125 billion in potential new capital inflows. For liquidity-constrained markets such as cryptocurrency and private equity, this influx could have a significant impact: driving short-term valuation increases and improving fundraising conditions and market depth over the medium to long term.

On the day the policy was announced, asset prices reacted quickly, especially within the cryptocurrency sector.

Bitcoin (BTC) closed at $114,284, despite a daily decline of 0.64%. However, its 24-hour trading volume rose by 1.38% to $57.92 billion, with a market capitalization of $2.26 trillion.

Bitcoin reached an all-time high of $123,218 on July 14, 2025, marking an approximate 25% gain year-to-date—substantially outperforming the S&P 500’s return of less than 8% over the same period. Other major cryptocurrencies such as Solana (SOL) and XRP also performed well, with prices near $256 and $2.78, respectively, benefiting from growth in decentralized applications and cross-border payments.

Source: TradingView

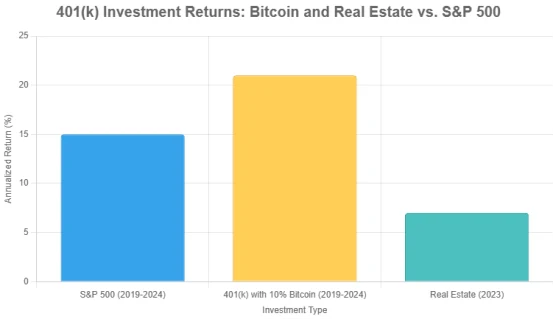

Furthermore, cryptocurrencies demonstrate strong long-term return potential. Between 2019 and 2024, Bitcoin delivered an annualized return of 60%, and Ethereum returned 49%. Had 401(k) investors allocated 10% of their portfolios to Bitcoin in 2019, their overall portfolio returns could have increased by approximately 5% to 7%, significantly exceeding traditional asset performance.

Optimistic institutional forecasts support this outlook: VanEck projects Bitcoin could reach $180,000 in 2025, while CoinPedia estimates a maximum of $168,000. These projections are grounded in Bitcoin’s fixed supply of 21 million coins, growing institutional adoption, and a cumulative inflow of $55 billion into Bitcoin ETFs in 2024.

Investor Opportunities

The implementation of the executive order will open new asset allocation opportunities for investors.

For decades, 401(k) plans have been largely limited to public stocks and bonds, which, while safeguarding capital, have constrained potential returns and portfolio diversification. Now, with alternative assets such as cryptocurrencies, private equity, and real estate investment trusts (REITs) officially incorporated as compliant options, investors’ allocation strategies are set to undergo significant changes.

As of 2024, approximately 60 million Americans participate in 401(k) plans, with an average account balance of about $127,000. The relaxation of alternative investment restrictions allows investors to allocate funds to cryptocurrencies, private equity, REITs, gold, and other assets, breaking the nearly half-century limitation on “safe assets.” This shift provides investors with the opportunity to customize portfolios based on their risk tolerance and financial goals.

For example, younger investors can improve long-term returns by allocating a small portion—such as 10%—to high-growth assets like Bitcoin or private equity, while those nearing retirement may prioritize stable income through real estate investments.

Alternative assets tend to have low correlation with traditional assets (Bitcoin’s correlation with the S&P 500 is approximately 0.2), effectively enhancing risk diversification. Between 2020 and 2024, 401(k) portfolios with a 10% allocation to alternative assets saw a roughly 5% reduction in volatility alongside improved potential returns. This offers investors the chance to build more resilient portfolios, particularly amid heightened economic uncertainty.

In a low-interest-rate environment, alternative assets have demonstrated significant return potential. Bitcoin delivered an annualized return of 60% from 2019 to 2024, while private equity returned 13%, both outperforming traditional asset classes. Proper allocation could substantially accelerate retirement savings growth; a 10% allocation to Bitcoin in 401(k) portfolios during 2019–2024 could have boosted overall returns by 5% to 7%. Real estate investments also offer alternatives for income-seeking investors, with an average 2023 return of about 7%.

Moreover, the inclusion of alternative assets is expected to attract more professionally managed products into the 401(k) market. In June 2025, BlackRock announced plans to launch 401(k) target-date funds with private investments in 2026. In July, Blue Owl Capital partnered with Voya Financial to develop private market investment products. These offerings may leverage economies of scale to reduce fees and provide more competitive returns for retail investors.

The sheer scale of the 401(k) market creates a substantial capital gateway for cryptocurrency and private equity industries. A 5% allocation of 401(k) assets to cryptocurrencies alone could channel $625 billion in new capital inflows, potentially driving up prices for Bitcoin and similar assets while enhancing market liquidity. The private equity sector will also benefit; global private equity assets under management reached $4.5 trillion in 2024.

This policy could accelerate growth in emerging sectors, offering investors opportunities to participate in high-growth markets.

Risks Not to Be Ignored

However, alternative assets exhibit significantly higher volatility compared to traditional assets. Bitcoin, for example, plunged more than 65% in 2022, demonstrating extreme price fluctuations. Private equity investments typically lock up capital for 7 to 10 years and have far lower liquidity than stocks, which can have daily trading volumes in the billions, or bonds.

Source: TradingView

Research indicates that alternative assets can increase overall portfolio volatility by up to 20%, posing challenges for investors with lower risk tolerance.

Liquidity risk is also a major concern. Private equity and certain cryptocurrency assets have lengthy exit horizons, making it difficult for investors to liquidate holdings quickly when cash is needed. For instance, in 2024, some private equity funds extended redemption periods to over 12 months, increasing uncertainty around capital availability.

Additionally, alternative assets usually involve higher fees, which can erode returns. Private equity funds commonly charge a 2% management fee plus a 20% performance fee, significantly exceeding the average 0.5% fee ratio for equity mutual funds. Cryptocurrency transactions may incur platform fees ranging from 1% to 2%. Smaller accounts are especially impacted by these higher costs, which may offset potential return advantages. Furthermore, alternative assets suffer from valuation opacity—for example, net asset value reports for private equity funds are often delayed by several months, complicating investment decisions.

It is important to note that under ERISA, plan sponsors act as fiduciaries required to prudently select investment products with reasonable fees and strong performance. Edward Gottfried, Vice President at Betterment at Work, highlights that alternative assets’ valuation opacity and high costs make it difficult to meet fiduciary standards. Investors must rely on sponsors’ due diligence and management of investment managers. Failure to fulfill fiduciary duties may lead to losses; while participants can file lawsuits under ERISA, legal costs and time commitments increase overall risk.

Moreover, a 2024 report from the Financial Industry Regulatory Authority (FINRA) shows that 70% of retail investors lack the capability to properly assess cryptocurrency investments. The complexity of alternative assets demands higher financial literacy. Regulatory uncertainty adds further risk. The executive order requires the Department of Labor and SEC to complete regulatory reviews by 2026, which may alter fiduciary standards or disclosure requirements. Overly lenient regulation could weaken investor protections, while excessively strict rules might limit the availability of alternative assets.

Investor Response Strategies

In an environment where risks and opportunities coexist, investors need clear strategies to optimize their retirement savings.

First, assess your risk tolerance and investment horizon. Younger investors might allocate 5% to 10% of their assets to alternative investments to balance long-term returns with volatility, while those nearing retirement should limit exposure and prioritize lower-volatility assets like REITs.

Second, conduct thorough due diligence. Understand the market trends and risk characteristics of target assets—for example, Bitcoin’s fixed supply mechanism or concentration risks in private equity. Review plan disclosure documents, evaluate fees and expected returns, and consult professional advisors when necessary.

Third, establish a reasonable asset allocation. Incorporate low-correlation assets to diversify the portfolio—for instance, 60% stocks, 30% bonds, and 10% alternatives. Avoid excessive concentration, especially keeping cryptocurrency allocations below 5%.

Fourth, monitor plan sponsors’ management practices. Demand transparency on investment processes, fee details, and manager qualifications. Document any concerns and seek legal support if needed to protect your rights under ERISA.

Finally, stay informed on regulatory and market developments. Follow updates from the Department of Labor and SEC scheduled through 2026, regularly assess their impact on your portfolio, and ensure your allocations remain aligned with the evolving environment.

The executive order relaxing 401(k) investment restrictions marks a fundamental shift in U.S. retirement savings asset allocation. It creates structural opportunities in areas like cryptocurrency and private equity. However, realizing sustained, stable returns depends on sound regulatory frameworks and fiduciary management.

In this new phase, investor prudence and professional judgment are more critical than ever.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates