Salesforce: AI, SaaS, and long-term value

10:18 August 9, 2025 EDT

The SaaS model is usually understood as a "software subscription system", but in Salesforce's business practices, its revenue structure and customer binding strategy are more diverse and systematic.

The company's core business is based on "modular stacking" and "customer data locking", and mainly includes the following steps:

Step 1: Customer Relationship Management System (CRM) as the basic entry point

Salesforce targets enterprise clients with its core CRM system. By providing customer information records, sales process management, and order tracking, it captures key sales data. Once a business completes data entry into its system, the costs of subsequent migration and switching service providers increase.

Step 2: Horizontal expansion of functional modules

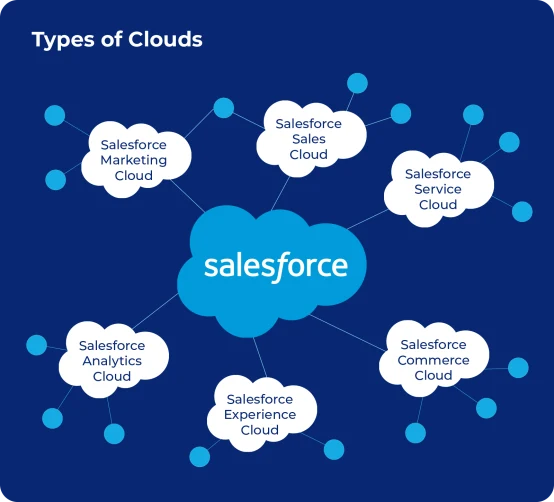

Building upon its CRM foundation, Salesforce has continuously expanded its product functionality to include multiple business modules, including Marketing Cloud, Commerce Cloud, and Service Cloud. Furthermore, it offers internal collaboration tools, data visualization tools, and AI-powered analytics. These modules are built around a common customer data platform and integrated with each other, enhancing the overall cohesion of the system.

This structure helps encourage users to make additional purchases on top of their existing services (i.e., the land & expand model), forming a business model of long-term subscription, product bundling, and service deepening.

Salesforce's business model uses an "annual subscription + feature-based billing" pricing model, with flexible pricing based on different modules, user numbers, and data capacity, supporting the combined use of multiple services. As customers' investment in the system increases year by year, the marginal cost of user replacement rises, and system dependence intensifies.

Salesforce is also upgrading its product portfolio to an "AI-driven enterprise operating platform." Its Agent Force platform, which supports automated sales email generation, ticket responses, and customer service scripts, signals its move toward a "system-driven business process."

In terms of AI deployment, Salesforce has launched over 8,000 instances of Agent Force to date and achieved over $1 billion in annual recurring revenue (ARR) for its Data Cloud-related AI products, with an annual growth rate exceeding 120%. This demonstrates that its AI products have entered the stage of large-scale application, placing it at the forefront of enterprise software.

Next, we can further evaluate its product stickiness and business sustainability through data such as subscription user renewal rates and customer retention.

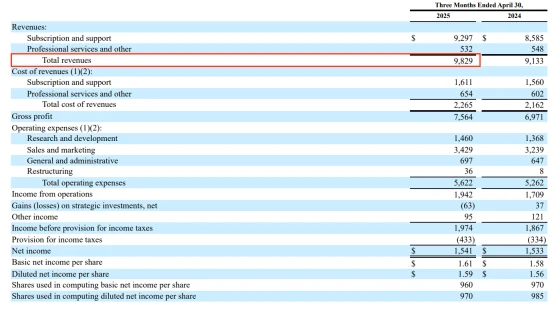

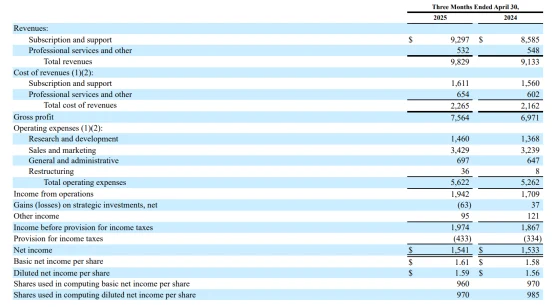

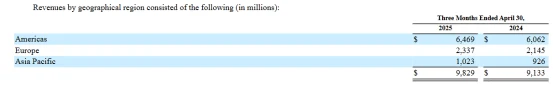

Financial performance: With revenue of nearly 10 billion , can profits be maintained?

According to Salesforce's first-quarter fiscal year 2025 financial report, the company's total revenue for the quarter was $9.8 billion, an approximately 8% year-over-year increase. This growth rate has slowed compared to its earlier rapid growth phase, but remains relatively stable given the current slowdown in the overall SaaS industry.

In a market environment where customer budgets are becoming more cautious, the steady growth in revenue this quarter indicates that its products and services have a certain degree of sustained market demand and customer stickiness.

According to Salesforce's first-quarter financial report for fiscal year 2025, the company's operating profit for the quarter was $1.9 billion, with an operating profit margin of 20%. With continued investment in AI research and development, the company has maintained a relatively stable profit level.

Salesforce has taken measures such as layoffs, cutting non-core product lines, and integrating teams over the past two years. Its AI capabilities are also deployed by integrating them into existing customer processes, improving efficiency without having to replace systems.

In terms of cash flow, free cash flow was $6.2 billion in the first quarter of fiscal year 2025, and has exceeded $12 billion in the past four quarters. R&D investment in the same period was $1.46 billion, accounting for 14.85% of total revenue.

Salesforce's AI deployment strategy focuses on embedding AI into existing enterprise customer processes, improving efficiency and customer retention by integrating AI capabilities into existing systems. Currently, its AI-related products are being applied across multiple business processes and generating sustained revenue growth.

In terms of industry competition, a large number of SaaS companies are still actively developing AI. The following analysis will focus on Salesforce's market position in the entire SaaS industry and its main competitors.

Industry landscape: Can it continue to lead in the face of Microsoft and others ?

As an early entrant in the enterprise SaaS and customer relationship management (CRM) markets, Salesforce has long maintained a high market share and industry influence. Its products and services cover a wide range and its customer base is solid. However, as competition in the industry intensifies, other companies are continuously launching functional or vertical CRM products, posing a potential challenge to Salesforce's market position.

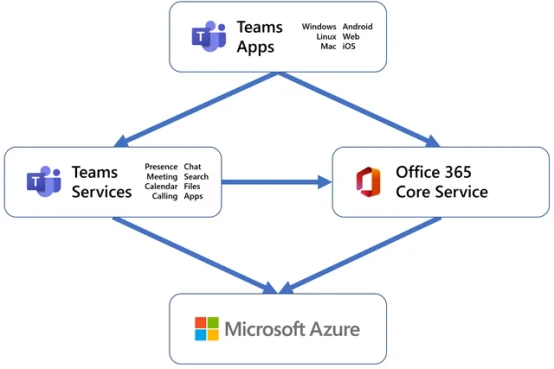

Microsoft's Dynamics 365 is one of Salesforce's main competitors in the customer relationship management (CRM) market. This product leverages Microsoft's existing ecosystem, including Office, Teams, and Azure, ensuring high user engagement. Microsoft has also integrated OpenAI technology into Dynamics 365 to enhance sales forecasting and marketing automation capabilities, contrasting functionally with Salesforce's Einstein AI. Although Microsoft's CRM business started relatively late and its product structure is relatively complex,

its ecosystem and technological expertise provide support for future growth.

SAP primarily focuses on enterprise resource planning (ERP) and has been transitioning to the cloud in recent years. In its CRM business, SAP products primarily target traditional industries like manufacturing. While its AI platform continues to improve, its penetration and growth rate in the CRM market are still catching up to other leading vendors.

Oracle, relying on its own database technology and cloud infrastructure, continues to advance its AI cloud strategy. While it has a strong customer base in the enterprise market, the growth of its cloud business has slowed, and the effectiveness of its AI transformation remains under observation.

Salesforce boasts a comprehensive CRM product portfolio, encompassing sales, marketing, customer service, and data analytics, with a high level of system integration. In recent years, Salesforce has deeply integrated Einstein AI with multiple core products, focusing on embedding generative AI technology into customer use cases to boost product stickiness and retention rates.

The competitive landscape in the enterprise SaaS market is constantly evolving. Microsoft, leveraging its Azure cloud services and its technical collaboration with OpenAI, continues to expand its capabilities in intelligent enterprise services. SAP is increasing its investment in vertical industry solutions. Oracle, leveraging its cloud infrastructure and database technologies, continues to promote the integration of AI and enterprise services.

Against this backdrop, Salesforce currently maintains a leading position in the SaaS market, but faces the dual pressures of technological innovation and industry competition. Its future development will depend on further improvements in product innovation and customer retention.

Growth space: Can AI and overseas markets support the next wave ?

From the perspective of future growth, Salesforce's main growth points include:

1. AI-driven business expansion : The company has integrated generative artificial intelligence (AI) capabilities into several of its core products. As AI technology continues to evolve and its penetration into enterprise applications such as intelligent automation and personalized services increases, this area is expected to continue to drive revenue growth.

2. International Market Expansion : Salesforce currently generates over 60% of its revenue primarily from North America. The company is increasing its investment in Asia Pacific, Europe, and other emerging markets, driving business expansion through localized product development and strategic partnerships. Digital transformation is accelerating in these regions, and market share is expected to expand.

Salesforce's future growth momentum is also reflected in the following aspects:

Product Matrix and Platform Ecosystem Expansion : The company continues to drive product integration, covering every aspect from customer communication and collaboration to data management and business operations, to build an integrated enterprise service platform. At the same time, its partner and developer ecosystem continues to expand, supporting platform feature innovation and customer retention.

Continued enterprise digitalization demand : Despite the gradual decline in demand for remote work following the pandemic, global enterprises continue to invest in digital transformation and intelligent upgrades. Enterprises' needs to improve operational efficiency and optimize customer management continue to drive the procurement and deployment of SaaS services.

Moat: Moat : Are systems, data and ecosystems really irreplaceable?

Salesforce has built a strong technological barrier through deep product line integration and a modular architecture. In addition to its core customer relationship management (CRM) module, the company also offers multiple functional modules, including Marketing Cloud, Service Cloud, Data Cloud, and an AI assistant. These modules are highly integrated, helping customers achieve a closed-loop process across sales, service, and data analytics. This architecture enhances customer loyalty by reducing the potential costs and business disruption faced by customers migrating to other providers.

Salesforce has a certain advantage in customer retention. Large enterprises' sales processes, customer data, and business rules are deeply embedded in their systems, making data migration complex and time-consuming. Furthermore, employees must adapt to the new platform's user habits. Furthermore, the secondary development and customization capabilities accumulated over years of use by enterprises raise the barrier to system migration.

In terms of the ecosystem, Salesforce has an extensive network of partners and developers. Third-party plug-ins and applications further expand the platform's functionality, enhance customers' business capabilities on the platform, and also improve the platform's user stickiness and industry barriers.

Salesforce has long maintained a high proportion of R&D investment in technology. The company's annual R&D expenditure accounts for approximately 15% of revenue, with a focus on areas such as AI and cloud computing, promoting the commercialization of these technologies in its products.

In addition, as one of the early participants in the enterprise SaaS market, Salesforce has a certain brand influence and market recognition, and has accumulated a broad customer base in the industry.

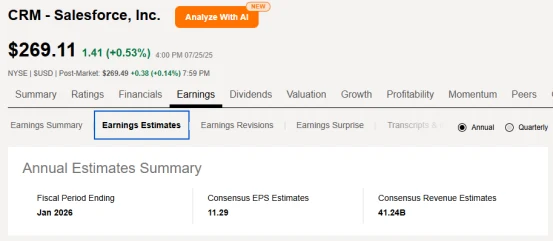

Investment judgment : Is it worth buying now with a forward PE ratio of 24?

Based on the company's fiscal year 2026 earnings forecast, Salesforce's forward price-to-earnings ratio is approximately 24 times, lower than its average price-to-earnings ratio of approximately 40 times over the past five years and also lower than that of peers such as Microsoft and Oracle. This valuation reflects the market's relatively conservative expectations for its future growth and indicates that its valuation is at the lower end of its historical range.

Salesforce currently has ample free cash flow and a strong financial structure, with net cash reserves to support its ongoing share repurchase and dividend programs. The company recently initiated a dividend, which currently yields approximately 0.6%. This low payout ratio allows the majority of its cash to be used for business investment and expansion.

This indicates that Salesforce's capital allocation strategy is gradually transitioning from a growth-focused approach to a dual structure that prioritizes both growth and shareholder returns. This strategic shift has attracted the attention of some long-term fund managers in the capital market.

At the same time, Salesforce still faces external risks, including intensified industry competition and macroeconomic fluctuations. Against this backdrop, market participants are evaluating the company's investment value based on its stable cash flow, balance sheet, and valuation.

Salesforce is not a highly popular conceptual enterprise. In the context of the market focusing on traffic and topics, its development path is more inclined to embed AI technology into the company's actual business processes, and form an integrated closed-loop system by connecting data, operating procedures and service links, thereby improving customer stickiness and profitability.

While the path to commercializing AI remains uncertain, the company has already integrated AI capabilities into its product portfolio, driving increases in subscription fees, service revenue, and renewal rates. These businesses have achieved significant scale and sustainability, demonstrating strong profitability.

At the same time, the company's valuation and pricing model has gradually transitioned from its early focus on rapid growth to a more stable structure centered on shareholder returns. Its ongoing share repurchase and dividend mechanisms, along with stable free cash flow, provide crucial support for its current financial structure. AI and data products remain key areas of future business development.

Overall, Salesforce maintains steady growth in the enterprise SaaS market, and is sustainable in terms of customer base, product layout, and business model. Relevant data is still changing, and market participants are evaluating its future potential and market positioning based on its financial and business performance.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates