Berkshire’s Slide: Is the Buffett Mystique Running Out?

06:00 August 7, 2025 EDT

Berkshire Hathaway (BRK.A/BRK.B) has long been regarded as the ultimate model of value investing, with Warren Buffett’s personal reputation almost factored into the company’s valuation. However, as his retirement approaches, this star investment firm appears to be gradually losing its former “moat.”

Since Buffett announced on May 3, 2025, that he would step down as CEO by year-end, to be succeeded by Greg Abel, Berkshire’s stock has declined more than 12%. The stock came under further pressure following the company’s second-quarter earnings release.

Source: TradingView

Although the company’s fundamentals remain solid, changes in valuation and market sentiment may signal that the firm once led by the “Oracle of Omaha” is undergoing a transition from a “faith premium” to an “operational-driven” phase.

Stock Price Volatility

Since Warren Buffett announced his intention to retire at the May 3, 2025, shareholder meeting, Berkshire Hathaway Class A shares (BRK.A) have declined over 10%, with a 14% drop from May to August 6. During the same period, the S&P 500 index rose 11%. This divergence highlights one of Berkshire’s weakest relative performances against the broader market since 1990.

Source: TradingView

However, the pullback in Berkshire’s stock price may not be solely a direct emotional reaction to Buffett’s retirement announcement. In fact, Buffett’s May 2025 statement did not specify an immediate departure but laid out a transition plan. The market’s heightened sensitivity primarily reflects growing uncertainty around future strategic execution.

At the same time, the stock’s decline is linked to a broader market rotation. Since Q2 2025, U.S. equities have trended upward, driven by technology and growth sectors. During this period, both the S&P 500 and Nasdaq indices have recorded significant gains, while value, low-volatility, and defensive assets have lagged. As a classic value investment portfolio, Berkshire’s stock price has been notably affected by this shift in market preference.

A More Cautious Approach to Asset Allocation

The market generally perceives Buffett’s aura as an additional valuation premium investors have been willing to pay for his long-standing excellence in capital allocation. However, this mechanism is now facing challenges. Uncertainty surrounding the management capabilities of his successor, as well as Berkshire’s relatively low activity in new investments and growth initiatives in recent years, have become influencing factors.

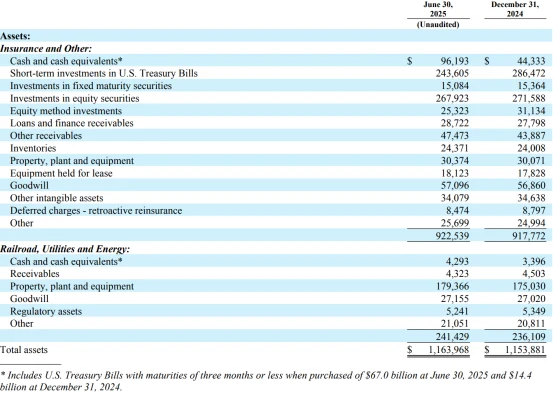

Berkshire’s Q1 2025 earnings report showed operating income of $9.64 billion, a 14% year-over-year decline; net income was $4.6 billion, down 64%, primarily due to insurance losses related to California wildfires. In Q2, operating income fell 4% year-over-year to $11.2 billion, alongside a $3.8 billion impairment on the Kraft Heinz investment. This directly contributed to a more than 3% intraday stock decline on August 5.

Source: Berkshire Hathaway

Notably, as of the end of Q2, Berkshire held $344.1 billion in cash and equivalents, slightly below $347 billion at the end of Q1, but still near historical highs. The company has been a net seller of stock for 11 consecutive quarters, with net sales totaling $4.5 billion in the first half of 2025, and no share repurchases during the quarter. This capital allocation strategy reflects management’s cautious stance on current asset valuations and the macroeconomic environment, with a lack of sufficiently attractive new investment opportunities.

Additionally, the earnings report specifically highlighted potential risks from the new round of “reciprocal tariffs” announced by the Trump administration, particularly affecting consumer goods and cross-border businesses. Berkshire acknowledged that nearly all its operating units could face negative impacts, and the heightened policy risk is likely to further constrain the company’s future earnings flexibility.

Why the Halo Is Fading

For decades, Buffett built Berkshire’s core asset portfolio based on a fundamentally driven value investing philosophy. However, in today’s environment—characterized by greater transparency in financial information, more diverse valuation methodologies, and increased activity from private equity—Berkshire’s structural advantages in traditional mergers and acquisitions and equity investments have been compressed. Particularly amid intensifying competition for assets, Buffett’s longstanding refusal to engage in bidding wars has limited the company’s ability to acquire high-quality targets.

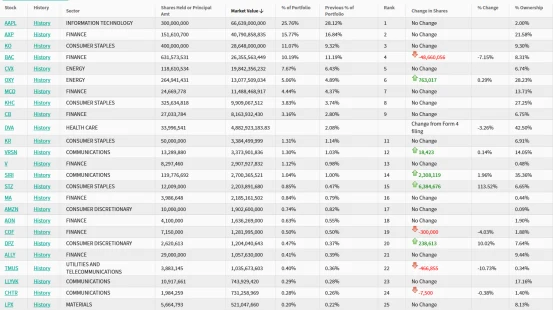

Over the past three years, Berkshire’s new investments have primarily focused on mature assets like Apple, which are already fully valued by the market, lacking fresh growth drivers or innovative investment directions. While the company continues to maintain strong cash flow and a solid balance sheet, its cash reserves exceeding $330 billion have not been actively deployed through capital market cycles, raising concerns about capital efficiency and the intent behind capital allocation.

Source:WhaleWisdom

Moreover, although it has been confirmed that Greg Abel will succeed Buffett as CEO by the end of 2025, the division of responsibilities within the executive team and the retention of key business unit leaders remain unclear. The absence of a well-communicated succession plan has yet to instill market confidence in the management’s capability and strategic direction in the post-Buffett era.

Notably, compared to Buffett, Abel places greater emphasis on operational efficiency and capital structure management, which could signal a shift from a passive capital allocation approach toward more active portfolio optimization going forward.

Strengths and Limitations Coexist

Although market sentiment has been shaken in the short term, the decline of Buffett’s halo is not a linear process. Current data indicate that the company still possesses core elements of long-term appeal.

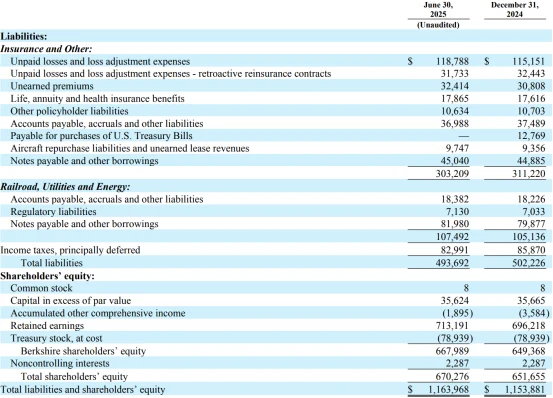

From a business perspective, Berkshire’s three major segments—insurance (including GEICO and reinsurance), BNSF Railway, and Berkshire Hathaway Energy (BHE)—continue to generate stable cash flows and maintain industry-leading positions. The second-quarter earnings report showed significant year-over-year growth in insurance profits, effectively offsetting the cyclical downturn in the utilities segment. Collectively, these three units contribute over 70% of the company’s operating earnings, providing strong fundamental support.

Source: Berkshire Hathaway

In terms of valuation, the company’s current price-to-book ratio stands at approximately 1.5 times, below the spring peak of 1.8 times and within its historical average range, indicating a degree of price correction. Moreover, when adjusting earnings to reflect the profits of its equity holdings (“look-through earnings”), Berkshire’s trailing twelve-month price-to-earnings ratio is around 16 times, notably lower than the valuation levels of broader growth stocks, suggesting attractive long-term investment value.

Berkshire currently holds over $330 billion in cash and cash equivalents, roughly one-third of its total market capitalization, offering substantial downside protection and flexibility for future strategic adjustments. Although the company has not conducted stock repurchases for over a year, management may consider resuming buybacks to support shareholder returns if valuations decline further.

Final Thoughts

Berkshire’s current stock price adjustment primarily reflects investors’ early reaction to the anticipated end of the “Buffett era,” rather than a deterioration in the company’s fundamental performance. While the Buffett halo is indeed under pressure and gradually diminishing, it has not disappeared entirely. The future preservation and rebuilding of this premium will depend largely on the new management team’s ability to execute strategic initiatives and efficiently deploy capital.

Going forward, Berkshire’s valuation will likely be driven less by the founder’s reputation or historical track record, and more by its ability to effectively utilize cash, optimize business structure, and deliver strong management performance. This shift implies that investors will need to adopt a more rigorous approach to financial and strategic analysis in order to assess whether Berkshire still possesses the potential for generating excess returns amid valuation convergence.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates