These Facts Confirm AMD Is Still Not the Next Nvidia

03:16 August 7, 2025 EDT

Key Points:

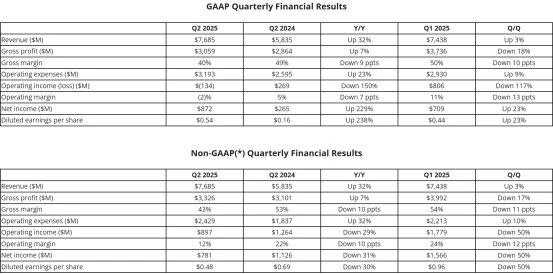

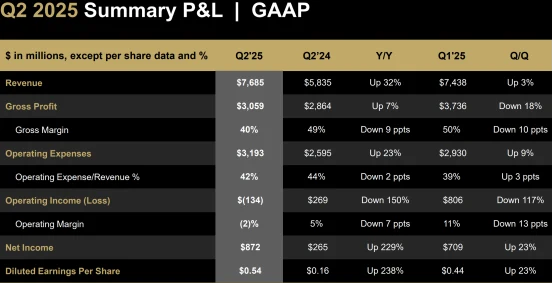

In Q2 2025, AMD reported total revenue of $7.685 billion, representing a 32% year-over-year increase, exceeding Wall Street expectations.

The primary source of AMD’s growth this quarter did not come from AI-related GPUs or data center products, but rather from its gaming segment.

Until the MI400 achieves commercial rollout and initial product validation, AMD is unlikely to compete with NVIDIA on equal footing in the AI server market.

Fueled by a surge of capital into artificial intelligence infrastructure, Advanced Micro Devices (AMD) has become one of the most closely watched AI-related stocks over the past year. As its AI GPU lineup gradually comes to market, investors have at times viewed AMD as a viable challenger to NVIDIA’s dominance in AI chips.

However, following the company’s Q2 FY2025 earnings release on August 5, despite posting $7.685 billion in revenue—a 32% year-over-year increase—and offering upbeat guidance, AMD’s stock dropped 6.5% in a single day. The market’s reaction reflects a classic “buy the rumor, sell the news” pattern already priced into the stock.

Source: AMD

At present, the market is reassessing the pace and scale at which AMD’s AI business can deliver. Based on the current landscape, AMD’s competitive strength remains largely in the “potential” phase, and in the short term, it may still lack the necessary elements to challenge NVIDIA’s leadership in the AI chip market.

Data Center Business Growth Slows

In the latest quarterly earnings report, AMD posted a 32% year-over-year increase in total revenue, surpassing Wall Street’s expectation of $7.41 billion. Adjusted earnings per share came in at $0.48, in line with consensus estimates.

Source: AMD

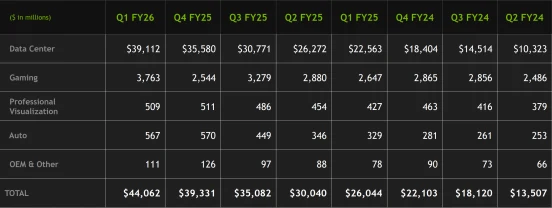

However, a breakdown of the business structure reveals that the primary driver of growth this quarter did not stem from AI-related GPUs or data center products, but rather from the gaming segment. Data shows that AMD’s data center business—including GPUs and CPUs—generated $3.2 billion in revenue this quarter, up 14% year-over-year, a sharp slowdown compared to 57% growth in Q1 and 122% in Q3 FY2024. In contrast, the gaming segment saw a 73% year-over-year increase, becoming the company’s key growth engine.

Source: AMD

For AMD, the data center segment was expected to be a major growth engine driven by investor enthusiasm around AI. However, with only 14% year-over-year growth this quarter—far below the elevated growth rates of prior quarters—it’s clear that AMD has yet to fully translate AI demand into performance during the current cycle.

Notably, AMD’s data center GPU sales have been primarily driven by the Instinct MI300X, which generated over $5 billion in revenue in 2024. The company expects double-digit growth in its data center business in 2025. However, U.S. export restrictions to China led to an estimated $800 million reduction in MI308 sales, which impacted overall growth.

By contrast, NVIDIA reported total revenue of $35.08 billion in Q3 FY2025, with its data center segment more than doubling year-over-year. This was largely fueled by the Blackwell architecture GPUs such as the B200 and GB200 NVL72. NVIDIA expects its data center revenue to reach $177 billion in fiscal 2025, underscoring its dominant market position.

Source: NVIDIA

Core Product Aimed at Challenging NVIDIA Falls Short of Expectations

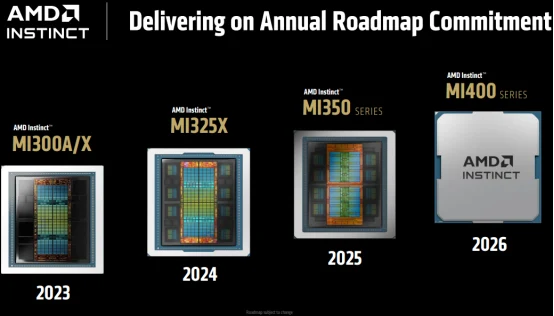

At the “Advancing AI” event in June 2025, AMD unveiled the Instinct MI350 series, designed to compete with NVIDIA’s Blackwell GPUs. However, initial market response has been relatively cautious.

While the MI350 series boasts impressive performance—featuring TSMC’s 3nm process and the CDNA 4 architecture with 185 billion transistors—it delivers up to 20 PFlops of peak compute in FP4/FP6 precision and exceeds NVIDIA’s B200 in inference throughput when running the DeepSeek R1 model. Nevertheless, compared to NVIDIA’s GB200 NVL72, AMD faces network communication disadvantages. For example, the MI355X requires 8 chips for full-speed communication, while the GB200 NVL72 supports full-speed communication across 72 chips. As a result, AMD’s system may be up to 18 times slower under complex workloads.

Source: AMD

Meanwhile, on the earnings call, management did not provide concrete guidance on MI350 order volume, customer adoption progress, or revenue contribution this quarter. Instead, they emphasized that “production capacity will scale quickly” and that “customer interest in MI400 is strong.”

Additionally, the MI400 is positioned as AMD’s first rack-scale AI server platform and is expected to launch in the first half of fiscal 2026. However, the product remains in the development and testing phase. In contrast, NVIDIA’s GB200 NVL72 has already been deployed in several AI supercomputing projects. For instance, Amazon AWS’s Project Ceiba supercomputer is powered by 20,736 NVIDIA GB200 Grace Blackwell chips, while AMD has yet to achieve similar validation for a rack-scale AI platform.

Source: AMD

These delays, combined with NVIDIA’s ecosystem advantages and entrenched customer relationships, contributed to a slight decline in AMD’s data center GPU market share in Q1 2025. Meanwhile, NVIDIA’s accelerated Blackwell GPU production further widened the competitive gap.

From another perspective, the AI infrastructure market is evolving toward high integration and end-to-end optimized systems. This means that standalone hardware capabilities no longer guarantee competitive advantage; instead, system-level integration, software ecosystem support, network bandwidth, and latency optimization are becoming the key differentiators.

NVIDIA has established a comprehensive system solution loop with NVLink, NVSwitch, BlueField DPUs, and the CUDA ecosystem, cementing its leadership in large-scale AI deployments. AMD, by contrast, has yet to demonstrate comparable market validation, and its overall system capability remains in catch-up mode.

Moreover, the Ultra Accelerator Link (UALink) consortium was formed to promote standardized interconnects for heterogeneous AI accelerators. Although AMD is one of its members, the consortium remains in its early stages and is unlikely to challenge NVLink’s position in current AI supercomputing deployments in the short term.

Expectation Overshoot and Misalignment

As of August 6, 2025, AMD’s year-to-date stock price has risen over 35%, with a 14% gain in the past three months, significantly outperforming the Nasdaq Composite Index over the same period. This increase has been partly driven by a systemic valuation uplift across AI-related assets and market expectations surrounding AMD’s next-generation GPU products.

Source: TradingView

However, following the earnings release, AMD’s stock price fell 6.5% in a single day, indicating that the high growth expectations are proving difficult to sustain in the short term based on fundamentals. This price movement reflects investors’ shift from valuation premised on speculative potential toward a focus on earnings delivery grounded in actual performance.

In comparison, NVIDIA, despite a steep drop earlier in the year, has still achieved a 33% gain and became the first tech giant globally to surpass a $4 trillion market capitalization. Although its price increase is less than AMD’s, NVIDIA’s GB200 platform has begun large-scale shipments, and its data center business maintains growth rates above 60%, showing a stronger alignment between fundamentals and valuation.

Source: TradingView

Regarding valuation, AMD’s current trailing twelve months (TTM) price-to-earnings ratio stands around 94x, significantly higher than its 32% revenue growth rate, suggesting that the market is assigning a substantial premium for future product cycles. By contrast, NVIDIA’s TTM P/E ratio is approximately 57x, with a 69% revenue growth rate, reflecting a more justified earnings realization.

This implies that until the MI400 product enters commercial production and initial validation results emerge, AMD is unlikely to compete on equal footing with NVIDIA in the AI server market. Investors at this stage are betting more on the future market success of AMD’s upcoming products rather than current financial performance.

In an environment of intensifying AI chip competition and capital markets emphasizing delivery and execution, AMD’s greatest challenge may not lie in product performance or technical potential, but in shortening the time from product launch to commercialization and closing the gap in system integration capabilities.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates