Is It a Good Time to Buy Novo Nordisk on the Dip?

02:00 August 6, 2025 EDT

Key Points:

The company's Q2 2025 sales were DKK 76.86 billion, up 13% YoY, but below expectations.

The company lowered its 2025 outlook, forecasting sales growth of 8%-14% and operating profit growth of 10%-16%.

As Novo Nordisk faces increasing competition and slower growth, several prominent Wall Street investment firms have downgraded the stock’s rating and significantly cut their price target.

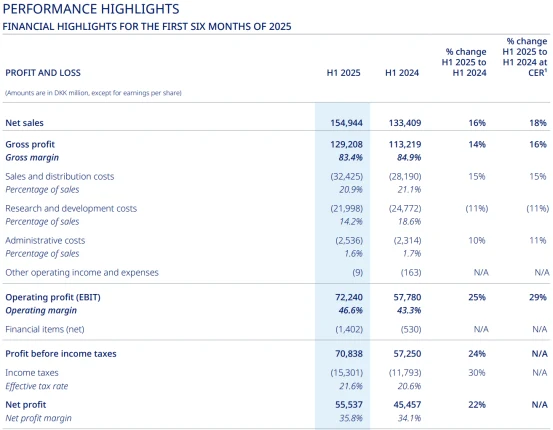

Novo Nordisk (Novo Nordisk) recently released its Q2 2025 earnings report, showing mixed performance. While total sales grew 13% YoY, they missed market expectations. Specifically, net sales were DKK 76.86 billion, below the expected DKK 76.99 billion. Both gross margin and operating margin showed growth, reaching 83.3% and 43.5%, respectively, but still fell short of analysts' expectations.

This performance failed to meet expectations, especially in the company’s key business segments—diabetes and obesity care, where sales growth slowed.

Since June 2024, Novo Nordisk’s stock price has been on a downward trend. As of now, the stock has plunged 67%, from a historic high of $145.16 to $47.22. So, for investors, does the current dip in Novo Nordisk’s stock represent a buying opportunity?

Source: TradingView

Growth Slows Down

Novo Nordisk’s Q2 2025 earnings report shows that, despite a 13% YoY sales increase, it fell short of the market expectation of 13.5%. Specifically, net sales were DKK 76.86 billion, missing the analyst estimate of DKK 76.99 billion. Although the gross margin remained at 83.3%, the company did not meet the expected gross profit of DKK 64.01 billion, with the actual figure slightly lower.

Source: Novo Nordisk

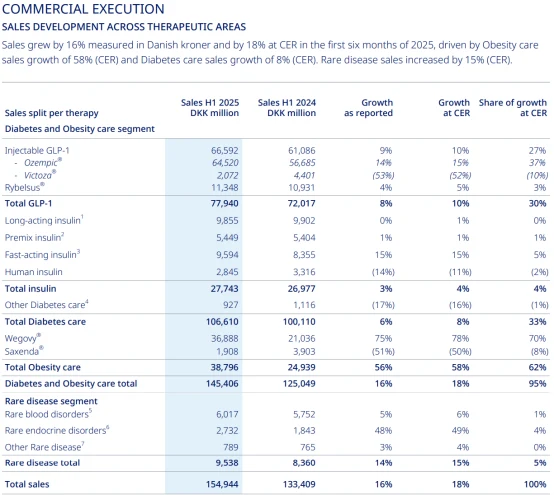

In terms of key product lines, the diabetes care segment showed weak performance, with total sales of DKK 51.57 billion, growing 3% YoY but falling short of market expectations. Sales of GLP-1 drugs amounted to DKK 38.37 billion, up 4% YoY, but again missing the expected 6% growth.

In contrast, the obesity treatment business performed exceptionally well, growing 47% YoY. Wegovy’s sales reached DKK 19.53 billion, marking a significant 67% increase YoY, becoming the key driver of overall company growth.

Source: Novo Nordisk

Earnings Downgrade

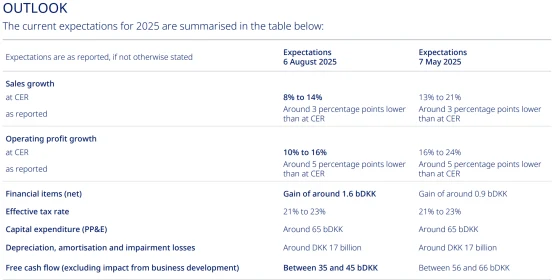

Novo Nordisk, in its earnings release, announced a downward revision of its full-year performance outlook. Due to expected slower growth of GLP-1 drugs in the second half of the year, Novo Nordisk lowered its 2025 sales growth forecast from 13%-21% to 8%-14%. The operating profit growth forecast was also reduced from 16%-24% to 10%-16%. One of the reasons for this revision is the underperformance of its flagship weight-loss drug, Wegovy, in cash-pay channels. Additionally, the rise of generic drugs has also impacted the product's market share.

Source: Novo Nordisk

It is worth noting that Wegovy, as Novo Nordisk's flagship product, had previously driven strong growth for the company. However, with the entry of competitors and the impact of generics, Wegovy is now facing increasing market pressure.

Eli Lilly, as a major competitor, has directly challenged Novo Nordisk with its semaglutide-based drug (brand name Zepbound). This drug offers more effective weight loss, with users experiencing greater weight reduction over 72 weeks compared to semaglutide (the active ingredient in Wegovy). Furthermore, Eli Lilly’s diabetes brand, Mounjaro (also based on semaglutide), is seeing rapid growth, with a 217% increase in Q1 2024.

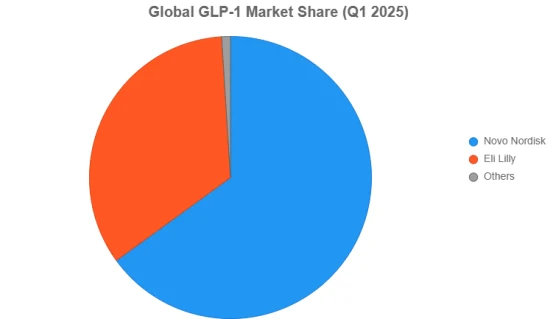

According to IQVIA data, in Q1 2025, Zepbound accounted for 53% of the U.S. weight-loss market, while Mounjaro's market share in the diabetes market has also surpassed 50% in terms of replacing Ozempic. Despite Novo Nordisk holding a 65% share of the global GLP-1 market compared to Eli Lilly’s 34%, Eli Lilly’s growth trajectory is steeper, and its momentum in capturing market share is more aggressive.

Currently, Eli Lilly’s Zepbound and Mounjaro product lines are showing stronger market penetration and adaptability, gradually surpassing Novo Nordisk in the GLP-1 market, especially in the key U.S. market, where their growth rate and product competitiveness are becoming more dominant.

Moreover, Novo Nordisk faced regulatory challenges in 2024, with slow progress in the approval of Wegovy for the treatment of non-alcoholic steatohepatitis (NASH), and the potential approval date for this indication is expected to be further delayed.

Is It Still Attractive?

After experiencing a significant decline over the past year, Novo Nordisk’s stock now appears to be in relatively undervalued territory. As of the close of trading on August 5, 2025, Novo Nordisk’s stock was priced at $47.22 per share, down more than 3% from the previous day. Over the past 12 months, the stock has fallen 64%, with a market value evaporating by over $400 billion, causing it to lose its position as Europe's most valuable company.

Source: TradingView

Currently, Novo Nordisk’s price-to-earnings (P/E) ratio has dropped to around 20x, below the industry average, making it potentially an attractive buy for value investors. However, this valuation also reflects the market's concerns about the company’s future growth, especially as its weight-loss and diabetes treatment businesses face intense competition and regulatory pressures.

Wall Street is also revising its outlook. As Novo Nordisk faces increasing competitive pressure and slower growth, several prominent investment firms have downgraded the stock’s rating and significantly lowered their price targets, including UBS, HSBC, Bank of America, JPMorgan, and Barclays.

Among them, UBS downgraded Novo Nordisk to "Neutral" just before the earnings report, with a target price of DKK 340 (approximately $49). UBS adjusted its stance after conducting a thorough analysis of the dynamics of relevant compounds in the U.S. market and reassessing its assumptions about the sustainable growth of GLP-1 drugs. The firm now expects the Danish company to face a "challenging period."

Final Thoughts

Novo Nordisk’s current stock price may present some appeal for long-term investors, but it still faces significant challenges in the short term. Given the intensifying market competition, particularly in the GLP-1 and weight-loss drug segments, investors considering buying on the dip should carefully assess the company’s long-term potential in research and development, as well as its market expansion efforts.

If investors can tolerate short-term volatility and maintain confidence in Novo Nordisk’s future product pipeline and strategic direction, now may be an opportune time to enter the market. However, for those who prefer more conservative investments, it may be prudent to wait until the company can demonstrate more concrete results in new product development and market growth.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates