The Biggest Trap Investors Are Falling Into

21:00 August 5, 2025 EDT

In recent years, the appeal of the private market, including private equity and private credit, has been steadily rising, transforming from a niche investment into a key component of mainstream portfolios. By 2025, the global private market will manage over $13 trillion in assets, a significant increase from $4 trillion a decade ago. This growth is driven by the expectations of high returns, diversification, and access to high-growth opportunities beyond the public markets.

However, an increasing number of skeptics argue that the excessive allocation of investor capital to these illiquid, high-risk assets represents a major mistake.

The Excessive Allure of Private Equity

The appeal of private equity lies in its narrative of "exclusive opportunities" and excess returns (alpha). Proponents argue that private companies are insulated from public market volatility and can create value through operational improvements and strategic acquisitions. However, the economic reality does not align with this view. While the number of private companies is vast (over 6 million, compared to approximately 4,000 publicly traded companies), their total profit pool is far smaller than that of public market giants like Apple or Microsoft, which contribute significantly to GDP.

Typical private equity targets are companies with market capitalizations under $200 million, essentially micro-cap stocks in the public markets. These smaller companies are riskier: they have lower diversification, are more vulnerable to economic shocks, and have higher bankruptcy rates. Data from S&P Global (1990-2020) shows that the five-year bankruptcy rate for micro-cap stocks is 30%, compared to just 10% for large-cap stocks.

Importantly, private equity transactions often involve leverage ratios of 6-8x EBITDA, much higher than the 2-3x ratio common in public markets. This high leverage amplifies returns in bull markets but significantly increases losses during economic downturns. For instance, during the 2008 financial crisis, private equity portfolios saw default rates surge by 40%.

Despite these risks, institutional investors such as university endowments, pension funds, and sovereign wealth funds continue to allocate 20-40% of their portfolios to private equity, well above the asset class’s actual share in the economy. This over-allocation is driven by the belief that private equity will consistently outperform the public market.

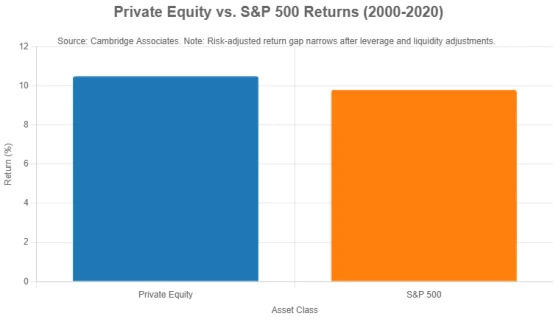

However, historical data calls this belief into question. According to Cambridge Associates, from 2000-2020, private equity generated an average annual return of 10.5%, compared to 9.8% for the S&P 500. However, after adjusting for leverage and liquidity, the risk-adjusted return gap significantly narrows.

Since 2022, private equity has underperformed the S&P 500 by 2-3% annually, reflecting increased challenges in exiting investments and difficulty in achieving favorable valuations in an environment of tightening monetary policy and high interest rates.

Valuation Distortions and Misleading Metrics

One of the core issues with the private equity market is its reliance on inflated valuations. Private equity firms often use "pro forma EBITDA," which includes adjustments for synergies, cost savings, or non-recurring expenses.

According to a 2023 study published in the Financial Analysts Journal, these adjustments can exaggerate reported profits by 20-30%, compared to the GAAP standards used by publicly traded companies. In 2024, the average private equity valuation was 12x EBITDA, compared to 10x for public companies, indicating a premium in the private market that contradicts the claim of "undervalued opportunities."

Additionally, private assets lack a mark-to-market mechanism. Unlike public markets, private assets are typically valued on a quarterly or annual basis, often with fund managers conducting the assessments themselves. This results in smoothened volatility, creating a false sense of stability.

A 2022 study by AQR referred to this as "volatility laundering," noting that the reported volatility of private equity is artificially reduced, masking the true risk exposure. For example, during the 2020 market crash, the public stock market fell by 30% in just a few weeks, while private equity valuations only dropped by 10-15% over several months, despite both facing similar economic pressures.

The Dilemma of Private Credit

Private credit is another rapidly growing sector, with assets expected to reach $1.7 trillion by 2025, driven by investors seeking higher yields in a low-interest-rate environment. Compared to U.S. Treasury yields of 4-5%, private credit offers returns of 10-12%, which appear highly attractive on the surface.

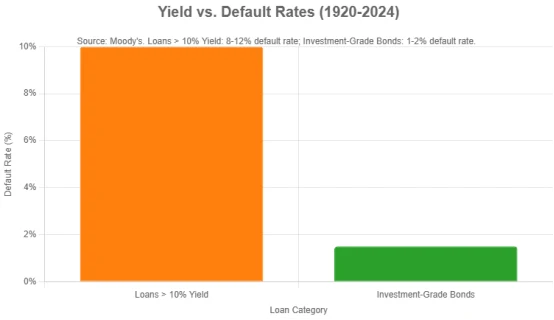

However, these high yields reflect default risk rather than operational efficiency. Data from Moody's (1920-2024) shows a strong correlation between yield and default rates: loans yielding over 10% have an annual default rate of 8-12%, while investment-grade bonds have a default rate of only 1-2%.

Private credit marketing often emphasizes low historical default rates, claiming that defaults have been under 2% in the post-2008 era. However, this period coincided with unprecedented monetary stimulus policies, which suppressed default rates across all credit markets. As interest rates rise to 5-6% in 2023-2025, private credit default rates have climbed to 4.5%, and are expected to continue rising if the economy further tightens.

Moreover, investors chasing high yields often overlook the erosion of returns due to defaults. For instance, an analysis of platforms like Lending Club in 2020 showed that a 25% yield resulted in net returns of only 5-6% after defaults, underperforming safer corporate bonds.

The risk in private credit is further exacerbated by its structural complexity. Many loans are "covenant-lite," lacking the traditional protective mechanisms found in bank loans, such as requirements for borrowers to maintain financial ratios. In 2024, 80% of private credit transactions were covenant-lite, up significantly from 50% in 2015. This increases vulnerability for lenders in economic downturns. During the 2008-2009 period, the default rate for covenant-lite loans was 25% higher than for loans with traditional covenants.

Liquidity Traps and Market Dynamics

Liquidity is a core issue in the private market.

Private equity and credit investments typically lock up capital for 7-10 years, limiting investors' flexibility. During the COVID-19 pandemic in 2020, private fund investors faced significant challenges in withdrawing their capital, with some funds even imposing redemption restrictions or delaying withdrawals.

In contrast, public market investors can quickly adjust their portfolios. This liquidity premium is often justified by the expectation of higher returns, but between 2023-2025, a slowdown in private equity exits (with IPO and M&A activity down by 30% from the 2021 peak) has resulted in capital being trapped in underperforming assets.

The massive influx of capital into the private market has also weakened its competitive edge. In 2000, private equity accounted for 10% of global M&A activity; by 2025, that share has risen to 40%. This saturation has reduced the market inefficiencies that once allowed skilled managers to identify undervalued opportunities. "Sponsor-to-sponsor" deals—transactions between private equity firms—now account for 50% of deals, up significantly from 20% in 2010. These transactions rarely create operational value, often relying more on financial engineering or market timing, further questioning the asset class’s value proposition.

Lessons from History

The growth trend in the private market bears striking similarities to the risk accumulation seen during the early 2000s dot-com bubble and the pre-crisis period leading up to the 2008 subprime mortgage crisis. In the early 2000s, the excessive leverage in private equity was one of the factors that contributed to the bankruptcy wave during the financial crisis. These historical experiences serve as reminders that excessive optimism can lead to history repeating itself. As of 2024, private equity leverage is nearing pre-crisis levels (7.5x EBITDA), and if the economic environment deteriorates, we could see a repeat of past mistakes.

Current trends exacerbate these concerns. The prolonged privatization of unicorn companies has delayed public market scrutiny but does not guarantee success. Among the 1,200 unicorns tracked by CB Insights in 2024, 15% failed to secure further financing or exited at valuations lower than their peak, highlighting the risks of over-optimism. Moreover, the democratization of the private market through retail-focused funds introduces new risks, as individual investors may underestimate the complexity and liquidity risks associated with these investments.

Contrarian Viewpoints

Critics like Cliff Asness and Daniel Rasmussen advocate for a return to first principles. If the private market offers higher returns, it must compensate for higher risk, liquidity constraints, and fees (typically 2% management fee and 20% performance fee). However, evidence suggests that these premiums are often overstated. Research has shown that from 2010 to 2020, the average net annual return on private equity, after fees, was 8.5%, which was only slightly higher than that of the public equity markets, when adjusted for risk.

This perspective emphasizes discipline: investors should limit their allocation to the private market to 5-10% of their portfolios, in line with its economic share, and prioritize diversified, liquid public market strategies. Historical data supports this cautious approach. In 2023-2024, smaller university endowments with lower allocations to private equity performed better than institutions like Yale, which heavily relied on private equity, as the public market rebound caused delays in private equity exits.

Final Thoughts

The chase for private markets reflects a pursuit of higher returns and diversification in a challenging economic environment. However, the combination of inflated valuations, excessive leverage, misleading metrics, and low liquidity presents significant risks. Investors allocating 20-40% of their portfolios to private equity and credit are betting on a sustained outperformance that is increasingly questioned by both historical and current data.

As capital flows reverse—potentially triggered by rising defaults or an economic slowdown—the private market boom could become one of the biggest missteps for investors in 2025. A disciplined, fundamentals-based, data-driven investment approach may still be the safer path forward.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates