The Market is Considering: Will the Fed Make a 25 or 50 Basis Point Cut in September?

18:00 August 5, 2025 EDT

Key Points:

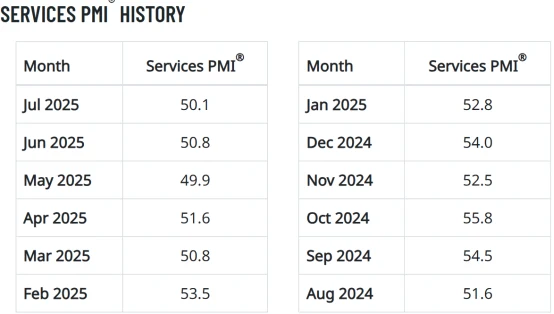

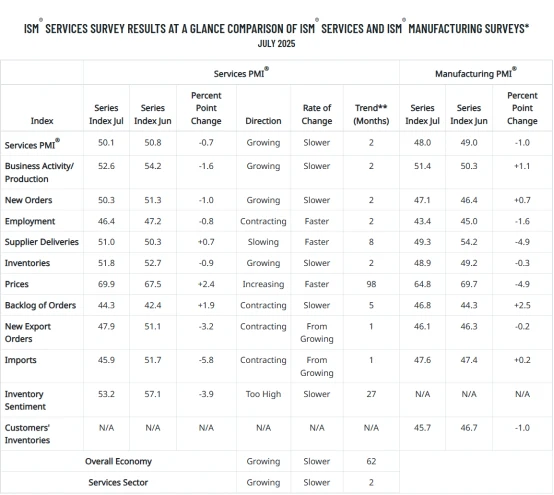

The U.S. July ISM Non-Manufacturing Index stood at 50.1, below the expected 51.5 and lower than the previous month's 50.8.

The market's focus has shifted from "whether the Fed will cut rates" to "by how much" the Fed will ease.

The market widely expects the Federal Reserve to adopt a more accommodative policy in the coming months.

In July 2025, the U.S. ISM Services PMI data showed that activity in the services sector nearly stalled, with the index at 50.1, barely holding above the breakeven line. This data reflects the slowdown in the U.S. economy, especially against the backdrop of persistent weakness in the labor market and consumer spending, significantly dampening economic growth momentum. The weakness in the ISM Services Index has acted as a catalyst for the shift in market expectations regarding the Fed’s future policy path.

Source: ISM

The market's attention has now turned to the Fed's September FOMC meeting, where the debate is no longer about "whether the Fed will cut rates," but "by how many basis points"—is it 25 basis points or 50?

For the Federal Reserve, faced with the increasingly severe economic slowdown and a weakening labor market, a rate cut may no longer be a choice but rather a necessary policy action.

Signs of Economic Slowdown

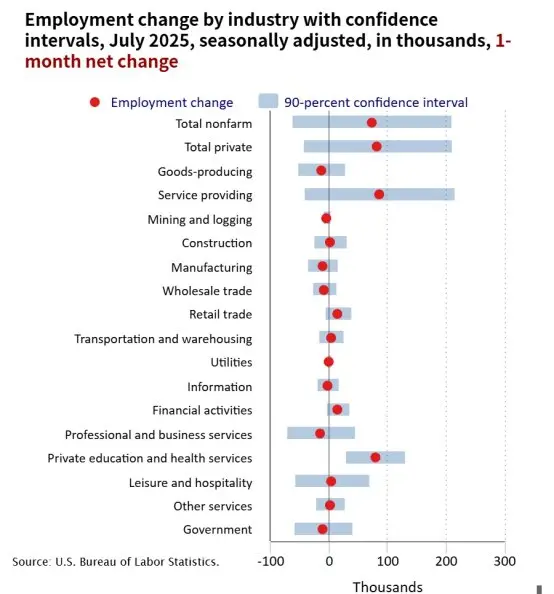

The July non-farm payroll report became a key turning point for the Federal Reserve's policy expectations.

The report showed that in July, U.S. non-farm payrolls increased by just 73,000, far below the market expectation of 110,000. Additionally, employment data for the previous two months was significantly revised downward, with a total revision of 258,000. The May non-farm payrolls were revised down from 144,000 to 19,000, and June's from 147,000 to 14,000, bringing the employment growth over the past three months to its lowest level.

Source: U.S. Bureau of Labor Statistics

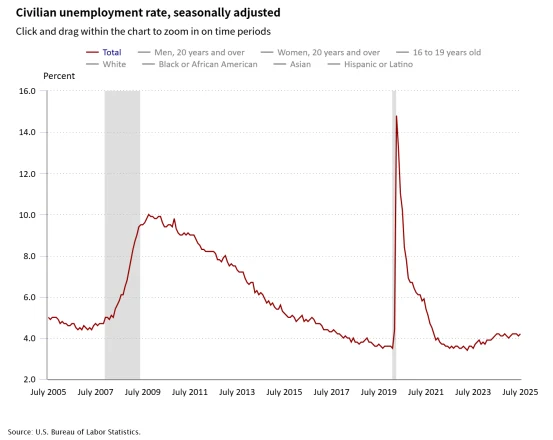

In addition, the July unemployment rate slightly rose to 4.2%, an increase of 0.1 percentage points from the previous month. Although the rise was modest, the increase in unemployment further reinforced market concerns about economic slowdown.

Source: U.S. Bureau of Labor Statistics

Analysts from Goldman Sachs and several other Wall Street investment banks unanimously believe that the weakness in the labor market has made a rate cut an inevitable choice for the Federal Reserve, and more aggressive monetary policy may be required in the coming months.

Pressure for Easing Intensifies

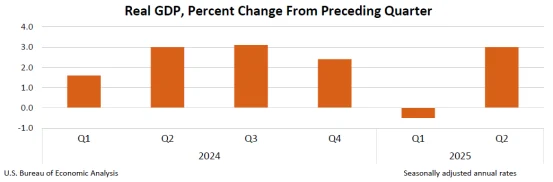

In addition to the employment data, the overall slowdown in economic growth has increased the pressure on the Federal Reserve to adopt an accommodative policy. According to Goldman Sachs' analysis, after excluding specific factors, the growth rate of real final sales in the U.S. during the first half of this year has significantly slowed, and GDP growth is expected to decline by 100 basis points compared to 2024. Specifically, the U.S. GDP growth for 2025 is projected to be 1.8%, down from 2.3% in 2024. This slowdown in growth reflects the pressures from weak consumer spending and domestic demand, further exacerbating the challenges to economic growth.

Source: BEA

In this context, the July ISM Non-Manufacturing Index stood at 50.1, below the expected 51.5 and lower than the previous value of 50.8, signaling near stagnation in the growth of the U.S. services sector. More concerning, the New Orders Index fell to 50.3, almost at a standstill, and the Business Activity Index saw a significant decline.

These figures highlight the multiple challenges facing the U.S. services sector, including high inflation, weak demand, and declining consumer confidence. Furthermore, the continued weakness in manufacturing has intensified the overall economic slowdown.

Source: ISM

The Rate Cut Dilemma

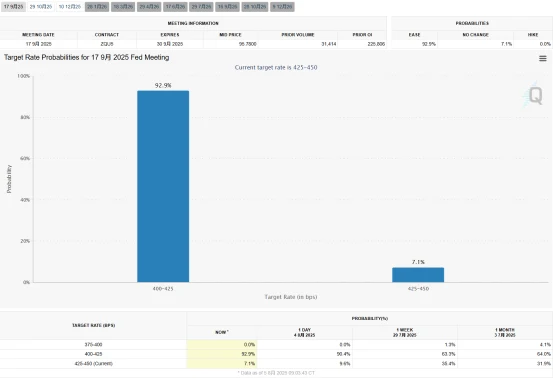

As economic data continues to weaken, the market is no longer questioning whether the Federal Reserve will cut rates, but rather discussing the magnitude of the rate cut.

Goldman Sachs expects the Fed is likely to cut rates by 25 basis points in September, but also warns that the market may be underestimating the likelihood of a more aggressive rate cut. If economic data continues to deteriorate in the coming months, especially if the unemployment rate rises above 4.4%, a 50 basis point rate cut could even be on the table.

Specifically, according to the CME "FedWatch" tool, the market currently expects a 25 basis point rate cut in September with a probability of over 90%, a significant increase from 84% after the release of the non-farm payroll report.

Source: CME

If non-farm payroll data continues to worsen, especially if the unemployment rate continues to rise or consumer spending fails to rebound in the August and September data, a 50 basis point rate cut could become a viable option for the Fed.

JPMorgan holds a more aggressive view, predicting the Fed may cut rates by 50 basis points in both September and November, followed by a 25 basis point cut in December, bringing the total rate cut for the year to 125 basis points. JPMorgan believes that despite the current U.S. economic weakness, inflation pressures are insufficient to prevent the Fed from implementing large-scale accommodative policies.

However, Bank of America takes a more cautious stance, suggesting that the Fed may choose to keep rates unchanged until 2026, with further rate cuts unlikely until then. Bank of America emphasizes that despite the slowdown in the labor market, the U.S. economy has not fallen into recession, unemployment remains relatively stable, and consumer spending has started to pick up. This could lead the Fed to refrain from taking more aggressive rate-cutting measures.

The core of this discussion revolves around whether the Fed can act swiftly and decisively with rate cuts while inflation remains at relatively high levels.

Political Pressure

The pressure exerted by the Trump administration on the Federal Reserve has added an extra layer of complexity to its monetary policy decision-making.

Recently, President Trump has repeatedly called for the Fed to accelerate rate cuts, even going as far as visiting the Fed's headquarters to apply direct pressure. This behavior has heightened market expectations for a shift in policy. In the context of political intervention, how the Fed balances economic data with external pressures may become one of the key factors in its future decisions.

Although there is growing internal support for an accommodative policy within the Fed, maintaining independence amid global economic and political pressures will also play a crucial role in determining the direction of future monetary policy.

The Actual Situation

As economic data continues to show signs of slowing down and the ongoing impact of the Trump administration's series of aggressive tariff policies, the expectation of a rate cut by the Fed in September has become a consensus in the market. From the July non-farm payroll data to the ISM services PMI, and the overall slowdown in GDP growth, the U.S. economy is facing increasing downward pressure.

Although there are still differences in market discussions about the magnitude of the rate cut, whether it is 25 basis points or 50 basis points, the market has widely anticipated that the Fed will adopt an accommodative policy in the coming months.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates