Other Than Figma, This IPO Stock Also Warrants Attention

04:54 August 5, 2025 EDT

Key Points:

Ambiq priced its IPO at $24 per share, with a first-day closing price surge of over 60%, reaching a market cap of $656 million.

Accelerated investment in edge AI is creating growth opportunities for companies like Ambiq that focus on ultra-low-power chips.

For investors seeking alternatives beyond high-valuation software stocks like Figma, Ambiq offers a compelling option for further research.

On July 30, 2025, low-power semiconductor design firm Ambiq Micro ("Ambiq") successfully went public on the New York Stock Exchange, priced at $24 per share. The stock opened at $38 and closed at $38.53 on the first day, marking a gain of over 60%. As of August 5, the stock was trading at $38.16, representing a cumulative gain of nearly 59%.

Source: TradingView

While the market’s attention has largely focused on Figma’s IPO performance, Ambiq, as another AI hardware company with long-term growth potential, also merits close attention.

Growth Drivers

On July 21, 2025, Ambiq announced its IPO plan, initially intending to issue 3.4 million shares within a price range of $22.00 to $25.00 per share. The final issuance was increased to 4 million shares, priced at $24.00 per share, raising $96 million. After underwriters exercised an additional 600,000 shares in the overallotment option, total proceeds reached $110.4 million.

The stock began trading on July 30 on the New York Stock Exchange (NYSE) under the ticker "AMBQ." As of August 5, despite a 3.42% decline from the previous trading day, the share price remains up 59% from the IPO price, with a market capitalization of approximately $656 million.

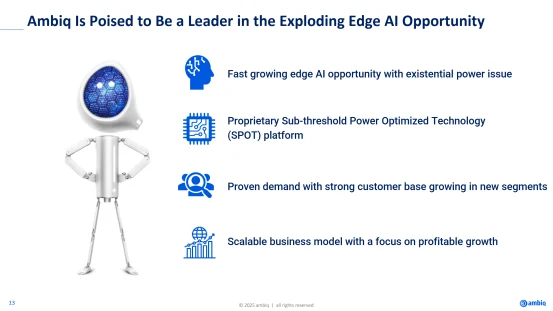

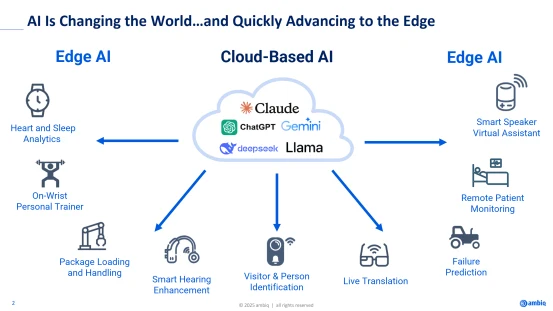

This strong stock performance reflects market recognition of Ambiq’s technology and strategic positioning. As an innovator in ultra-low-power semiconductors, Ambiq’s Sub-Threshold Operation Technology (SPOT®) reduces power consumption by 2 to 5 times, effectively meeting the stringent energy efficiency requirements of edge AI devices such as wearables, medical monitoring, and IoT systems.

Source: Ambiq

Regarding core technology, Ambiq’s Apollo510 chip is based on the advanced Arm Cortex M55 core, integrating AI processing, graphics, and cybersecurity features. The chip has demonstrated competitive advantages in wearable devices. The company plans to actively expand into emerging markets including automotive and robotics to enhance future growth momentum.

Investment in edge AI is accelerating. According to IDC forecasts, global shipments of edge AI devices are expected to reach 3.4 billion units in 2025, a 22% year-over-year increase. Unlike centralized AI architectures relying on cloud computing, edge AI demands a high integration of local computing power and energy efficiency, creating growth opportunities for companies like Ambiq focused on ultra-low-power chips.

Source: Ambiq

Revenue Diversification

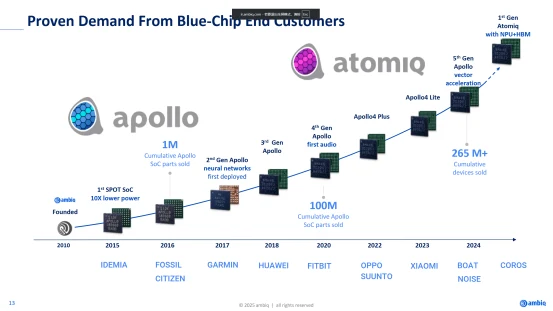

In its prospectus, Ambiq disclosed that its major customers include consumer electronics companies such as Garmin, Fitbit (a subsidiary of Alphabet), and Xiaomi. Previously, Huawei accounted for more than 40% of its sales. However, due to geopolitical tensions and supply chain constraints, Ambiq has proactively adjusted its regional business strategy. In the first quarter of 2025, revenue from mainland China declined to 6% of total sales, while sales from the U.S., Europe, and other Asian regions grew 94% year-over-year.

Source: Ambiq

The data confirms this shift. In 2024, the company’s revenue increased 16.1% year-over-year to $76.1 million. In the first quarter of 2025, gross margin improved significantly to 53.3%, and operating cash flow turned positive. Although the company still reported a net loss of $8.3 million, overall financial indicators show clear signs of improvement.

Concentrated but Manageable Risks

Ambiq currently has a market capitalization of approximately $670 million, significantly lower than Figma’s $60 billion valuation. The company’s current price-to-sales (P/S) ratio is slightly above 10, well below the average level for the AI chip industry. In contrast, Figma, despite having a larger revenue base, trades at a P/S ratio exceeding 40, indicating a substantial valuation premium.

However, Ambiq faces risks related to a concentrated customer base. As of 2024, Xiaomi, Garmin, and Fitbit accounted for 24%, 24%, and 21% of its revenue, respectively. Additionally, the company has not secured long-term purchase agreements with its customers, which introduces potential short-term revenue volatility.

From an industry perspective, as AI applications increasingly move to edge devices, demand for ultra-low-power AI chips is expected to grow steadily. Ambiq is a key participant in this supply chain. Although still in an early development stage, its fundamentals are gradually strengthening, supported by improving gross margins, optimized customer mix, and clear market positioning.

For investors seeking AI exposure beyond high-valuation software stocks like Figma, Ambiq offers a compelling alternative with a strong technological moat, reasonable valuation, and clear growth potential.

Source: TradingView

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates