Oil Market Losing Its Balance

21:00 August 4, 2025 EDT

In early August 2025, OPEC+ officially announced the end of its voluntary production cut agreement. The 2.2 million barrels per day (bpd) output reduction plan, implemented since 2023, has been fully terminated, with all eight participating member states—including Saudi Arabia and Russia—removing production caps. Saudi Arabia has agreed to increase output by 547,000 bpd starting in September, marking a return to the group’s traditional, flexible supply management strategy.

Although OPEC has officially stated that the production increase aims to meet global energy demand, the market broadly interprets the move as an effort by member states to compete for remaining market share amid the accelerating global energy transition. The decision has exerted direct downward pressure on oil prices.

As of press time on August 5, WTI crude futures were trading at $66 per barrel, down approximately 2.5% from the previous trading session, while Brent crude was quoted at $68 per barrel, down around 2%. JPMorgan further projected that if weak demand persists, the global oil market could face a supply surplus of 2.2 million bpd, putting additional downside pressure on prices.

Source: TradingView

U.S. Shale Oil Growth Slows

While OPEC+ moves to increase output, the growth momentum of U.S. domestic crude production is slowing. The latest data shows that the number of active U.S. oil rigs has declined to 410—the lowest level in nearly four years—while the number of frac spreads has also fallen to its lowest since 2021. Meanwhile, the number of natural gas rigs has slightly increased to 124, indicating a reallocation of drilling activity toward the gas sector.

This suggests that under current price conditions, the growth potential of U.S. shale oil production is increasingly constrained and unlikely to provide an effective counterbalance to OPEC+’s additional supply. Although changes in rig counts do not immediately affect output, they are a key forward-looking indicator for future production capacity.

At the same time, natural gas prices are under downward pressure, with the September contract approaching the critical $3.00/MMBtu support level. Despite potential disruptions from extreme heat and hurricane season, overall supply-demand conditions remain loose, with inventories at historically high levels—undermining the weather-related price support.

According to analysis by John Kemp Energy, U.S. natural gas drilling activity reached a two-year high in 2025, while oil rig counts continued to decline. This trend reinforces expectations of rising gas supply. Unless industrial and power generation demand improves significantly, natural gas prices are likely to remain suppressed.

Impact of Trump’s Tariff Warnings

On August 4, U.S. President Donald Trump issued a warning over India’s large-scale purchases of Russian crude oil, stating that he would impose higher tariffs on Indian exports to the U.S. as part of efforts to pressure Moscow. He had already announced a 25% tariff on Indian goods and threatened further punitive measures should India continue to import Russian oil or military equipment.

As one of the primary importers of Russian crude, India now faces the risk of secondary sanctions. Its state-owned refiners have reportedly suspended purchases of Russian oil. Should exports from Russia to India decline, global crude supply could tighten. However, the planned production increase by OPEC+ may offset this potential shortfall.

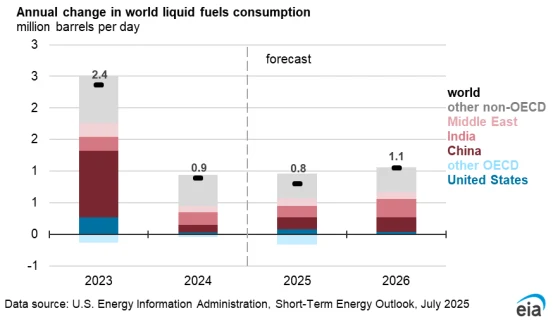

In addition, Trump’s announcement of a “reciprocal tariff” policy has triggered concerns over a global economic slowdown. Global oil demand growth in 2025 is now expected to be reduced by 400,000 barrels per day. According to the EIA’s July 2025 Short-Term Energy Outlook, global oil demand is forecast to grow by 800,000 barrels per day in 2025, down 180,000 barrels per day from the previous estimate.

Source: EIA

Geopolitical tensions—such as the Israel-Iran ceasefire and the Russia-Ukraine conflict—have contributed to a risk premium in oil prices. However, signs of de-escalation tend to weaken that premium. In June 2025, concerns over Iran’s nuclear program drove Brent crude to as high as $81 per barrel, with a monthly average around $70. Following the ceasefire announcement, prices retreated to around $68 per barrel.

Source: TradingView

If geopolitical tensions escalate further, oil prices may find near-term support. However, based on current market dynamics, the trend appears to be skewing downward.

Tehnical Indicators Signal Further Downside

From a technical perspective, WTI crude oil futures have closed below a key support zone for three consecutive trading days and have temporarily fallen below both the 20-day and 50-day moving averages, indicating weakening short-term momentum. If the $65 level is breached, the next technical support is likely near $62.50.

Source: TradingView

Brent crude is also under pressure, with the $68 level, a short-term support, starting to weaken. If this support fails, the price may test the $65 area.

Source: TradingView

The Relative Strength Index (RSI) for WTI currently stands below 35, approaching oversold territory but has yet to generate a reversal signal. Meanwhile, the MACD momentum indicator continues to expand downward, signaling the ongoing bearish trend.

Source: TradingView

Pricing Dynamics

The crude oil market is facing dual pressures from rising supply and weakening demand. OPEC+ production increases, the U.S. shale industry’s shift toward natural gas, geopolitical developments, and economic uncertainties are collectively intensifying price volatility.

In response, Goldman Sachs recently noted in a report that sanctions risks on Russia and Iran are adding pressure to oil supply, representing an upside risk to energy price forecasts. However, due to increased U.S. tariff rates, threats of secondary tariffs, and weak U.S. economic activity data, Goldman Sachs expects downward risks to U.S. daily oil demand growth forecasts for 2025-2026.

At present, crude oil prices are likely to maintain a volatile downward trend in the near term. In the long run, the ongoing energy transition will continue to reduce oil’s share in the primary energy mix, limiting its demand growth potential.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates