Trump Demands Drug Price Cuts, Pharma Stocks Under Pressure: Opportunity or Risk?

18:00 August 4, 2025 EDT

On July 31, 2025, U.S. President Donald Trump sent formal letters to 17 global pharmaceutical giants, including Pfizer, Johnson & Johnson, Novartis, and AstraZeneca, demanding that they lower U.S. drug prices to the lowest levels among developed countries within 60 days. The letters also outlined multiple proposals for pricing reforms.

Following the announcement, the healthcare sector broadly declined, with several major drugmakers seeing single-day losses of more than 5%. This marked Trump’s latest effort to pressure drug pricing since signing an executive order in May, and was widely interpreted by markets as a direct challenge to the profit model of the biopharmaceutical industry.

Source: TradingView

Against this backdrop of policy pressure and market volatility, investors must ask: What is the substance behind this new storm? Are pharmaceutical stocks facing genuine systemic risk? And is now the right time to consider buying shares in these companies?

Regulatory pressure

This "final ultimatum" is not the first of its kind but part of the Trump administration’s ongoing strategy to reform drug pricing. Following the executive order issued in May to implement a "most favored nation" pricing system within the Medicaid program, this latest letter further reinforces four core demands: first, to anchor drug prices to the lowest international levels; second, to expand price adjustments to cover the Medicaid system; third, to encourage pharmaceutical companies to establish direct-to-consumer sales channels; and fourth, to push for the repatriation of revenue gained from overseas price increases back to the U.S. market.

Although the letter lacks legislative authority, it signals a policy inclination toward comprehensive intervention in drug pricing through administrative or legislative means in the future.

This tough stance triggered an immediate market reaction, with investors concerned about reduced pharmaceutical revenues leading to a sell-off. On July 31, Sanofi’s stock plunged more than 7%, while Novo Nordisk, Bristol-Myers Squibb, and others fell nearly 5%, dragging the entire pharmaceutical sector into selling pressure and highlighting investors’ urgent repricing of industry profitability.

Is the sell-off justified?

Concerns in the market over Trump’s drug pricing reforms likely stem from two main expectations: first, the risk of declining profit margins; second, a valuation re-pricing driven by uncertainty over policy implementation. Drug prices in the U.S. are typically two to three times higher than in other developed countries, so price reductions would significantly impact revenues for companies heavily reliant on the U.S. market. For example, in 2024, BeiGene’s BTK inhibitor zanubrutinib generated approximately $2 billion in U.S. sales, accounting for about 73.7% of its global revenue. The drug’s price for a 30-day treatment course was $12,935—16 times higher than in China. Price cuts could erode margins, especially for firms with high U.S. market dependence.

Smaller pharmaceutical companies reliant on a single high-priced drug or with weaker product portfolios may face survival challenges due to margin compression, potentially leading to industry consolidation. Large-cap companies like Pfizer and Merck, benefiting from economies of scale or acquisition capacity, are better positioned to withstand pricing pressure. To offset revenue losses, drugmakers may increase investment in high-value new drug development to maintain premium pricing. For instance, Novartis reported $14.05 billion in sales in Q2 2025 and launched a $10 billion share repurchase program, signaling confidence in its product lineup. However, companies facing patent cliffs—such as Pfizer and Johnson & Johnson—may struggle if innovation falters.

Additionally, Trump’s demand that pharmaceutical firms repatriate overseas profits to lower domestic drug prices could disrupt international market strategies. Should companies raise prices abroad to compensate for U.S. revenue losses, they risk losing market share in price-sensitive regions like Europe, potentially forcing resources back to the U.S. and intensifying domestic competition. Research estimates that if a “most favored nation” pricing mechanism is implemented, U.S. drug prices could decline by 20% to 60%, placing dual pressure on gross margins and free cash flow for innovation-driven companies reliant on the U.S. market.

However, is this market reaction overstating the short-term feasibility of the policy? In reality, broad pricing reforms are unlikely to be widely implemented without Congressional approval. While the current executive orders carry symbolic weight, their execution faces significant uncertainties due to lack of legislative authorization, judicial reviews, and industry legal challenges. Notably, a similar attempt to implement “most favored nation” pricing during Trump’s 2020 administration was halted by federal courts on procedural grounds. Therefore, the recent sell-off may be driven more by investor sentiment than by a fundamental reassessment of corporate operating conditions.

Not all drugmakers will suffer

Although the overall pharmaceutical sector has faced pressure, the impact varies significantly across companies. From a revenue perspective, large pharmaceutical firms with extensive international markets and diversified product portfolios are less affected by policy changes in any single market.

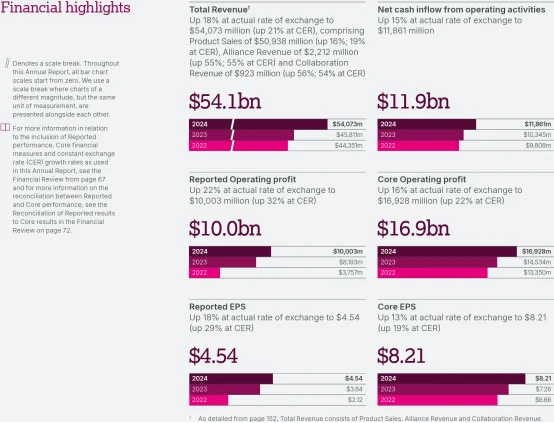

For example, AstraZeneca generates more than half of its revenue outside the U.S., with a diversified product mix that includes oncology drugs, treatments for rare diseases, and vaccines. This diversity helps mitigate risks stemming from U.S. policy shifts. In contrast, companies that rely heavily on a single blockbuster drug, have weaker innovation pipelines, or limited international presence are more vulnerable to changes in pricing mechanisms.

Source: AstraZeneca, 2024 Financial Data

Additionally, some companies have proactively developed direct-to-consumer sales channels to adapt to potential changes in payment models. Pfizer, Novo Nordisk, and Eli Lilly, among others, have launched platforms allowing consumers to purchase lower-cost prescription drugs directly, bypassing intermediaries. Should future healthcare or government policies promote direct payment systems, these firms could turn regulatory challenges into competitive advantages, potentially increasing market share.

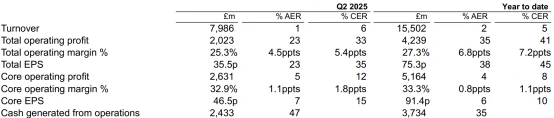

It is noteworthy that in 2025, the healthcare sector declined by 3.4%, significantly underperforming the broader market’s 6.6% gain. However, large pharmaceutical companies have maintained solid financial performance. AstraZeneca reported a 12% year-over-year revenue increase in Q2, surpassing market expectations. Bristol-Myers Squibb achieved revenue growth driven by sales of apixaban and nivolumab, recording $2.9 billion in profit. GlaxoSmithKline’s revenue grew 6.8% year-over-year, with adjusted core earnings per share exceeding consensus estimates. Novartis announced a $10 billion share repurchase program, demonstrating strong confidence in capital markets.

Source: GlaxoSmithKline, Q2 2025 Financial Data

These figures indicate that current policy pressures have yet to materially affect core product sales and profitability for pharmaceutical companies. Compared to the high volatility in market sentiment, the underlying business fundamentals appear more stable. The valuation compression resulting from recent share price declines may, in fact, present a favorable entry point for medium- to long-term investors.

Opportunities are gradually emerging

Although the market is still assessing the direction of regulatory policies, a temporary pause does not mean a complete avoidance from an investment strategy perspective. For institutional investors with medium- to long-term allocation goals or conservative capital, the recent systematic adjustment in the pharmaceutical sector has in fact created targeted entry opportunities. Considering valuation levels, fundamental quality, and companies’ adaptability to policy variables, the market is revealing three types of structural opportunities:

First, leading innovative pharmaceutical companies with global competitiveness. These firms, characterized by diverse product lines, solid R&D pipelines, and high degrees of internationalization, are better positioned to withstand policy shocks. Examples include AstraZeneca, Johnson & Johnson, and Novartis.

Second, companies whose current valuations have already priced in potential policy pressures. After recent share price adjustments, some have entered historically low valuation ranges, with current forward price-to-earnings ratios falling within the 15-20x range and dividend yields maintained between 3% and 5%. Pfizer, GlaxoSmithKline, and Roche fall into this category and present potential valuation recovery opportunities.

Third, companies that have proactively embraced payment pathway transformations in healthcare. Firms that have advanced direct-to-consumer sales models and patient service systems may gain advantages as healthcare payment reforms continue to reduce intermediaries. Eli Lilly and Novo Nordisk have launched multiple pilot programs for direct sales platforms, positioning them favorably if this de-intermediation trend persists.

When market sentiment subsides, intrinsic value will re-emerge.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates