Is Amazon Being Undervalued?

03:00 August 4, 2025 EDT

Key points:

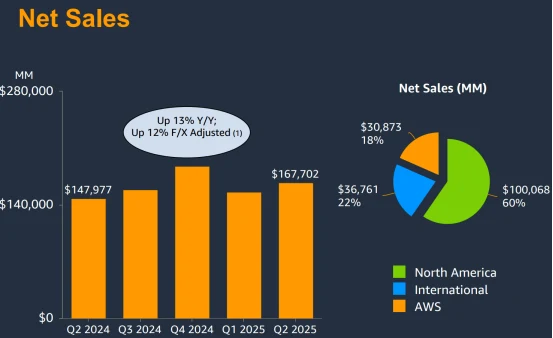

In Q2 2025, Amazon reported revenue of $167.7 billion and net profit of $18.2 billion, both exceeding market expectations, but AWS growth lagged behind Microsoft Azure and Google Cloud.

In the AI-driven cloud computing race, market focus on growth rates may overshadow more critical differences in profitability structures.

In Q2 2025, Amazon posted revenue of $167.7 billion and net profit of $18.2 billion, both beating market estimates. However, AWS’s 17.5% growth rate trailed Microsoft Azure’s 39% and Google Cloud’s 32%, raising investor concerns and leading to an 8.27% drop in Amazon’s after-hours stock price. From a profitability perspective, AWS contributed over half of Amazon’s operating profit, with an operating margin of 33%, far exceeding the core retail business margin of 6.6%. This positions AWS as the key pillar of Amazon’s overall profitability and a critical variable for future valuation re-ratings.

Source: TradingView

In contrast, Microsoft and Google may lead in cloud revenue growth, but their cloud business margins are significantly lower than those of their traditional software and advertising segments. Over the long term, this could dilute overall profitability. This suggests that the market’s negative reaction to the AWS growth slowdown may overlook Amazon’s advantages in profit quality and cash flow stability.

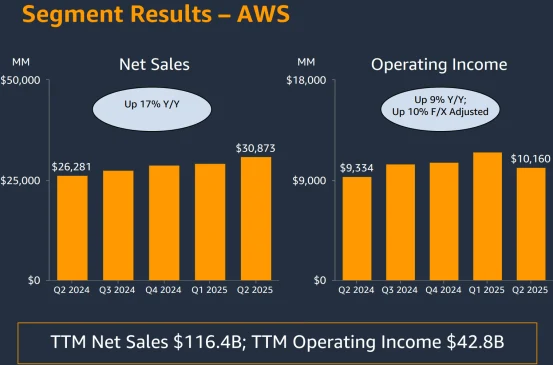

AWS’s Profit Center

In Q2 2025, Amazon reported total revenue of $167.7 billion, up 13% year-over-year, with net profit reaching $18.2 billion and earnings per share of $1.68, all exceeding market expectations. However, following the earnings release, the company’s stock fell 8.27% to close at $214.75, reducing its market capitalization to $2.29 trillion.

Source: Amazon

The primary driver behind the negative market reaction was AWS’s quarterly revenue growth of 17.5%, trailing behind Microsoft Azure’s 39% and Google Cloud’s 32%, raising concerns over slowing momentum.

This interpretation, however, may overlook the core value in profitability quality and future revenue backlog. AWS generated operating income of $10.16 billion this quarter, with an operating margin of 33%, significantly higher than Amazon’s retail business margin of 6.6%, making AWS the main profit engine. In 2024, AWS accounted for 17% of Amazon’s total revenue, up from 9.8% in 2017. Over the same period, the company’s overall operating margin rose from 2.3% to 10.7%, driven largely by AWS.

Source: Amazon

The growth outlook is also underpinned by substantial fundamentals. According to New Street Research, AWS’s backlog of orders increased 25% year-over-year to $195 billion this quarter, providing high visibility into future revenue. Additionally, Amazon is advancing a capital expenditure plan of approximately $100 billion in 2025 aimed at alleviating capacity constraints and strengthening AI compute infrastructure. Analysts broadly expect this expansion to drive AWS growth back above 20% in the second half of the year.

From a valuation perspective, post-earnings Amazon’s trailing twelve-month P/E ratio stands at 32.74, well below its five-year average of 72, falling to the lower historical range. Considering AWS’s stable profit contribution, high-certainty future orders, and expansion potential following capital investments, the current stock price reflects a notably conservative market expectation.

Microsoft and Google’s Price of Growth

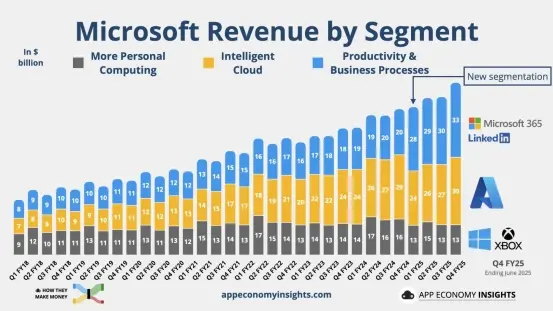

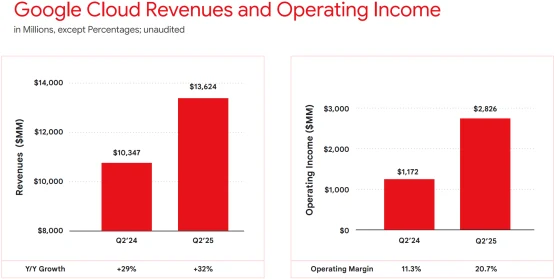

The Q2 2025 earnings report shows that Microsoft and Google continue to sustain rapid growth in the cloud computing sector, but underlying margin pressures are becoming increasingly evident.

Microsoft’s Intelligent Cloud segment generated $29.88 billion in revenue this quarter, a 26% year-over-year increase, with Azure growing at 39%. However, the operating margin of this segment remains significantly lower than that of Microsoft’s core software business (Productivity and Business Processes segment).

Source: App Economy Insights

Google Cloud faces a similar challenge, reporting revenue growth of 32% to $13.6 billion, but with a profit margin around 20.7%, far below the approximately 40% margin of its advertising business.

Source: Google

Both companies’ cloud businesses are growing much faster than their higher-margin core operations. As cloud revenue increasingly represents a larger portion of overall income, this “high growth, low margin” structure is diluting aggregate profitability and altering the companies’ earnings base.

Additionally, to support AI and cloud expansion, Microsoft and Google have significantly increased capital expenditures. While these investments strengthen AI infrastructure capabilities, they also compress short-term margins, delaying profit stabilization. Microsoft has announced AI-related annualized revenue of $13 billion, yet this segment has yet to generate consistent profit contributions. Google’s substantial AI investments are similarly challenged by its roughly 10% market share in cloud and comparatively lower profitability, limiting its competitive positioning against AWS.

Regarding valuation, Microsoft’s market capitalization stands at $3.3 trillion with a forward P/E of approximately 29, reflecting strong market optimism about AI commercialization. However, this valuation does not fully account for systemic risks posed by elevated capital spending, shifts in profit structure, and regulatory uncertainty. For instance, the UK Competition and Markets Authority (CMA) is currently reviewing Microsoft’s licensing practices, with potential fines reaching up to 10% of global revenue if found in violation of antitrust regulations.

Against this backdrop of high valuation premiums, the sustainability of Microsoft and Google’s corporate earnings models faces growing scrutiny.

Has Amazon Been Undervalued?

The market may be underestimating Amazon AWS’s profitability model and future growth potential.

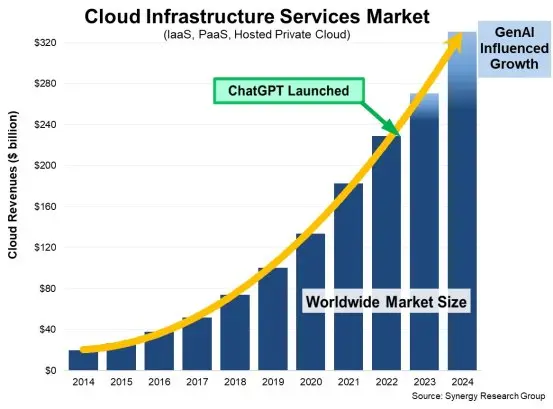

AWS continues to hold a leading position in the global cloud services market. According to Synergy Research Group, the global cloud market grew 22% year-over-year to $90.6 billion in Q4 2024, with AWS maintaining a 30% market share, ahead of Microsoft and Google. AWS serves a diverse client base spanning industries such as PepsiCo, Airbnb, and Nasdaq, covering traditional IT migration as well as emerging AI workloads.

Source: Synergy Research Group

Beyond its diverse customer base, AWS’s sustained investments in core technologies have significantly strengthened its medium- to long-term competitive edge. Amazon plans approximately $100 billion in capital expenditures for 2025, focused primarily on expanding AI infrastructure and deepening collaboration with Nvidia. Its self-developed chips and AI development platforms further enhance customer retention and marginal cost control, reinforcing AWS’s leadership in enterprise AI applications.

Despite short-term pressure from high capital expenditures on depreciation and amortization, AWS maintains a robust 33% operating margin, substantially higher than Microsoft and Google’s cloud businesses. AWS’s backlog of $195 billion provides strong revenue visibility and serves as an effective hedge against market cycle fluctuations. Analysts expect AWS growth momentum to rebound above 20% in Q3 2025 as capacity constraints ease.

In the context of increasing market concentration in cloud computing, regulatory risks are becoming a significant external factor for major providers. With Microsoft and AWS combined holding roughly 60% to 80% market share, regulators such as the UK Competition and Markets Authority (CMA) have intensified antitrust scrutiny, focusing on licensing policies and customer lock-in practices. Microsoft faces higher regulatory risk due to its longstanding practice of bundling Office software with Azure, with potential fines reaching up to 10% of global revenue.

In contrast, AWS’s open platform strategy and diverse client base mitigate regulatory exposure. Google, while currently less targeted by regulators, faces competitive constraints due to its smaller market share.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates