Despite Berkshire’s Profit Drop, Buffett’s Long-Term Thesis Still Deserves Your Trust

21:00 August 3, 2025 EDT

Key Points:

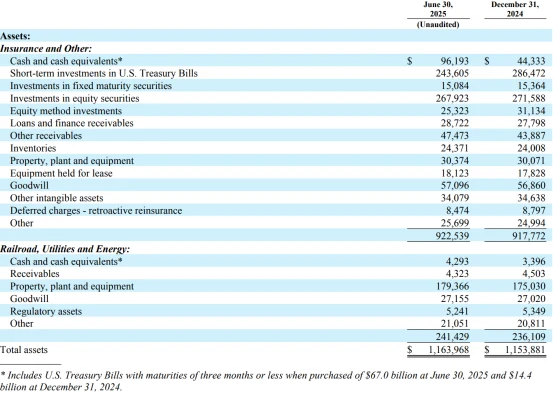

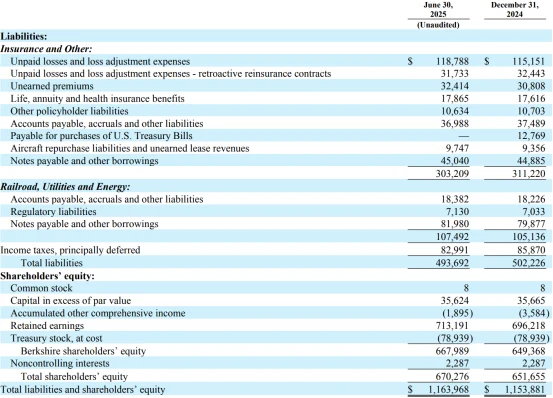

In Q2 2025, Berkshire Hathaway reported revenue of $92.515 billion, down 1.2% year-over-year, and net income of $12.37 billion, marking a steep 59% decline from the prior year.

The company took a $3.76 billion impairment charge on its investment in Kraft Heinz, reducing the asset’s book value to $8.4 billion.

Berkshire has now been a net seller of equities for 11 consecutive quarters, executed no share buybacks this quarter, and warned that U.S. tariff policies may negatively impact both its operating businesses and equity holdings.

As Warren Buffett prepares to retire, Berkshire Hathaway released its Q2 2025 financial results during a period of transition. While both revenue and earnings surpassed market expectations, the sharp year-over-year declines signal growing pressure on earnings quality. The renewed impairment charge on its investment portfolio has prompted investors to reassess the effectiveness of the company’s capital allocation — once a hallmark of “margin of safety” investing.

That said, the company’s stable asset structure, strong cash position, and resilient performance across core business segments reinforce the validity of Berkshire’s long-term investment logic. The core message of this report is clear: despite near-term earnings pressure, Berkshire maintains a fundamentally sound operating base, and the essence of Buffett’s long-termism remains intact.

Profits Plunge

In the second quarter of 2025, Berkshire Hathaway reported revenue of $92.515 billion, down 1.2% year-over-year. Net income came in at $12.37 billion, marking a steep 59% decline from the same period last year. The sharp earnings drop was primarily driven by a significant contraction in net investment income, which plunged from $18.75 billion in Q2 2024 to just $4.97 billion this quarter—a decline of more than 73%.

Source: Berkshire Hathaway

Against the backdrop of heightened macroeconomic uncertainty and elevated market volatility, such dramatic fluctuations in investment returns have challenged Berkshire’s ability to maintain earnings stability. This earnings profile—heavily influenced by the fair-value swings of financial assets—stands in contrast to the firm’s longstanding reputation for counter-cyclical, resilient operations.

While earnings per share (EPS) reached $8,601—well above the consensus estimate of $7,443—it remained significantly below the $21,122 recorded a year ago, signaling a meaningful deterioration in earnings quality.

Despite the sharp decline in overall profitability, Berkshire's core operating businesses continued to show positive momentum, partially offsetting the impact of investment losses. Still, in the face of adverse external factors, these operating gains were not enough to fully absorb the investment-related drag on earnings.

Breaking down the operating segments, BNSF Railway saw a 19% year-over-year profit increase, supported by a recovery in U.S. manufacturing activity and a rebound in logistics demand. As parts of the economic cycle begin to stabilize, freight transportation demand appears to be regaining strength. The energy segment posted a 7.2% rise in profits, continuing to generate reliable cash flows. Manufacturing, service, and retail operations delivered $3.6 billion in operating profit, up 6.5% from the prior year—evidence of Berkshire’s solid positioning in lower-volatility consumer and industrial sectors.

Source: Berkshire Hathaway

However, performance in the insurance business revealed vulnerabilities. While underwriting profit reached $2.5 billion, the segment absorbed a $1.2 billion charge related to wildfires in Southern California, driving a 12% decline in underwriting revenue year-over-year. On the investment side, insurance-related gains rose just 1.4%, offering limited relief.

Taken together, Berkshire’s operating businesses remain on a growth path. Yet their capacity to shield overall profitability from external shocks—such as natural disasters and currency fluctuations—appears increasingly constrained, calling into question the perceived structural insulation of the firm’s earnings engine.

A Rare Misstep

This quarter, Berkshire Hathaway recorded a $3.76 billion impairment on its investment in Kraft Heinz, reducing the asset’s book value to $8.4 billion. This marks the company’s second major write-down on Kraft Heinz in the past six years. Since the initial $12.9 billion impairment in 2019, total write-downs now amount to $16.66 billion—well in excess of Berkshire’s original investment cost.

Looking back at Warren Buffett’s 2015 strategic push to merge Kraft and Heinz, nearly every pillar of the investment thesis has fallen short—whether in expected synergies, brand moat strength, or alignment with evolving consumer preferences. The anticipated cost efficiencies failed to materialize; integration costs remained elevated and margins saw no meaningful improvement. The company was slow to respond to consumer trends toward healthier and more personalized products, and an overemphasis on cost-cutting over innovation drained momentum from core product categories.

Kraft Heinz’s stock is currently trading around $27.40—more than 60% below its 2016 peak—while the S&P 500 has surged over 200% during the same period. From a long-term return perspective, the position has clearly underperformed the broader market. This misstep highlights an aging investment logic in Berkshire’s approach to legacy consumer brands—now increasingly out of sync with a market environment driven by AI and digital innovation.

Source: TradingView

It’s worth noting, however, that despite the steep markdown in book value, Berkshire has still realized a total return of nearly 60% on the investment, thanks to preferred shares with high-yield dividends and favorable deal terms. This underscores Buffett’s continued prowess in securing superior transaction structures—far beyond the reach of ordinary investors. Still, it does not negate the underlying misjudgment in the original investment thesis.

Capital Allocation Turns Conservative

The earnings report shows that as of the end of Q2, Berkshire Hathaway held $344.1 billion in cash and cash equivalents, slightly down from $347 billion at the end of Q1, but still near historical highs. Additionally, the company has net sold shares for 11 consecutive quarters, with net sales reaching $4.5 billion in the first half of 2025. No share repurchases were conducted during this quarter.

This capital allocation strategy reflects management’s cautious stance toward current asset valuations and the macroeconomic environment, as well as a lack of sufficiently attractive new investment opportunities.

Moreover, the report specifically highlights the potential risks posed by the latest round of “reciprocal tariffs” introduced under the Trump administration, especially impacting consumer goods and cross-border businesses. Berkshire clearly states that nearly all its operating units could face negative impacts, and the rising policy risks are expected to further compress the company’s future earnings flexibility.

As of August 1, 2025, Berkshire Hathaway Class A shares traded at $711,480, up 4.49% year-to-date—slightly underperforming the S&P 500’s 6.06% gain over the same period. However, since Buffett’s retirement announcement in May that he will step down at the end of the year, the stock has dropped more than 10% from its peak, significantly underperforming the broader market.

Source: TradingView

Market concerns about Berkshire’s capital allocation capabilities and the continuity of its management style in the “post-Buffett era” remain a core reason behind the current valuation pressure. Since Buffett’s retirement announcement for late 2025, investors have questioned whether his successor can maintain the disciplined investment approach and long-term strategy that have defined the company, while also doubting the firm’s ability to navigate the current macro and policy uncertainties. This gap in expectations is driving the market’s short-term pricing of Berkshire’s shares.

However, looking through a longer-term lens, Berkshire’s performance track record and financial structure remain solid, offering systemic advantages. From 1965 to 2024, the company achieved a compound annual growth rate (CAGR) of 19.9%, significantly outperforming the S&P 500’s 9.9% over the same period. In 2024 alone, the stock rose 25.5%, marking nine consecutive years of positive returns. The insurance business continues to generate stable float exceeding $170 billion, providing a sustained source of low-cost capital.

Source: TradingView

While the current valuation lacks strong catalysts, Berkshire remains a rare compound asset for patient, risk-tolerant long-term investors. The key variable for its revaluation going forward will be how the market reassesses the sustainability of the Buffett investment philosophy in the company’s next chapter.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates