Market Update: New Reciprocal Tariffs Kick In Aug. 7, ISM Services Index Ahead, September Rate Cut Hopes Build

12:00 August 3, 2025 EDT

FoolBull Brings You This Week’s Market Highlights

Market Focus

New “Reciprocal Tariffs” to Take Effect on August 7

On July 31, the White House issued an executive order to reset tariff rates for certain countries under the new "reciprocal tariffs" framework. According to Annex 1 of the order, specified countries will be subject to individualized tariff rates, while all others will face a uniform 10% rate. In addition, any country or region that attempts to circumvent tariffs through transshipment will be subject to a 40% transshipment tax.

As stated in the White House announcement, the new tariffs will not take effect until August 7, leaving a window for countries to enter negotiations to lower their tariff rates.

The list released by the White House shows that major economies with agreements with the U.S., such as the EU and Japan, have secured relatively favorable rates. In contrast, Switzerland and South Africa will face punitive tariffs of up to 39% and 30%, respectively. India will face a 25% tariff, while goods from Taiwan and Vietnam will be taxed at 20%. Cambodia, Thailand, Malaysia, and Indonesia will face tariffs of 19%.

ISM Services Index on Watch as September Rate Cut Bets Rise

The July ISM Non-Manufacturing PMI, scheduled for release on August 5, will be closely watched. The previous June reading came in at 50.8, with a sharp contraction in the employment sub-index. A further deterioration could reinforce market expectations for a Fed rate cut in September.

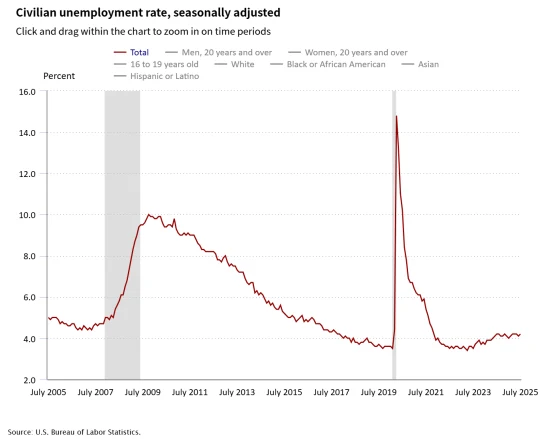

On Friday, the July nonfarm payrolls report came in far below expectations. The U.S. economy added just 73,000 jobs last month, and the prior two months’ figures were revised down by a total of 258,000. The unemployment rate rose to 4.2%.

Source: U.S. Bureau of Labor Statistics

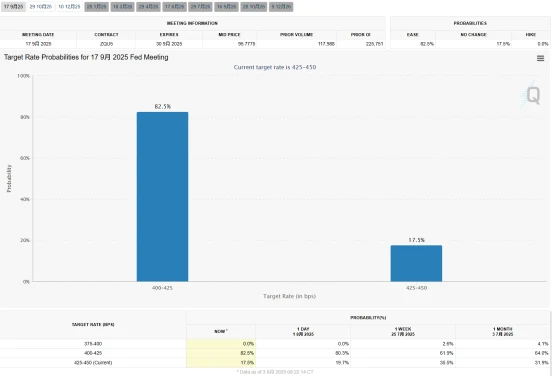

Following the release of the jobs report, expectations for a September rate cut surged. As of now, markets are pricing in an 82.5% chance of a cut next month.

Source: CME Group

In response to the jobs data, President Donald Trump posted on Truth Social calling for Fed Chair Jerome Powell to resign. Trump noted that Fed Governor Adriana Kugler, appointed by former President Biden, had already announced her resignation, and suggested that she did so because “Powell got it wrong on rates.” He argued that Powell should also step down.

Trump also used social media to accuse Bureau of Labor Statistics Commissioner Erica McEntarfer of inflating employment numbers ahead of the 2024 election to benefit former Vice President Kamala Harris. He demanded her immediate dismissal and replacement by a “more capable” official. Furthermore, he stated that if Powell still refuses to cut rates, the Fed Board should take control.

Several Fed officials are set to speak this week, including St. Louis Fed President Alberto Musalem, a 2025 voting member of the FOMC. Previously, Musalem stated that tariffs’ inflationary impact will take time to materialize, signaling caution on rate cuts. With signs of a cooling labor market, markets will closely monitor whether his tone on the policy outlook shifts.

Eight OPEC+ Members Agree to Raise Output in September

During Sunday’s meeting, eight OPEC+ member countries agreed to increase oil production by 548,000 barrels per day in September. This move is part of OPEC+’s phased unwinding of production cuts that began in April 2025. If implemented, the cumulative production increase since April will reach 2.47 million barrels per day—about 2.5% of global demand.

The next OPEC+ meeting is scheduled for September 7. The group plans to reassess its 1.66 million barrels-per-day output increase plan by the end of December.

S&P 500 Earnings Growth Slows in Q2 Despite Beating Expectations

The Q2 earnings season is more than halfway through. Analysts had previously projected that S&P 500 companies would post 5% earnings growth for the quarter—marking the slowest pace since Q4 2023 and a sharp deceleration from Q1’s 13% growth.

However, the actual numbers have exceeded expectations. Over 90% of S&P 500 companies have reported so far, with Q2 EPS growing 10.9% year-over-year—above the 8.9% expected at the start of earnings season. Roughly 79% of companies have beaten earnings estimates.

Performance has varied widely across sectors. Technology and communication services are expected to drive earnings growth, with the two sectors combined posting a 20% increase. In contrast, the energy sector is forecast to report significant declines. Consumer companies have posted the lowest beat rate, with major players like Starbucks and Procter & Gamble missing estimates—sparking concerns that weakening consumer spending may drag the economy toward recession.

This week, Dow components Disney, McDonald’s, and Caterpillar will report earnings, offering investors additional insight into the broader health of the U.S. economy.

Market Recap

All three major U.S. stock indexes ended last week lower. The S\&P 500 fell 2.4%, marking its worst weekly performance since May 23. The Dow Jones Industrial Average dropped 2.9%, its steepest weekly loss since April 4. The Nasdaq declined 2.2% over the week.

Source: TradingView

Markets Face Key Economic Data and Events:

The labor market is flashing warning signs. July nonfarm payrolls came in below expectations, and the unemployment rate ticked higher. Revisions to May and June jobs data were sharply negative. The weak labor data has heightened concerns about slowing economic growth and pressured equity markets.

Meanwhile, ongoing uncertainty surrounding trade policy continues to weigh on sentiment. Although the newly reached U.S.-EU trade agreement brought better-than-feared tariff terms, the Trump administration’s adjusted tariff framework—set to take center stage on August 1—has raised investor anxiety. Markets fear the new measures could hurt global trade and economic activity, impacting corporate earnings and investor sentiment.

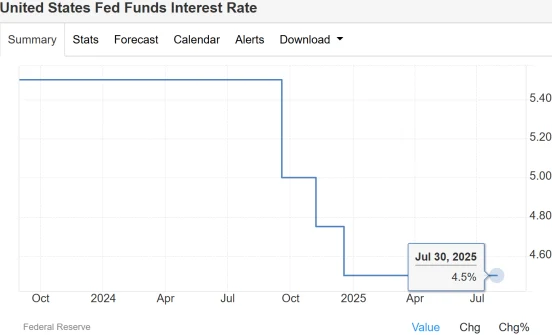

Additionally, although the Federal Reserve kept its benchmark interest rate unchanged at its latest policy meeting, uncertainty remains around the future rate path. Investors are watching closely how interest rate policy may affect economic momentum and corporate profitability.

Source: TradingEconomics

As earnings season continues, results have been a mixed bag. While tech giants like Meta and Microsoft delivered strong reports, Amazon saw a sharp post-earnings selloff after offering weaker-than-expected operating income guidance. The uneven performance has introduced both upside and downside volatility across the market.

Investors are also closely tracking corporate commentary on AI-related spending. These insights are being used to evaluate the sustainability of AI investments, which is increasingly driving performance across individual stocks and sectors.

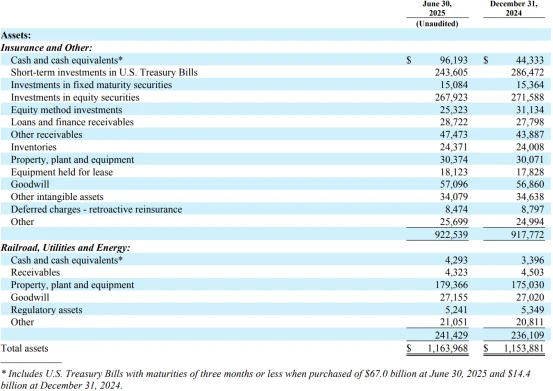

On August 2, Berkshire Hathaway reported Q2 revenue of \$92.515 billion—above expectations but down 1.2% year over year. Net income came in at \$12.37 billion, also beating estimates of \$10.703 billion, but down a steep 59% from a year ago. The earnings decline was largely attributed to a \$3.76 billion impairment on its investment in Kraft Heinz.

Source: Berkshire Hathaway

The company disclosed that it was a net seller of \$4.5 billion in stocks during the first half of 2025—marking its 11th consecutive quarter of net equity sales. No share repurchases were reported. Berkshire also warned in its filing that the Trump administration’s newly implemented tariff measures could negatively affect “nearly all operating businesses,” particularly in consumer goods.

Following the earnings release, Berkshire Hathaway Class B shares fell 1.1% in after-hours trading. Despite revenue and net income beating expectations and strength in its GEICO insurance unit, a combination of headwinds—including the Kraft Heinz writedown and trade-related concerns—kept investor enthusiasm muted.

Source: TradingView

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates