Tariff Hit Milder Than Expected, Apple’s Q3 Revenue Growth Hits 3-Year High

05:30 August 1, 2025 EDT

Key Points:

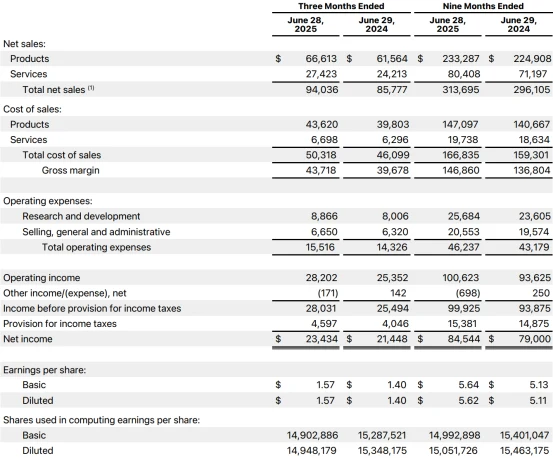

Apple Inc. (AAPL.US) reported fiscal Q3 2025 revenue of $94.04 billion, up 9.6% year-over-year. Earnings per share came in at $1.57, marking a 12.1% increase—both metrics exceeded analyst expectations.

Strong iPhone and Mac sales, a return to revenue growth in Greater China, and tariff-driven front-loaded demand contributed to the better-than-expected quarterly performance.

Despite Apple’s continued stability in an environment of elevated interest rates and rising trade policy uncertainty, the company’s growth narrative may be entering a phase of repricing.

In fiscal Q3 2025, Apple (AAPL.US) delivered results that surpassed market expectations. Against headwinds including tariff pressure, lagging AI transformation, and intensifying competition in the China market, the company posted 9.6% year-over-year revenue growth—the fastest pace since the end of 2021. Robust iPhone and Mac sales, a return to revenue growth in Greater China, and accelerated purchases ahead of expected tariff hikes all contributed to the strong quarter.

Following the earnings release, Apple’s shares rose more than 4% in after-hours trading, before paring gains to around 2% at the time of writing—still marking a notable uptick.

Source: TradingView

However, the company continues to face real challenges: its AI roadmap has yet to deliver a breakthrough, hardware innovation remains muted, and the sustainability of its growth trajectory is still uncertain.

Fastest Growth in Three Years

Apple reported fiscal Q3 2025 revenue of $94.036 billion, up 9.6% year-over-year and above market expectations of $89.3 billion. Net income reached $23.434 billion, a 9.3% increase from the prior year. Earnings per share (EPS) came in at $1.57, well ahead of the $1.43 consensus estimate. Gross margin stood at 46.5%, near the high end of the company’s guidance range.

Source: Apple

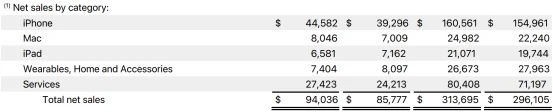

The rebound in quarterly performance was primarily driven by a sharp recovery in iPhone sales. iPhone revenue rose 13.5% year-over-year to $44.582 billion, accounting for nearly half of Apple’s total revenue—well above last quarter’s sub-2% growth. This reflects a short-term boost from government subsidies (“Guo Bu”) in China and front-loaded demand due to anticipated tariff hikes.

The services segment maintained steady expansion, with revenue reaching $27.423 billion, up 13.3% year-over-year. With nearly 29% of total company revenue, services have become a key stabilizing force for Apple amid broader market cycles.

Source: Apple

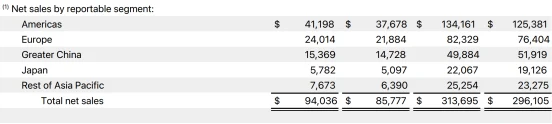

Regionally, Apple saw continued growth in the Americas and Europe, with revenue up 9.3% and 9.7% year-over-year, respectively. Notably, Greater China revenue rose 4.35%—reversing from negative growth in the previous quarter and marking the first year-over-year increase in nearly two years.

Source: Apple

iPhone sales and China’s “Guo Bu” subsidy program (consumer electronics incentives) were the main catalysts. According to IDC, Q2 2025 smartphone shipments in China fell 4% year-over-year to 69 million units. Apple shipped 9.6 million iPhones, down just 1.3%, outperforming the market average. High average selling prices helped sustain revenue growth. CEO Tim Cook highlighted that iPhone active installed base hit a record high and that the MacBook Air was the top-selling notebook in China.

Management emphasized that China’s subsidy program significantly supported product sales, especially for iPhone and Mac. iPhone installed base in the region again reached a record level, underscoring continued brand stickiness among Chinese consumers.

However, this growth is largely built on the back of government subsidies and price promotions. Whether it is sustainable over the long term remains to be seen.

Tariff Impact Manageable

Starting in April 2025, the Trump administration imposed new tariffs on key Apple production hubs, including a 25% levy on imports from India and Vietnam. As a result, Apple incurred an $800 million increase in costs this quarter—lower than the $900 million previously estimated. CEO Tim Cook noted that tariffs drove a 1% revenue boost as consumers rushed to buy iPhones and Macs ahead of anticipated price hikes.

Apple expects tariff-related costs to reach $1.1 billion next quarter, with full-year impacts likely to exceed $2 billion.

Despite the cost pressure, management still projects revenue growth in the mid-to-high single-digit range for the next quarter, suggesting that front-loaded demand has not yet been fully exhausted. On margins, the company maintained gross margin guidance of 46% to 47%, indicating that the current level of tariff impact has yet to materially erode profitability.

That said, while tariffs may have temporarily lifted demand, sustained cost pressures could force Apple to raise prices or make structural changes to its supply chain over time. Roughly 60% of Apple’s production depends on India and Vietnam, where tariffs are directly inflating manufacturing and logistics costs. In 2024, India accounted for 14% of Apple’s global iPhone production, with Vietnam contributing 20%.

According to Bank of America analysts, if tariffs persist, Apple’s gross margin in Q1 of fiscal 2026 could drop to 45%. For every $1 billion in additional tariff costs, gross margin may decline by approximately 50 basis points. While early consumer demand is helping to offset some of the burden in the short term, longer-term pressures could lead to price increases or supply chain optimization. Additional retaliatory tariffs from China or India could also disrupt Apple’s production footprint further.

Lagging AI Strategy

Apple reiterated its commitment to AI this quarter, with CEO Tim Cook calling it “one of the most profound technologies of this generation.” The company disclosed it has acquired seven AI-related firms this year. However, Apple has yet to unveil a clear AI product roadmap or breakthrough features, falling significantly behind tech giants like Microsoft, Google, and Meta.

Source: Apple

At the 2025 WWDC, Apple introduced Apple Intelligence, upgrading iOS, iPadOS, and macOS. Yet investor reaction was muted, largely due to concerns over the delayed release of an enhanced Siri AI. Against the backdrop of OpenAI, Anthropic, and others rapidly advancing AI hardware and platform ecosystems, Apple risks losing long-term device loyalty if it cannot build a comprehensive AI strategy around semantic models, inference chips, and on-device AI capabilities.

Source: Apple

Meanwhile, AI features on Android devices now cover over 1 billion units, gradually eroding Apple’s ecosystem stickiness. Data shows that in Q2 2025, global smartphone AI penetration reached 15%, while Apple’s penetration lagged at just 8%. In the upcoming AI-driven upgrade cycle, Apple faces the risk of being marginalized.

This is already reflected in the numbers. This quarter, iPad sales fell 8.1% year-over-year, and wearables, home, and accessories declined 8.6%, extending a multi-quarter weakness.

The iPad’s underperformance mainly stems from delayed product refreshes, while the ongoing decline in wearables highlights a lack of innovation and waning consumer appetite. This trend limits the overall growth of Apple’s hardware business and poses challenges to mid-to-long-term product diversification.

Prospects and Risks

From the current perspective, Apple’s Q3 earnings demonstrate solid short-term operational resilience. The company has effectively navigated high tariff pressures through product recovery, market subsidies, and pricing strategies. However, looking further ahead, Apple faces structural challenges including a lagging AI strategy, weak hardware innovation, and diminishing growth potential in its services segment.

Key points to watch in the coming quarters include whether the next-generation iPhone can trigger a fresh upgrade cycle, if AI capabilities can deliver meaningful on-device innovation, and whether Apple can strengthen its pricing power in overseas markets to offset ongoing tariff-related margin pressures.

In the short term, Apple has successfully weathered external shocks with better-than-expected results. But over the medium to long term, if its AI strategy continues to lag and hardware innovation remains sluggish, the company’s premium business model and market leadership may no longer command an unconditional valuation premium.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates