You Can’t Afford to Miss This High-Yield Energy Stock

12:03 July 31, 2025 EDT

In the current macro environment of elevated interest rates and increased market volatility, asset classes with stable cash flows, clear dividend policies, and growth capabilities are receiving growing attention from institutional investors. Energy Transfer LP (NYSE: ET), as one of the largest midstream oil and gas infrastructure operators in the United States, possesses solid profitability, a well-defined growth trajectory, and sustainable dividend coverage, making it an attractive option for conservative and long-term investors.

At present, the stock’s valuation remains reasonably low, offering an entry point for investors seeking stable return assets.

Source: Energy Transfer

High Dividend with a Margin of Safety

Energy Transfer is a master limited partnership (MLP) operating the largest midstream energy infrastructure network in the United States, covering natural gas, crude oil, natural gas liquids (NGL), refined products, and liquefied natural gas (LNG) businesses.

As of the end of July 2025, Energy Transfer’s dividend yield stands at approximately 7.9%, ranking among the higher yields within comparable midstream MLPs. In comparison, the Alerian MLP ETF, which tracks the sector, offers an average dividend yield of 7.1%, while the S&P 500’s average dividend yield is around 1.3%.

Despite the relatively high dividend yield, Energy Transfer maintains a safe distributable cash flow coverage ratio. In the first quarter of 2025, the company generated $2.3 billion in distributable cash flow, while actual dividend payments totaled about $1.1 billion, resulting in a coverage ratio exceeding 2.0x—well above the industry standard of approximately 1.3x. This structure ensures the company can sustain stable dividends and capital expenditures without relying on external financing.

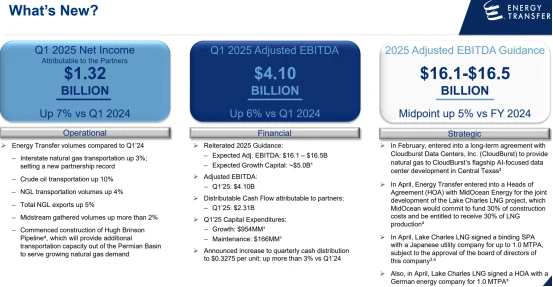

Energy Transfer’s solid financial performance provides a strong foundation for maintaining its high dividend policy. In the first quarter of fiscal 2025, the company reported revenues of $21.02 billion and adjusted EBITDA of $4.1 billion, representing a year-over-year increase of 5.67%, primarily driven by continued growth in pipeline throughput. Distributable cash flow (DCF) attributable to common partners reached $2.31 billion, 2.1 times the dividends distributed during the quarter, meaning that after paying $1.1 billion in dividends, approximately $1.2 billion remained available for capital expenditures and debt repayment. This cash flow coverage places the company among industry leaders.

Net income during the same period was $1.72 billion, up 1.65% year-over-year, while earnings per share (EPS) increased 15.63% to $0.37, reflecting ongoing improvements in the company’s earnings structure.

Source: Energy Transfer

Looking at the medium to long term, the company’s EBITDA has grown from $10.5 billion in 2020 to $15.5 billion in 2024, representing a compound annual growth rate (CAGR) of 10.2%. Management projects EBITDA to further increase to between $16.1 billion and $16.5 billion in 2025, reflecting a year-over-year growth rate of 3.9% to 6.5%. The current leverage ratio stands at 4.1x, near the lower bound of its long-term target range of 4.0 to 4.5x, supporting its investment-grade credit rating (S&P BBB). Additionally, the company holds $6.5 billion in liquidity reserves and repaid $1.2 billion in debt during 2024, demonstrating ongoing balance sheet improvement.

Source: Energy Transfer

Notably, Energy Transfer has improved its financial leverage over the past three years. At the end of 2020, the company’s net debt to EBITDA ratio exceeded 5.5x but had decreased to 4.2x by Q1 2025, approaching the company’s target lower limit of 4.0x. Credit rating agencies Moody’s and S&P have both maintained stable outlooks on its investment-grade ratings.

Over the past 12 months, the company generated approximately $3.4 billion in free cash flow (FCF), indicating that after covering dividends, operations, and capital expenditures, a significant surplus remains available for debt repayment and potential acquisitions. This provides a financial buffer to support future capital spending expansion or refinancing efforts.

Diversified Business Model

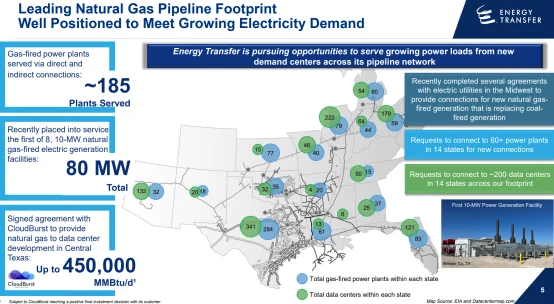

Energy Transfer’s core competitive advantage lies in its highly integrated and diversified asset portfolio. The company operates over 120,000 miles of pipelines, covering the transportation, processing, and storage of crude oil, natural gas, natural gas liquids (NGL), and refined products. Additionally, it owns multiple terminals, compression facilities, and export assets, holding a leading position especially in U.S.-Mexico border and Gulf of Mexico export operations.

Source: Energy Transfer

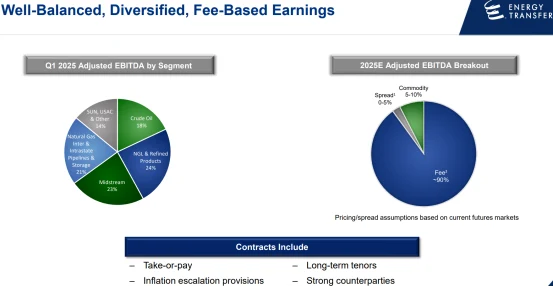

In fiscal year 2024, approximately 90% of the company’s EBITDA was derived from fee-based contract revenues, a significant portion of which are regulated or structured as take-or-pay contracts. This revenue model insulates cash flows from commodity price volatility, providing investors with clear cash flow visibility and reducing earnings variability.

Among its operating assets, the natural gas midstream segment is the largest contributor, accounting for roughly 50% of total EBITDA. The NGL business and crude oil transportation operations represent about 30% and 15%, respectively, with the remainder coming from terminals and other ancillary facilities. The ongoing energy transition toward decarbonization is driving growth in natural gas-fired power generation, and the company is actively investing in new pipeline infrastructure and processing capacity within its natural gas segment.

Projected Expansion

Energy Transfer maintains disciplined capital investment strategies. For fiscal year 2025, the company expects capital expenditures of approximately $5 billion, primarily directed toward expanding natural gas processing capacity, upgrading export terminals, and constructing new pipeline systems. Most of these projects are scheduled to come online between the second half of 2026 and early 2027, with anticipated incremental EBITDA contributions in the range of $700 million to $1 billion annually.

Beyond organic growth, the company has continued its pace of strategic acquisitions. Between 2023 and 2024, Energy Transfer completed the integration of three key assets—Crestwood Equity, WTG Midstream, and Lotus Midstream—with a combined transaction value exceeding $12 billion. These acquisitions not only strengthened the company’s footprint in the Permian Basin, Haynesville, and Delaware Basin but also enhanced logistics efficiency and cash flow stability connecting to export terminals.

Management has repeatedly emphasized that its acquisition strategy prioritizes immediately accretive cash flow, compatibility with the existing network, and long-term growth potential, without compromising capital structure stability. This approach has increased the likelihood of realizing post-acquisition synergies and has been well received by the market.

Source: Energy Transfer

Attractive Valuation

As of the close of U.S. markets on July 31, Energy Transfer’s stock price settled at $18.04. Despite a cumulative decline of 4.62% over the past year, Wall Street remains optimistic. According to The Wall Street Journal, 16 analysts currently hold buy ratings on the stock, with an average price target of $22.67—indicating upside potential of more than 25% from current levels.

Source: TradingView

From a valuation standpoint, Energy Transfer remains undervalued by the market. Its projected EV/EBITDA multiple for 2025 stands at 6.8x, below the industry average range of 7.5x to 8x for U.S. midstream pipeline companies. Additionally, the company’s expected free cash flow yield in 2025 is approximately 10% to 11%, significantly higher than the overall U.S. equity market average of about 3.5%.

This valuation level has yet to fully reflect the company’s stable cash flow generation, sustainable dividend profile, and growth prospects, offering room for potential re-rating.

Although challenges remain, including policy and regulatory uncertainties as well as the ongoing energy transition, Energy Transfer continues to exhibit clear cash flow advantages and attractive valuation metrics. For investors with a moderate risk tolerance, seeking stable cash flow returns and comfortable with the MLP structure, Energy Transfer represents a high-quality allocation opportunity within the U.S. energy infrastructure sector.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates