The value of AI for investors and markets

10:11 August 3, 2025 EDT

On May 6, 2010, the US stock market plummeted nearly 10% in just a few minutes, triggering the historic event known as the "Flash Crash." This crash wasn't caused by breaking news, macroeconomic data, or a change in Federal Reserve policy. According to an investigation by the US Commodity Futures Trading Commission (CFTC), the real trigger was a massive sell order for E-Mini S&P 500 futures contracts initiated by a mutual fund and executed by an algorithm.

This sell order set off a chain reaction, quickly triggering a simultaneous sell-off among other high-frequency trading (HFT) algorithms, exacerbating the market’s decline. Prior to this event, algorithmic trading had remained a relatively limited presence in the market, and the Flash Crash marked a turning point.

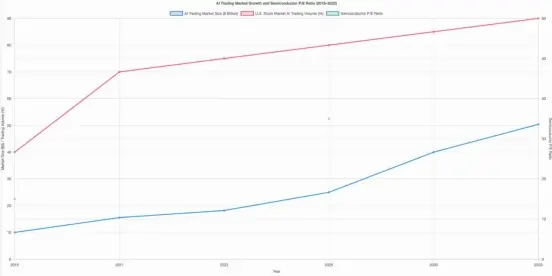

Since then, algorithmic trading has rapidly become mainstream and a vital component of market operations. In recent years, the rapid development of artificial intelligence has further fueled the evolution of trading algorithms, making AI an increasingly crucial player in modern financial markets. AI not only participates in trading decisions but also, to a certain extent, drives the entire market.

Today, a strong macroeconomic outlook or solid technical analysis alone are no longer sufficient to support investor decision-making in the financial markets. Understanding how artificial intelligence (AI) impacts the market, the operating mechanisms, advantages, and potential pitfalls of AI investors has become essential in the current and future investment landscape. Therefore, it's necessary to reexamine how AI actually drives the market.

The development of artificial intelligence

Artificial intelligence is rapidly reshaping the way financial markets are researched and traded, outperforming human analysts and even surpassing traditional, non-AI algorithms. By processing vast amounts of price data, financial reports, macroeconomic indicators, and market sentiment, AI can quickly identify trends and provide profound insights with efficiency and accuracy far beyond the reach of manual labor or traditional models.

More importantly, artificial intelligence is completely based on data, eliminating human emotions and biases, ensuring that every decision is more calm, rigorous and rational.

Currently, investors are incorporating artificial intelligence into their strategies in a variety of ways. These include BlackRock's Aladdin system, which uses AI to analyze stock prices, returns, and macroeconomic data in real time, optimize portfolio allocation, and help institutional investors dynamically manage risk and return in complex markets. TradeRiser uses natural language processing technology to monitor social media, news, and earnings calls, extract market sentiment, and proactively identify potentially bullish or bearish "hot" stocks for investors. CopyTrader enables retail investors or institutions to replicate the trading strategies of top investors in real time, narrowing the cognitive gap between ordinary investors and professionals. AI stock selection models can quantitatively evaluate individual stocks such as Apple based on classic value investment concepts such as Ben Graham's, reconstructing the integration of traditional investment philosophy with modern intelligent tools. Neural networks can mimic the structure of the human brain, capture complex nonlinear patterns, and identify deep relationships that traditional models often miss.

Artificial intelligence is fundamentally changing the way we understand markets and formulate strategies, driving financial decision-making into a new era of greater efficiency and intelligence.

The value of AI for investors and markets

Compared to traditional research, which often takes hours or even days, AI can process vast amounts of data in real time, quickly identifying market patterns and dynamically adjusting portfolios or generating trading strategies. This rapid response is especially crucial during periods of extreme market volatility, as witnessed in April of this year.

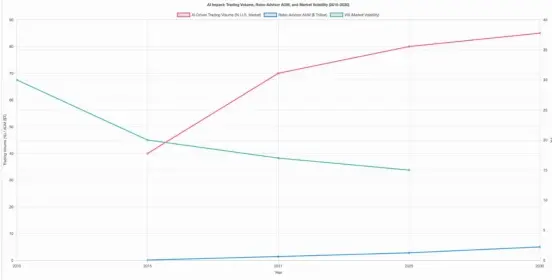

Beyond speed, AI also significantly reduces investment management costs. Compared to traditional advisors who rely on highly paid research teams, AI-powered advisory platforms like Betterment and WealthFront charge a fraction of the cost, significantly increasing the accessibility of asset management.

The characteristics of "low cost and high intelligence" are driving the financial market to become more accessible to the public - AI is delegating institutional-level insights to retail investors, allowing ordinary investors to have analytical and trading capabilities that were previously only available to large institutions.

More importantly, AI is not only changing investor behavior but also optimizing market structure. AI trading algorithms are improving market liquidity and pricing efficiency, rapidly identifying and correcting short-term mispricings, thereby reducing volatility and stabilizing the market. For example, during the 2010 flash crash, if AI systems had been deployed at scale earlier, they might have mitigated or even prevented the dramatic sell-off.

Of course, there are also doubts: if AI had been available at the time, would it have exacerbated volatility? This is exactly the question we will explore next.

Market risks brought by artificial intelligence

While AI investment tools bring efficiencies and advantages, they are not without hidden dangers.

Consider the 2010 "flash crash," where a large, algorithm-driven sell order triggered market panic within minutes. With the widespread adoption of AI in the market, similar programmatic risks are likely to intensify. This is because an increasing number of models are trading based on similar data sources and logic, potentially leading to highly consistent responses to certain triggering events, exacerbating market volatility and even triggering systemic risk.

Although advanced AI systems have stronger anomaly recognition and risk control capabilities than traditional algorithms, and can theoretically detect and block potential collapses earlier, it must be acknowledged that the speed with which they respond to information may also become an amplifier of fluctuations.

The double-edged sword of speed and emotion

One of the advantages of AI trading is its ability to instantly capture market sentiment and make trading decisions accordingly. However, this capability can also lead to significant volatility in the face of unexpected events. Information transmission is no longer measured in hours, but in seconds.

For example, on July 16, 2025, Florida Representative Ana Paulina Luna posted on Platform X that she had learned from President Trump that Federal Reserve Chairman Powell would be immediately replaced. In the past, such rumors might take hours to spread and typically had limited impact until proven false. But in today's AI-driven trading world, relevant engines can crawl this content from social media within seconds, identifying it as a tradable signal and triggering a dramatic reaction in bond and stock markets.

This incident demonstrates that AI can make trading decisions and drive market fluctuations before humans can distinguish true from false. While this can improve efficiency in some cases, it can also trigger drastic price fluctuations and asymmetric reactions due to "fake news" or misinterpretation.

Therefore, in the context of AI increasingly dominating the market structure, how to strike a balance between improving transaction efficiency and controlling systemic risks will be a core issue that must be faced in future supervision and technological evolution.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates