Stock Market, Dollar and Bubbles

18:49 August 1, 2025 EDT

US stocks closed weaker overall for the week, with the market lacking clear direction. The equal-weighted Invesco S&P 500 Equal Weight ETF (RSP) fell approximately 0.6%, while the market capitalization-weighted broad market index was virtually flat, suggesting a temporary downturn. At the start of a week that should have been packed with news, the market appeared remarkably calm, with no significant developments worthy of discussion.

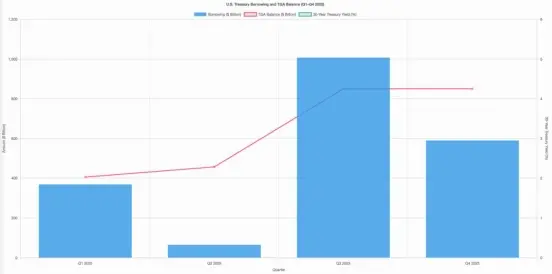

At the same time, the U.S. Treasury announced a new round of financing plans, aiming to rebuild the Treasury General Account (TGA) balance to $850 billion between the end of September and the end of December. This target is significantly higher than expected in April, meaning the Treasury plans to borrow more than $1 trillion this quarter, $453 billion more than previously forecast, and to borrow another $590 billion in the next quarter.

This plan signals that the Ministry of Finance has no intention of changing its current approach and will continue to rebuild the TGA by increasing bond issuance. Most market participants expect this round of financing to primarily involve the issuance of Treasury bills (T-Bills), with the detailed operational plan to be announced on Wednesday morning.

Although interest rates generally did not fluctuate much, the 30-year Treasury yield still rose slightly by 3.5 basis points to 4.96%. Furthermore, the Treasury's rebuilding of the TGA will separate it from the banking system, reducing the budget for funds flowing into the financial market.

In short, even though the stock market appears calm on the surface, the current tight fiscal financing operations are also having an impact on stock market funds, which may lead to fluctuations in financial markets in the future.

It's worth noting that the most significant market fluctuations today occurred in the foreign exchange sector. Following the announcement of the trade deal, the US dollar strengthened significantly, particularly against the euro, which is a significant advantage for the United States. However, uncertainty remains about whether the deal will be implemented, as it still requires ratification by EU member states.

Image source: TradingView

It's worth noting that a stronger dollar not only affects exchange rates but can also have a profound impact on global markets. Because exchange rate fluctuations measure the degree of dollar circulation, a stronger dollar means increased pressure on global exchange rates.

Meanwhile, the overall performance of the US stock market has been relatively stable, with limited volatility. The S&P 500 is approaching overbought territory, with the RSI approaching 70 and the price trading above the upper Bollinger Band. While the index may remain overbought for a period of time during a strong trend, this balance may be difficult to maintain in the context of the continued appreciation of the US dollar and low realized volatility.

The stock market is overbought. Is this time really different?

People always say that.

To be fair, they do have some truth to this one. The current tech boom is fundamentally different from the dot-com bubble of 2000 in many ways. However, behind every "difference" lies a sense of familiarity, and behind every reason for optimism lie risks worth worrying about.

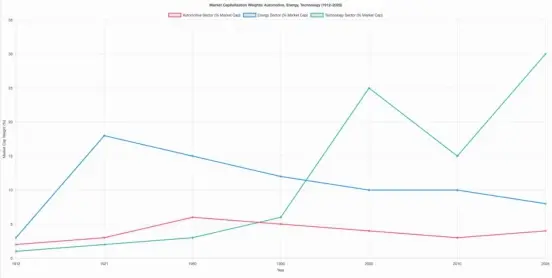

This week’s data chart epitomizes this scenario – it shows that the market capitalization weight of the U.S. semiconductor industry has climbed to a record high.

For optimists, historically, as economies evolve, different industries have always taken turns becoming the dominant players in the capital markets. A rising sector's market capitalization often reflects its growing importance to the economy. For example, the widespread adoption of automobiles fueled General Motors' long-term dominance in the 20th century; the energy sector's market capitalization rose from approximately 3% in 1912 to 18% in 1921, then hovered between 10% and 20% for nearly a century; the technology sector's market capitalization accounted for approximately 6% in the early 1990s and remained around 15% in the decade following the dot-com bubble. And so on.

From this perspective, if we are in a new era driven by artificial intelligence and the importance of semiconductors is increasing, then the rapid increase in their market value share may not only be reasonable, but even healthy.

For pessimists, the question is: Is the current stock market overheated and too fast?

Even acknowledging the long-term value of semiconductors, from a tactical perspective, valuations and market enthusiasm may have exceeded reasonable short-term ranges. Historically, many sectors have experienced sharp corrections after rapid surges in market capitalization, even if they ultimately maintain their role in the economy. For example, the energy industry has repeatedly experienced cycles of extreme booms and severe recessions; multiple industrial sectors have achieved astonishingly high market capitalization at the peak of hype, only to quickly shrink. Even after adjustments, these sectors remain stronger than before the hype, but the declines from their peaks are often dramatic.

In other words, even if "this time is different," the market's pricing of semiconductors may still need time to digest and correct. A rapid rise often means sharp fluctuations are to come. From a cyclical perspective, we are currently in three overlapping cycles: first, the stock market is in the middle of an uptrend, performing strongly; second, we are in a technology hype cycle, with stories surrounding AI, chips, and new energy attracting significant capital; and finally, a bubble cycle, with some asset prices showing signs of excessive speculation.

The most dangerous phase of a bubble cycle is the "melt" phase, when markets accelerate upward amidst extreme euphoria and valuations soar. The dual risks of this phase are that short sellers may exit prematurely, as bubbles often run deeper than anticipated. Furthermore, holders can easily become complacent, and if a trend reversal, such as occurred in April of this year, occurs, the crash can be sudden and swift, as has happened in the past.

Therefore, now is not the time to make rhetorical pronouncements about market direction, but rather to strengthen risk awareness. We need to remain sober, recognize the speculative factors behind the surge, hedge risks through diversification and asset allocation, and, when necessary, utilize hedging tools to protect against a drastic correction, ensuring we are not severely damaged. This is an exciting yet anxious period.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates