Meme stock craze is back

23:09 August 1, 2025 EDT

The Nasdaq has recently traded above its 20-day moving average for an extended period. This doesn't directly signal a crash, but it does suggest the current rebound is unusually persistent. More alarmingly, amidst rapidly growing market complacency, speculative "meme stock" trading is making a comeback, exacerbating market uncertainty.

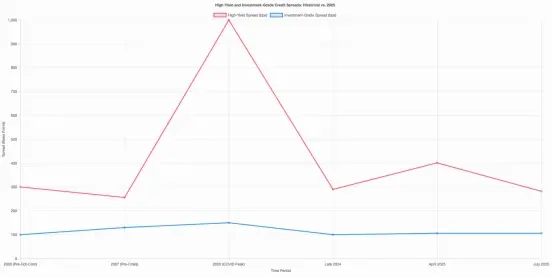

A key indicator of complacency is credit spreads—particularly the difference between high-yield bonds (also known as "junk bonds") and U.S. Treasuries . Currently, spreads for both investment-grade (BAA) and high-yield (BB) bonds are at historical lows, with the latter even approaching levels seen before the dot-com bubble burst in 2000. This suggests that investors have little concern about credit risk.

This extreme market sentiment usually occurs during a strong bull market, but it also often appears on the eve of a market reversal.

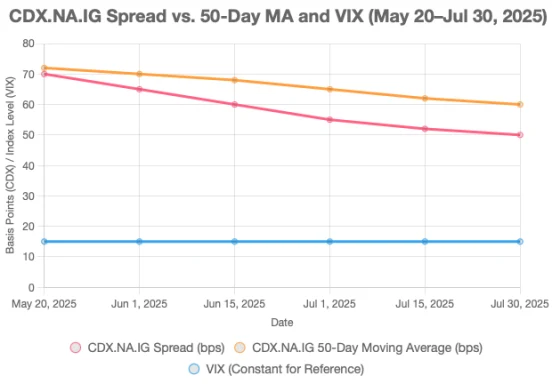

Credit default swaps (CDX) also released similar signals

Sentiment Trader, a sentiment analysis platform, pointed out that the credit default swap index (CDX), which measures risk sentiment in the bond market, has been below its 50-day moving average for nearly 50 consecutive trading days, one of the longest low-level running periods in recent years.

Because the CDX follows a similar trajectory to the VIX (Volatility Index), its low level suggests that bond traders are minimally concerned about future default risk. However, historically, the CDX typically rebounds ahead of the VIX, signaling rising market pressures. Currently, the CDX has yet to reach a turning point, providing a tailwind for the stock market.

Therefore, the current market strategy suggests a more balanced approach, not a time to reduce positions. While we are seeing signs of speculation and excessive optimism, this does not warrant an immediate sell-off or significant reduction in holdings. As Sentiment Trader puts it, "The market can remain complacent for longer."

Therefore, the more reasonable strategy at present is:

Maintain risk exposure, rebalance positions, and closely monitor leading indicators such as CDX and VIX for reversals.

Meme stock craze is back

The speculative atmosphere is not only reflected in the credit market, but also spreads to individual stocks in the stock market.

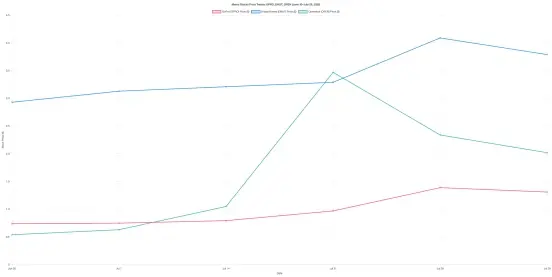

We previously mentioned that Kohl's stock price doubled due to short positions of nearly 50% and concentrated buying by retail investors.

This week, the meme craze continued with GoPro (NASDAQ: GPRO) and Krispy Kreme (NASDAQ: DNUT): First, GoPro soared from $0.80 to $2.70 in just a few days, an increase of more than 230%; Krispy Kreme also increased by more than 100% during the same period, but is still down more than 75% from its 2021 high.

The common characteristics of these stocks are: weak fundamentals, high short ratio, and stock prices that fluctuated sharply after sideways trading at a low level. These are emotion-driven transactions.

The once-forgotten Opendoor stock price soared from $0.50 to $5.00 in two weeks, only to fall back in half, though it remains significantly higher than its starting point. This type of movement is typical of the current meme market.

Summarize

The current market risk appetite is at an extremely high level. Both the credit spread and the CDX index show strong optimism among investors, but there are no signs of a clear reversal.

Meanwhile, the resurgence of meme stocks also reflects a surge in speculative enthusiasm. Therefore, investors should avoid panic selling due to short-term fluctuations and instead maintain a calm and rebalanced approach. However, it's important to closely monitor key risk indicators like the CDX and VIX. If a significant reversal signal emerges, defensive allocations should be promptly increased to prepare for a potential market correction.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates