Gold: Upside Potential Behind the Short-Term Pullback

02:01 August 1, 2025 EDT

Despite mounting pressure from equities, bonds, and a stronger U.S. dollar, gold prices have remained relatively resilient, standing out as one of the few defensive assets in the market. As of writing, spot gold (XAU/USD) is trading at $3,323.98 per ounce, down just 0.09%.

However, over the past week, gold has undergone a notable correction, falling sharply from a mid-to-late July peak of $3,431 per ounce to around $3,300—shedding more than $110 in just six trading sessions. On the surface, gold appears under pressure. Yet this may not be a sign of fundamental weakness, but rather a healthy consolidation phase that could lay the groundwork for the next leg higher.

Source: TradingView

Gold Under Pressure

The recent pressure on gold prices is closely linked to an easing of global trade tensions.

On July 22, the U.S. reached a trade agreement with Japan, followed by a deal with the European Union on tariffs and investment on July 27. These developments significantly reduced the risk of a trade war and injected a sense of certainty into the markets. As a result, the S&P 500 posted six consecutive record-high closes, while the Nasdaq also reached new highs, reflecting surging demand for risk assets. Gold, as a traditional safe haven, saw demand weaken—becoming a primary driver of its price decline.

Source: TradingView

Notably, the EU’s pledge to purchase $750 billion worth of goods during Trump’s current term—including $600 billion in U.S. military equipment—further fueled market optimism. This reduced gold’s appeal as a safe haven and added downward pressure on prices.

At the same time, the inverse correlation between the U.S. dollar and gold prices has been particularly evident in the current environment. As trade agreements were reached, expectations for a de-escalation in global trade tensions lifted demand for the dollar, pushing the dollar index sharply higher. UBS Wealth Management multi-asset strategist Anthi Tsouvali noted that earlier weakness in the dollar driven by high tariff policies has now reversed, with the new trade deals restoring dollar strength. Since gold is priced in dollars, a stronger greenback raises the cost for overseas buyers, dampening demand. This helps explain gold’s continued pullback over the past week and underscores the direct constraint the dollar currently imposes on gold.

Source: TradingView

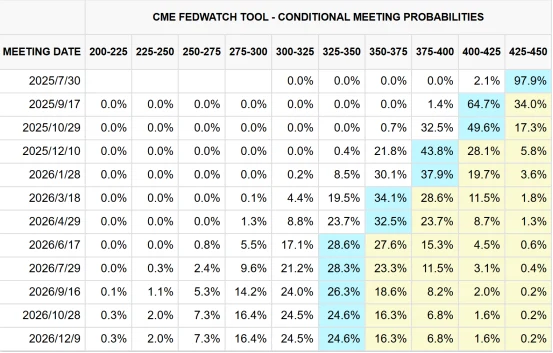

On the macroeconomic front, stronger U.S. employment data and the rising dollar index have added further downside pressure on gold. As a non-yielding asset, gold is highly sensitive to interest rate expectations. The market currently expects the Federal Reserve to keep the federal funds rate steady at 4.25%–4.50% in July. According to the CME FedWatch tool, there is a 43.8% probability of a 50 basis point rate cut by year-end. With little in the way of near-term rate cut signals and a firm dollar, gold’s rebound potential remains limited.

Source: CME

Supporting Factors

Despite the easing of trade tensions, geopolitical factors continue to offer some support for gold. Key issues in the U.S.-China trade relationship remain unresolved, leaving lingering uncertainty and prompting markets to stay alert to potential risks. In addition, escalating tensions in the Middle East could further drive demand for safe-haven assets.

However, these factors are not yet strong enough to offset the downside pressure brought by the recent trade agreements. On the other hand, inflation expectations and rising government debt levels provide longer-term support for gold prices. According to the Congressional Budget Office, the tax and spending legislation signed by President Trump is projected to increase the U.S. deficit by $3.4 trillion over the next decade and lead to millions losing health coverage. The 15% tariff deal could also contribute to higher domestic inflation in the U.S.

Aakash Doshi, Head of Gold Strategy at State Street Global Advisors, noted that rising debt and persistent inflation are likely to weigh on economic growth, forcing the Federal Reserve to adopt a more accommodative policy stance. This would lower real interest rates, indirectly benefiting gold.

Technical Support

Technical analysis shows that gold remains firmly above key support levels despite multiple headwinds. Aakash Doshi has defined $3,000 per ounce as the new baseline, with current prices holding above $3,300.

Despite record highs in the stock market and volatility falling to year-to-date lows, gold has not broken below the critical $3,000 level. Its year-to-date gain of over 26% highlights its resilience.

Source: TradingView

The market appears to be in a consolidation phase, and Aakash Doshi expects sideways movement over the next month. However, the upcoming Federal Reserve meeting could act as a catalyst. He anticipates that Chair Powell may begin laying the groundwork for rate cuts between September and year-end. A weaker dollar could push gold back toward its April highs, with potential to approach $4,000 per ounce before year-end.

Key Takeaway

Historical data suggests that accommodative Federal Reserve policy is supportive of gold prices. In June 2024, the Fed kept the federal funds rate unchanged at the 5.25%–5.5% target range. As inflation expectations rose more rapidly, real interest rates declined, prompting a gain in gold prices that day. At the June FOMC meeting, the Fed revised its 2025 GDP growth forecast down to 1.4% (from 1.7%), raised its core PCE inflation projection to 3.1% (from 2.8%), and increased its unemployment forecast—signaling stagflation risks. If inflation continues to run hotter than expected, gold stands to benefit as a hedge.

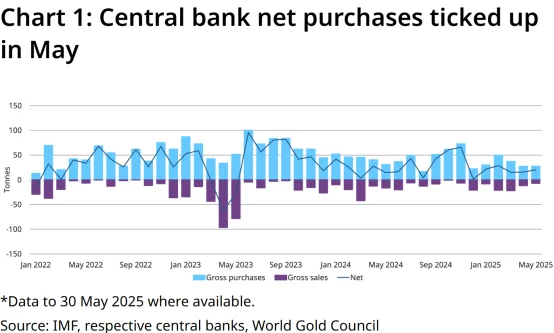

J.P. Morgan Research forecasts gold to reach $3,675 per ounce by Q4 2025, and possibly approach $4,000 per ounce by mid-2026, driven by an annual average of 900 tons in central bank purchases and robust investor demand.

Source: World Gold Council

In the short term, thin summer trading and profit-taking may cap upside potential, but any pullback could present a buying opportunity. Despite elevated equity markets and subdued volatility, gold has remained resilient, holding above key support. Short-term consolidation may offer a strategic entry point, while over the medium to long term, gold’s role as a core hedge in global asset allocation remains intact.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates