The Probability of a September Interest Rate Cut Is Declining

01:54 August 1, 2025 EDT

Key Points:

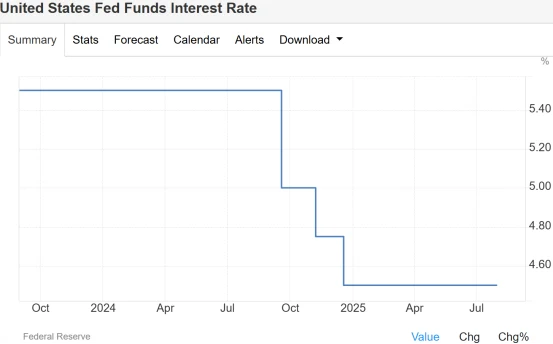

The Federal Reserve kept the federal funds target range unchanged at 4.25%–4.50% during the July FOMC meeting.

Chair Jerome Powell gave no forward guidance on whether the Fed will cut rates in September, stating that “it’s too soon to say.”

Market expectations for a September rate cut have declined significantly. However, if upcoming data show a clear deterioration in the labor market or easing inflationary pressure, a rate cut is still possible.

As broadly expected by the market, the Federal Reserve held rates steady at the July FOMC meeting. However, Fed Chair Jerome Powell did not provide a clear signal regarding a potential rate cut in September during the subsequent press conference. Instead, he emphasized ongoing uncertainties surrounding inflation and tariffs. This stance quickly dampened investor bets on monetary easing in the fall, and expectations for a September rate cut have notably cooled.

Source: TradingEconomics

Powell Sounds Hawkish

The July Fed meeting reflected a cautious balancing act between inflation pressures and a slowing economy.

At its July FOMC meeting, the Federal Reserve held interest rates steady for a fifth consecutive time, keeping the federal funds target range at 4.25%–4.50%. The vote came in at 9–2, with one member absent. Notably, Governors Christopher Waller and Michelle Bowman dissented, both favoring an immediate 25-basis-point rate cut. This marked the first time since 1993 that two Fed governors voted against the majority on a rate decision.

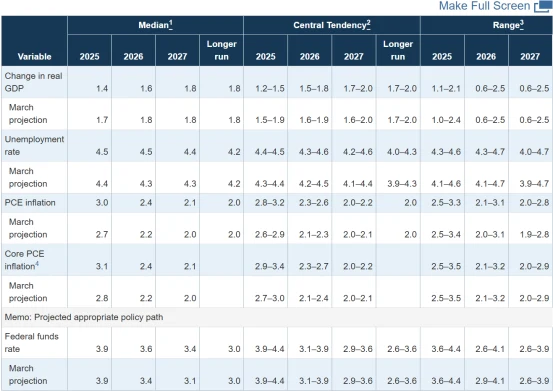

On the economic outlook, the FOMC downgraded its growth forecast for the first half of 2025, lowering expected GDP growth from 2.1% to 1.7%. The unemployment rate projection ticked up slightly to 4.4%, while core PCE inflation expectations were revised upward from 2.5% to 2.7%. However, the statement continued to characterize the labor market as “strong” and inflation as “elevated,” signaling the committee’s overall cautious stance.

Source: Federal Reserve

All eyes were on Chair Jerome Powell’s press conference, where he noted that economic growth had slowed in the first half of the year but that the labor market remained resilient and inflation was still above target. He added that while the inflationary impact of tariffs may be transitory, their transmission effects remain uncertain. Powell reiterated that current rates are “modestly restrictive” and emphasized that future rate decisions would be data-dependent. With two more jobs and inflation reports due before the September meeting, those releases will be critical.

Powell declined to offer forward guidance on a potential September cut, saying, “It’s too soon to say.” This statement diverged notably from prior market expectations and dampened optimism around near-term rate cuts.

Of note, Powell’s reluctance to provide forward guidance comes just as former President Donald Trump has publicly pressured the Fed. Trump recently claimed, “I hear they’re going to cut rates in September,” in a clear push for looser monetary policy. Analysts suggest Powell’s more hawkish tone reflects both concern about lingering inflation and transmission lags, as well as a renewed effort to defend the Fed’s independence.

Market Expectations Adjust

Ahead of Powell’s remarks, markets had priced in a 65% probability of a rate cut in September based on interest rate swaps. However, following his comments, that probability quickly dropped to around 41%.

According to the CME FedWatch Tool, markets now assign a 57.9% chance that the Fed will hold rates steady in September, with the probability of a rate cut falling to 42.1%. By the October meeting, the likelihood of a cut rises back to 80%, but the rate path has clearly become more uncertain.

Source: CME

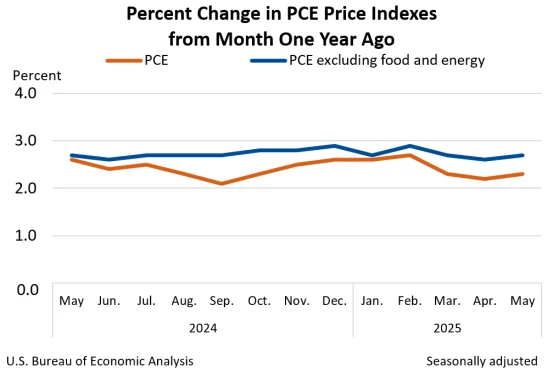

Meanwhile, inflation pressures appear to be intensifying.As of June 2025, the core PCE inflation rate stood at 2.7%, well above the Fed’s 2% target. Powell noted that while inflation in the services sector has eased somewhat, tariffs have pushed up the prices of certain goods.

Source: BEA

Recent developments suggest growing headwinds.New tariff measures announced by the Trump administration—targeting key goods and major trade partners—are further clouding the outlook for inflation and economic growth. This includes a 50% tariff on copper products and additional duties on imports from Brazil and India, which could fuel imported inflation and limit room for monetary easing.

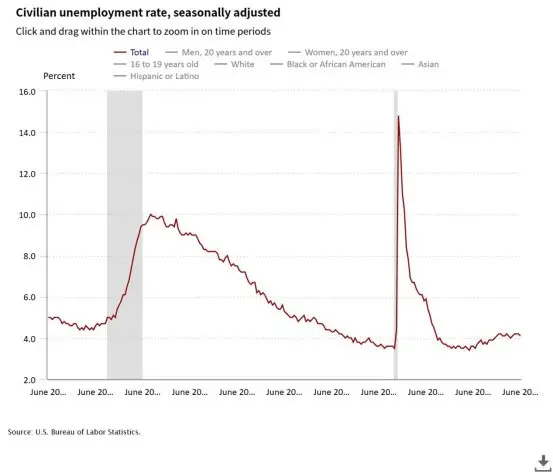

At the same time, Powell described the labor market as “broadly balanced.” The unemployment rate remains at 4.1%, and while wage growth has moderated, it continues to outpace inflation. The resilience of the job market reduces the urgency for an immediate rate cut and supports the Fed’s “wait-and-see” posture.

Source: U.S. Bureau of Labor Statistics

Rate Cut Probability

While Powell struck a cautious tone at the press conference, the Fed has not fully closed the door on a September rate cut.

Rather than issuing a firm rejection, the central bank appears to have opted for a “wait-and-see” approach—future decisions will be highly dependent on data over the next two months. In other words, should macro indicators show meaningful deterioration, the Fed could still pivot quickly.

From a macroeconomic perspective, conditions may be evolving in favor of a rate cut.

The FOMC’s downgrade of its full-year GDP growth forecast reflects concerns over weakening consumer demand and slowing exports. If job and inflation data for July and August come in soft, the Fed may seize the opportunity to begin an easing cycle in September.

The dissenting votes within the FOMC are also noteworthy—not just symbolic, but indicative of rising internal skepticism over prolonged high rates.

Two governors voted in favor of an immediate 25-basis-point rate cut, signaling early signs of a policy shift inside the Fed. If upcoming data aligns with their concerns, the dovish camp could gain more traction in shaping the committee’s stance.

Wall Street is increasingly betting on a coming easing cycle.Goldman Sachs continues to forecast 25-basis-point cuts in September, October, and December—adding up to a full 75-basis-point reduction in 2025. Citi also sees September as the likely start of a sustained easing trend. If upcoming data confirms that recent inflation spikes are temporary, the Fed could have more flexibility to bring policy rates—currently “slightly above neutral”—back to a more appropriate level.

Ultimately, the next two months of data will be critical.If the labor market weakens significantly or inflation pressures ease, a September rate cut remains on the table. Otherwise, the Fed may delay policy easing until late 2025.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates