The Second to Hit a $4 Trillion Market Cap

01:47 August 1, 2025 EDT

Key Points:

Driven by strong momentum in artificial intelligence and cloud computing, Microsoft delivered earnings that exceeded market expectations.

The results sent Microsoft shares surging more than 8% in after-hours trading. If the rally continues, the company’s market capitalization could rise to around $4.1 trillion.

Despite a relatively high valuation, assuming 15% annual growth in revenue and profit over the next 3–5 years, Microsoft’s share price could gradually climb to the $600–650 range.

On July 31, Microsoft reported its financial results for the fourth quarter and full fiscal year 2025. Azure cloud services continued to accelerate, cementing their role as a key growth engine. Both revenue and profit for the quarter beat expectations across the board, sending the stock up more than 8% in after-hours trading. If the rally continues, Microsoft’s market capitalization could rise to around $4.1 trillion, officially joining the “$4 Trillion Club” and becoming the second global tech giant—after NVIDIA—to surpass this key market cap milestone.

Source: TradingView

Earnings Highlights

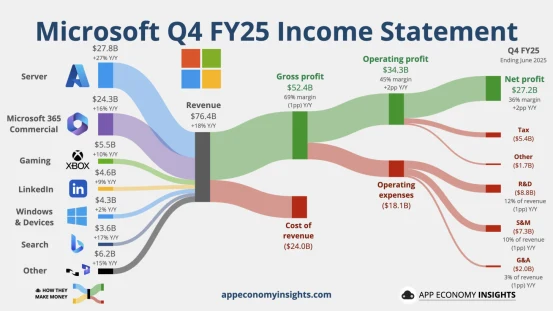

Microsoft's earnings report shows that total revenue for the fourth fiscal quarter reached $76.44 billion, up 18% year-over-year, significantly exceeding the market estimate of $73.89 billion. Net income was $27.2 billion, up 24% year-over-year, with diluted earnings per share (EPS) of $3.65, also up 24% from the same period last year. Full-year revenue came in at $281.724 billion, up 15% year-over-year, while net income reached $101.832 billion, marking a 16% increase.

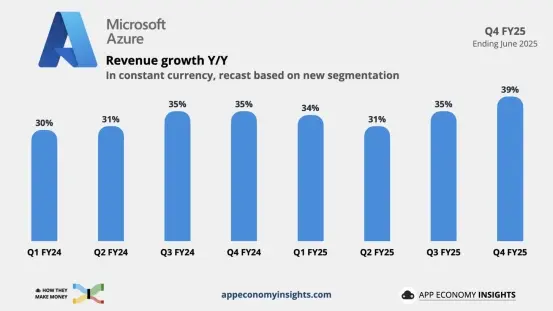

Source: App Economy Insights

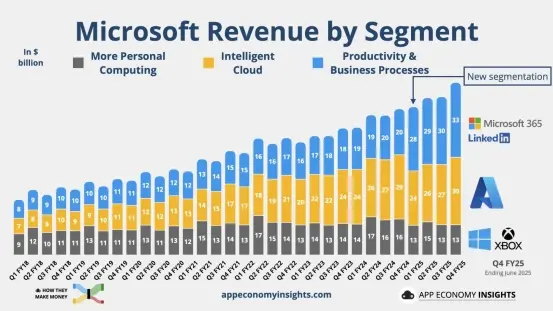

Among the business segments, Intelligent Cloud delivered the strongest performance. The segment generated $29.88 billion in revenue, a 26% year-over-year increase. Within this, Azure revenue grew 39% year-over-year—well above the market expectation of around 35%. This marked Azure’s fastest quarterly growth rate in two and a half years. For the full year, revenue from Azure and other cloud services exceeded $75 billion, up 34% year-over-year, accounting for nearly 27% of Microsoft’s total revenue and serving as the company’s primary growth engine.

The Productivity and Business Processes segment also showed significant improvement. Business cloud revenue, including Microsoft 365, rose 16% year-over-year, while consumer products and cloud services revenue grew 21%. The More Personal Computing segment posted revenue of $13.451 billion, up 9% year-over-year, achieving steady growth, with notable contributions from Windows OEM and search advertising.

Source: App Economy Insights

According to the earnings report, Microsoft’s capital expenditures surged to $24.2 billion in the fourth quarter, up 27% year-over-year, setting a new quarterly record. CFO Amy Hood stated that capital expenditures in the first quarter of fiscal year 2026 are expected to exceed $30 billion, with full-year spending likely surpassing $120 billion—well above market expectations.

The acceleration in capital spending is mainly allocated toward expanding data centers and enhancing AI infrastructure to meet the rapidly growing demand for cloud and AI services. Although Microsoft still faces tight supply-demand conditions in data center infrastructure, its continued investment reflects strong conviction in future technology trends and strategic positioning.

Additionally, Microsoft remains optimistic about the outlook for the first quarter of fiscal year 2026, projecting revenue in the range of $74.7 billion to $75.8 billion—above market expectations. Operating margin is also expected to rise to 46.6%. The Productivity and Business Processes and Intelligent Cloud segments are expected to maintain double-digit growth, with Azure forecasted to grow by 37%.

Source: Microsoft

Azure Growth Accelerates

For fiscal year 2025, Microsoft reported total revenue of $281.72 billion, up 15% year-over-year. Operating income reached $128.53 billion, a 17% increase from the previous year, while net income rose to $101.83 billion, up 16% year-over-year. Earnings per share (EPS) came in at $13.64, also up 16%. Microsoft Cloud generated $46.7 billion in revenue for the year, marking a 27% year-over-year increase and accounting for 16.6% of total revenue. Gross margin remained stable throughout the year, reflecting a balanced tradeoff between the high profitability of cloud services and ongoing investments in AI.

Notably, Microsoft for the first time disclosed the size of its Azure business in U.S. dollar terms. Azure and other cloud services generated over $75 billion in revenue for fiscal 2025, up 34% year-over-year and accounting for approximately 27% of total revenue. Azure’s growth rate was roughly twice that of the company’s overall revenue growth. The Intelligent Cloud segment accounted for over 40% of total annual revenue, firmly establishing itself as Microsoft’s primary growth engine.

Source: App Economy Insights

Microsoft CEO Satya Nadella emphasized that cloud computing and AI are critical drivers of digital transformation across industries, and Microsoft is helping customers adapt to the demands of a new era through continued technological innovation. Azure, as the centerpiece of Microsoft’s cloud platform, has experienced significantly accelerated growth due to surging demand for AI services.

One particularly noteworthy disclosure was that Microsoft 365 Copilot has reached 100 million monthly active users, reflecting the commercial traction and scale of AI-integrated productivity tools. This trend is contributing to increased business application revenue. Microsoft also holds an equity stake in OpenAI and leverages NVIDIA’s high-performance chip infrastructure to enhance its AI model training and cloud capabilities.

Is It Time to Buy?

Currently, Microsoft is widely favored on Wall Street. According to TipRanks data, 33 analysts provided 12-month price targets over the past three months, with an average target price of $558.71, representing approximately a 9% upside from the latest closing price of $513.24. The consensus rating is a "Strong Buy," including 30 “Buy” ratings, 3 “Hold,” and 0 “Sell.”

Analysts are unanimously optimistic about Azure’s 39% growth and AI business’s 175% annualized revenue growth. Wedbush notes that Microsoft is entering the next phase of AI monetization, with Copilot and Azure as key drivers.

From a valuation perspective, Microsoft’s current market value has risen to around $4.1 trillion. Its after-hours stock price at $555.20 is notably above the 52-week high of $518.29, indicating that the market has already priced in significant expectations for future growth. The current price-to-earnings ratio is about 39.6x, near historical highs, which could limit further short-term upside. The post-earnings one-day gain of over 8% may also trigger some investors to take profits.

However, despite the relatively high valuation, if revenue and profit grow at an average annual rate of 15% over the next 3–5 years, Microsoft’s stock price could gradually rise to the $600–$650 range. For medium- to long-term investors, the stock still holds allocation value. Strategically, it is recommended to build positions in batches below $550, for example, dividing capital into three purchases to smooth the cost basis and reduce short-term volatility risk associated with high valuation. Current holders may continue to hold, awaiting returns from both dividends and capital appreciation.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates