3 Core Investment Rules You Can’t Ignore: What 2025 Revealed

23:45 July 31, 2025 EDT

In the first half of 2025, global financial markets experienced notable volatility and a period of adjustment. Early in the year, optimism following the U.S. election helped lift sentiment, but markets later pulled back due to intensifying competition in artificial intelligence technology from China, new tariff policies under the Trump administration, and shifting macroeconomic data.

Despite these headwinds, overall market performance ultimately delivered positive returns. As of July 30, 2025, the S&P 500 had gained approximately 8% year-to-date, while the Bloomberg U.S. Aggregate Bond Index posted a return of around 2.5%, including a 0.8% increase during the equity market correction from February to April. The volatility underscored the importance of maintaining long-term investment discipline.

This article draws on market developments from the first seven months of 2025 to highlight three core investment principles designed to help investors navigate future periods of potential volatility and risk.

Market Background

So far this year, market uncertainty has played out across several dimensions.

At the start of 2025, U.S. equities extended the post-election rally that began in November 2024. However, markets soon came under pressure from a combination of headwinds. China’s DeepSeek AI breakthroughs sparked concerns over the global competitiveness of U.S. tech stocks. Meanwhile, newly announced tariffs from the Trump administration fueled inflation expectations, triggering a broad market pullback. From February 19 to April 8, the S&P 500 declined by roughly 18%, while the 10-year U.S. Treasury yield climbed to 4.38%.

Source: TradingView

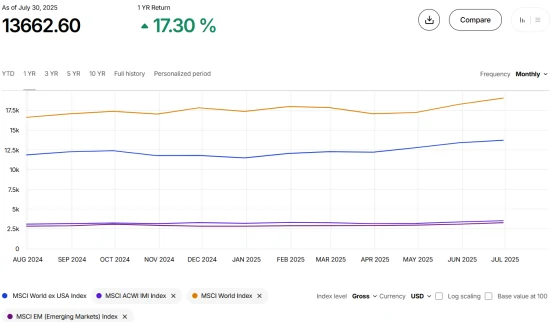

Markets began to rebound in the second quarter, with the S&P 500 gaining 5.8% in May and another 4.9% in June, bringing year-to-date returns to around 8%. Bonds provided steady performance during the equity selloff— the Bloomberg U.S. Aggregate Bond Index rose 1.2% over the same period, highlighting their diversification benefits. International markets outperformed the U.S.: the MSCI World ex-U.S. Index has returned 17% year-to-date, supported by a weaker dollar, European rate cuts, and robust growth in India.

Source: MSCI

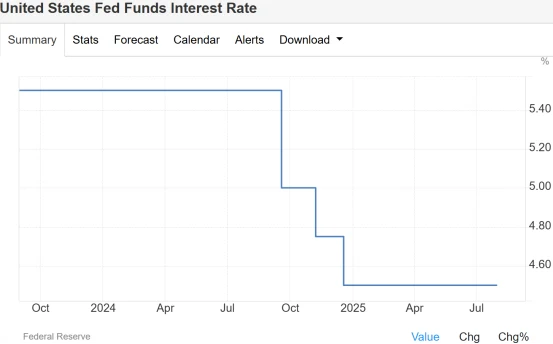

Several forces are driving this volatility. The Trump administration’s tariff measures are adding to inflationary pressures and raising corporate input costs. At its July 29–30 FOMC meeting, the Federal Reserve held the federal funds rate steady at 4.25%–4.50%. The probability of a rate cut in September has fallen to 41%, reflecting the Fed’s cautious stance toward sticky inflation and labor market resilience.

Source: TradingEconomics

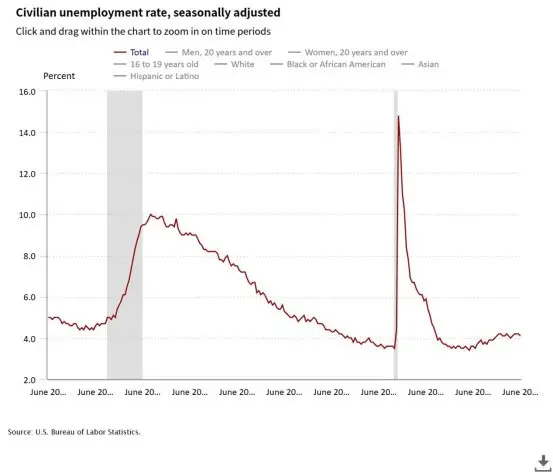

Labor data fluctuations—including a 4.1% unemployment rate—and shifting corporate earnings have also heightened investor concerns about stretched valuations. Meanwhile, the Bank of Japan’s unexpected rate hike in Q3 2024, coupled with shifting expectations around Fed easing, triggered a wave of global asset repricing.

Source: U.S. Bureau of Labor Statistics

3 Core Principles

Principle 1: The Market Is Unpredictable

Market volatility in 2025 highlights the unpredictability of short-term movements. Early-year optimism around tech stocks was derailed by rising AI competition from China and new tariff policies, leading the S&P 500 to decline about 18% from February through April. The rebound in May and June demonstrated a rapid reversal in market sentiment. A similar pattern unfolded in 2024, with an AI-driven summer rally pushing the S&P 500 higher, followed by a selloff in Q3 triggered by the Bank of Japan’s rate hike and shifting expectations around Fed easing. The post-election rally in November extended into 2025.

Source: TradingView

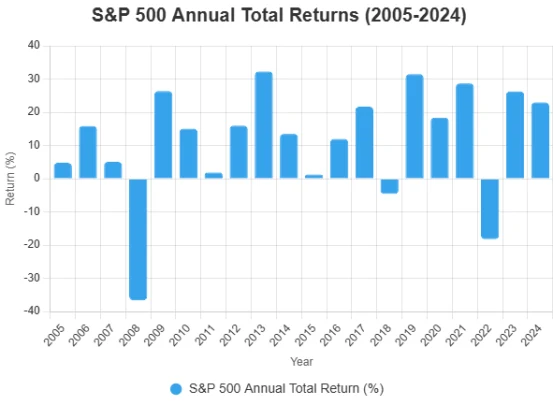

Historical data supports this principle. According to S&P Global, the S&P 500 averaged an annual return of 9.8% between 2005 and 2024, but yearly returns ranged widely—from -36.6% in 2008 to +31.5% in 2019. Investors attempting to time the market often miss key rally days, resulting in lost gains.

As a result, investors should avoid frequent trading based on short-term forecasts. A buy-and-hold strategy helps capture long-term returns by minimizing timing errors. It is recommended to build portfolios aligned with long-term goals and to rebalance asset allocation every 6 to 12 months to manage volatility.

Principle 2: Global Diversification Reduces Risk and Enhances Returns

International markets outperformed the U.S. in 2025, with the MSCI World ex-US Index delivering a year-to-date return of 17%, compared to the S&P 500’s 8%. European markets benefited from the ECB’s rate cuts and attractive valuations, while India emerged as an investment hotspot with GDP growth of 8.2% (IMF data). Latin America, the worst-performing region in 2024, became a bright spot in 2025. A 3.7% decline in the U.S. dollar index amplified international investment returns.

Source: TradingView

The return potential of global investing has long been evident. The MSCI World ex-US Index outperformed the S&P 500 in 2017 and 2020, with respective gains of 23.8% and 15.2%. Global diversification helps mitigate single-market risks—for example, in 2025, U.S. tech stocks faced pressure from AI competition, while Europe and India offered growth opportunities. Many international companies generate significant revenue from the U.S., providing American investors with indirect global exposure.

Therefore, investors may allocate 20%-40% of their portfolios to international equities, including developed markets (Europe, Japan) and emerging markets (India, South Korea). Low-cost index funds such as the iShares MSCI ACWI ex-US ETF (ticker: ACWX) or Fidelity International Growth Fund (FIGFX) can be effective options. Regularly adjusting global allocation to align with risk tolerance is advised.

Principle 3: The Defensive Role of Bonds and Fixed Income Assets

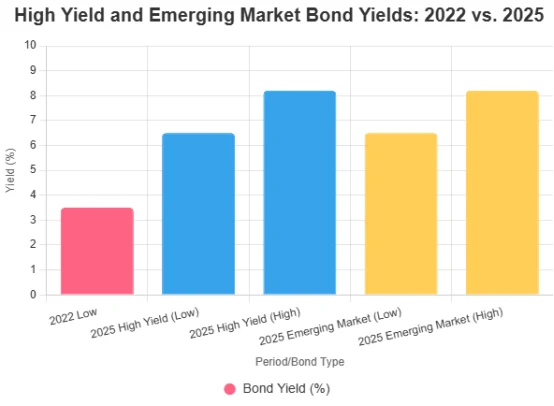

The bond market showed stability in 2025, with the Bloomberg U.S. Aggregate Bond Index rising 1.2% during the equity market downturn, effectively diversifying risk. Despite the tariff-driven spike in April that pushed the 10-year Treasury yield to 4.59%, bonds still offered returns above inflation. Bloomberg data shows high-yield and emerging market bonds yielding between 6.5% and 8.2%, significantly higher than the 3.5% lows seen in 2022.

Historical performance supports bonds’ defensive role. According to S&P Global data, from 2000 to 2024, a 60% equity/40% bond portfolio had an annualized volatility of 11.8%, lower than the 15.1% volatility of a 100% equity portfolio, providing a cushion during downturns in 2008 and 2022. Following rate hikes in 2022-2023, bond yields reached two-decade highs, offering investors reliable income streams.

Investors are advised to allocate 20% to 50% of their portfolios to bonds, prioritizing high-grade bonds to effectively manage credit risk in the current environment. For conservative investors, focusing on short-duration bond funds can help mitigate interest rate volatility, while those with higher risk tolerance may consider allocating to high-yield bond funds to pursue enhanced returns.

Future Possibilities

Overall, significant uncertainty remains around the market’s trajectory for the remainder of 2025, with the potential for multiple rounds of volatility. Short-term price movements are influenced by a combination of macroeconomic indicators, policy shifts, and unforeseen events, making precise predictions challenging. Long-term investment value, however, relies more on fundamental factors and reasonable valuations.

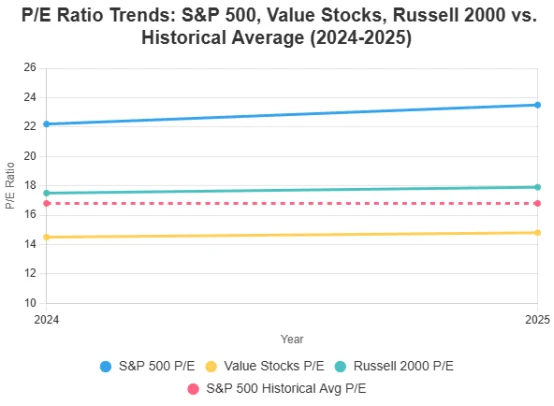

Currently, the S&P 500 trades at a price-to-earnings (P/E) ratio of approximately 23.5, well above its long-term historical average of 16.8, indicating elevated overall market valuations but not yet entering a systemic bubble territory. Within this valuation landscape, value stocks (P/E around 14.8) and small-cap stocks (e.g., Russell 2000, P/E around 17.9) appear relatively inexpensive, offering potential for multiple expansion and medium- to long-term allocation appeal.

On the bond side, valuations remain within a reasonable range. The 10-year U.S. Treasury yield holds steady around 4.38%, providing attractive real yields suitable for balancing equity market volatility and enhancing portfolio stability.

International markets also present investment opportunities. The European market (MSCI Europe P/E approximately 14.2) is clearly cheaper than the U.S., supported by a shift in monetary policy and expectations of fiscal stimulus, which may attract medium- to long-term capital flows. The Indian market (MSCI India P/E about 21.5) carries relatively higher valuations but benefits from economic growth prospects and structural reforms, maintaining its appeal. Overall, in the current environment, a moderate tilt toward undervalued assets and regions can help improve a portfolio’s long-term risk-adjusted returns.

Amid challenges such as tariffs, AI competition, and Federal Reserve policy, investors are advised to maintain a long-term perspective and address uncertainty through diversified global equity and high-quality bond allocations. Value stocks, international markets, and bonds currently offer attractive opportunities. Future market direction will depend on economic data and policy developments, underscoring the importance of discipline and a focus on fundamentals rather than short-term sentiment.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates