Inflation Edges Higher, Complicating the Fed’s Path Forward

23:35 July 31, 2025 EDT

Key Points:

The U.S. Personal Consumption Expenditures (PCE) price index surged 2.6% year over year in June, with core inflation returning to a year-to-date high of 2.8%, driven largely by a sharp rise in goods prices.

While consumer spending continues to grow, signs of weakening real purchasing power are mounting, with inflationary pressure and slowing growth coexisting.

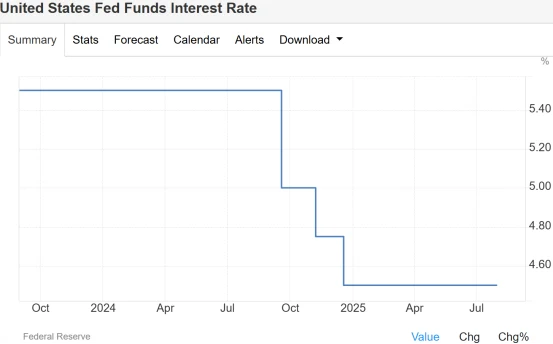

The Federal Reserve held rates steady for the fifth consecutive meeting in July, keeping the federal funds rate target range at 4.25%–4.50%, and the likelihood of a rate cut this year is steadily declining.

Amid the effects of a new wave of sweeping tariff measures announced by former President Trump, U.S. inflation rebounded broadly in June, breaking the previous narrative of continued disinflation. The PCE price index rose more than expected on both a monthly and yearly basis, with core inflation returning to its highest level of the year—largely driven by surging goods prices.

Although consumer spending remained resilient, mounting evidence of constrained real purchasing power underscores a more complicated economic backdrop where inflationary pressure and growth deceleration now coexist. With less than two months remaining until the Fed’s September meeting, the renewed upward momentum in inflation is forcing markets to reassess the timing of any potential rate cuts.

Tariffs Fuel Rising Costs

The U.S. Personal Consumption Expenditures (PCE) price index rose 0.3% month over month in June, pushing the year-over-year increase to 2.6%, the highest level so far this year. Core PCE inflation remained steady at 2.8% year over year, while its monthly pace also rose to 0.3%, both exceeding the prior month's data and market expectations. This rebound breaks the earlier disinflation trend and indicates that short-term price pressures are building. Core inflation remains meaningfully above the Federal Reserve’s 2% target.

Source: BEA

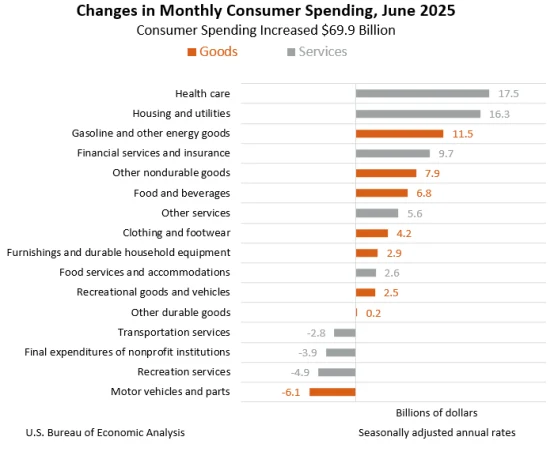

Notably, goods prices climbed 0.4% on the month, marking the largest monthly increase since January. Within durable goods, furniture and household appliances rose by 1.3%, recreational goods and vehicles increased by 0.9%, and clothing and footwear were up 0.4%. Meanwhile, energy prices rebounded 0.9% after four consecutive months of decline, adding another layer of pressure to overall inflation.

Source: BEA

The inflation rebound is increasingly being driven by policy-related cost inputs—specifically, tariffs. Broad-based tariff actions announced by the Trump administration have begun to show up in the June price data. Starting July 30, former President Trump announced a new set of tariffs targeting key import categories, including goods from South Korea, Brazil, India, and copper-based products.

This latest round of tariffs covers both final consumer goods and intermediate inputs, raising production costs for businesses. These costs are gradually passed on to end consumers through the inventory cycle.

Companies have started to respond. Consumer goods makers such as Procter & Gamble (P&G) have stated they will raise U.S. market prices to offset tariff-related cost pressures. This transmission mechanism suggests that goods price pressures are both delayed and persistent, and will likely continue to push core inflation higher over the next two to three quarters—dampening earlier market expectations for a steady disinflation trend.

Consumer Momentum Is Slowing

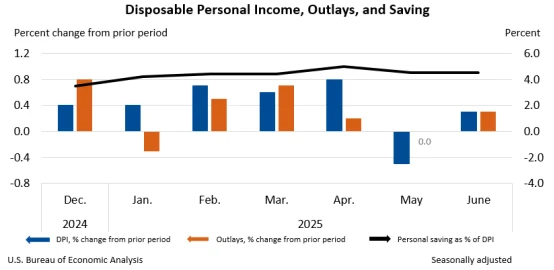

Although nominal Personal Consumption Expenditures (PCE) rose 0.3% month over month in June, real consumption adjusted for inflation increased only 0.1%, following a 0.2% decline in the previous month. Services spending remains the primary support for consumption, but the marginal recovery in goods spending fails to offset the overall trend of constrained purchasing power.

In June, both personal income and disposable income increased by 0.3% month over month, while the savings rate remained steady at 4.5%. Labor market conditions are still relatively stable, but signs of weakening are accumulating. Initial jobless claims have risen for two consecutive weeks, and continuing claims remain near 1.95 million.

Source: BEA

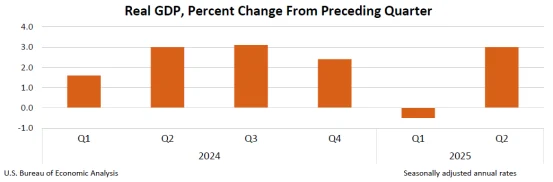

Economists expect the unemployment rate to rise to 4.2% in July, up from 4.1% in June. Second-quarter GDP grew at an annualized rate of 3.0%, driven by a narrowing trade deficit that reversed a 0.5% contraction in the first quarter. However, higher costs resulting from tariffs and restrained corporate hiring are weakening the labor market’s support for consumption. Additionally, wage growth has slowed, with inflation-adjusted year-over-year increases falling to 0.9%, the lowest level in nearly a year.

Source: BEA

It is noteworthy that financial stress is emerging among high-income households, while middle- and lower-income groups face more pronounced pressures from both inflation and rising interest rates. Given that consumption accounts for more than 60% of GDP growth, the marginal weakening of consumption momentum will directly weigh on economic expansion in the coming quarters.

Fed Is in a Dilemma

On July 31, the Federal Reserve held its federal funds rate target range steady at 4.25%–4.50% for the fifth consecutive time during the July FOMC meeting.

Source: TradingEconomics

The FOMC statement noted that “some progress” has been made toward the 2% inflation target, using more cautious language compared to the June statement. Federal Reserve Chair Jerome Powell reiterated that future policy decisions will be data-dependent and did not provide a clear signal regarding a rate cut in September.

Current PCE data indicate that inflation has not continued to ease; instead, it has risen again due to policy and input cost changes. This places the Fed in a deeper dilemma between “controlling inflation” and “supporting the economy.” An early rate cut risks fueling inflation further, while delayed easing could suppress growth. The impact of tariffs has significantly complicated the path to a soft landing.

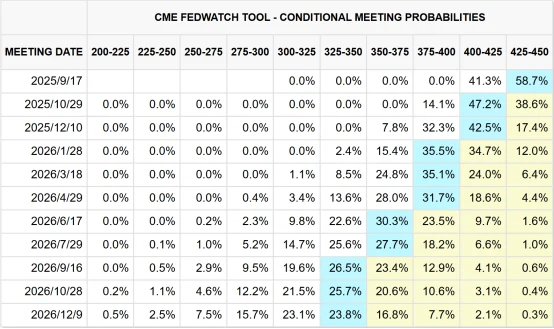

Market expectations for a September rate cut have cooled sharply. Unless inflation data improve materially in July and August, the first rate cut of the year may be delayed until the fourth quarter or even 2026.

Source: CME

Bottom Line

June’s inflation data disrupted the prior optimistic trend, indicating that price pressures from goods and tariff policies are combining to exert sustained upward pressure on core inflation. With corporate inventory digestion still incomplete, the transmission of imported inflation is expected to persist for several more months, effectively pushing back the Fed’s window for easing.

The renewed upward trajectory of inflation not only disrupts market expectations on the timing of rate cuts but also constrains the policy space for economic stabilization. Key factors to watch moving forward include whether tariffs will escalate further, if goods prices will exhibit lagged amplification effects, and how the Fed will navigate the balance between growth and inflation.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates