Eli Lilly vs. Novo Nordisk: Who’s the Better Pick for Investors?

23:08 July 31, 2025 EDT

Key Points:

Novo Nordisk issued an earnings warning, significantly lowering its full-year 2025 sales and operating profit growth outlook, primarily due to weaker-than-expected performance of its flagship weight-loss drug, Wegovy.

Eli Lilly is set to report fiscal Q2 2025 earnings on August 7, with market expectations that strong sales of its weight-loss drug Zepbound and diabetes treatment Mounjaro will drive robust results.

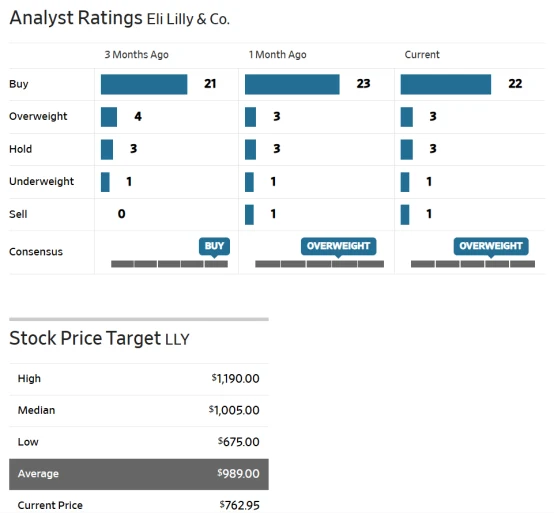

Analysts are broadly bullish on Eli Lilly, with an average price target of $989.00, implying roughly 30% upside from current levels.

As competition in the weight-loss drug market intensifies, Eli Lilly is gradually establishing a clear lead. Its main rival, Novo Nordisk, recently issued a profit warning after Wegovy sales fell short of expectations, sending its stock sharply lower—down more than 36% year-to-date. In contrast, Lilly’s Zepbound and Mounjaro product lines are demonstrating stronger market penetration and adaptability, positioning the company as one of the few in the sector with sustained growth visibility.

Although Lilly’s stock has edged slightly lower this year, investors broadly expect a solid update when the company reports Q2 fiscal 2025 results on August 7. In the face of sector-wide valuation pressure and potential policy headwinds, whether Eli Lilly can maintain its relative strength will be a key indicator for assessing the investment value of the weight-loss drug space.

Source: TradingView

Eli Lilly Delivers Strong Results

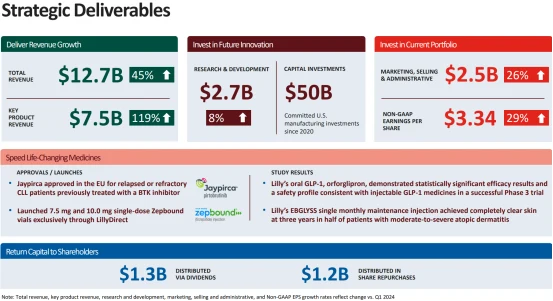

Eli Lilly reported strong growth in its fiscal Q1 2025 earnings, driven primarily by its GLP-1 drug portfolio, significantly outperforming Novo Nordisk. The company posted total revenue of $12.73 billion, up 45% year-over-year and beating market expectations. Adjusted earnings per share came in at $3.34, a 29% increase from a year earlier and also above consensus estimates.

In terms of key products, diabetes drug Mounjaro generated $3.84 billion in revenue, marking a 113% year-over-year increase. The newly launched weight-loss treatment Zepbound delivered $2.31 billion in sales, representing a staggering 347% growth, signaling its establishment of a clear lead in the rapidly expanding obesity drug market. At the same time, Eli Lilly's non-GLP-1 drugs in oncology and immunology contributed approximately 20% growth, underscoring its diversified strength.

Source: Eli Lilly

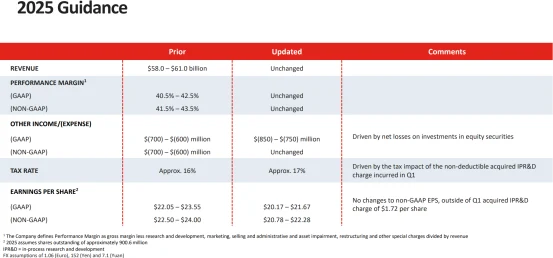

Despite the across-the-board earnings beat, the company lowered its full-year EPS guidance to a range of $20.78 to $22.28 (from the previous $22.50 to $24.00), citing a $1.57 billion acquisition-related charge. However, it maintained its full-year revenue outlook at $58 to $61 billion, implying a growth range of 28% to 35%. Additionally, the FDA announced in December 2024 that the shortage of tirzepatide had ended, and improved supply conditions are expected to support continued GLP-1 sales momentum in Q2.

Looking ahead to the second quarter, the market expects Eli Lilly to sustain its strong performance. Total revenue is forecast to reach $14.71 billion, up 37% year-over-year. Adjusted EPS is projected at $5.57, a 41% increase. Mounjaro sales are expected to hit $4.5 billion, up 49%, benefiting from rising prescription volumes and broader insurance coverage. Zepbound revenue is estimated at $3 billion, up 100%, maintaining approximately 53% market share in the U.S. obesity market. Non-GLP-1 products are projected to contribute 15% to 20% revenue growth, with continued support from oncology and immunology businesses.

Source: Eli Lilly

In addition, Eli Lilly is ramping up production capacity, with plans to invest $4 billion in building four new manufacturing plants. The company aims to boost GLP-1 production capacity by 60% in the first half of 2025. This move is expected to further strengthen its supply chain and reinforce market share.

However, investors should also remain alert to potential margin pressures stemming from drug pricing adjustments and changes in reimbursement policies. Overall, Eli Lilly is well-positioned to gain greater dominance in the GLP-1 market through its strong product portfolio and capacity expansion. Its Q2 earnings report will serve as a critical gauge of whether this momentum can be sustained.

Eli Lilly’s Competitive Edge

Eli Lilly is steadily overtaking Novo Nordisk in the GLP-1 market, particularly in the core U.S. segment, where its growth momentum and product competitiveness are beginning to show clear signs of market leadership.

According to IQVIA data, Zepbound captured 53% of the U.S. obesity drug market in Q1 2025, while Mounjaro has now replaced over 50% of Ozempic prescriptions in the diabetes segment. Although Novo Nordisk still holds 65% of the global GLP-1 market compared to Lilly’s 34%, Lilly’s steeper growth trajectory and aggressive market penetration suggest a rapid closing of the gap.

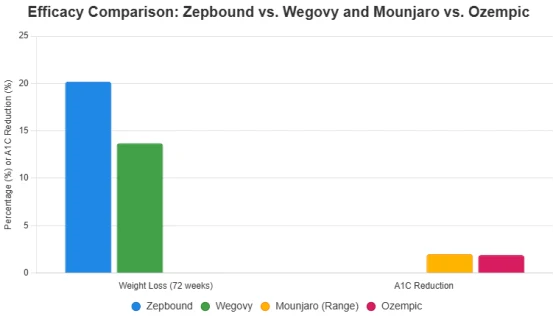

In terms of efficacy, Lilly also holds a competitive edge. The latest SURMOUNT-5 trial showed Zepbound delivering an average weight loss of 20.2% over 72 weeks, significantly outperforming Wegovy’s 13.7%. Similarly, results from the SURPASS-2 study demonstrated that Mounjaro reduced A1C levels by 2.0% to 2.3%, ahead of Ozempic’s 1.9%. In a market driven by clinical outcomes, these efficacy differentials carry substantial influence over both physician prescribing behavior and patient preference.

Lilly’s R&D pipeline further reinforces its long-term outlook. Its oral GLP-1 candidate, Orforglipron, achieved success in a Phase 3 diabetes trial in Q1 2025, with a weight-loss indication filing planned by year-end. In contrast, Novo Nordisk’s next-generation candidate CagriSema has shown 15.7% weight loss—less than Zepbound—while Lilly’s triple agonist, Retatrutide, is expected to report late-stage clinical data in 2025 and is seen as a potential game-changer in the next phase of GLP-1 evolution.

On pricing and access, while CVS Caremark began favoring the lower-cost Wegovy for reimbursement starting in July—posing short-term pressure for Zepbound—Lilly has leveraged its LillyDirect platform to offer Zepbound directly to patients at $349 to $599 per month, creating a more flexible access model in terms of affordability and availability. Novo Nordisk, meanwhile, partnered with Ro to offer a $499/month plan, but faces more challenges in pricing strategy and long-term market access, especially amid growing concerns over generic competition.

On July 29, Novo Nordisk cut its 2025 sales growth forecast to 8%–14% (down from 13%–21%), citing softer Wegovy demand and intensifying competition. This downward revision underscores the contrast with Lilly’s ongoing strength across sales, R&D, and access strategies, highlighting its accelerating momentum in the GLP-1 arena.

Risks Have Not Disappeared

Despite Eli Lilly’s strong market performance, its share price fell nearly 5% following Novo Nordisk’s profit warning, reflecting investor concerns about a potential slowdown in the overall obesity drug market. Key risks include the possibility of a price war if Novo Nordisk aggressively cuts prices, which could erode industry-wide profit margins. In addition, weaker-than-expected demand in the obesity and diabetes drug markets could impact the long-term revenue growth of both companies.

Another factor weighing on pricing power is the availability of compounded generics, particularly in the U.S.—the world’s largest pharmaceutical market. While current regulations restrict some types of generic production, allowances for personalized formulations continue to create uncertainty around branded drug pricing.

Over the long term, Lilly’s robust R&D capabilities and diversified product portfolio provide it with a sustained competitive edge in obesity and diabetes treatment. Its growing market share and the steady advancement of its pipeline are expected to support revenue and earnings growth over the next several years. Analysts remain broadly optimistic on the stock, with an average price target of $989.00—implying roughly 30% upside from current levels.

Source: The Wall Street Journal

Investors should closely watch Lilly’s upcoming quarterly results and updated full-year guidance, particularly any developments related to its experimental oral drug, Orforglipron.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates