Wall Street Predicts a Post-Earnings Rise for Microsoft Stock

22:53 July 29, 2025 EDT

Key Points:

Microsoft is set to report its fiscal Q4 2025 earnings after the market closes on July 30. Street consensus expects revenue and profit to maintain double-digit growth.

Year to date, Microsoft shares have gained more than 22%, hitting multiple all-time highs in July. The stock is currently trading near its record high of $518.

Wall Street remains highly optimistic on Microsoft’s outlook, with a consensus “Buy” rating.

Microsoft is scheduled to release its fiscal fourth-quarter 2025 results after the bell on July 30, with analysts widely expecting double-digit growth in both revenue and earnings. Benefiting from the continued rollout of generative AI (GenAI) across its Azure and Copilot businesses, Microsoft shares have risen over 22% this year and have reached several new record highs in July.

Source: TradingView

Options market pricing indicates that investors are betting on further upside following the earnings release, with the stock potentially breaking above $532 in the near term to set a fresh high.

Earnings Expectations

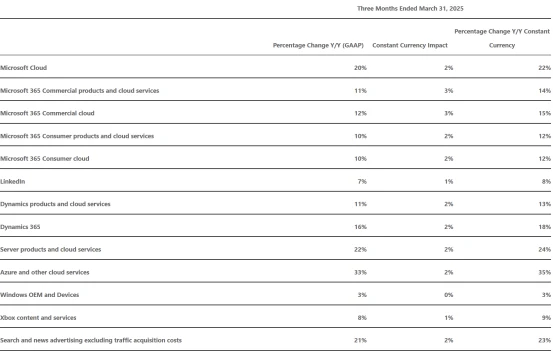

According to institutional estimates compiled by FactSet and Visible Alpha, Microsoft’s revenue for the quarter (fiscal Q4 2025) is expected to reach $73.71 billion, representing a 13.88% year-over-year increase; adjusted EPS is projected at $3.35, up 13.56% year-over-year. Consensus expectations for major business segments are as follows:

The Intelligent Cloud segment is forecasted to generate $28.89 billion in revenue, up 21.5% year-over-year. Azure is expected to grow 34% to 35% on a constant currency basis, driven by demand for AI model training, inference services, and hybrid cloud, making it the primary growth driver.

The Productivity and Business Processes segment is projected to deliver $32.1 billion in revenue, up 12.2% year-over-year. Office 365 commercial cloud products are expected to grow 14%, while LinkedIn revenue is anticipated to maintain high single-digit growth.

Source: Microsoft

The More Personal Computing segment is estimated to bring in $12.43 billion, a 1% increase year-over-year. Despite overall softness in consumer electronics demand, deployments of Copilot + PCs, a rebound in Windows licensing revenue, and high single-digit growth in Xbox content and services are expected to provide support.

Commercialization of AI applications remains a key focus for analysts. Wedbush analysts noted in their latest report that the AI product suite formed by Copilot and Azure is propelling Microsoft into the “second phase of AI monetization,” leading them to raise the target price to $600.

Overall, Wall Street remains highly optimistic about Microsoft’s outlook. According to The Wall Street Journal, out of 65 analysts covering Microsoft, 51 have a “Buy” rating, with an average price target of $556.64, implying an 8.6% upside from the current stock price.

Fundamental Support

From a financial quality perspective, Microsoft demonstrates sustained growth in free cash flow and stable profit margins.

Microsoft’s fiscal Q3 2025 earnings report (ending March 2025) showed revenue of $70.07 billion, a 13% year-over-year increase, beating market expectations of $68.42 billion. Adjusted earnings per share (EPS) came in at $3.46, surpassing analyst estimates of $3.21 and up from $2.94 in the same period last year. Net income rose 18% year-over-year to $25.8 billion. All business segments delivered solid performance, with Intelligent Cloud revenue reaching $26.8 billion and Azure revenue growing 33%, well above the market consensus of 29%.

Source: Microsoft

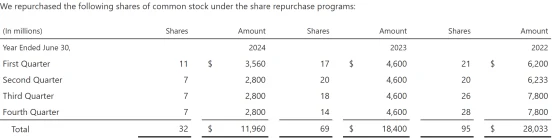

As of the most recent quarter, Microsoft’s trailing twelve-month free cash flow exceeded $70 billion, with net profit margins maintained above 35%. The company continues to return capital to shareholders through dividends and buybacks. The current dividend yield stands at 0.75%, slightly below the S&P 500 average, while buyback activity has accelerated, with over $18 billion repurchased year-to-date.

Source: Microsoft

On the valuation front, Microsoft’s forward price-to-earnings ratio (Forward PE) for fiscal 2026 is approximately 32x. Considering an expected three-year compound annual growth rate (CAGR) of EPS exceeding 15%, along with AI-driven long-term growth tailwinds, the current forward PE remains reasonable, especially compared to other large tech names like Apple or Google, where Microsoft’s combination of growth prospects and valuation appears more attractive.

Stock Price Outlook

As of the close on July 29, Microsoft’s stock price stood at $512.57, near its all-time high of $518. The options market expects the stock to fluctuate within a ±4% range by the close of August 2 (this Friday), implying an upside target of around $532 and downside support near $494.

Source: TradingView

The 14-day Relative Strength Index (RSI) is approaching the overbought territory (above 70), signaling that short-term momentum may be weakening. A break above $518 would confirm a bullish trend, while a drop below $494 could lead to a pullback toward $480.

Source: TradingView

If the earnings report meets or exceeds expectations, the stock is poised to break above the previous high; if it falls short, the pullback could return to the range seen in early July. Historical data shows that in the past four earnings releases, Microsoft’s stock has moved on average 5% the next day, with three instances of declines and only one gain in April 2024, driven by AI-related business, when the stock surged 8% in a single day.

Source: TradingView

Key Takeaways

At present, Microsoft appears well-positioned to reach new all-time highs in the near term, with its upcoming earnings report serving as a key catalyst. Over the medium to long term, as AI deployment deepens across PCs, enterprise software, and cloud platforms, Microsoft’s profitability and cash flow generation are expected to strengthen further, providing a solid foundation for stable investor returns.

For investors seeking high-quality growth and long-term steady returns, Microsoft remains a core asset worthy of significant allocation.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates