S&P 500 Hits New Highs but Momentum Slows—Uptrend or Pullback Ahead?

05:01 July 29, 2025 EDT

Key Points:

Recent progress in global trade has boosted market sentiment, with the U.S. and the EU reaching an agreement, and a new round of U.S.-China trade talks underway. These developments help stabilize market risk premiums, but high concentration, earnings pressure from tech companies, and Fed policy uncertainty remain constraining factors.

The S&P 500 index continues to hit new highs, but technical indicators show rising overbought pressure, suggesting the possibility of short-term volatility at elevated levels.

On July 29, 2025, the S&P 500 intraday briefly surpassed 6,400 points, marking a record high, before closing at 6,389.77, with the daily gain narrowing to 0.02%. Despite the continued upward trend, technical indicators point to rising overbought pressure, which may lead to short-term consolidation at elevated levels.

Source: TradingView

Market focus is gradually shifting to the upcoming earnings reports from major tech giants and the Federal Reserve’s July 31 policy meeting, both of which could influence short-term risk appetite.

Tariff Risks Ease

Recent progress in global trade has boosted market sentiment.

On July 27, the U.S. and the EU reached an agreement to reduce EU import tariffs to 15%, which is half of the tariffs originally scheduled to take effect on August 1. This move is expected to ease short-term cross-border cost pressures and stabilize confidence in manufacturing across the U.S. and Europe.

Regarding U.S.-China relations, on July 28, representatives from both sides held a new round of trade talks in Stockholm, Sweden, aimed at extending the trade truce agreement set to expire on August 12. The discussions covered tariffs, export controls, and potential areas of cooperation.

Ahead of the talks, U.S. Treasury Secretary Janet Yellen publicly expressed a desire to extend the trade truce agreement due to expire on August 12. The outcome of these negotiations will have a direct impact on market risk pricing. If the talks yield positive results, they could alleviate market pressures related to the tariffs set to take effect on August 1 against multiple countries.

Mag 7 Impact on Index Performance

This week marks a critical period in earnings season, with approximately 160 S&P 500 constituent companies set to report their Q2 results, including four core members of the U.S. "Mag 7" tech giants—Meta, Microsoft, Amazon, and Apple.

According to data from the London Stock Exchange, more than one-third of S&P 500 companies have already reported their Q2 2025 earnings, with 80% of those beating expectations. Analysts currently forecast an overall earnings growth of 7.7% year-over-year, up from 5.8% at the beginning of the month. However, it is notable that excluding the Mag 7, earnings growth among the remaining companies has significantly slowed, making the market highly reliant on the upcoming earnings reports from Microsoft, Meta, Amazon, and Apple.

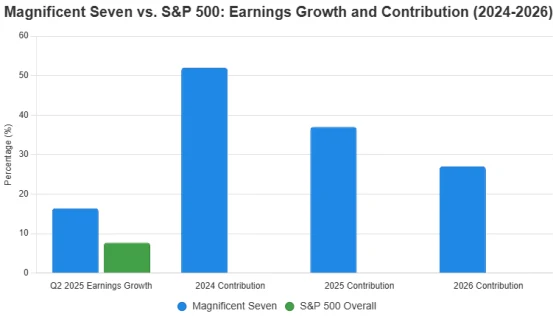

For Q2 2025, the seven major tech giants are expected to report earnings growth of 16.4%, compared to 7.7% for the overall index. Nevertheless, their contribution to the S&P 500’s total earnings growth is projected to decline from 52% in 2024 to 37% in 2025 and 27% in 2026, indicating a potential gradual diversification in market performance.

Recently, Alphabet’s increased investment in artificial intelligence has boosted market optimism, while Tesla, after announcing a $16.5 billion chip deal with Samsung, saw its stock price gradually rebound following a drop on earnings day. However, Tesla also warned of challenges from reduced electric vehicle subsidies.

Source: TradingView

Market concerns have grown over the heavy reliance on a small group of large tech stocks. Since 2023, the S&P 500 has gained 67%, with the Mag 7 accounting for more than half of the total returns. In contrast, the equal-weighted S&P 500 — which removes market-cap weighting — has only risen 32% over the same period. As of July 2025, the index’s market cap ratio has reached 0.84, the highest since 2003. Any disappointing earnings from any of the Mag 7 could trigger market volatility.

Overbought Risk

From the daily chart, the S&P 500 index has gained over 30% since April and is currently in the overbought zone according to the 14-day RSI indicator. Historical data shows that when the RSI exceeds 75 without sufficient pullback, the probability of a market correction within the following 1 to 2 weeks rises significantly.

Source: TradingView

Key technical support levels below the current price are at 6300, 6230, and 6152 points. If short-term negative factors accumulate, pullbacks could unfold around these zones.

Source: TradingView

On the upside, the 6500 level serves as a critical psychological resistance point with initial resistance significance. A break above could target 6600 and 6700 points.

Source: TradingView

As the index approaches 6500, it may test this psychological barrier; however, the overbought RSI, along with upcoming earnings reports and the Federal Reserve meeting, increase the likelihood of short-term consolidation or a pullback. A break below 6300 could open the door to further declines toward 6230 or 6152, especially if earnings or trade negotiations disappoint.

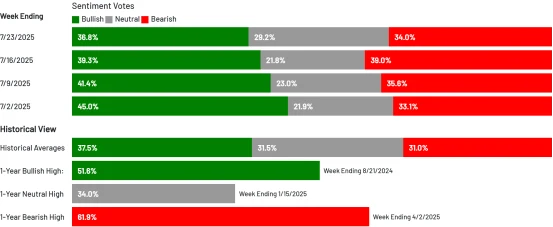

Meanwhile, current market sentiment remains cautiously optimistic, supported by trade progress and strong earnings, but concerns about concentration risk and macro uncertainty are limiting enthusiasm. The latest weekly AAII survey shows 36.8% of retail investors are bullish on the stock market’s six-month outlook, still below the historical average of 37.5%.

Source: AAII

According to the latest data from the U.S. Commodity Futures Trading Commission (CFTC), as of July 23, net speculative long positions in S&P 500 futures have declined for the third consecutive week, reflecting some institutional investors taking profits at elevated levels. The VIX volatility index remains at low levels, but short-term implied volatility has risen, indicating the market is guarding against potential unforeseen events.

Source: TradingView

Final Thoughts

The S&P 500 index entered this week with strong momentum. Marginal improvements in U.S.-China and U.S.-EU trade policies have helped stabilize market risk premiums, though high concentration, earnings pressure from tech companies, and uncertainty around Federal Reserve policy remain key constraints.

Technically, the index shows short-term overbought conditions. If core tech earnings reports disappoint this week, a pullback in the index may be needed. Investors are advised to monitor the divergence in corporate earnings quality and maintain a cautious stance until the index decisively breaks through key resistance levels.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates